Analyzing the ebb and move of futures contracts throughout exchanges can present invaluable insights into the market’s collective outlook. The state of open curiosity in Bitcoin futures and the ratio between lengthy and quick positions will help us decide whether or not the market is bullish or bearish and anticipate potential value actions.

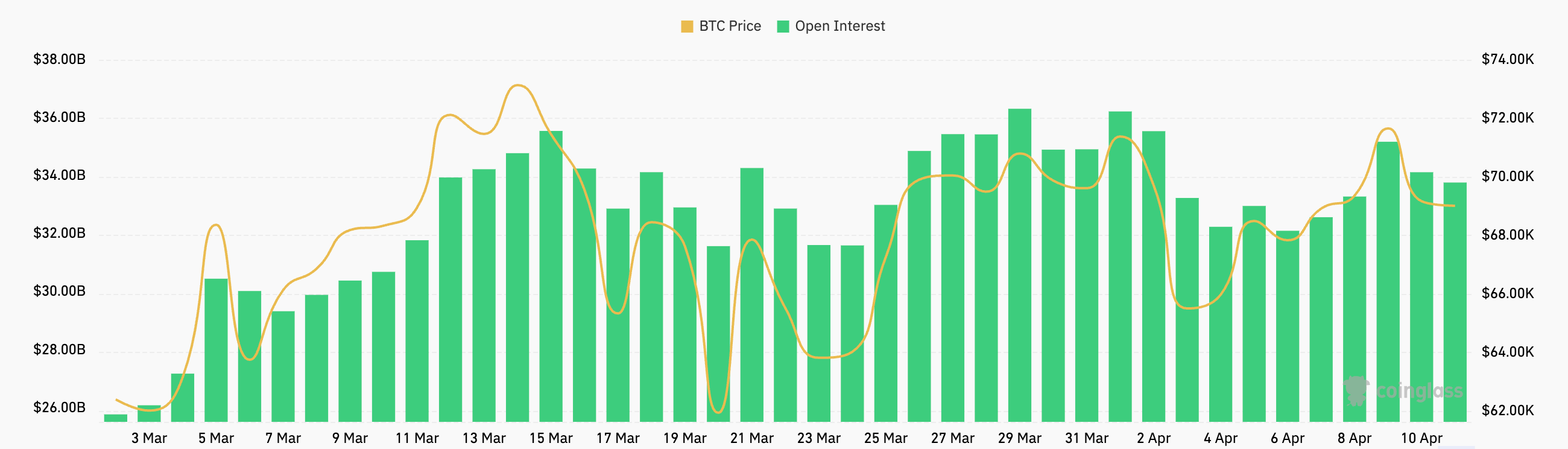

Over the course of 24 hours between April 9 and April 10, the futures market skilled a slight however notable shift. Open curiosity, a measure of the overall variety of excellent futures contracts that haven’t been settled, decreased from $35.17 billion to $33.77 billion. This decline in open curiosity, alongside a 4.55% lower in lengthy positions to $39.65 billion and a minor 0.38% lower briefly quantity to $37.31 billion, signifies a cautious retraction in market participation. These figures counsel a slight bearish tilt in dealer sentiment prior to now 24 hours.

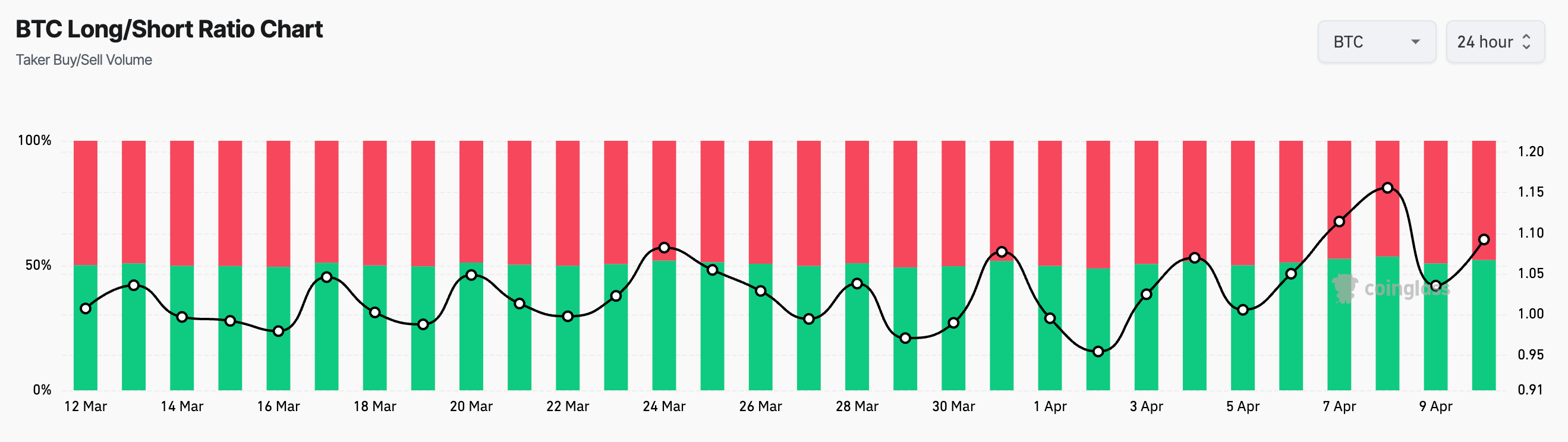

The fluctuation within the futures’ lengthy/quick ratio over the previous few weeks illustrates how the market felt. Whereas the ratios oscillated, they often remained optimistic, making it evident that the market is leaning towards a bullish stance. Nonetheless, confidence ranges have various in response to Bitcoin’s value volatility. A peak of 1.1561 on April 8 correlated with a surge in Bitcoin’s worth after a correction, whereas a dip to 0.9712 on March 29 mirrored a wave of bearish sentiment that got here after BTC failed to satisfy market expectations.

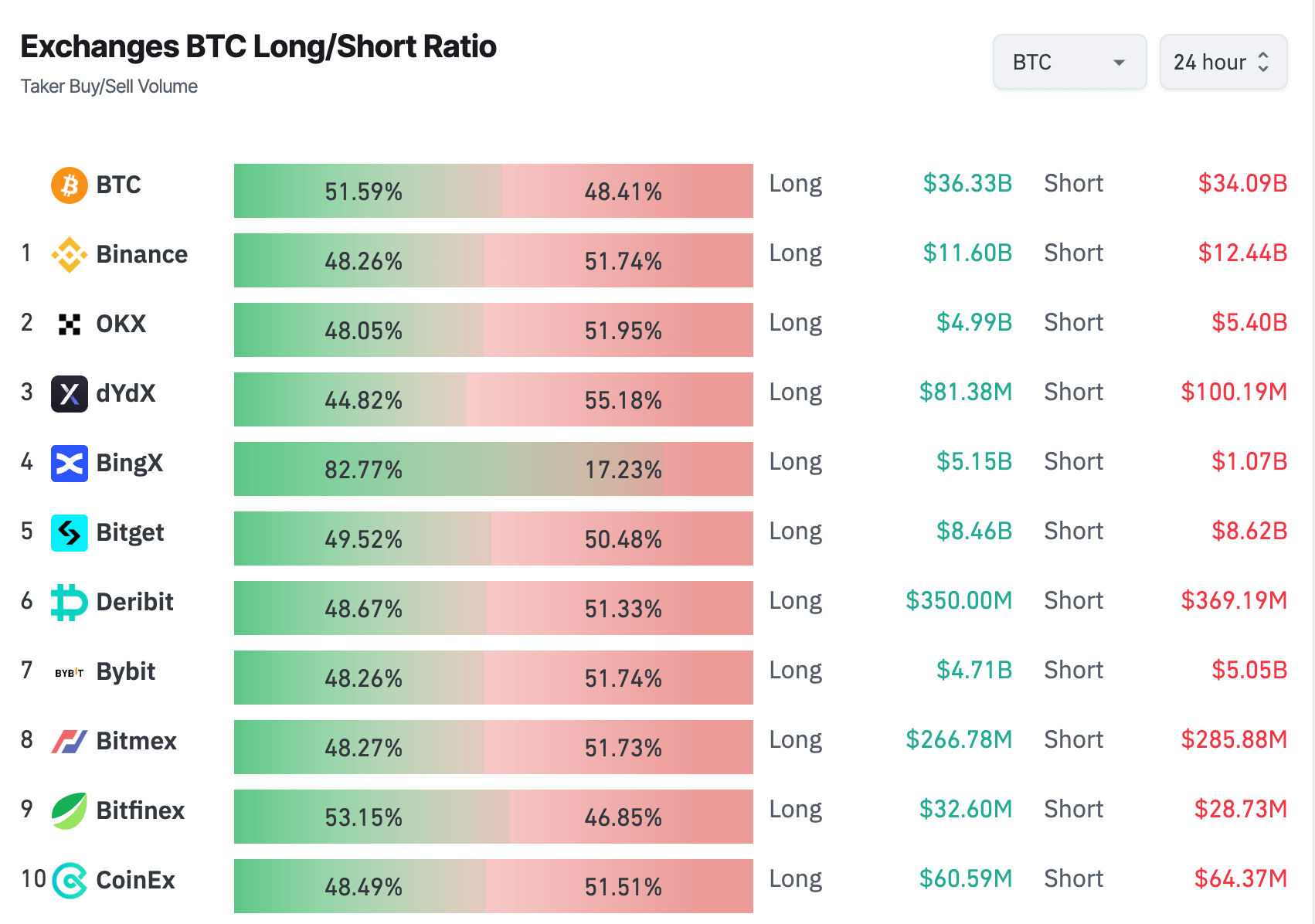

A more in-depth take a look at the distribution of lengthy and quick positions throughout numerous exchanges reveals a really various panorama of dealer sentiment and technique. As an illustration, BingX stands out with a considerably larger proportion of lengthy positions (82.77%) than shorts (17.23%), indicating a very bullish sentiment amongst its person base or strategic positioning of the trade’s merchants.

Then again, platforms like Deribit and Bitget, with ratios hovering round 50%, point out a extra evenly break up market outlook. The distinction between Binance’s predominant quick place bias (51.74%) and BingX’s bullish leanings reveals how various methods and perceptions throughout buying and selling platforms are, with Binance’s quick positions considerably outnumbering BingX’s lengthy bets.

The slight dip in open curiosity the market has seen prior to now 24 hours suggests a collective transfer in direction of warning. This could end result from many alternative components, however broader market uncertainty as Bitcoin continues to wrestle to regain the $70,000 may be the largest one. The contraction in OI also can mirror a broader hesitation amongst merchants to decide to long-term positions.

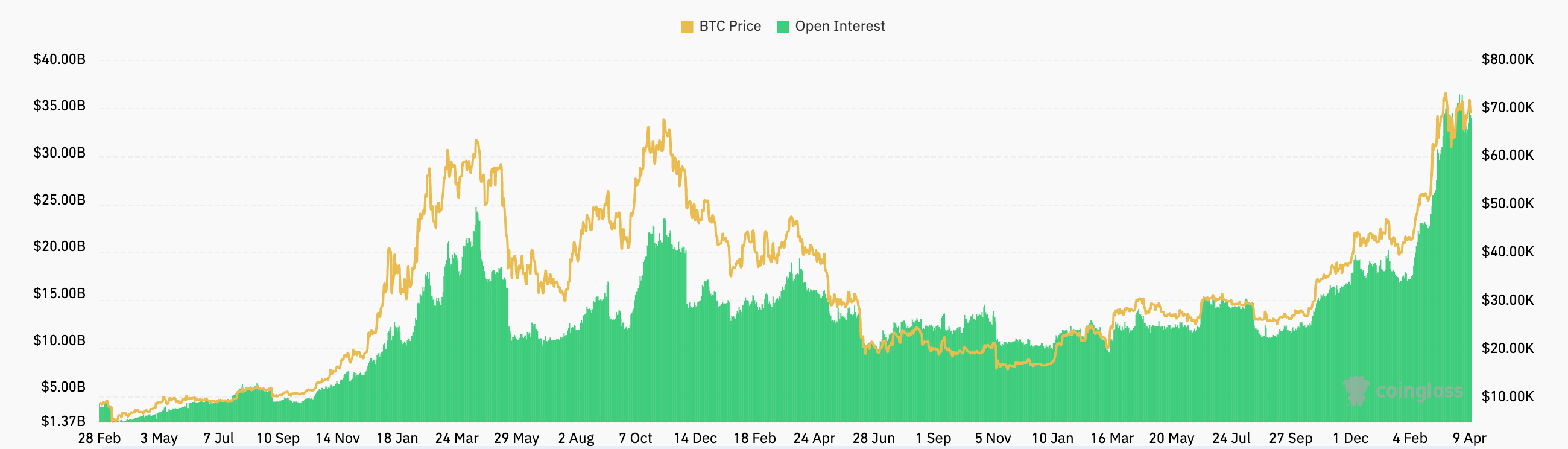

Nonetheless, it’s necessary to notice that the blended sentiment and cautious stance seen throughout completely different exchanges is relative to the current highs in OI the market has seen. Regardless of the drop prior to now few days, the market continues to be in a derivatives cycle with the highest open curiosity in Bitcoin’s historical past.

Because of this the warning and indecisiveness we’re seeing now are acute and don’t symbolize the long-term pattern seen this yr. Elements like macroeconomic developments, regulatory modifications, and inner developments inside the crypto market, just like the ETFs, are more likely to affect this sentiment.

We will anticipate the present pattern to alter because the market continues to digest these components. Future expectations and buying and selling methods will regulate shortly to new developments out there, which is why it’s necessary to maintain an in depth eye on derivatives.

The put up Bearish tilt in Bitcoin futures as open curiosity contracts appeared first on CryptoSlate.