Fast Take

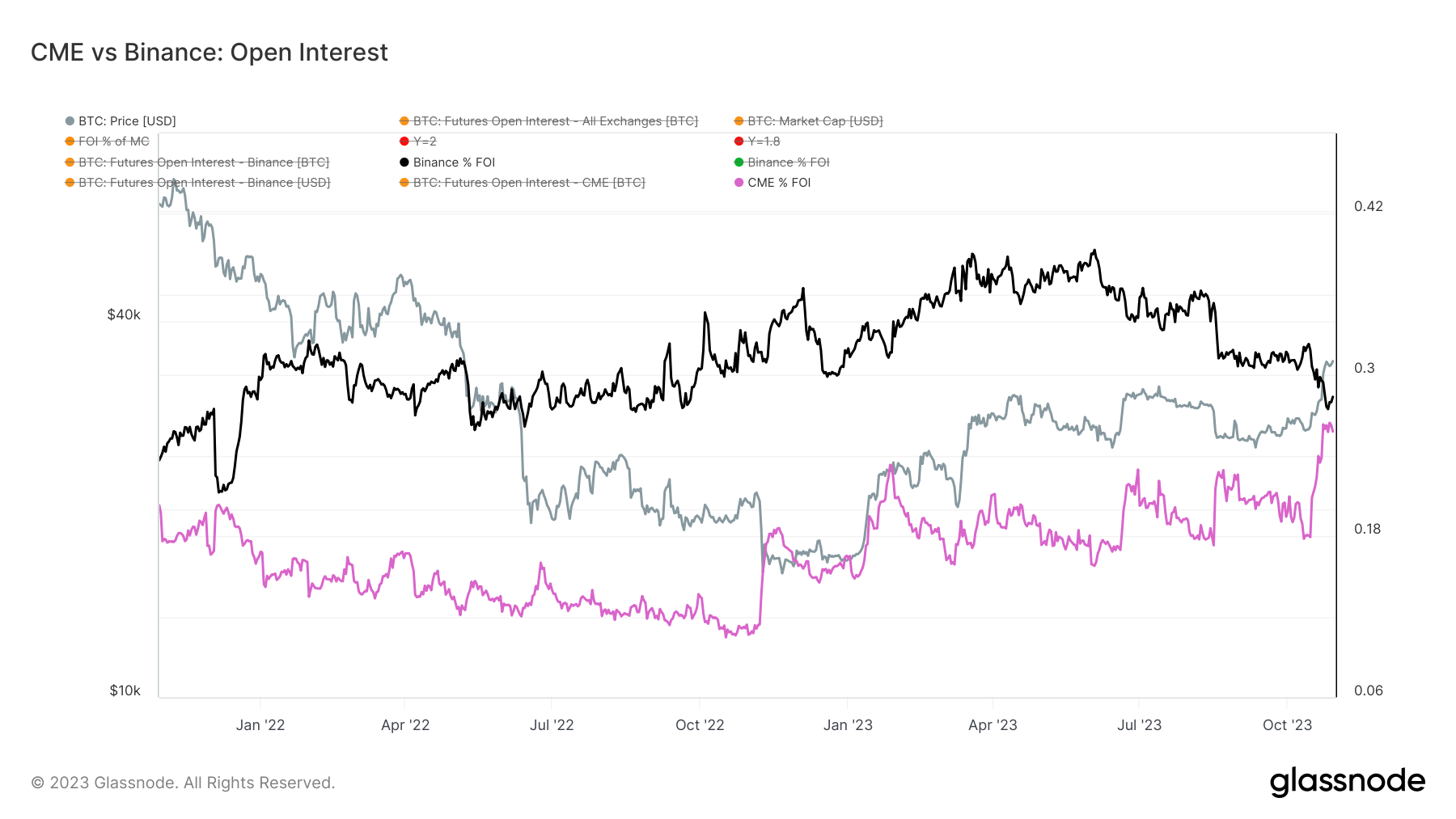

The dynamics of Bitcoin futures open curiosity unveils an intriguing interaction between main change platforms, Binance and CME. The previous, a world cryptocurrency change with a large attain, presently holds a barely bigger piece of the pie at simply over 28%. CME, primarily identified for institutional buying and selling, accounts for 26% of all futures open curiosity.

In numeric phrases, the whole quantity invested in open futures contracts equates to 400,000 Bitcoin. Of this, CME has just lately reached new heights, with 103,075 Bitcoin in open curiosity. In the meantime, Binance maintains a lead, albeit a slender one, with 113,419 Bitcoin. The small distinction between the 2 exchanges portrays tight competitors inside the cryptocurrency futures market.

This evaluation underpins the evolving dynamics of the cryptocurrency market as extra institutional merchants get entangled. The tight hole between Binance and CME may replicate rising institutional curiosity in Bitcoin futures, a major shift from the beforehand retail-driven market.

The publish Binance and CME are in a neck-and-neck race for dominance in Bitcoin futures appeared first on CryptoSlate.