Fast Take

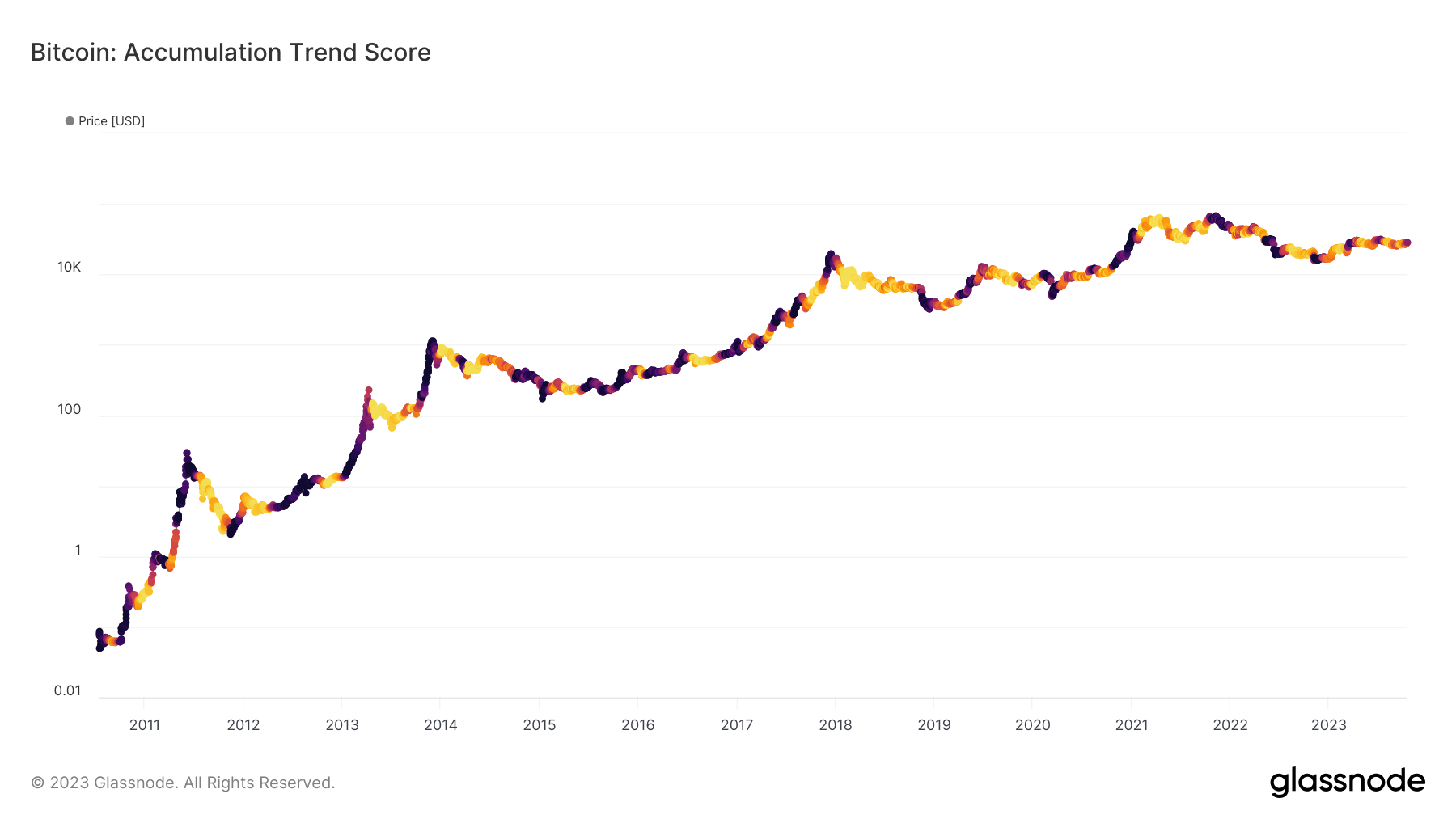

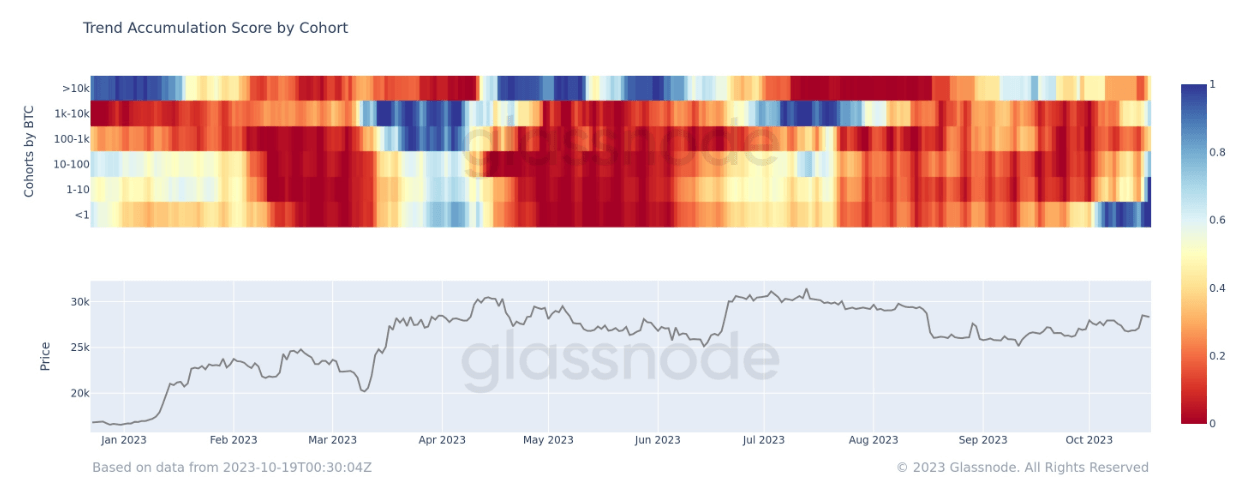

The Accumulation Development Rating, a metric indicating the relative dimension of entities actively accumulating Bitcoin, has signaled a shift. This indicator evaluates on-chain Bitcoin holdings, factoring within the dimension of an entity’s steadiness (participation rating) and their current acquisition or promoting exercise (steadiness change rating).

On this scale, a rating approaching 1 suggests intensive accumulation by bigger entities, whereas a rating nearing 0 signifies distribution or an absence of accumulation.

For the primary time since July, the Accumulation Development Rating reached above the 0.5 mark on Oct. 17 whereas registering at 0.64 yesterday, Oct. 18. This upturn implies that important cohorts are amassing Bitcoin, displaying a development in direction of accumulation on a network-wide scale.

The information reveals extra profound patterns when damaged down by cohort dimension. “Shrimps,” or these holding lower than 1 Bitcoin, have persistently accrued all through October. Bigger cohorts, particularly these holding between 1-10, 10-100, and 1,000-10,000 Bitcoin, have proven a marked development in direction of accumulation starting this week. This surge in accumulation throughout numerous cohorts indicators a broadening development of Bitcoin acquisition.

The submit Bitcoin accumulation hits highest stage since July, signaling bullish development appeared first on CryptoSlate.