It’s no secret that Binance advantages from FTX’s insolvency. After the second largest change on the planet went stomach up, different exchanges needed to divide FTX’s market share amongst themselves.

And that Binance is without doubt one of the largest winners now appears to be confirmed by current information. The Block claims that Binance now has a 75% market share on the spot market, 8.5 instances greater than the second Coinbase.

🚨Binance now represents 75% of all change quantity, and virtually 8.5x that of the second (Coinbase)

Good or dangerous for the ecosystem? pic.twitter.com/ykPisGn3W2

— Mario Nawfal (@MarioNawfal) November 30, 2022

Different Information Suppliers Do Not Agree

The chart is predicated on CryptoCompare information and exhibits that complete quantity for the month was $642.7 billion. Binance’s share of the yet-to-be-completed month of November reportedly equates to $481.7 billion.

Nevertheless, there are discrepancies with different information suppliers. Their information doesn’t discover a large dominance by Binance.

Coinmarketcap, which was acquired by Binance in April 2020, exhibits that the change presently has $12.5 billion in each day buying and selling quantity. It’s adopted by Coinbase Change with $1.5 billion {dollars}, Kraken with $626 million and KuCoin with $495 million.

With a complete quantity of $44.985 billion over the previous 24 hours, this solely calculates to a a lot more healthy 27.8% market share for Binance.

CoinGecko, alternatively, tracks 544 crypto exchanges with a complete 24-hour buying and selling quantity of $59.5 billion. Binance’s market share is definitely solely 21.7% based mostly on this determine. Nevertheless, each information suppliers solely present each day volumes and thus not an entire image.

Binance Is In The Crosshair Due To Different Causes

Whatever the dialogue about Binance’s market supremacy, the change is within the crosshair of critics attributable to different causes. One of many harshest critics is Bitcoin analyst Dylan LeClair.

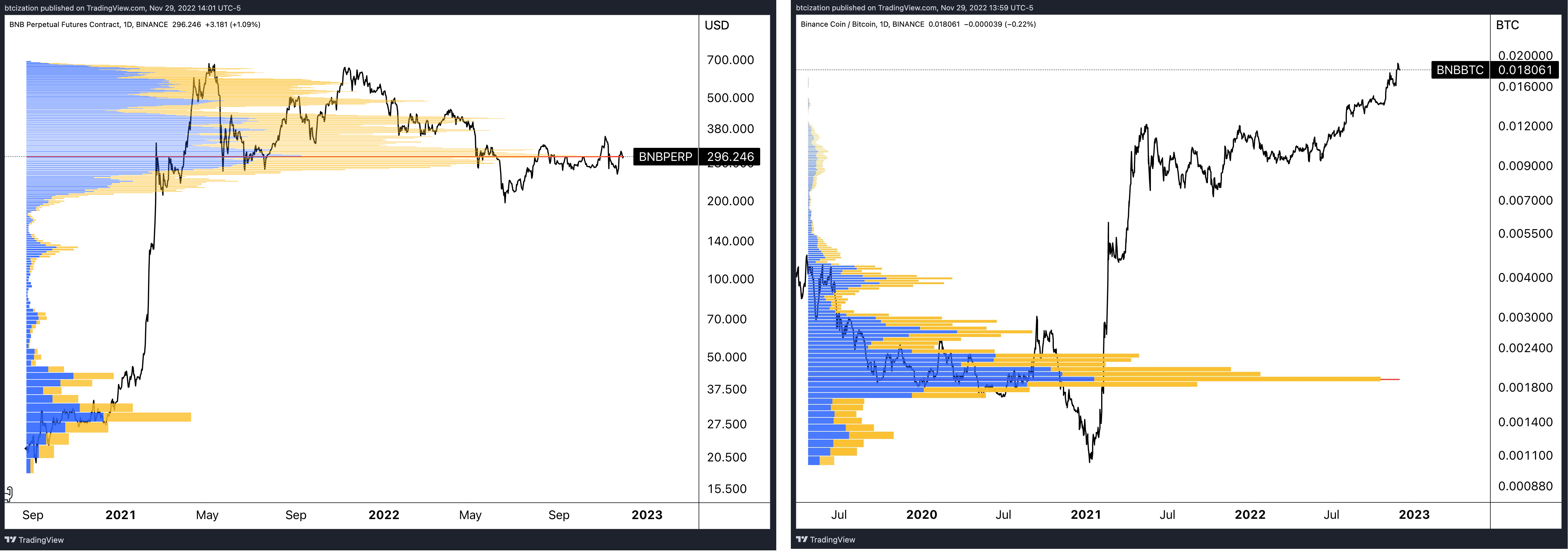

As he notes, BNB has made 9x in two months in the course of the bull run with barely a retrace, 10x versus BTC since 2021. “Have to be a brand new paradigm,” LeClair wrote and shared the next chart.

The analyst drew comparisons to FTX and commented mockingly; “I’m certain it was retail that despatched BNB 10x in two months. Similar with FTT, proper?”, and shared a chart of FTT and BNB with an identical worth development.

“It undoubtedly wasn’t the change operator with an incentive to drive up the worth of their very own token to create a suggestions loop of consideration, hype, and extra customers…. Positively not,” LeClair additional commented.

He argues that the outperformance in opposition to “every little thing” is critical, and one ought to marvel what the reason being.

Who’s supporting this market (we all know), and have they got infinite cash? […] Consider some alts that outperformed this bull run? SOL (Alameda leverage and fraud), AVAX (3AC), LUNA (perpetual movement machine), and so forth.

To assist his conjecture, LeClair additionally seemed on the quantity aspect profile for BNB/BTC spot market and BNB/USDT perpetual swaps (leverage) on Binance. He discovered a placing disparity.

Whereas Binance CEO Changpeng Zhao (CZ) mentioned the change by no means makes use of leverage, customers are inspired to take action via varied gives on Binance, based on the declare.

Additionally, CZ reiterated after the FTX collapse that Binance has by no means used its BNB token as collateral and has by no means taken on debt. LeClair solely commented, “CZ my man, I actually hope you’re telling the reality.”

Jack Dorsey And Others Additionally Categorical Criticism

Remarkably, Twitter co-founder and former CEO Jack Dorsey took a stand on the matter, commenting: “All made up.” Dorsey is named a Bitcoin proponent, however his assertion is imprecise.

His solely different touch upon the topic was a response to “Bitcoin, not shitcoin” with “sure,” leaving the neighborhood at the hours of darkness as as to whether he helps LeClair’s theses.

All made up

— jack (@jack) November 29, 2022

Famend on-chain analyst Willy Woo additionally expressed cautious criticism of Binance, particularly on its Safe Asset Fund for Customers (SAFU):

SAFU is deceptive advertising. It was boosted to “$1 billion,” however in case you have a look at it intently and issue out the correlated impression of BNB and to a lesser extent BTC, the fund is basically solely good for 0.5% of the $68 billion in belongings on Binance. This isn’t hate, it’s informing the general public.

At press time, BNB was down 0.9%, whereas BTC skilled a small surge and posted a each day achieve of two.5%.