After weeks of failing to interrupt the robust resistance, Bitcoin surged above $21,000. The few quick hours it spent above $21,000 earlier than a slight correction introduced some much-needed confidence again into the market.

Whereas it’s exhausting to estimate how lengthy the correction will final, change information means that BTC is at the moment up in opposition to a a lot more healthy market which may result in one other surge quickly.

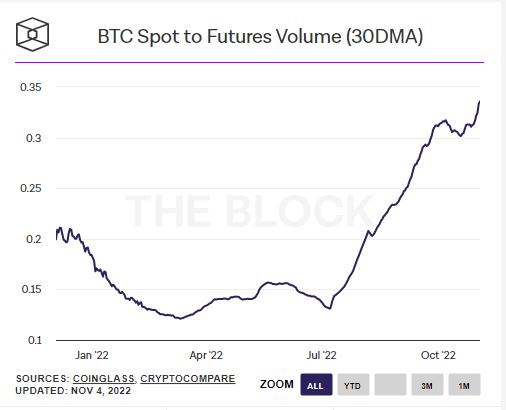

Knowledge analyzed by CryptoSlate confirmed that there was a big lower each within the variety of futures contracts and their quantity because the finish of October. Spot volumes on exchanges have been on the rise, signaling a recovering retail shopping for strain.

The ratio between Bitcoin’s spot and futures quantity has reached its year-to-date excessive after a slight correction in mid-October, persevering with the upward development that started in July.

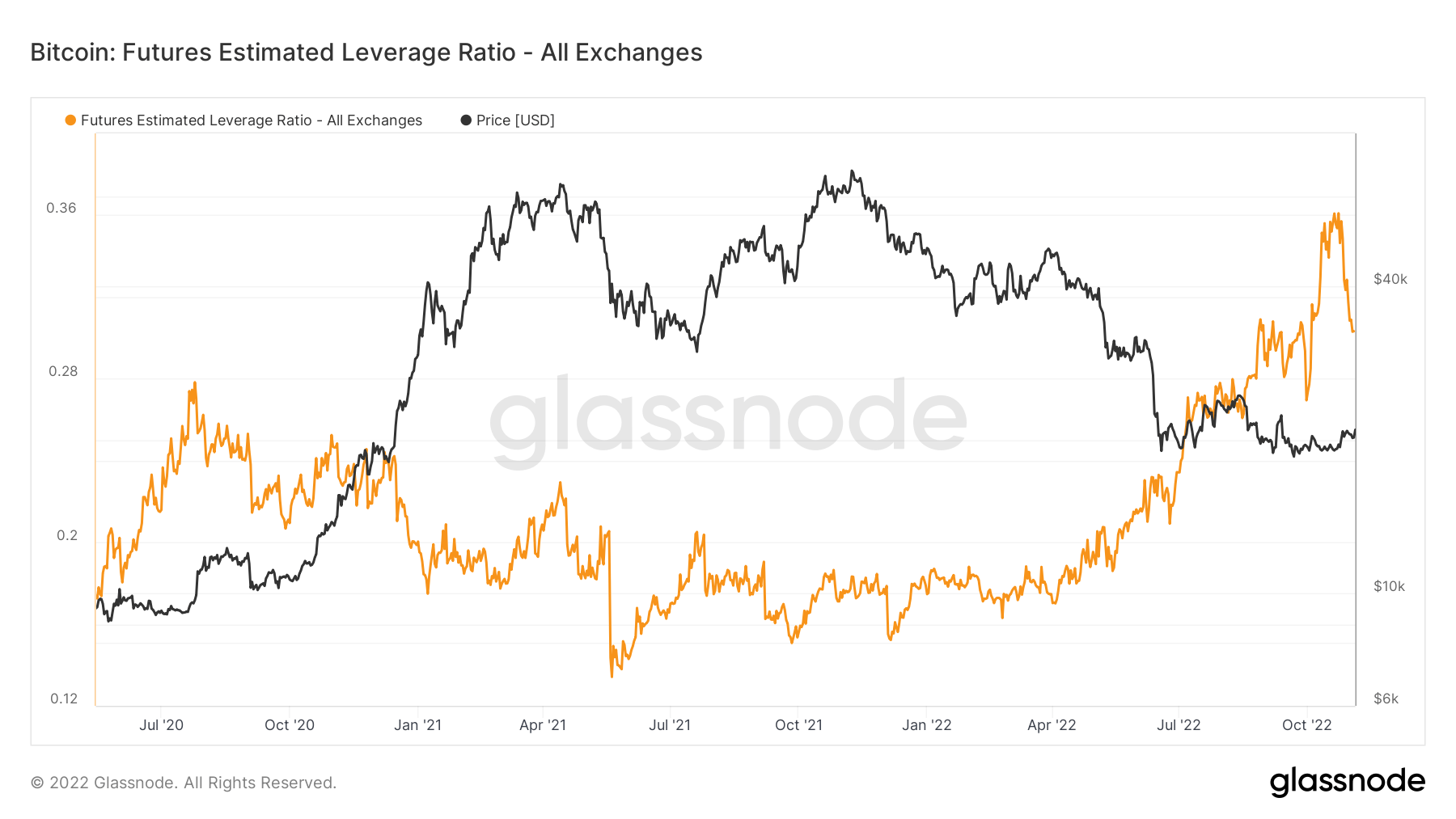

A deeper take a look at Bitcoin derivatives reveals a a lot much less unstable market. The Bitcoin Futures Estimated Leverage Ratio (ELR) reveals the proportion of open curiosity divided by the reserves of an change. Open curiosity is the full variety of excellent derivatives contracts. The Bitcoin ELR reveals the common leverage utilized by by-product merchants and has traditionally been a strong indicator of market volatility — the upper the ratio, the larger the liquidation threat for by-product merchants.

After reaching an all-time excessive of 0.34 in October, ESL has dropped sharply and at the moment stands at 0.30.

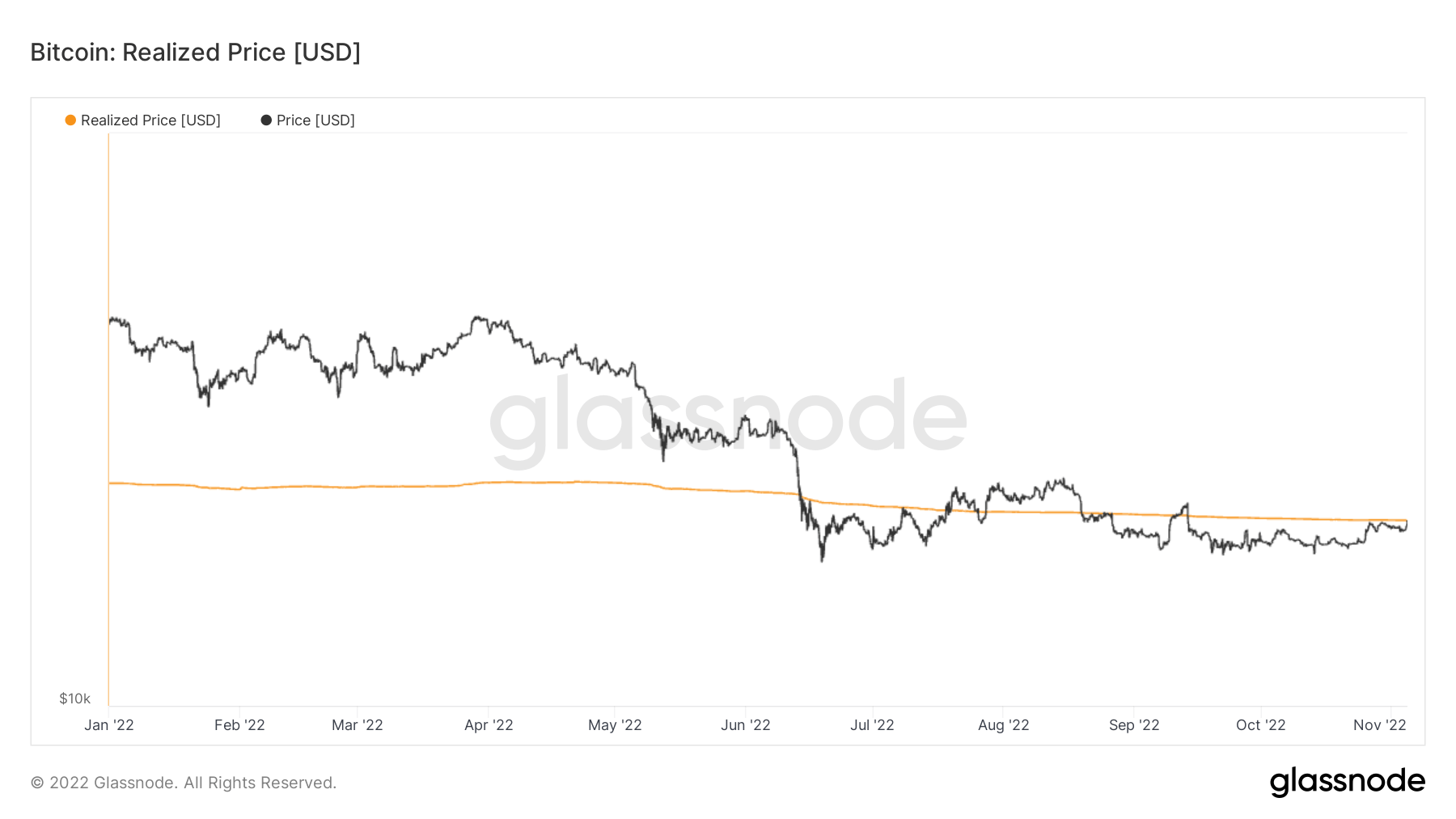

The steadiness brought on by the derisking of the derivatives market has the potential to create a brand new resistance level for BTC at $21,000. Friday’s surge previous $21,000 pushed Bitcoin above its realized worth of $21,092 for the third time this yr.

Bitcoin’s realized worth is a helpful metric because it reveals the realized market capitalization divided by the present provide — i.e. the common worth at which all bitcoins in circulation have been bought. When BTC’s spot worth rises above the realized worth there’s a excessive probability that strong assist can be fashioned.