On September 29, Bitcoin Journal Analyst Dylan LeClair famous Bitcoin had began to “decouple” from the S&P 500.

His charts under present an upturn within the distinction between the 2 because the S&P 500 continues sliding amid macro weak point showcased by the Financial institution of England’s (BoE) pivot to quantitative easing this week.

As a result of its fastened provide of 21 million tokens, Bitcoin was all the time offered as an “anti-fiat” that would not be debased to zero.

As the worldwide financial system continues to falter, that narrative unwound as BTC exhibited risk-on traits. Nevertheless, BTC’s latest efficiency could counsel in any other case.

Is Bitcoin a legacy hedge?

In April, Bloomberg printed an article displaying the correlation between Bitcoin and the S&P 500 on the highest it has ever been. This additional derailed discuss of BTC being a “secure haven asset.”

Inflation has since worsened, and on a regular basis individuals are experiencing firsthand the results of free financial coverage in a value of residing disaster.

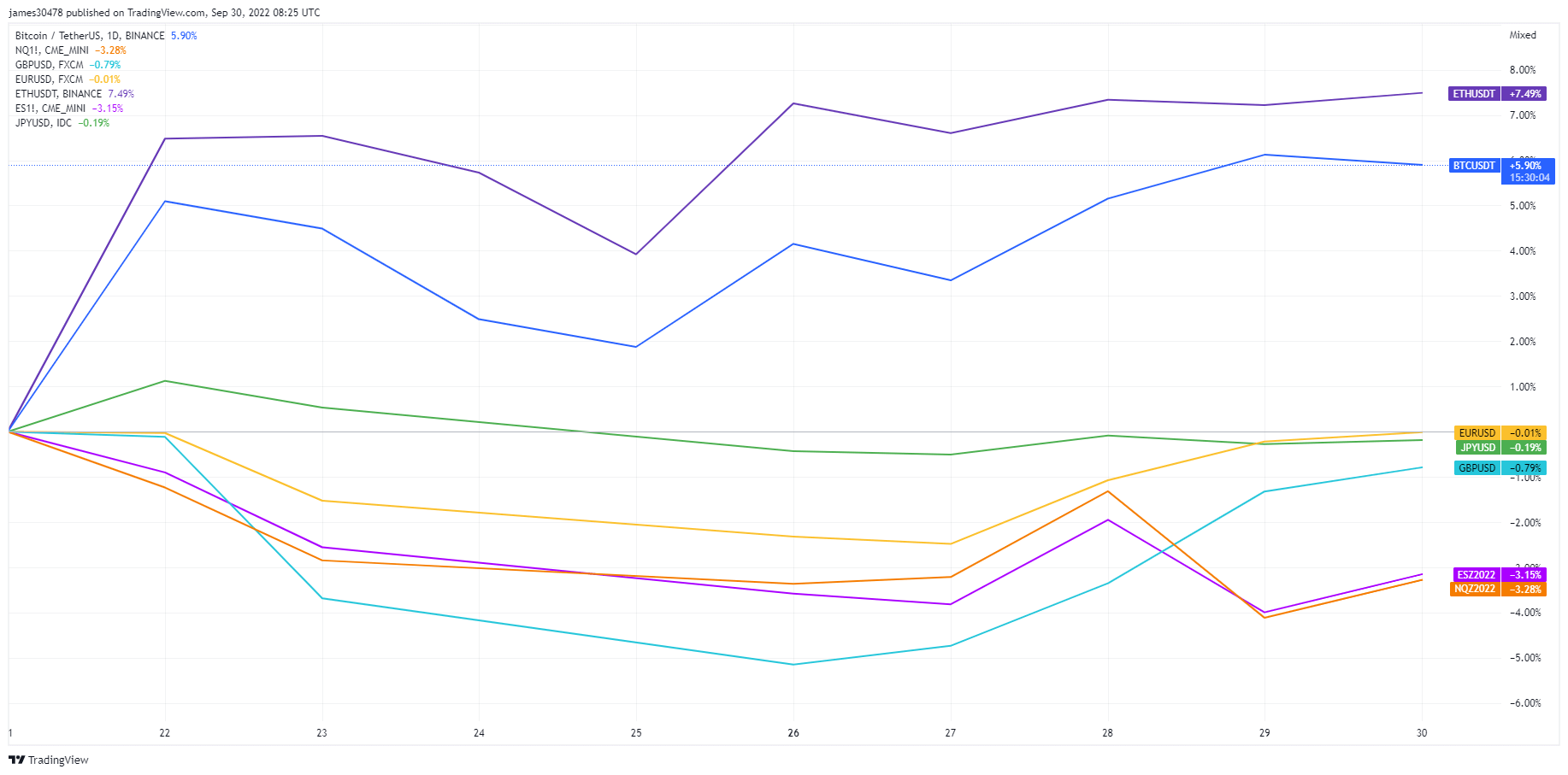

As risk-on belongings proceed to sink, Bitcoin has been holding regular, buying and selling between $18,100 and $22,800 all through September.

In the meantime, the S&P500 has charted a definite decline over the identical interval, dropping 10% since September 1 – a major proportion drop for a legacy index.

For the reason that FOMC assembly on September 21, wherein the Fed applied a 3rd consecutive 75 foundation level fee hike, BTC and ETH have outperformed non-USD main currencies, offering additional proof of a decoupling.

LeClair doubts the decoupling will proceed

The query stays, will this development persist because the macro panorama continues to deteriorate?

LeClair responded by saying a continuation of this development is “extremely unlikely.” But, BTC’s latest outperformance is a “respectable begin” to restoring its secure haven narrative.

“Nonetheless suppose a long-lasting “decoupling” is extremely unlikely on this stage, however relative outperformance is a good begin.“

With that, he signed off, saying it’s “all eyes on FX, international bonds, and equities” as traders brace for what’s to come back.

Within the close to time period, some analysts anticipate different central banks to comply with the BoE and reverse hawkish insurance policies to intervene in coming crises.