Bitcoin clawed its method over $27,000 on Sep. 18 after struggling to reclaim its tight summer time buying and selling vary for many of the month. Though each worth uptick brings a breath of optimism to the trade, on-chain knowledge nonetheless suggests a dominant sell-side regime in the marketplace.

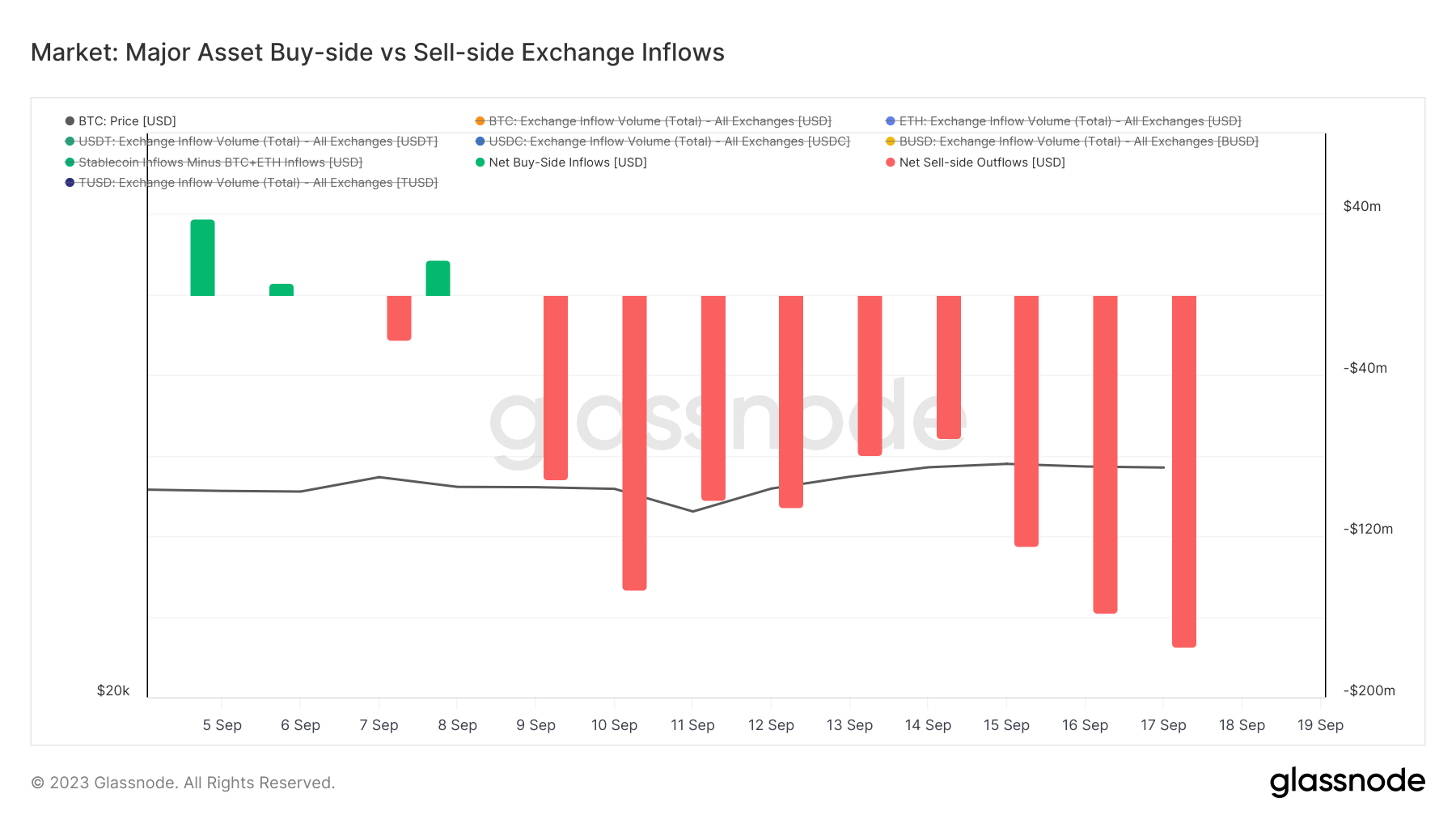

Purchase-side and sell-side change inflows are vital in shedding mild on this market sentiment. These inflows provide a tangible technique to gauge capital shifts primarily based on preferences regarding change volumes.

Particularly, the idea lies in treating Bitcoin (BTC) and Ethereum (ETH) inflows, when denominated in USD, as indicative of sell-side strain. Conversely, inflows of stablecoins are seen as consultant of buy-side strain.

The metric offsets the BTC/ETH sell-side volumes in opposition to stablecoin buy-side volumes, giving an overarching view of change inflows. Primarily, values hovering round zero recommend a market equilibrium. Optimistic values signify a buy-side dominance, whereas destructive ones level to a sell-side dominance.

Nevertheless, it’s necessary to notice that this metric relies on the premise that BTC and ETH are deposited to exchanges to be bought, and stablecoins are deposited to exchanges to purchase different main belongings. Each stablecoins and different digital belongings can stream into exchanges for myriad causes, not restricted to commerce. These embrace custody issues, collateral functions, or sustaining place margins. Subsequently, it’s extra necessary to research shift modifications than nominal quantities of outflows.

A heightened sell-pressure started final week, casting a shadow over Bitcoin’s ascension to $27,000. Which means market individuals appear to be cashing out their positions regardless of the uptick in worth.

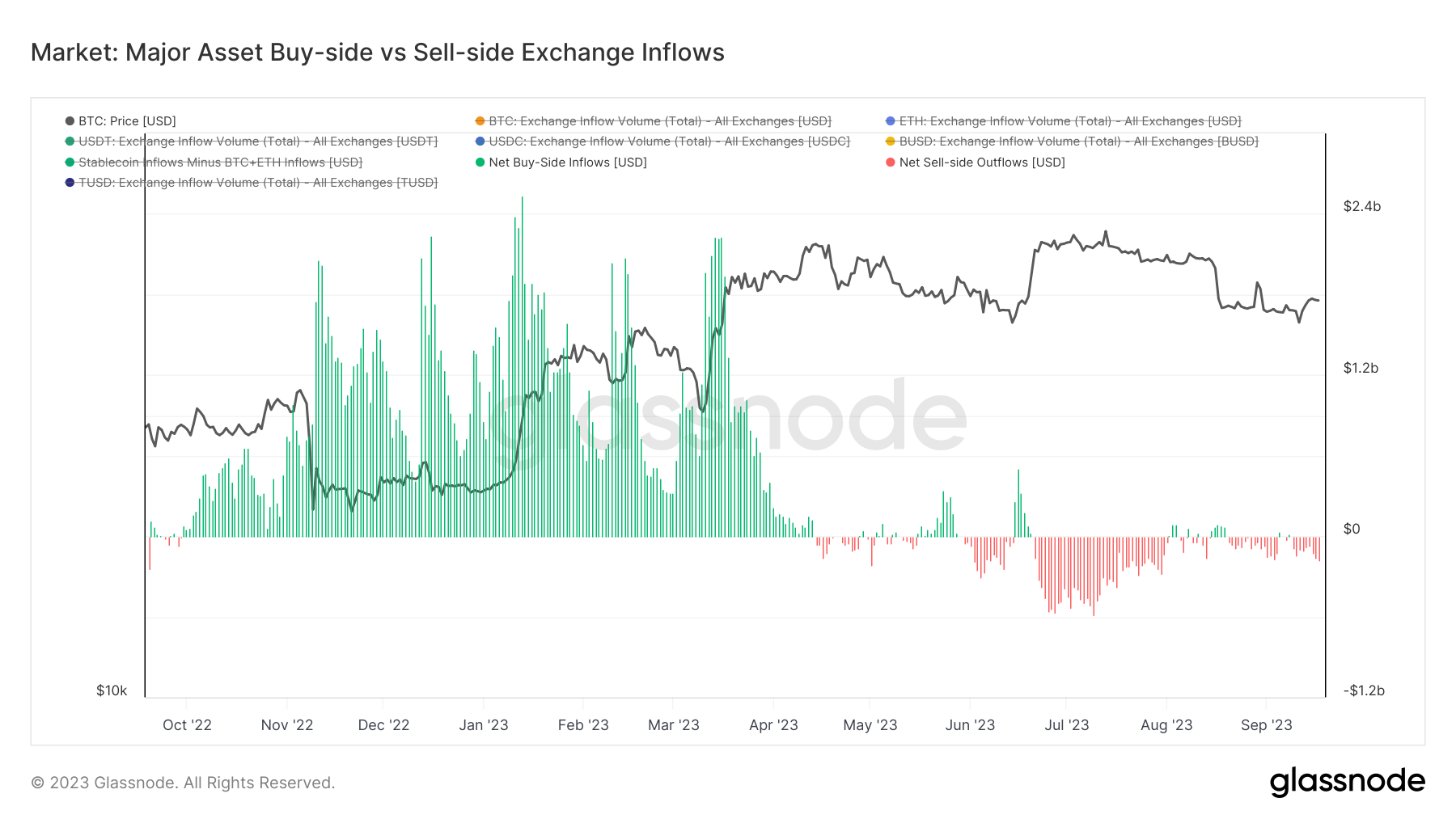

A wider lens reveals a noticeable pivot from buy-side to sell-side started unfolding in April. After a tumultuous three months of fast regime shifts, the market sank right into a sell-side dominance by mid-July, a development that lasted until August.

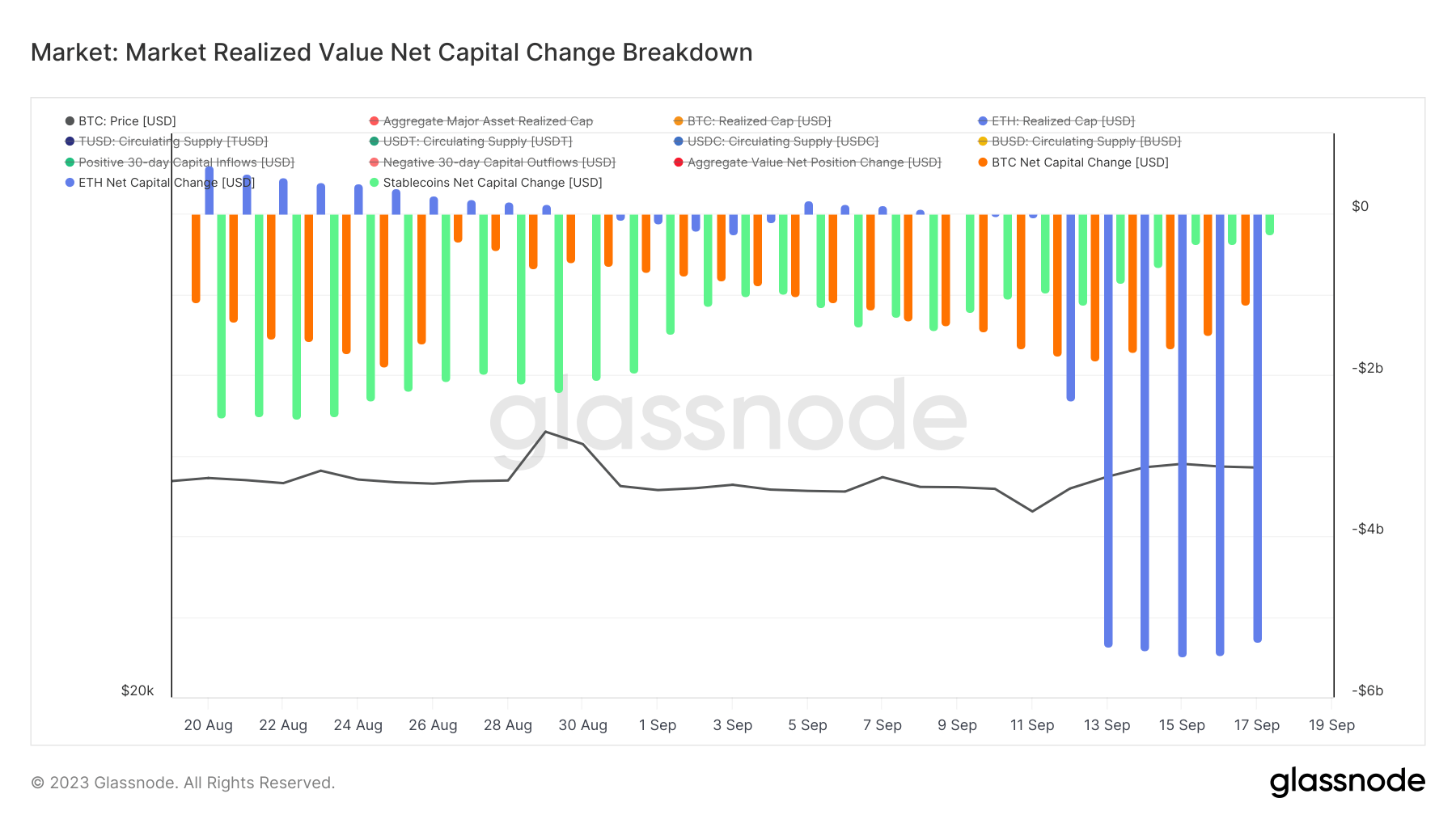

The market-realized worth internet capital change (MRVNCC) is one other useful metric for gauging capital inflows. It reveals the mixture 30-day internet place change for the most important belongings available in the market, basically representing the market’s monetary well being.

The MRVNCC considers the realized cap of main community belongings extra precisely representing real capital actions than the spot worth. The realized cap assigns a worth to every coin primarily based on its final transacted worth, accounting for coin liquidity and successfully filtering out speculative off-chain buying and selling. This metric reveals constructive capital inflows, destructive capital outflows, and the whole capital flows for community belongings (like BTC, ETH, and LTC) and stablecoins (USDT, USDC, and BUSD).

A destructive capital outflow of Bitcoin started firstly of August. Its most vital dip occurred on Aug. 15, recording an outflow of $1.89 billion. As Bitcoin’s worth initiated its upward journey on Sep. 11, Ethereum skilled a considerable drain.

Ethereum’s capital outflows have been $35 million on Sep. 11, escalated to $2.3 billion by Sep. 12, and peaked at $5.48 billion on Sep. 15. In distinction, Bitcoin recorded an outflow of $1.66 billion the identical day. By Sep. 18, Bitcoin’s capital outflows receded barely to $1.12 billion.

Whereas the current worth hike of Bitcoin rekindles optimism, the persisting sell-side strain, evident from main asset outflows and contrasting stablecoin inflows, means that the market continues to be treading cautiously. This predominant sell-side development could be indicative of a number of underlying market dynamics. Merchants, particularly short-term holders who accrued all year long at decrease costs, could be cashing out to notice income.

The substantial outflows may sign an absence of market confidence or be attributed to elevated institutional engagement within the crypto sector. Institutional traders handle a lot bigger portfolios, so their buying and selling methods may cause extra vital inflows and outflows than retail merchants.

The submit Bearish warning as sell-side strain persists regardless of Bitcoin surge – on-chain knowledge reveals appeared first on CryptoSlate.