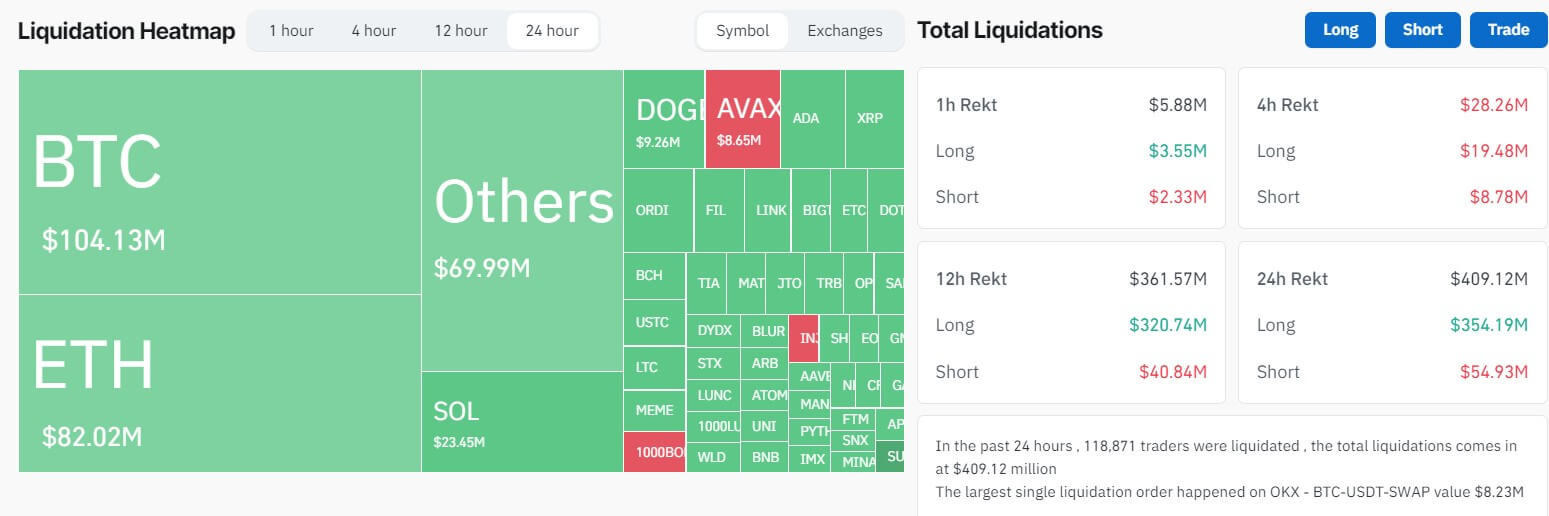

Almost 120,000 crypto merchants misplaced greater than $400 million up to now 24 hours as digital asset costs plummeted throughout the opening of Asia buying and selling hours on Dec. 11.

Coinglass information signifies that roughly $356 million of those liquidations had been attributed to lengthy positions, marking essentially the most intensive single-day loss pushed by lengthy hypothesis within the final 4 months. Moreover, brief merchants confronted losses totaling $54.79 million.

Bitcoin merchants bore the brunt of those losses, accounting for about $104 million in whole liquidations. Lengthy positions in BTC contributed $90.9 million to this determine, whereas shorts accounted for $12.12 million.

Ethereum buyers additionally confronted appreciable losses, with round $74.62 million liquidated in lengthy positions alongside $6.52 million from brief positions.

Different cryptocurrencies akin to Solana, XRP, Dogecoin, Avalanche, Cardano, and Litecoin noticed notable losses for merchants holding lengthy positions throughout this era.

Amongst exchanges, OKX and Binance witnessed essentially the most vital losses, tallying liquidations exceeding $171 million and $128 million, respectively. Notably, essentially the most substantial particular person loss recorded was an $8.2 million lengthy wager on Bitcoin’s value on the OKX alternate.

Crypto market takes a breather.

Bitcoin, the biggest cryptocurrency by market capitalization, tumbled round 5% to a low of $41,649 earlier than recovering to its present worth of $42,155 as of press time, in keeping with CryptoSlate’s information.

BTC’s fall ignited the value declines in different main cryptocurrencies like Ethereum, which slid by nearly 5%, adopted by different large-cap cryptocurrencies akin to Solana, XRP, Binance-backed BNB, and Cardano, enduring a few of their most appreciable losses in current weeks.

The worldwide crypto market capitalization fell by round 4% to $1.57 trillion.

The current drop comes after a three-month surge fueled by optimism in regards to the potential approval of a Bitcoin Alternate-Traded Fund (ETF) in the USA.

Though the approval hasn’t materialized but, specialists level to ongoing communications between the U.S. Securities and Alternate Fee (SEC) and the candidates as a optimistic signal, hinting that the regulator may lastly give the inexperienced gentle to those funding merchandise.