Fast Take

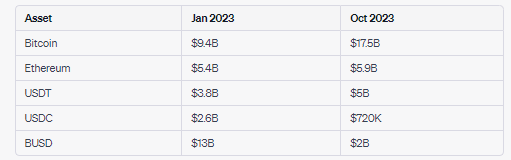

12 months-to-date information for 2023 displays important shifts in Binance’s proof of reserves, an official disclosure of the change’s on-chain property.

Bitcoin, buoyed by a 60% appreciation, has seen Binance reserves double from $9.4 billion in January to $17.5 billion in October. This surge has boosted Bitcoin’s share in Binance’s reserves from 27% at first of the yr to roughly 50% by October.

Nonetheless, there was a steep decline in BUSD, Binance’s proprietary stablecoin, whose reserves have plummeted from $13 billion to $2 billion. Ethereum reserve figures remained comparatively steady, rising barely from $5.4 billion to $5.9 billion, regardless of the cryptocurrency appreciating 30% year-to-date. The Tether (USDT) reserves have grown from $3.8 billion to $5 billion, contrasting sharply with USD Coin (USDC), which tumbled from $2.6 billion to a mere $720,000.

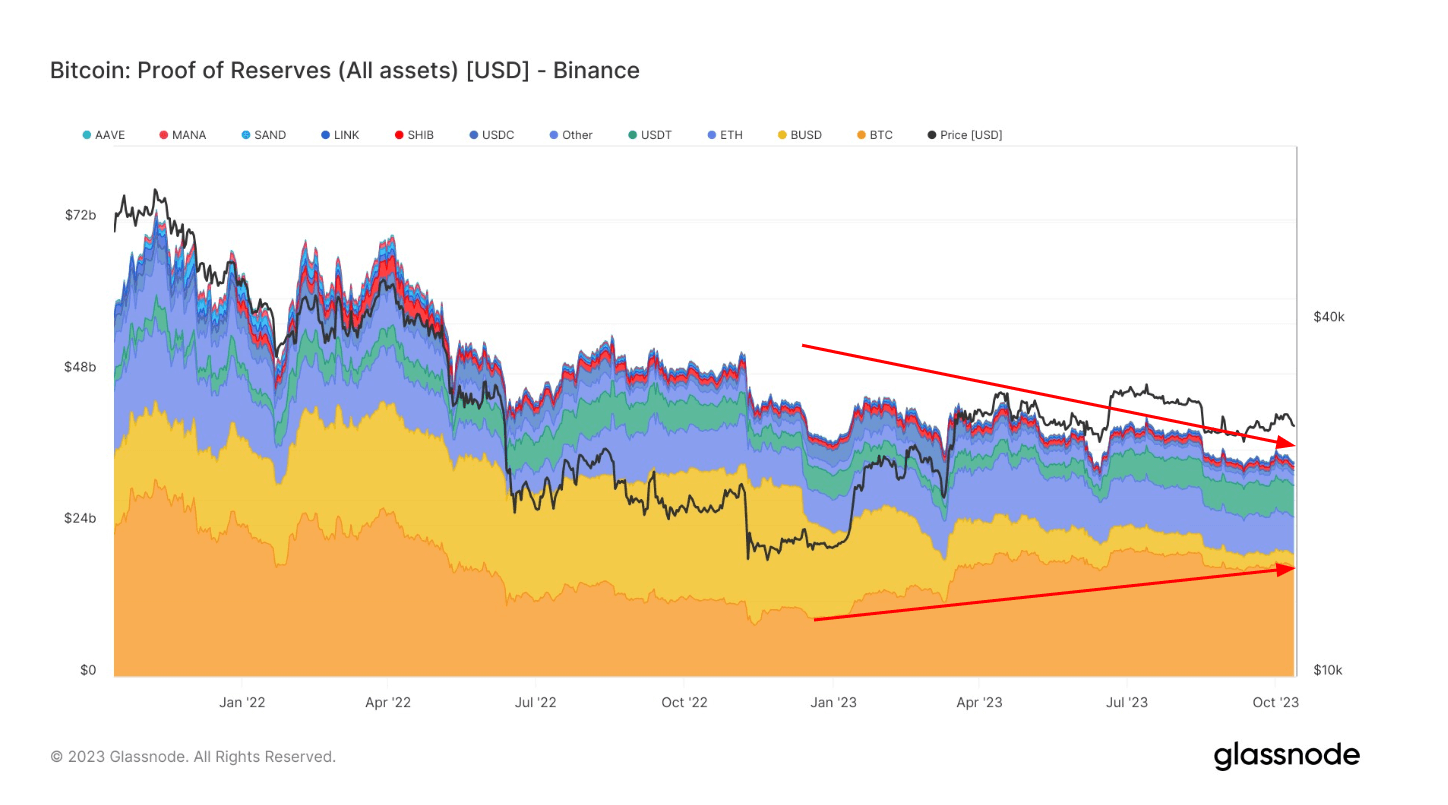

This commentary is backed up by Andre Dragosch, the Head of Analysis at Deutsche Digital Property, who famous a paradoxical development: Whereas Bitcoin rallied by 80% since November 2022, there was a noticeable decline in general crypto reserve property throughout the identical interval.

These shifts underline a transparent development: Bitcoin is changing into an more and more dominant reserve for Binance amidst diversified market dynamics.

The publish Binance Bitcoin reserves double, whereas proprietary stablecoin BUSD plummets in 2023 appeared first on CryptoSlate.