Bitcoin (BTC) withdrawal patterns on centralized exchanges have modified considerably over the previous 5 years.

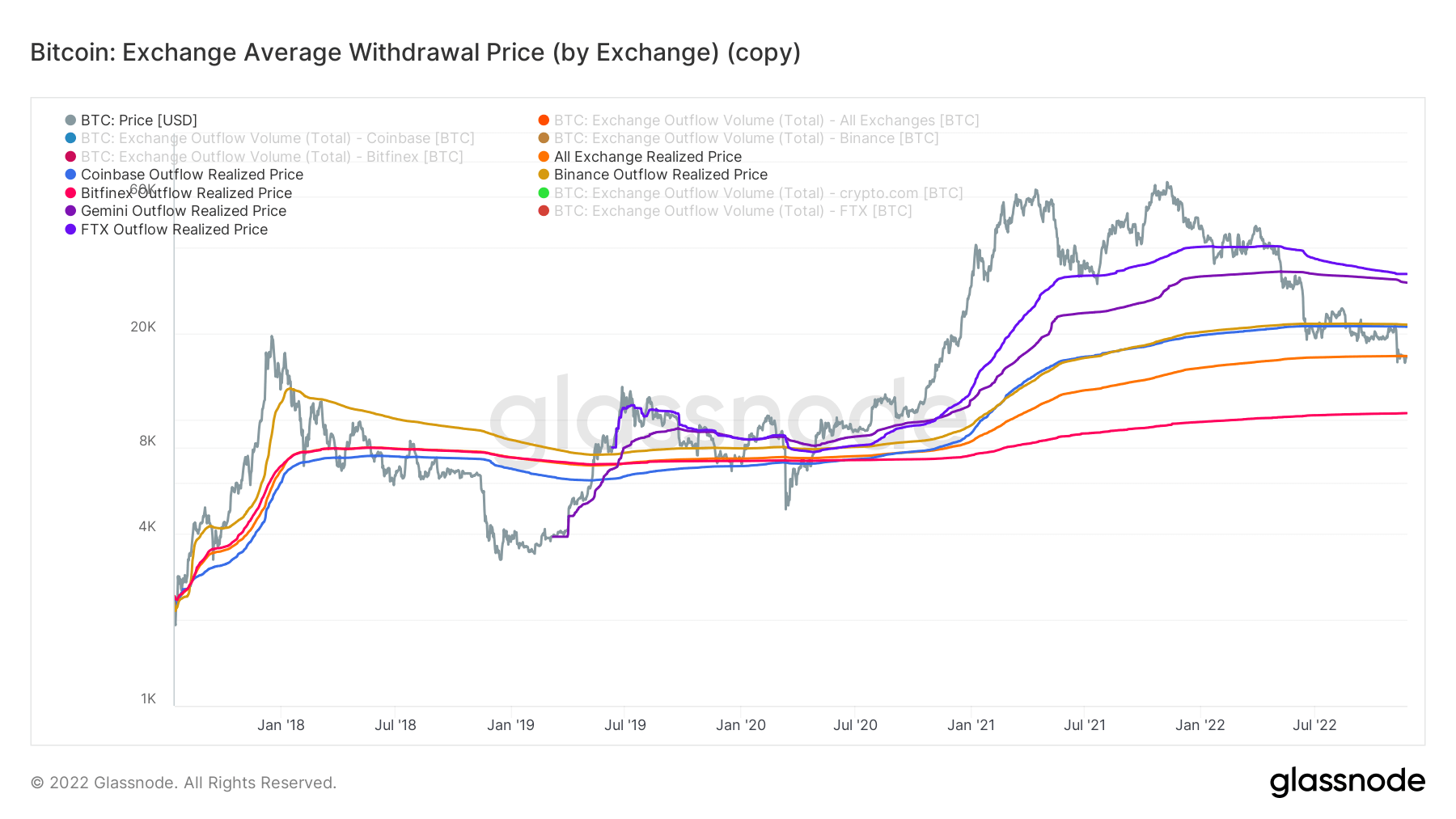

CryptoSlate evaluation of Glassnode knowledge on BTC’s common withdrawal value on prime exchanges like Coinbase, Gemini, Binance, FTX, and Bitfinex reveals an fascinating sample.

The chart above confirmed that within the early days of crypto adoption, notably in 2017 when Binance was established, the alternate noticed many of the dumb cash influx to crypto.

In keeping with Investopedia, dumb cash refers to retail traders who purchase primarily due to market hype and the worry of lacking out. Often, this group of traders tends to purchase when the worth is excessive or near the height.

As a result of they purchase near the height, they find yourself promoting or withdrawing when the worth of the asset declines. This was evident within the early days of Binance, when many of the withdrawals on the platform occurred after Bitcoin peaked.

This implies that almost all customers weren’t withdrawing at most income even when they weren’t at a loss. Thus, the realized outflow value finally ends up exceeding the present.

Nevertheless, the emergence of newer exchanges like FTX and Gemini noticed the motion of the “dumb cash traders” away from Binance. Since these exchanges have been launched in 2019, their common withdrawal value has been very excessive.

For reference, the common withdrawal value on Gemini and FTX was at a file excessive in the course of the Terra LUNA market implosion. Additionally, FTX’s latest collapse noticed retail merchants massively withdraw their belongings from the bankrupt alternate.

Compared, the common withdrawal value on Bitfinex has remained low and secure since 2017. This implies that the alternate has a extra subtle consumer base, i.e., good cash.

Investopedia describes good cash traders as institutional and educated traders who’ve a greater understanding of the market and use this to make knowledgeable selections. This class of traders has the instruments and the expatriate to make higher funding selections.

In the meantime, solely Bitfinex has a Bitcoin outflow realized value under the common for all exchanges.