Fast Take

- As the worldwide world faces excessive inflation, central banks attempt to rein in inflation by reducing their steadiness sheets (quantitative tightening) and growing rates of interest.

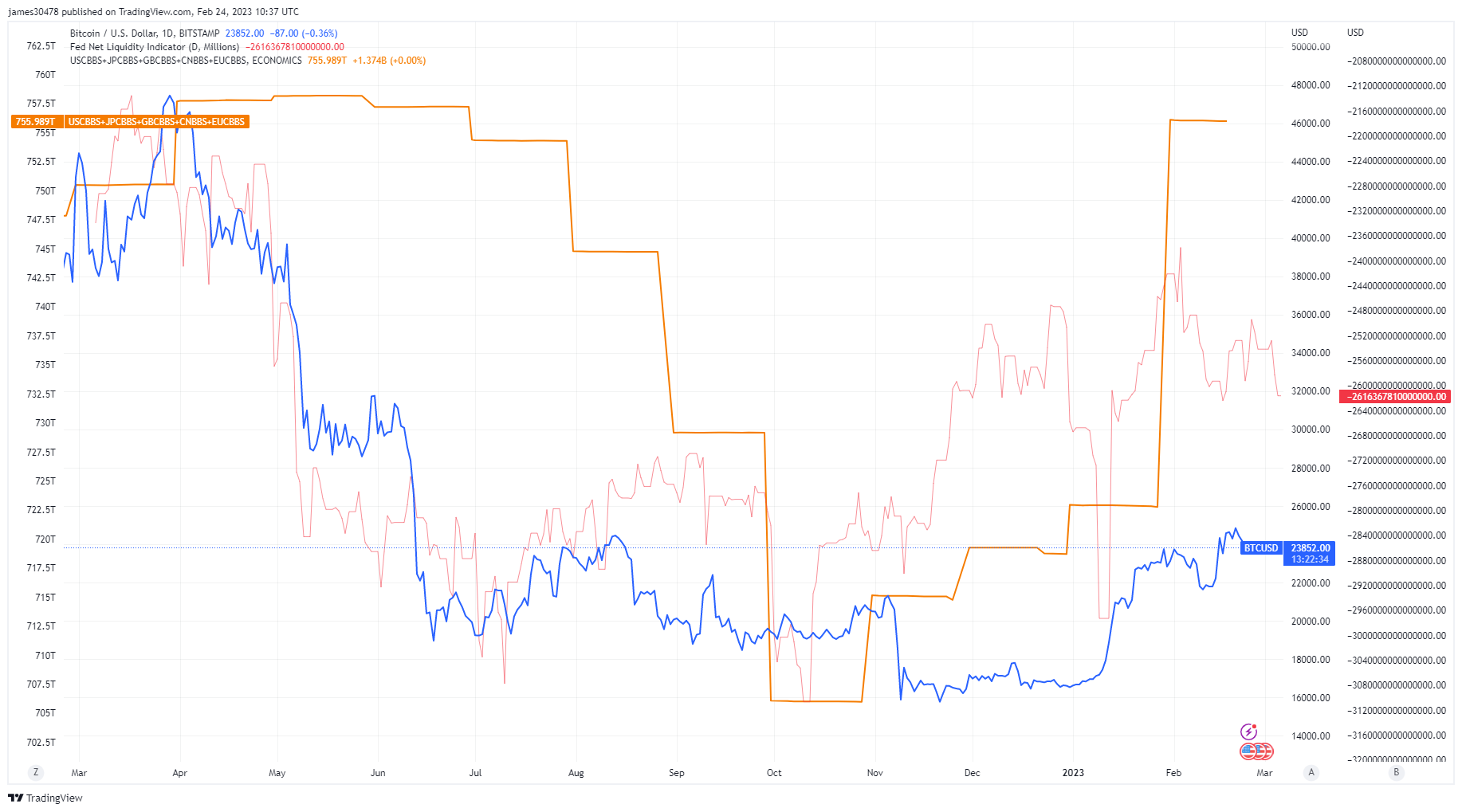

- The blue line is Bitcoin which has soared roughly 50% 12 months to this point.

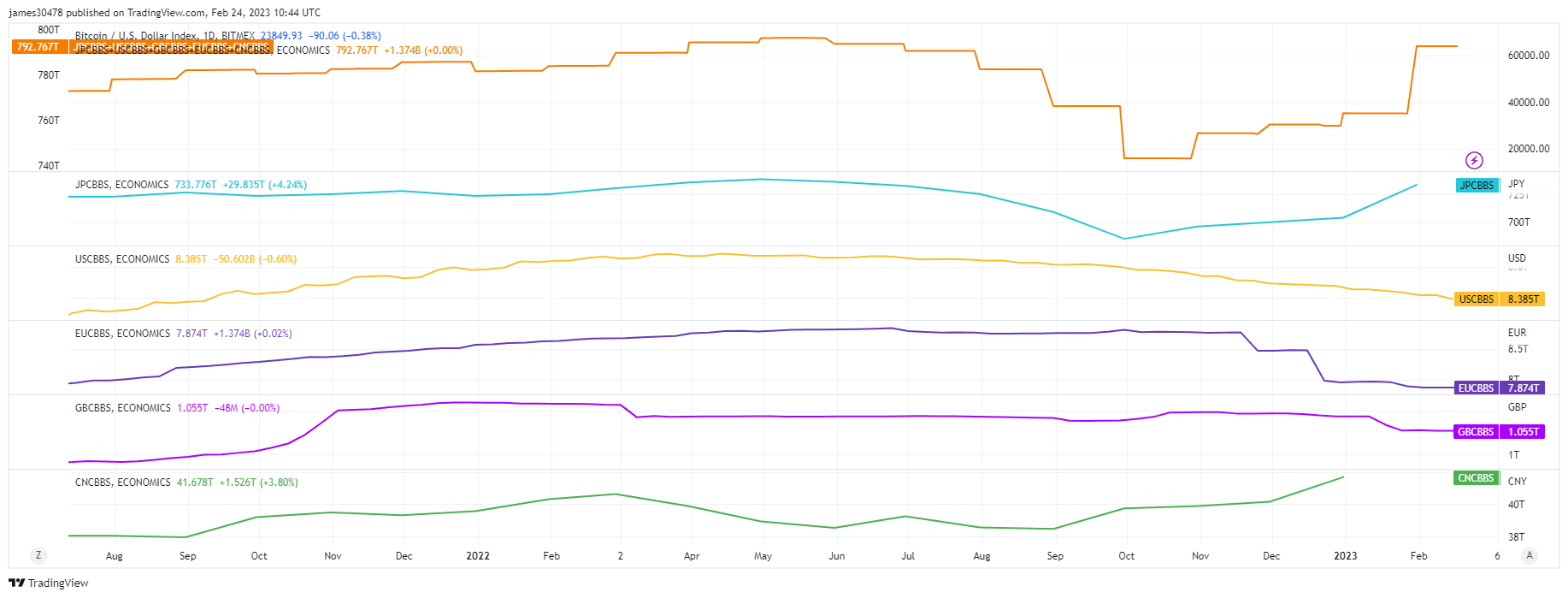

- The orange line aggregates central financial institution steadiness sheets, together with the US, EU, UK, Japan, and China.

- The pink line is the fed web liquidity indicator; the formulation is as follows; web liquidity = (fed steadiness sheet – (Treasury Basic Account + Reverse Repo)) / models.

- All three metrics have elevated from their respective bottoms in October 2022 — whereas the steadiness sheet of the key central banks has elevated to 756 trillion from roughly 706 trillion

- Japan and China have continued to extend their steadiness sheet — regardless of excessive inflation and undoing the work the US, EU, and UK try to realize.

The publish Bitcoin continues to comply with the liquidity plus the aggregation of central financial institution steadiness sheets appeared first on CryptoSlate.