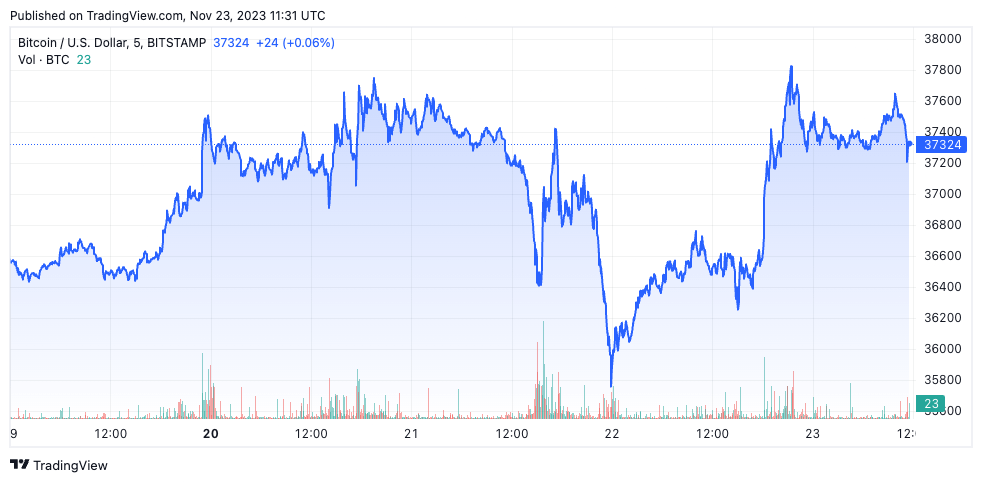

The SEC’s $4 billion fantastic on Binance and the next stepping down of the alternate’s CEO, Changpeng Zhao, considerably impacted the market. Whereas Bitcoin’s worth dipped barely on Nov. 21, it skilled a big drop to $35,740 within the early hours of Nov. 22, displaying an instantaneous and aggressive market response to the information.

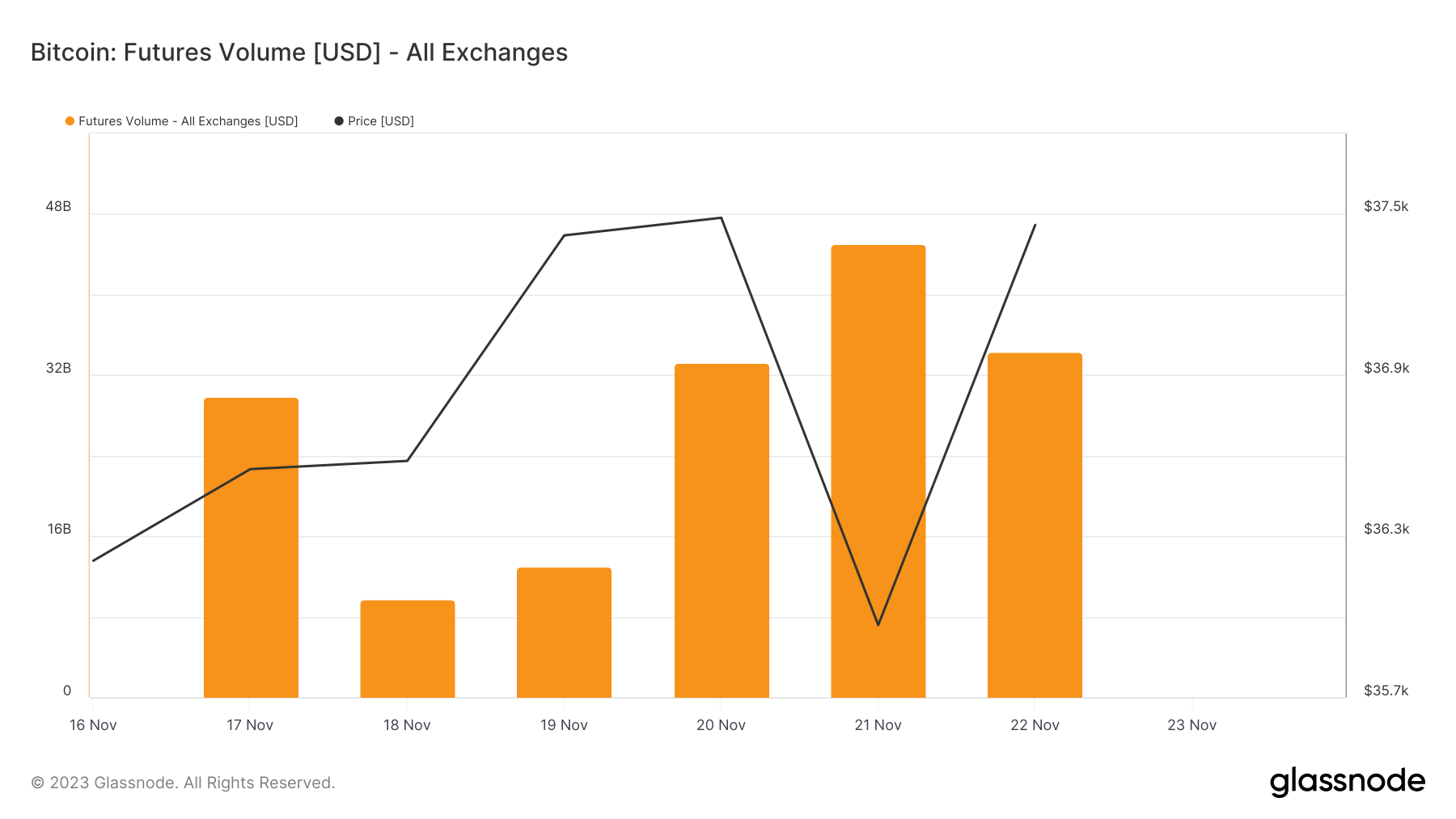

The futures market wasn’t spared from the volatility, experiencing an equally sharp spike in exercise. The whole quantity traded in Bitcoin futures contracts surged to $45.05 billion by Nov. 21, up from $9.79 billion on Nov. 18. This spike, greater than quadrupling in a matter of days, reveals a flurry of buying and selling exercise within the futures market. It probably displays a mixture of speculative buying and selling, hedging methods, and speedy changes by merchants in response to the uncertainty and volatility launched by the information from Binance. The following lower to $34.3 billion on Nov. 2 signifies a partial normalization however nonetheless displays heightened exercise in comparison with the interval earlier than the SEC’s announcement.

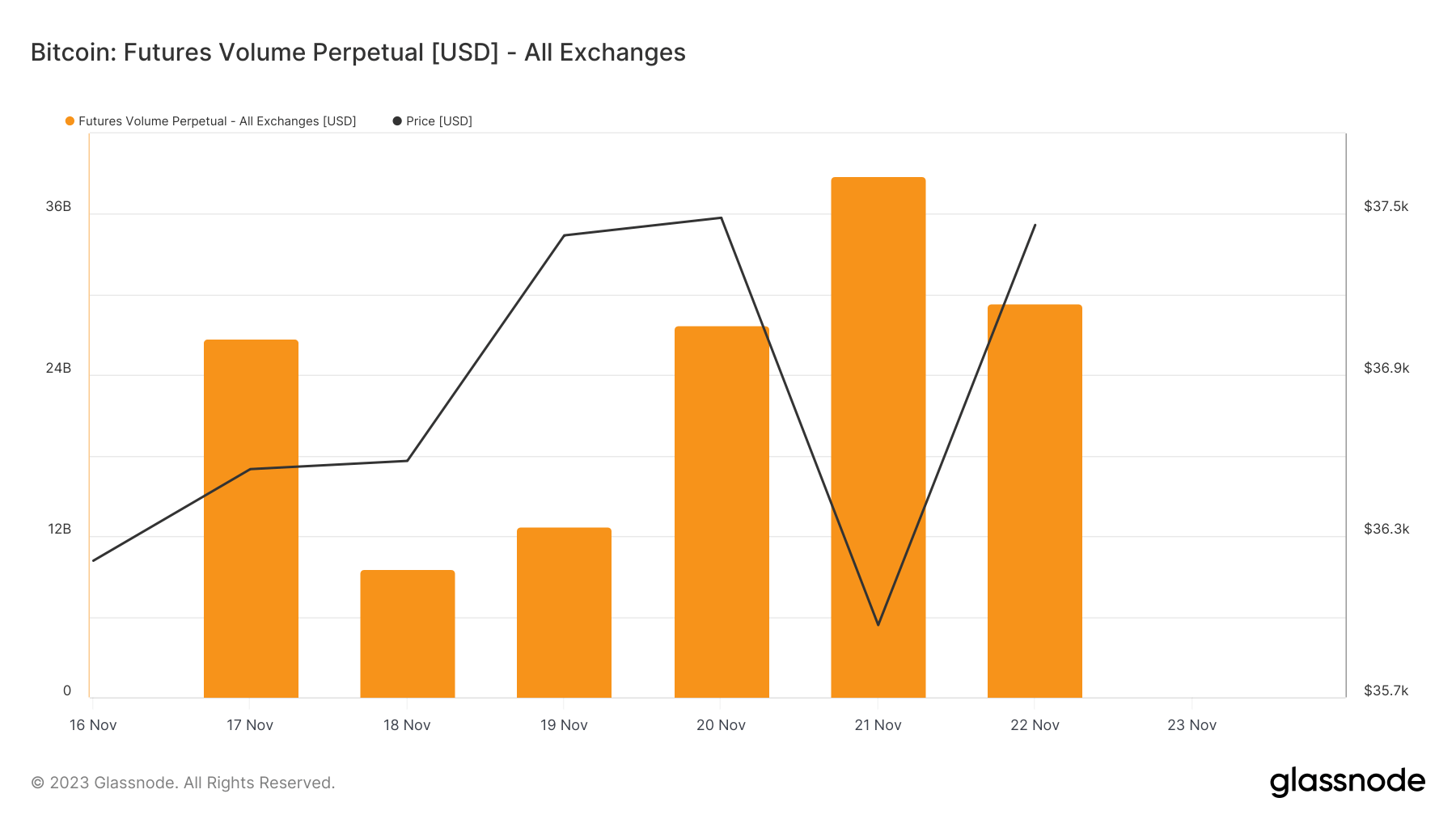

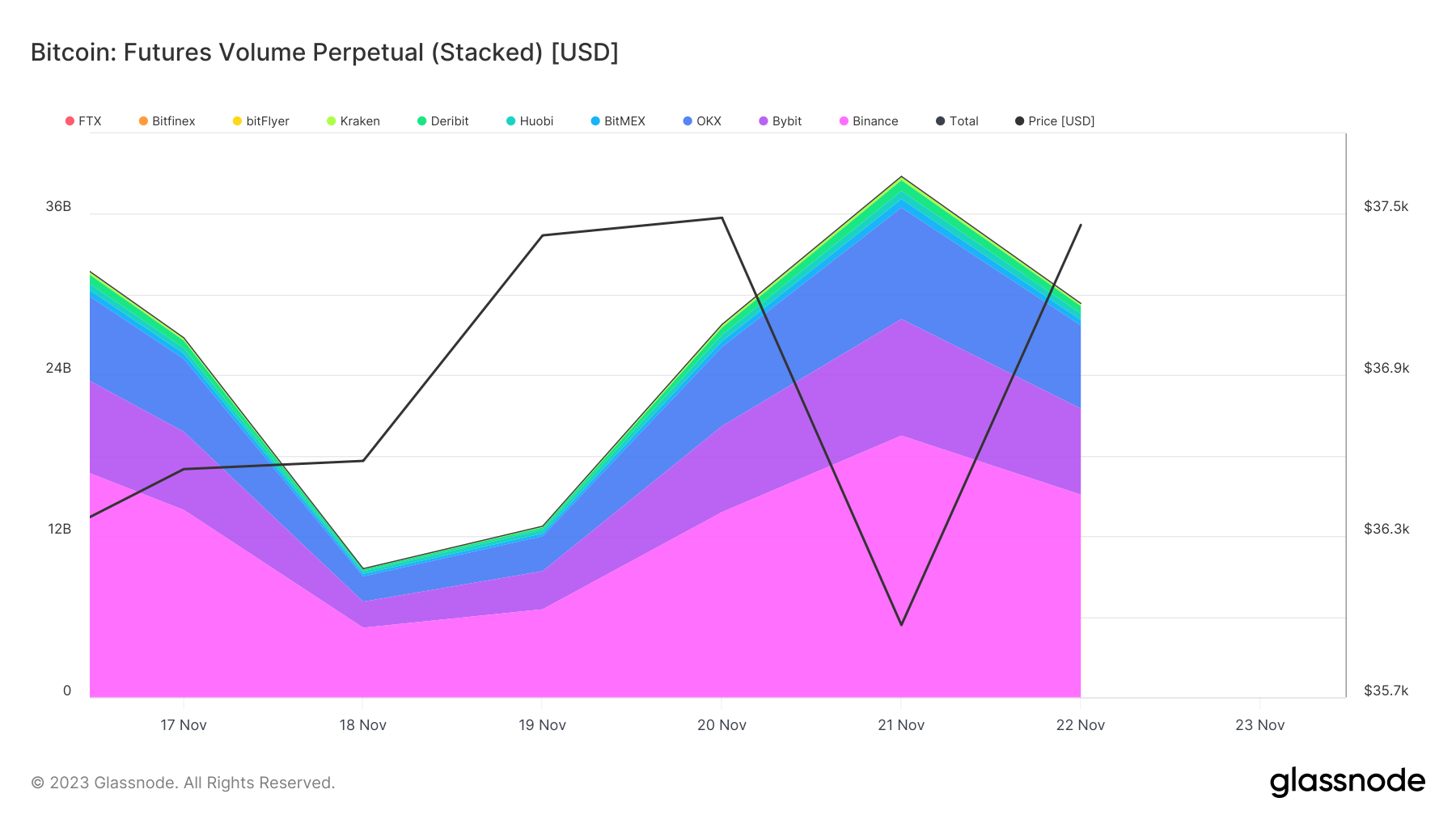

Parallel tendencies have been seen within the perpetual futures market as nicely. Right here, the quantity elevated from $9.58 billion on Nov. 18 to $38.79 billion on Nov. 21 earlier than decreasing to $29.33 billion on Nov. 22. Perpetual futures, being non-expiring contracts, are sometimes favored for long-term positions. The elevated quantity on this phase reveals simply how reactive the market is to adjustments within the trade.

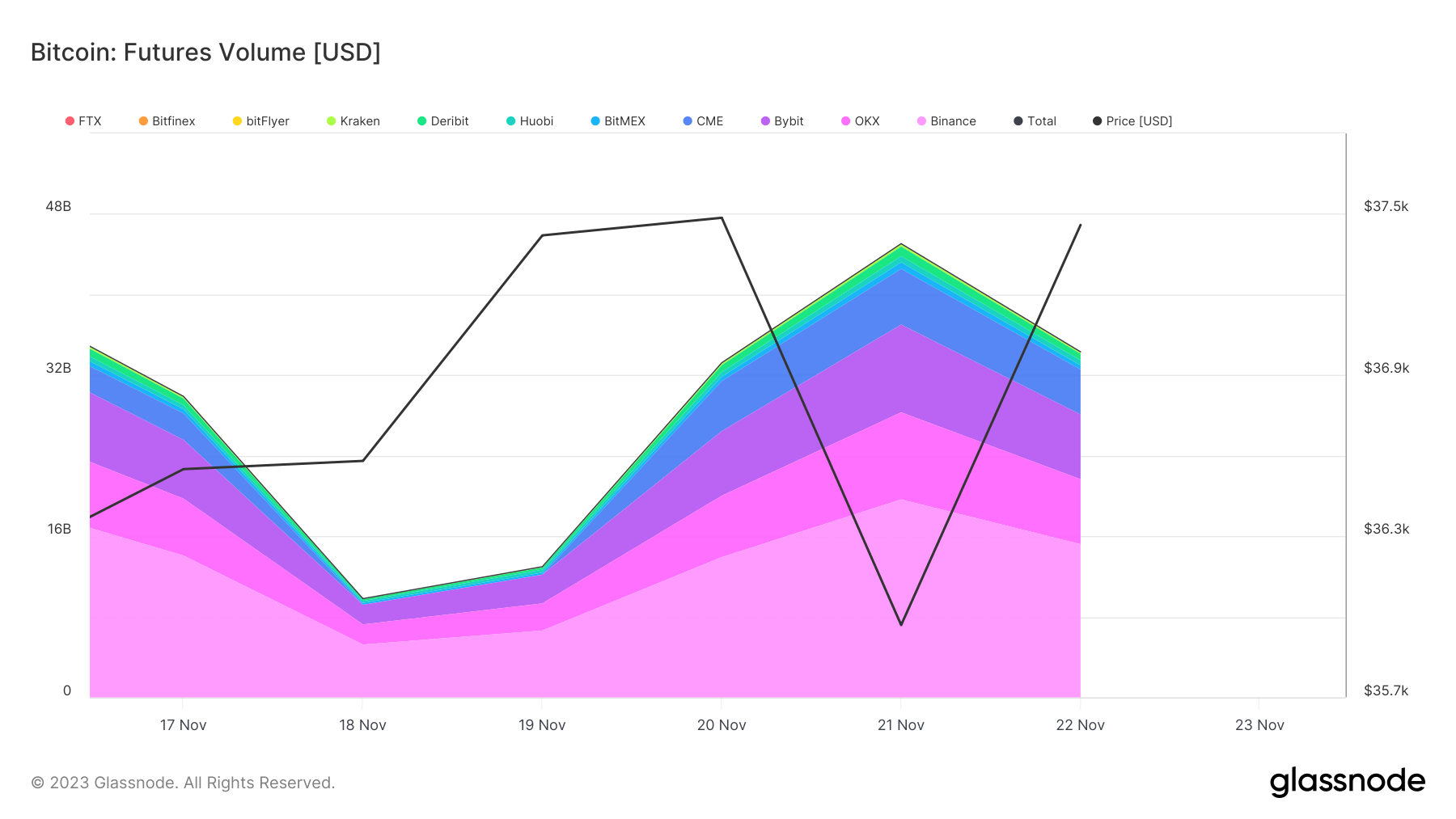

The distribution of volumes throughout exchanges reveals the place many of the buying and selling occurred. Binance, straight impacted by the information, noticed its futures buying and selling quantity bounce from $5.24 billion on Nov. 18 to $19.65 billion on Nov. 21. regardless of the detrimental information, this improve would possibly point out merchants’ makes an attempt to liquidate positions or capitalize on anticipated market actions. The same, although much less pronounced, progress in buying and selling volumes on different exchanges like OKX and Bybit, from $2 billion and $1.94 billion, respectively, on Nov. 18 to $8.65 billion and $8.71 billion on Nov. 21, reveals a broader market response not restricted to Binance.

Within the perpetual futures phase, Binance’s quantity elevated from $5.18 billion to $19.48 throughout the identical interval, once more displaying vital dealer exercise on the platform. The same will increase in volumes on Bybit and OKX present a market-wide response for perpetual futures as nicely.

The info reveals an aggressive however short-lived market response to the information of Changpeng Zhao’s stepping down and the SEC fantastic. A short dip in Bitcoin’s worth under the seemingly-established $36,000 degree brought about a big spike in buying and selling volumes throughout main exchanges. This response highlights the sensitivity of the crypto market to regulatory information and management adjustments in main trade gamers.

The publish Binance turmoil results in file futures exercise – analyzing the impression appeared first on CryptoSlate.