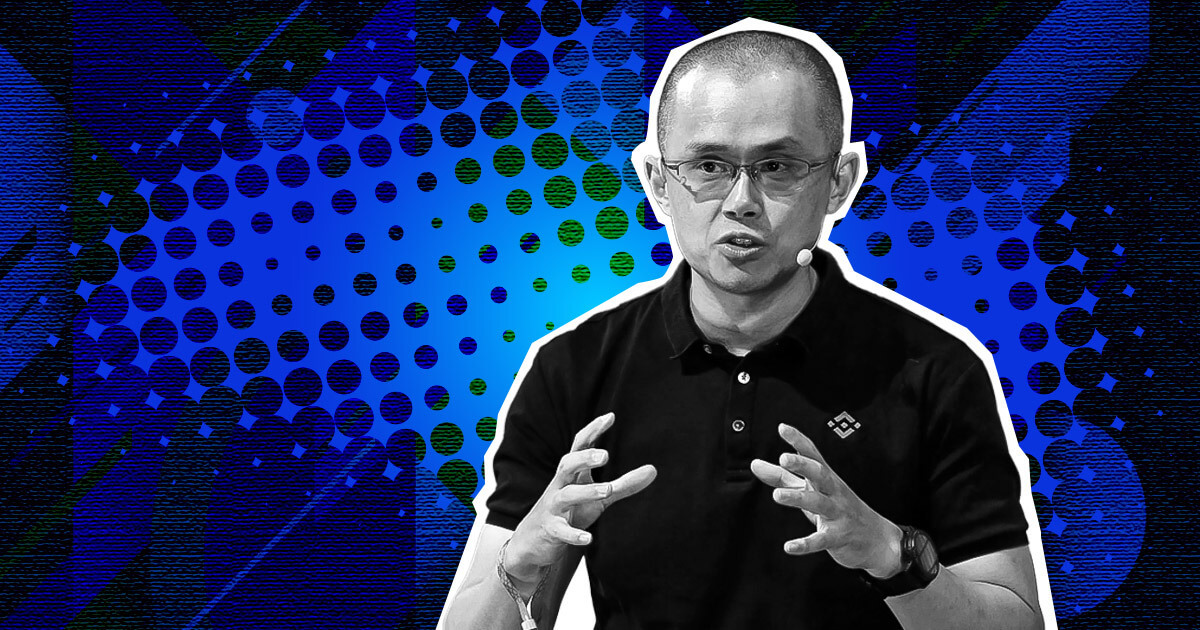

Changpeng Zhao (CZ) defined the circumstances surrounding Binance leaving the Canadian market – saying the regulatory necessities meant it was unfeasible to proceed working within the nation.

Exit from Canada

On Might 12, Binance introduced it might be “proactively withdrawing from the Canadian market.”

The agency acknowledged that new crypto alternate regulatory steering on stablecoins and investor limits meant it was “now not tenable” to proceed working within the nation.

The assertion talked about long-running negotiations with authorities had turned up no center floor, resulting in the choice to withdraw.

“We delay this choice so long as we might to discover different cheap avenues to guard our Canadian customers, nevertheless it has change into obvious that there are none.“

Three weeks on, throughout an AMA Twitter Areas, CZ gave a extra detailed rationalization of what had occurred – saying there was numerous stress on regulators to implement a strict regime following the Quadriga CX and FTX scandals.

In December 2018, Quadriga CX CEO founder Gerald Cotten fell ailing and died underneath mysterious circumstances in India. Initially, it was understood that solely Cotten had entry to the corporate’s keys, however investigations later revealed company mismanagement and lacking consumer funds.

Extra not too long ago, FTX filed for chapter on November 11 after a run on the alternate. Incoming CEO John Ray, tasked with salvaging the corporate, described a catalog of company failures and unacceptable practices.

Regulators wished escrow deposit

Increasing on the Canadian withdrawal, CZ mentioned he was paraphrasing and will or is probably not technically or legally correct. Nonetheless, primarily based on his understanding, regulators wished Binance to place C$100 million ($73.5 million) in third-party escrow.

“My tough understanding was we had to make use of a third-party custodian. We needed to put CAD $100 million in escrow of some type. So we couldn’t even use our personal custodian service, which we consider is safer.”

The sticking level associated to regulators sticking to their weapons on the collateral being escrowed with a non-Binance supplier – which was unacceptable for the corporate.

“Third-party custodian know-how suppliers are smaller than us and fewer examined, so we view that as the next threat, not much less threat.

CZ additionally talked about a requirement to restrict the variety of tokens Binance supplied Canadian prospects.

Following an evaluation, the agency concluded that the Canadian market didn’t provide a viable enterprise as assembly the regulatory necessities would imply working a extra custom-made and costly mannequin.

Nonetheless, CZ mentioned he hopes “Canada would flip again in a few years,” citing regulatory experiences in Japan and Thailand, which have opened up significantly not too long ago after beforehand being hostile.