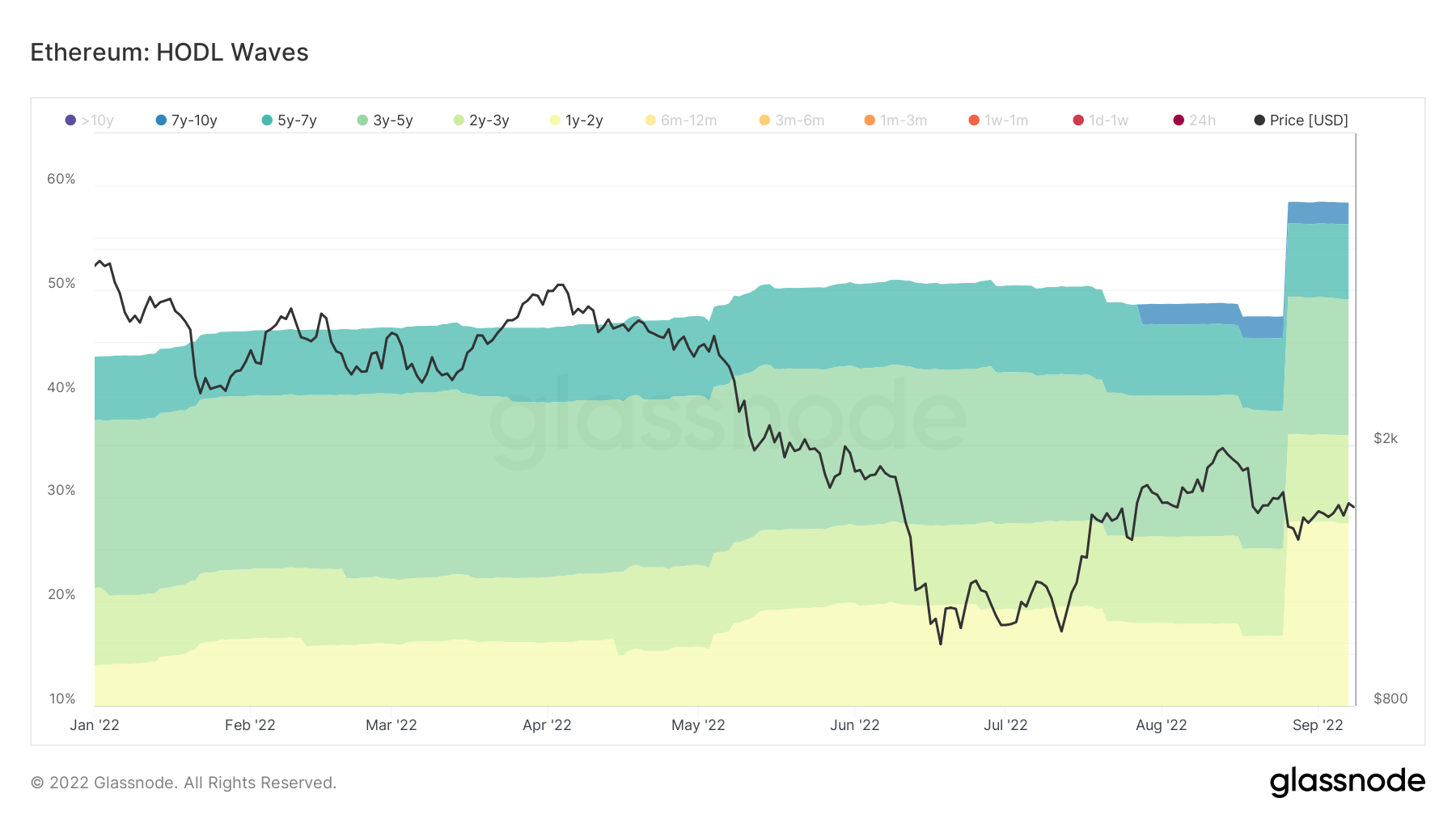

In accordance with on-chain information, because the merge approaches, the dominant habits throughout the Ethereum community is to HODL. Cash held by Ethereum traders are maturing to showcase a better variety of HODLers unwilling to promote.

Inside the Ethereum ecosystem, just below 60% of traders have held for multiple 12 months, in contrast with Bitcoin, which has 80% of HODLers holding for a similar time frame.

Nonetheless, we at the moment are seeing 7-year holders (darkish blue) of Ethereum begin to improve. From July 28, the primary 7-year holders started to point out and now maintain over 2% of the provision.

Provided that Ethereum mined its first block in July 2015, cash that haven’t moved in 7-years are doubtless genesis cash which have by no means moved. As time goes on, it’s anticipated that the 7-year HODLers will proceed to develop as HODLers who entered the Ethereum ecosystem in the course of the 2017 bull run begin to emerge.

Not like Bitcoin, Ethereum shouldn’t be also known as a retailer of worth. Nonetheless, on-chain information means that 2% of Ethereum holders imagine it could possibly be. Relying on the exercise of the community, Ethereum may be deflationary after The Merge, which provides credence to this principle.

Bitcoin has an in-built inflation charge of 1.7%, whereas Ethereum might see deflation of 4%, nearly 6% decrease than Bitcoin. But, Ethereum has sturdy utility throughout its community, so an absence of obtainable ETH as a consequence of traders holding might impression the community’s efficiency.

Inflation is a software designed to encourage spending. If Ethereum turns into deflationary, there can be little incentive to transact on the community.

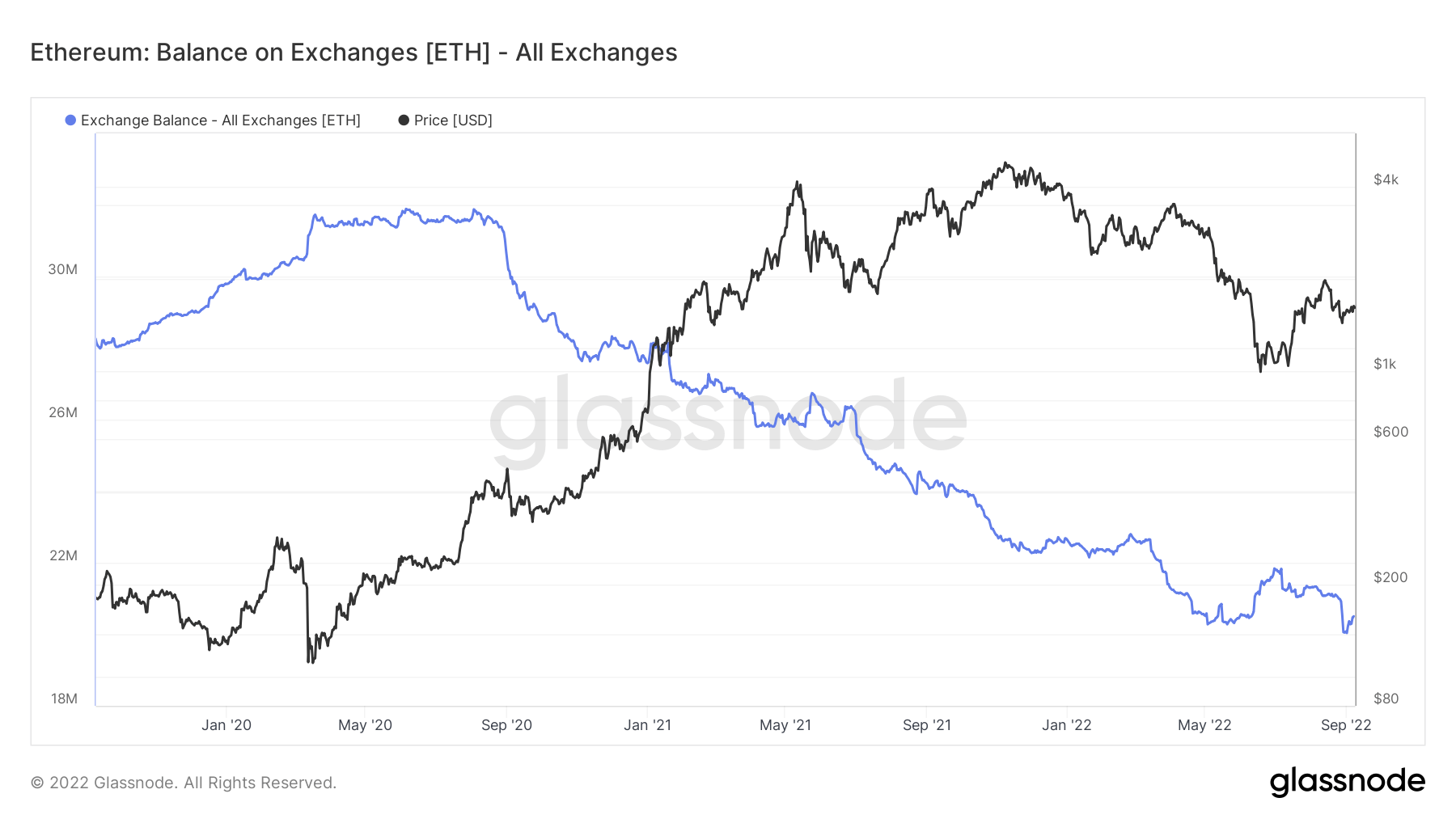

Additional, nearly 32m ETH was sitting on exchanges in mid-2020. Nonetheless, two years later, the quantity of ETH dropped to simply 20m. The variety of long-term HODLers, inflation charges, and provide on exchanges are vital long-term developments required to grasp provide/demand dynamics