Fast Take

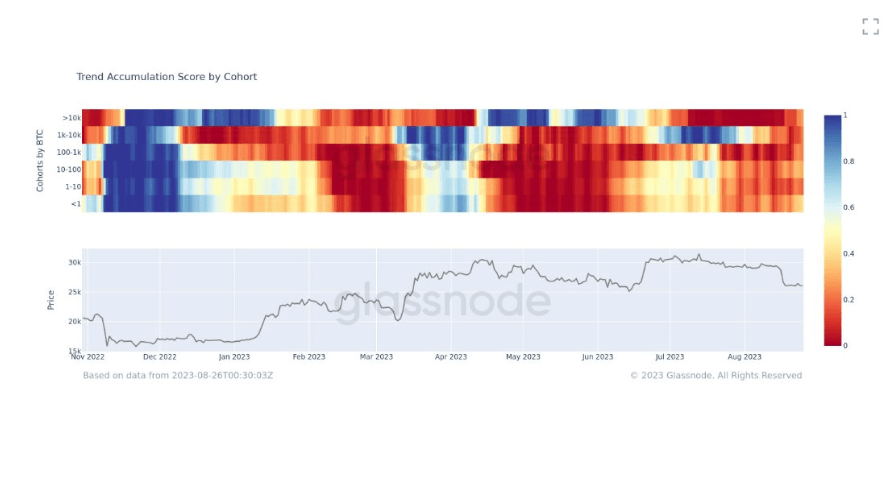

The Accumulation Pattern Rating, created by Glassnode, affords an in depth breakdown of the cryptocurrency acquisition habits of various entity pockets cohorts. The algorithm calculates this rating by evaluating the dimensions of those cohorts and the amount of Bitcoin they amassed over the last fortnight. A rating nearer to 1 implies that the entities in that cohort primarily accumulate cash, whereas a rating nearing 0 suggests a predominant distribution of cash inside the cohort.

Bitcoin has dropped roughly 11% in August, hovering round $26,000. Nevertheless, the Accumulation Pattern Rating signifies a marked paucity in accumulation from any cohort. This statement is supported by the visualization’s purple hue, signifying that almost all cohorts had been distributing cash somewhat than accumulating. It’s vital to notice that sure entities, together with exchanges and miners, are excluded from this calculation to make sure an unbiased analysis of the market sentiment amongst totally different cohort contributors.

The stagnation within the accumulation pattern, mirrored within the distribution-dominant habits of the cohorts, underscores the market’s conservative stance in Bitcoin buying and selling throughout August.

The submit Bitcoin accumulation sees slowdown amid August market downturn appeared first on CryptoSlate.