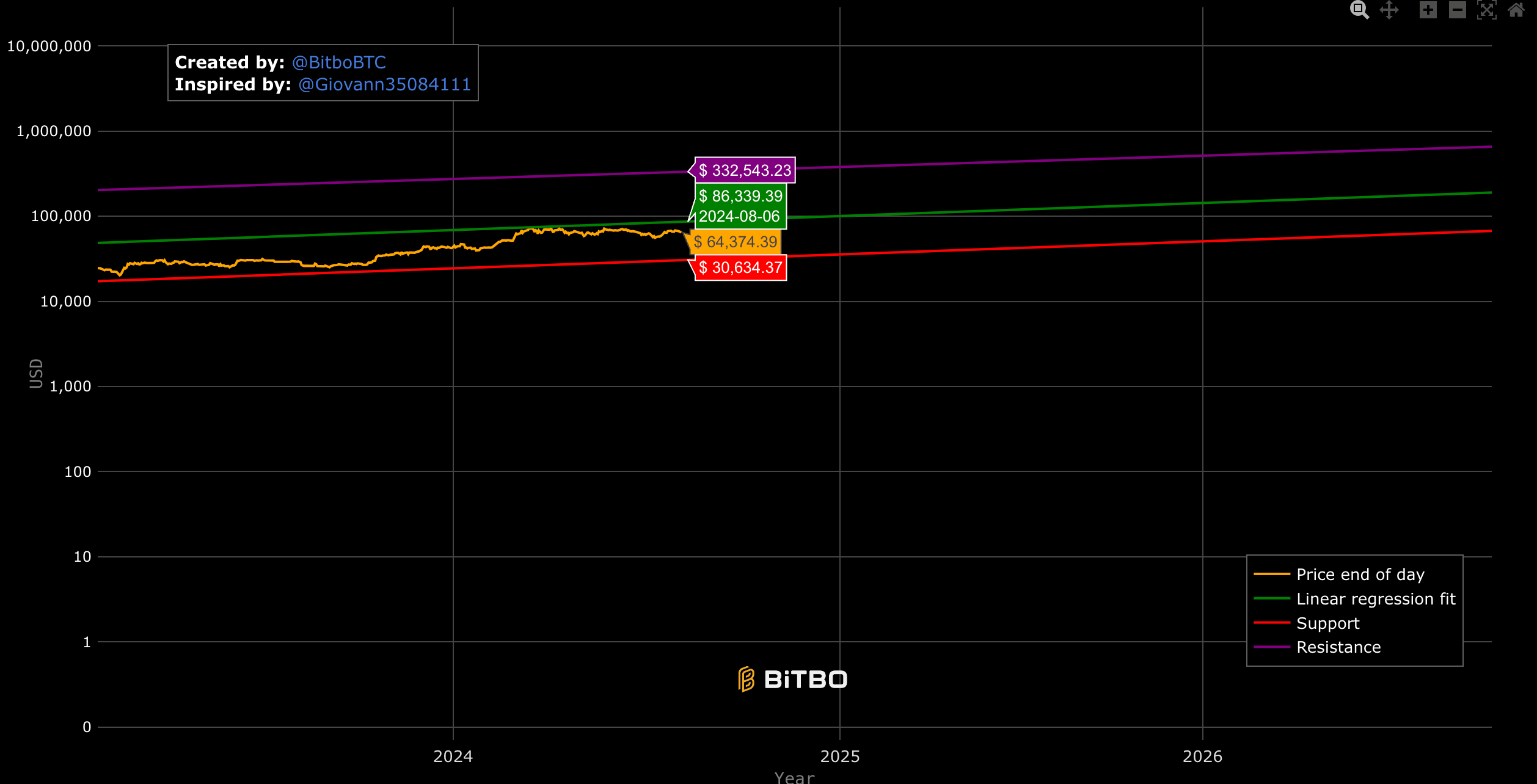

Giovanni Santostasi’s Bitcoin Energy Regulation mannequin suggests Bitcoin’s value is not going to fall beneath $30,000 once more, indicating a flooring for future valuations. The mannequin reveals Bitcoin’s value trajectory will proceed to rise, with its present ‘truthful value’ at $86,339 and potential ceiling at $332,543.

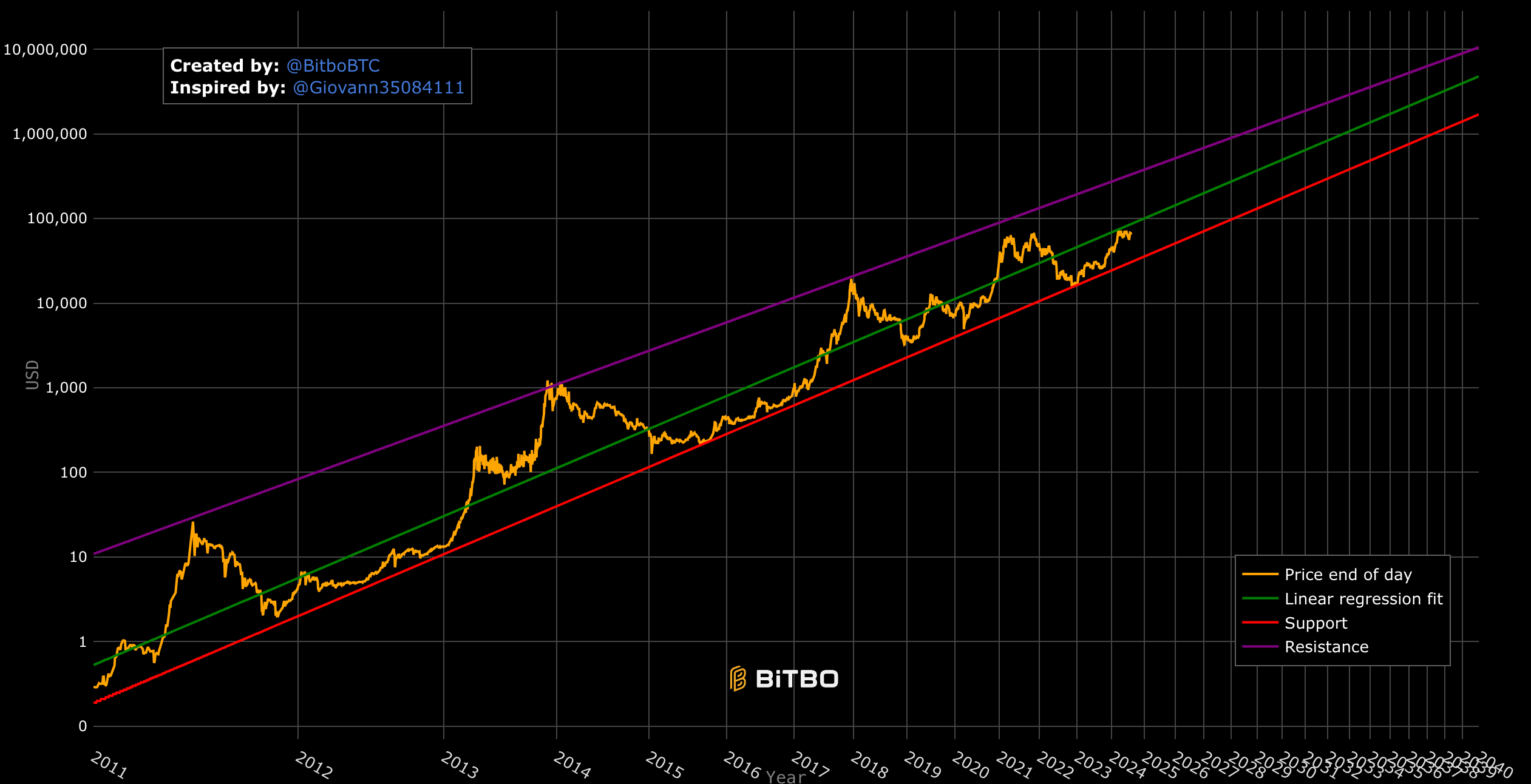

As depicted within the charts from Bitbo, the mannequin makes use of linear regression to determine help and resistance bands, which have traditionally contained Bitcoin’s value actions. The help band, derived from previous value information, suggests a decrease boundary that Bitcoin’s value shouldn’t breach, whereas the resistance band signifies an higher boundary.

The mannequin predicts that Bitcoin ought to attain $100,000 per coin earlier than 2028 and won’t drop beneath this value after 2028. Moreover, it forecasts that Bitcoin may hit $1,000,000 between 2028 and 2037 and keep this stage thereafter.

The mannequin’s basis lies within the energy regulation distribution, a statistical relationship the place one amount varies as the ability of one other. This distribution has been noticed in numerous pure phenomena and monetary markets, offering a strong framework for long-term value predictions. The facility-law mannequin’s utility to Bitcoin suggests a constant upward pattern, aligning with the asset’s historic efficiency regardless of its volatility.

Critics of the mannequin argue that it depends closely on historic information, which can not account for future market forces or unexpected occasions. They warning that whereas the mannequin offers a structured strategy to understanding Bitcoin’s value actions, it shouldn’t be taken as an absolute predictor of future costs. Nonetheless, the Energy Regulation mannequin gives a compelling perspective on Bitcoin’s potential development, reinforcing the idea amongst some analysts that Bitcoin’s value will proceed to rise over the long run.

In contrast to the Inventory-to-Circulate mannequin, the Energy Regulation has by no means been invalidated. If this continues, the truthful value on the subsequent halving ought to be round $290,000 in 2028.