Fast Take

Bitcoin: A Critiqued Funding

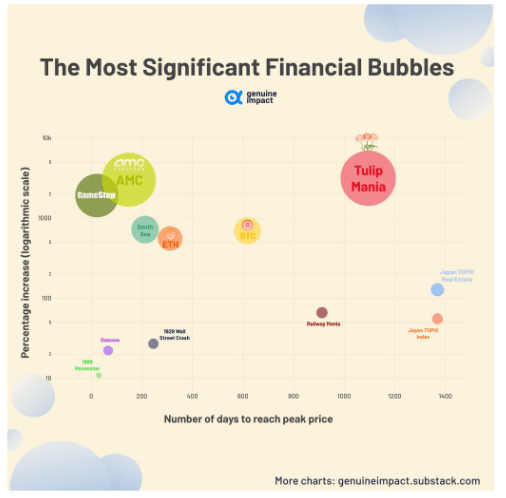

Since its inception in 2009, Bitcoin has typically been disparaged as a monetary bubble. Now, in 2023, Bitcoin is valued at over $30,000, providing a big return for buyers over the previous fourteen years. The value of Bitcoin even surged by 1,000% in a mere 600-day timeframe. From an outsider’s perspective, this spectacular development might justify the skepticism surrounding its sustainability.

Historic Parallels

All through historical past, we’ve witnessed related monetary phenomena, such because the infamous “Tulip Mania,” which delivered over 1,000% return, albeit over an extended interval than Bitcoin. Extra lately, the explosive value actions of AMC and GameStop shares have been in comparison with these historic speculative bubbles.

Affect of Financial Insurance policies

Traditionally, main monetary crises and bubbles, just like the Nice Despair of 1929 and 1969 and the Tech Increase in 2000, have been fuelled by sure financial insurance policies akin to low-interest charges and quantitative easing. With the continuing development of zero rate of interest coverage for over 15 years, one can’t assist however speculate concerning the potential for upcoming bubbles in bonds, equities, or sovereign debt.

Future Prospects

As we glance towards the long run, it’s essential to think about these historic patterns and financial traits in our monetary decision-making. The query stays – are we on the point of witnessing the following main monetary bubble?

The publish Bitcoin and historic monetary bubbles appeared first on CryptoSlate.