On a sure-to-be historic day for Bitcoin, I spent the morning wanting again at historic knowledge to see how impactful the primary Gold ETF was on the time. We’ve seen loads of analysts, together with our personal, discuss how Gold ETFs modified the panorama for the commodity, resulting in outsized positive aspects over the continuing 20 years. But, what was it actually like on the time? Did gold explode on day one, or did it take time? Let’s dig in.

First, let’s take a look at the timeline of the related exchange-traded merchandise we are going to take a look at.

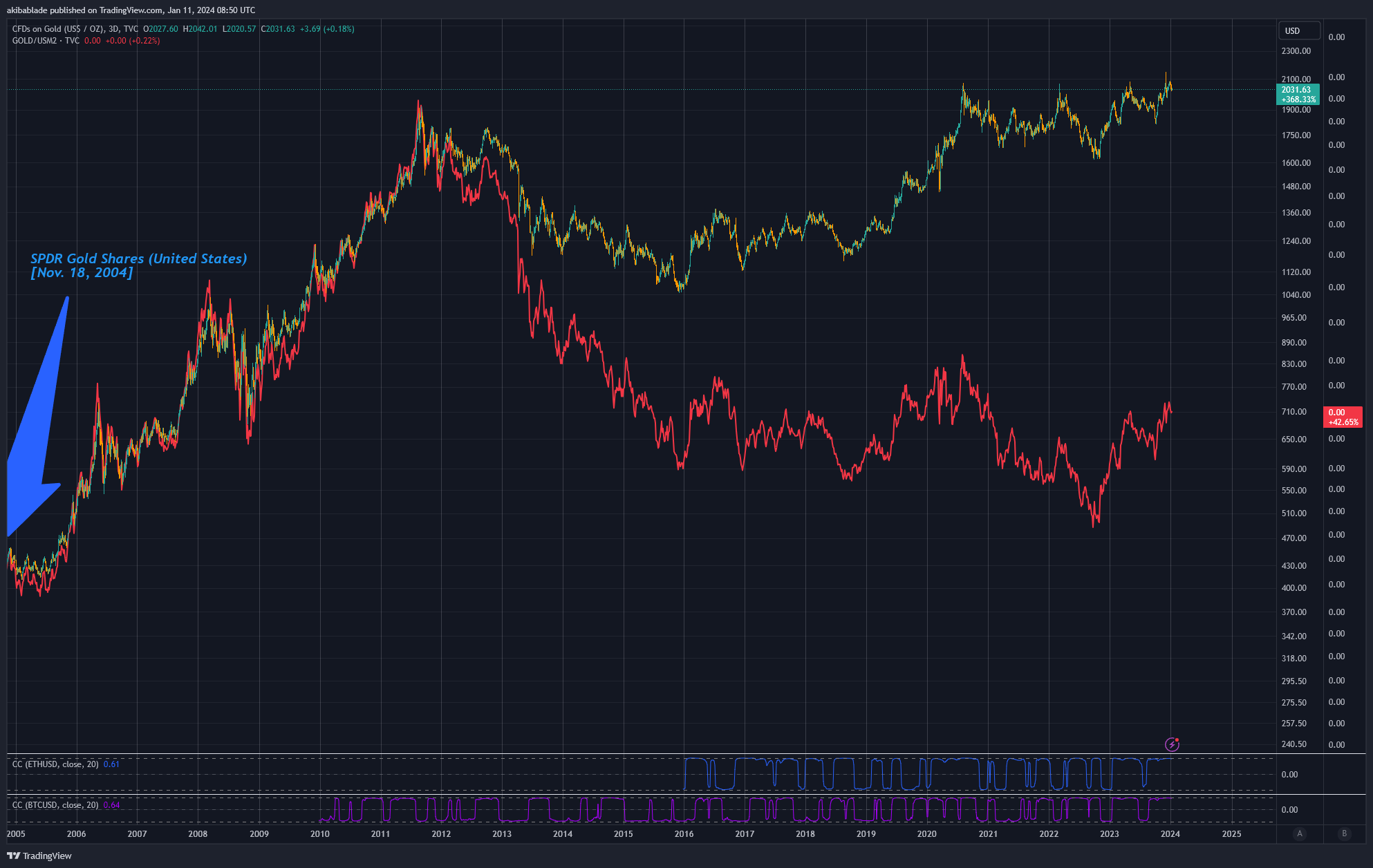

On Nov. 18, 2004, State Avenue Company launched SPDR Gold Shares (GLD), buying $114,920,000 in belongings below administration on launch and $1 billion in its first three buying and selling days.

On Oct. 19, 2021, ProShares launched ProShares Bitcoin Technique ETF (BITO), which had $570 million in inflows on day one, hitting $1 billion in belongings the following day.

On Jan. 11, 2024, eleven spot Bitcoin ETFs will launch within the U.S. with $115.88 million below administration by way of the sponsors’ seed funds. This implies as soon as they’ve taken $115 million in inflows, issuers like BlackRock, Ark, VanEck, and firm will purchase Bitcoin from the open market by way of Coinbase and Gemini, identical to the remainder of us.

Thus, earlier than buying and selling commences (eradicating Grayscale, which is changing its belief* into an ETF that already has $28.58 billion in AUM), the mixed spot Bitcoin ETFs can have surpassed GLD’s day one buying and selling. If we embrace Grayscale, spot Bitcoin ETFs have extra belongings below administration than gold did for the primary 5 years. GLD didn’t garner $29 billion in AUM till Feb. 12, 2009.

Nevertheless, to be truthful, it was now not the one gold ETF by this level. BlackRock launched its iShares® COMEX® Gold Belief in 2005. Mixed with GLD, gold ETFs reached an equal AUM round Feb. 10, 2009, with IAU acquiring $2 billion in belongings by the tip of Q1 2009.

By the tip of 2009, three gold-backed ETFs have been traded in america: ETFS Bodily Swiss Gold Shares, SPDR Gold Shares, and iShares Comex Gold Belief.

| Firm | Seed Funding ($M) |

|---|---|

| Bitwise | 20 |

| VanEck | 72.50 |

| Valkyrie | 0.52 |

| Franklin Templeton | 2.60 |

| WisdomTree | 4.95 |

| Invesco Galaxy | 4.85 |

| BlackRock | 10 |

| Ark | 0.46 |

| Grayscale | 2,858 |

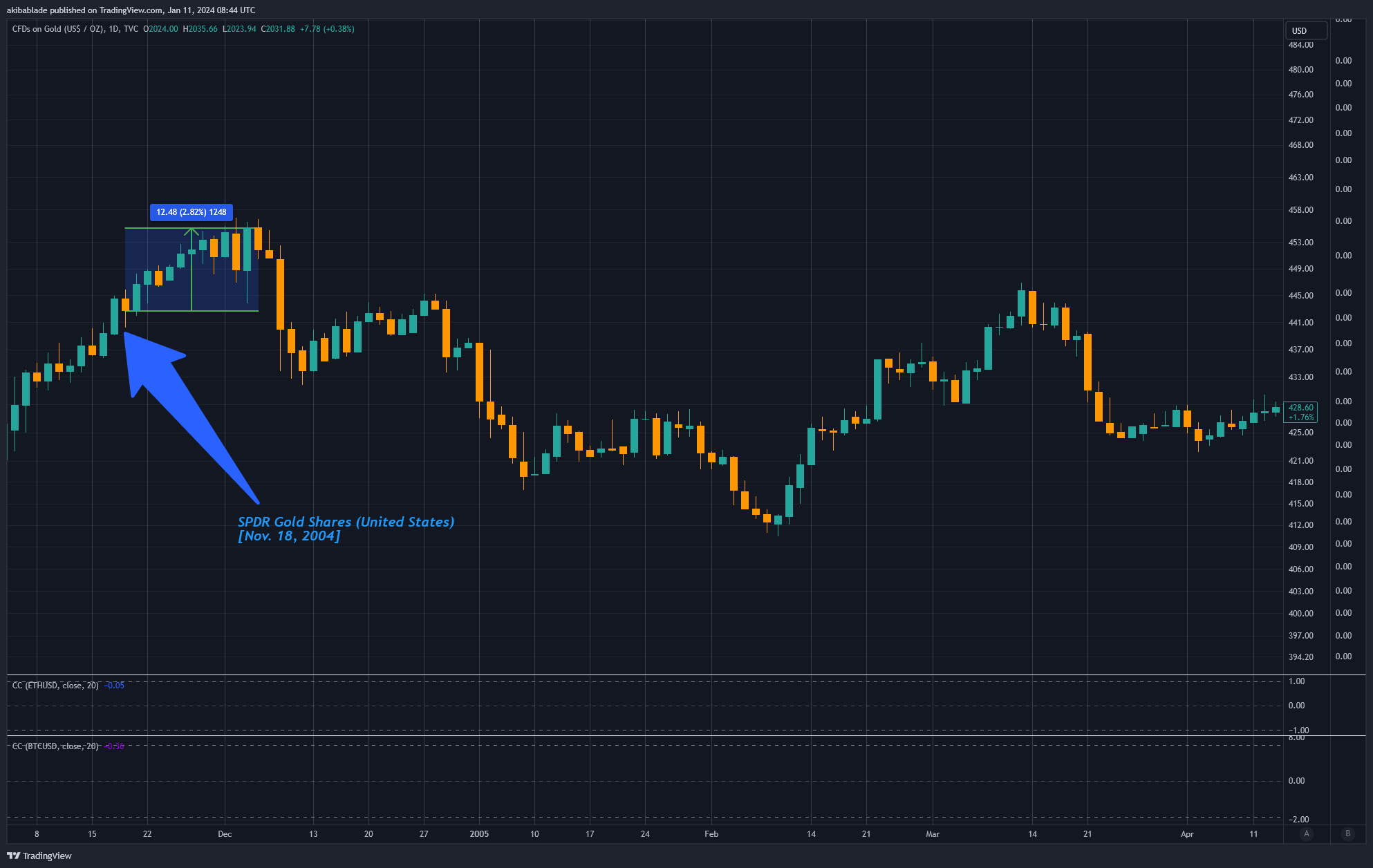

How did GLD commerce at launch?

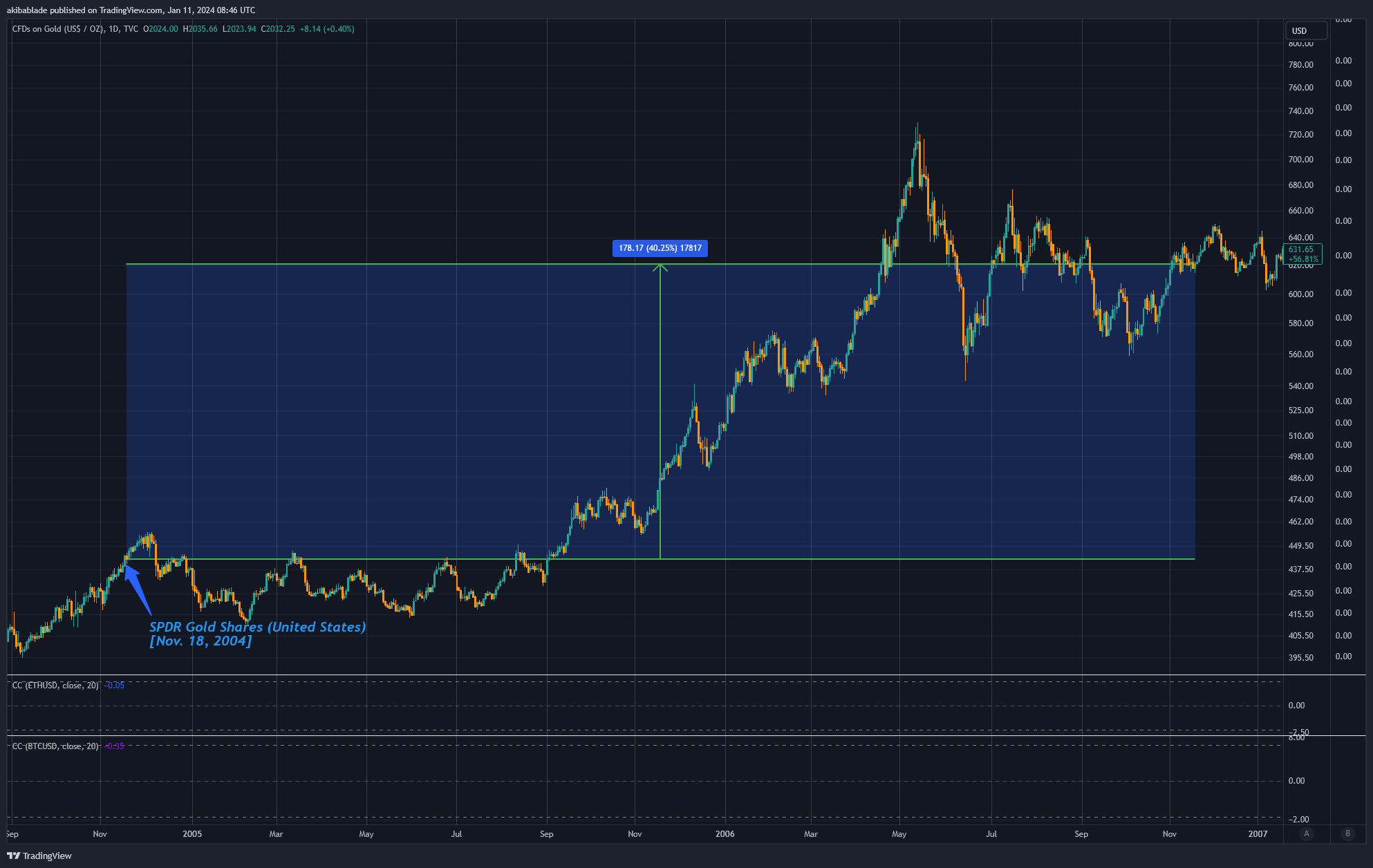

The primary gold ETF was launched within the U.S. on Nov. 18, 2004, and inside 12 days, the worth of gold was up simply 2.82%.

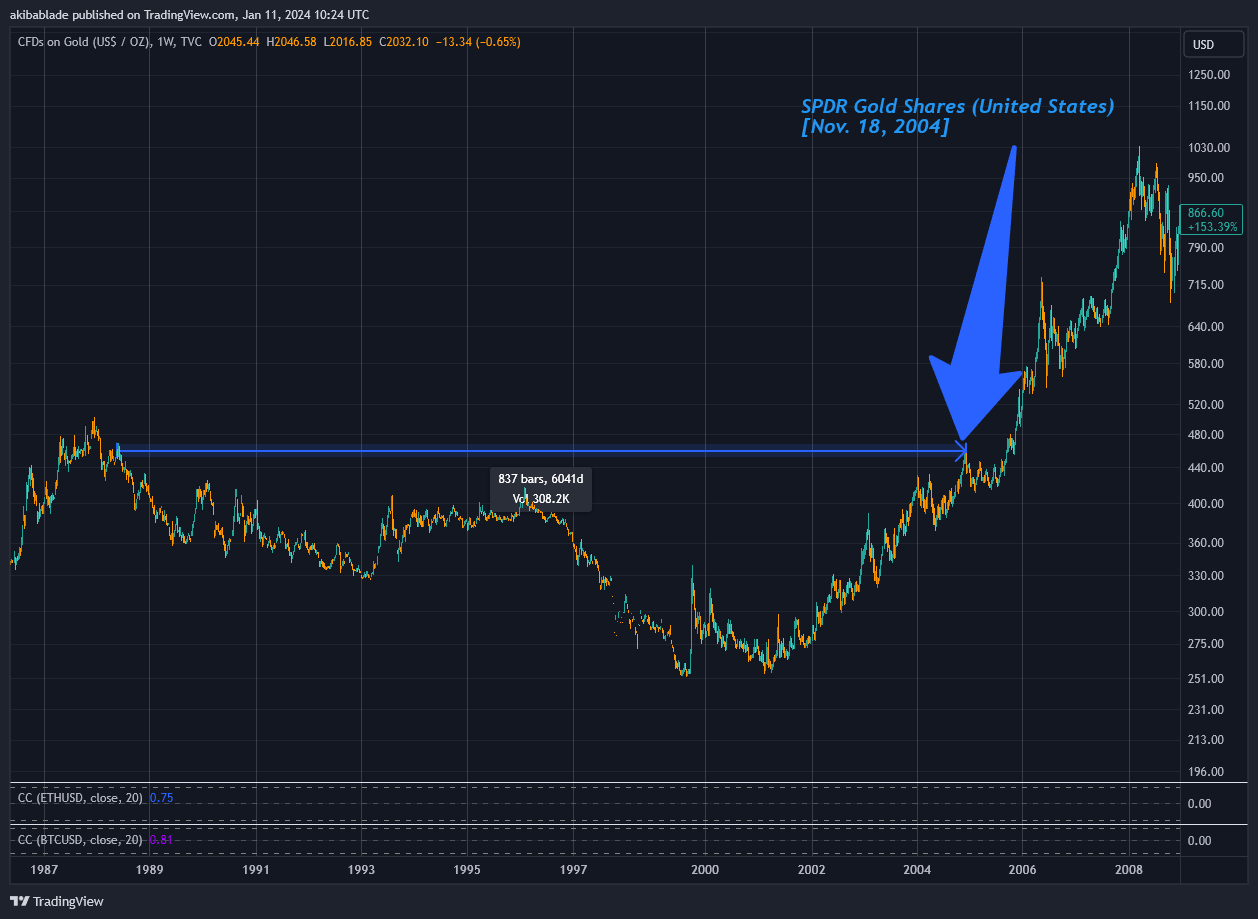

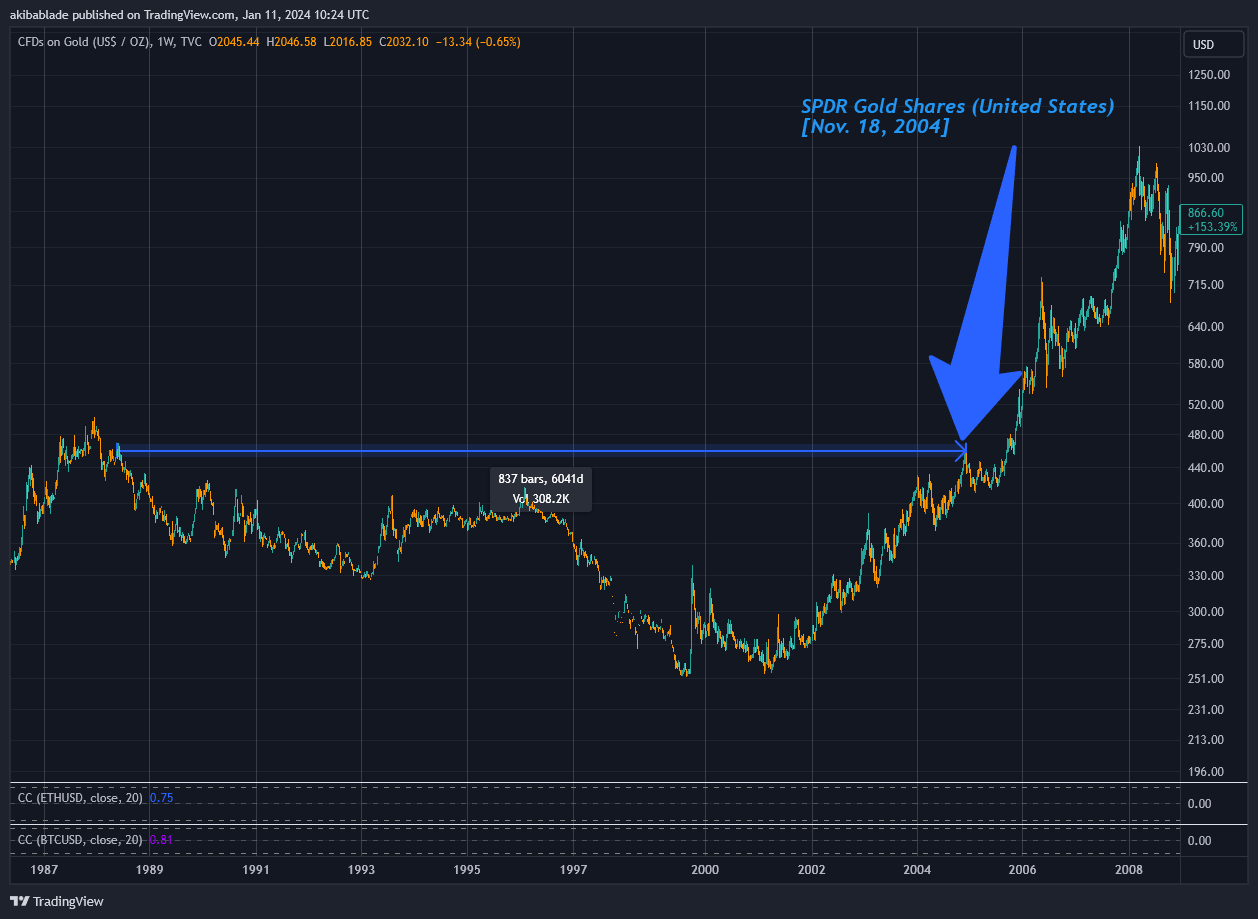

This marked a sixteen-year excessive for gold, which had not reached $453 per ounce since Could 1988. Nevertheless, it was not at an all-time excessive. In reality, it could take one other 4 years earlier than that might happen.

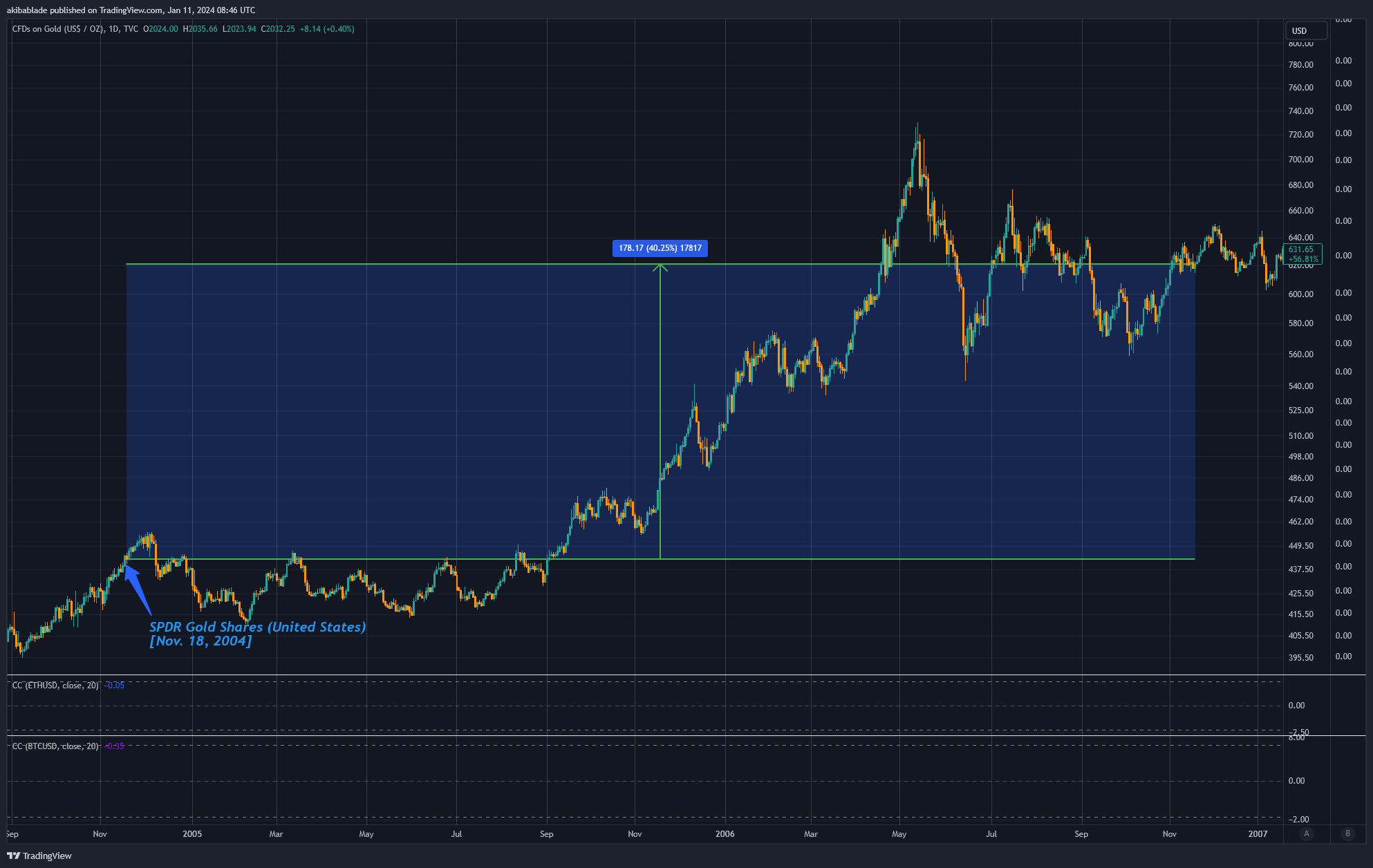

Following the native excessive in Dec. 2004 at $453.40, gold went on a chronic downward trajectory, with the worth down 4% over the following six months. On its sixth-month birthday, GLD had acquired $2.4 billion in belongings below administration, with gold priced at $419.75.

Nevertheless, issues began to get a lot better for the flagship commodity. By Nov. 2004, on the anniversary of its launch, gold had risen to $485,85, up 8.15% since launch. Thus, gold was up lower than Bitcoin after a 12 months and will swing on a Gary Gensler tweet. Removed from the earth-shattering influence many predict from the comparability to the gold ETF launch.

As GLD turned 2 on Nov. 18, 2006, gold was as much as $620.50, a rise of round 40%.

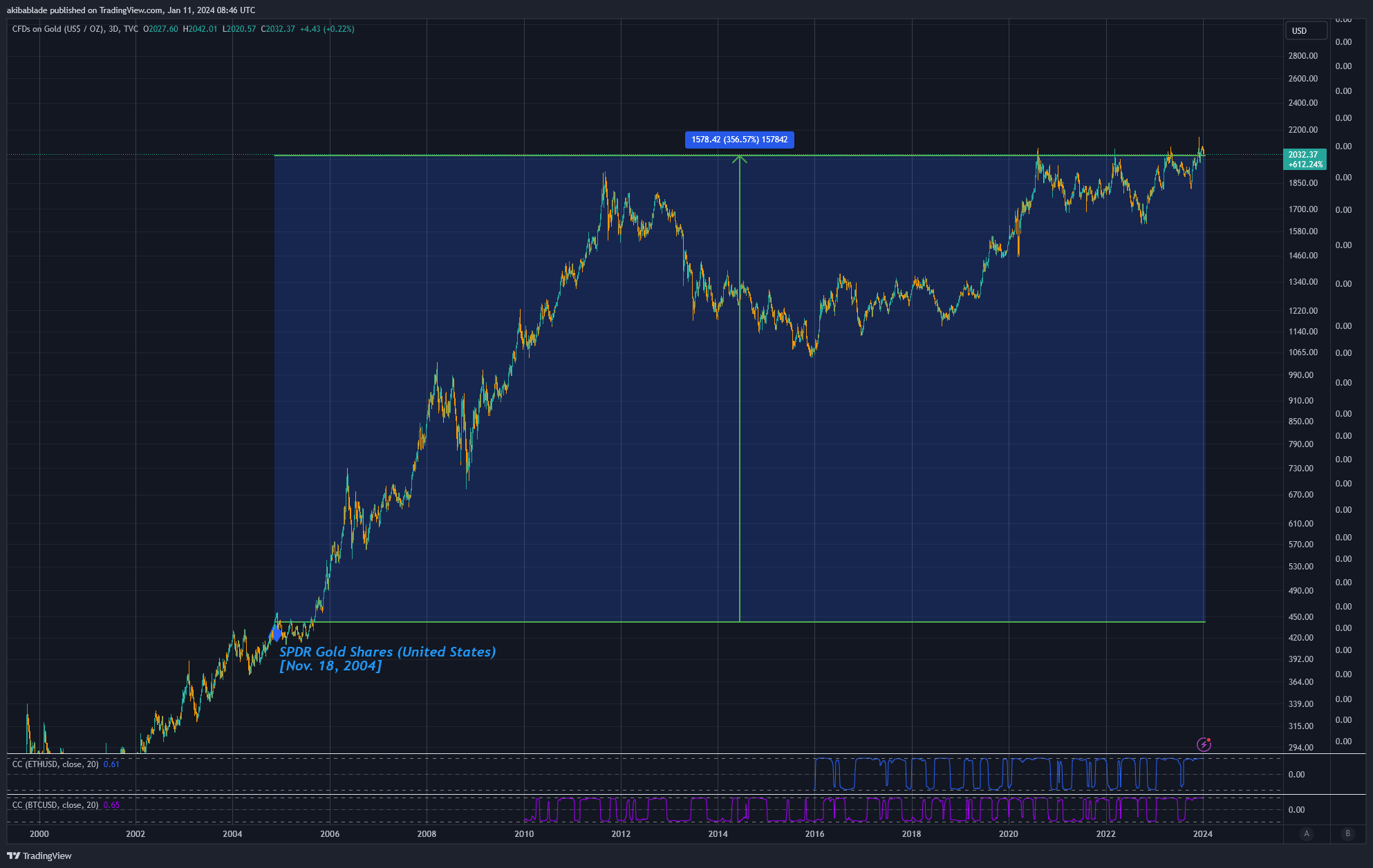

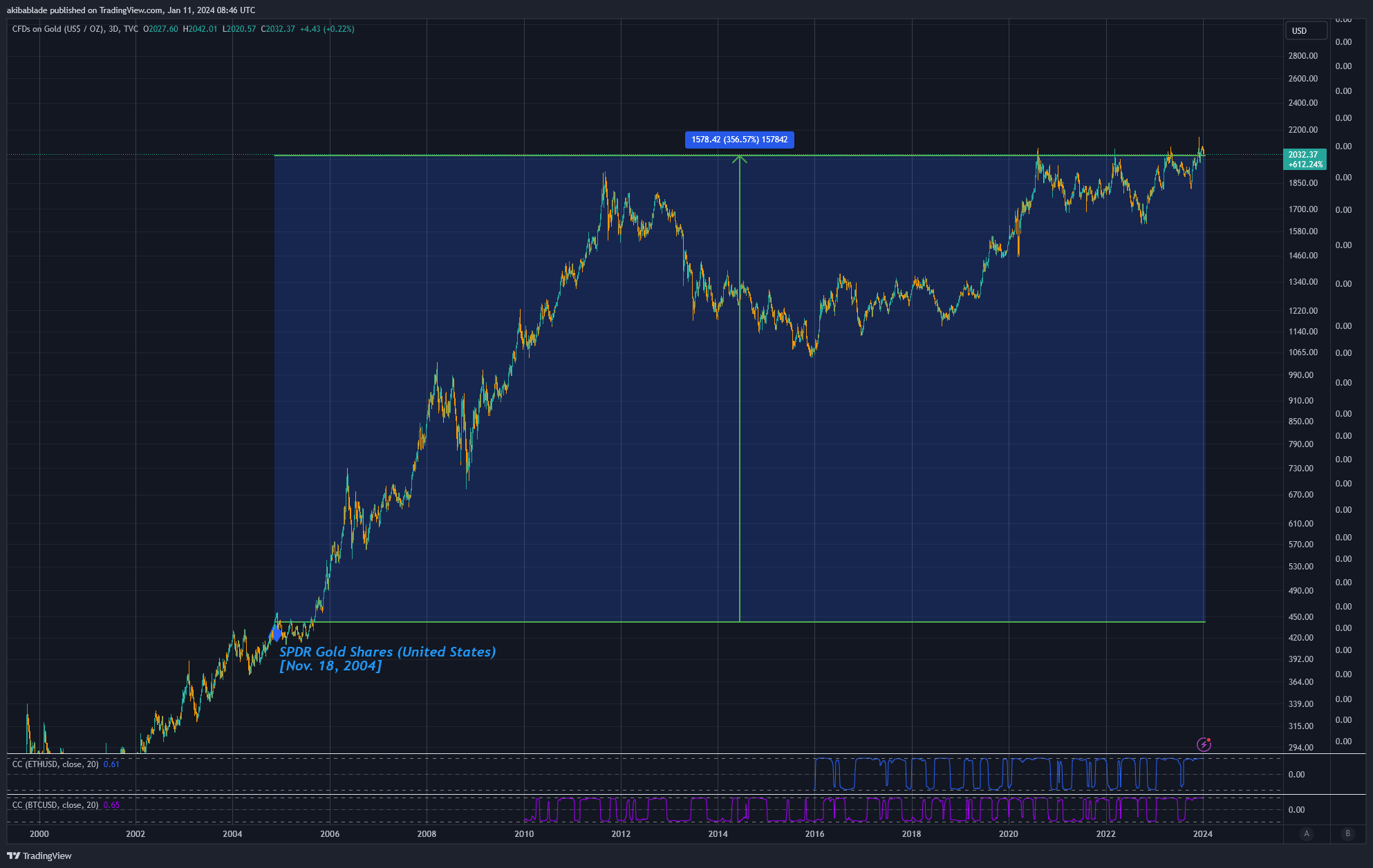

Immediately, gold is priced at round $2,032 as of press time and a staggering 356%. Nevertheless, that’s on a virtually 20-year timeframe. By comparability, have been Bitcoin priced at $210,000 on Jan. 11, 2044, what number of buyers could be pleased with that return? Following gold’s trajectory, that’s the worth level we’d be taking a look at.

Nevertheless, gold and Bitcoin are like evaluating apples with oranges. Whereas we might talk about Bitcoin as digital gold, it’s undoubtedly far more.

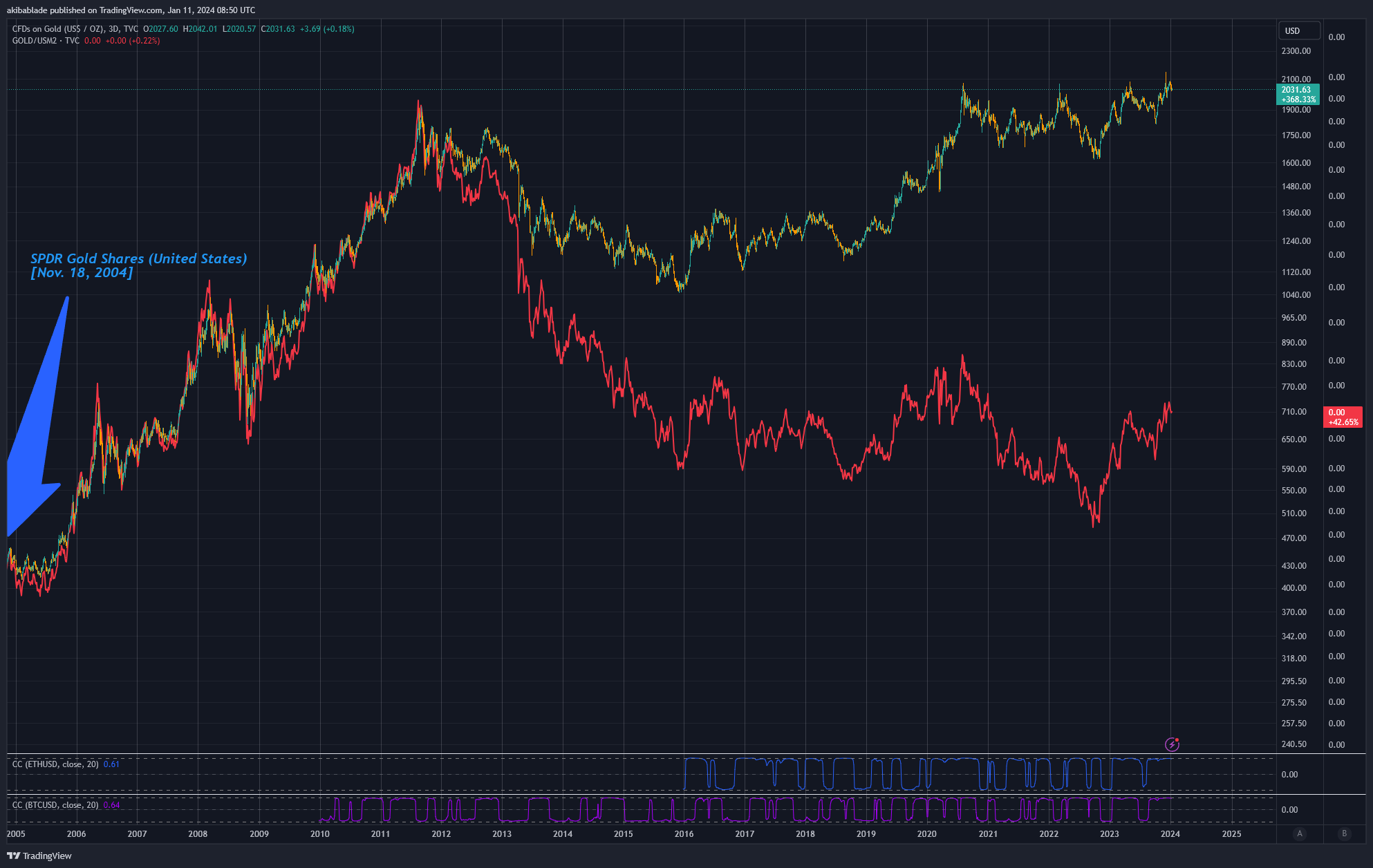

Let’s begin by taking a look at gold in relation to the M2 cash provide within the U.S. M2 is a broad measure of the cash provide. It contains all parts of M1 (notes and cash, checking accounts, different checkable deposits, traveler’s checks) plus financial savings deposits, small-denomination time deposits (time deposits in quantities of lower than $100,000), and balances in retail cash market funds.

M2 solely excludes giant deposits, institutional cash market funds, short-term repurchase agreements, and different extra appreciable liquid belongings, making it a related long-term metric to evaluate the spending energy of the U.S. greenback.

When adjusted for the M2 provide, gold is up simply 42%. Gold adopted Gold/M2 fairly tightly from 2004 till 2012, and whereas the greenback worth of gold continued to rise, Gold/M2 has been on a downtrend ever since.

Comparisons with Bitcoin

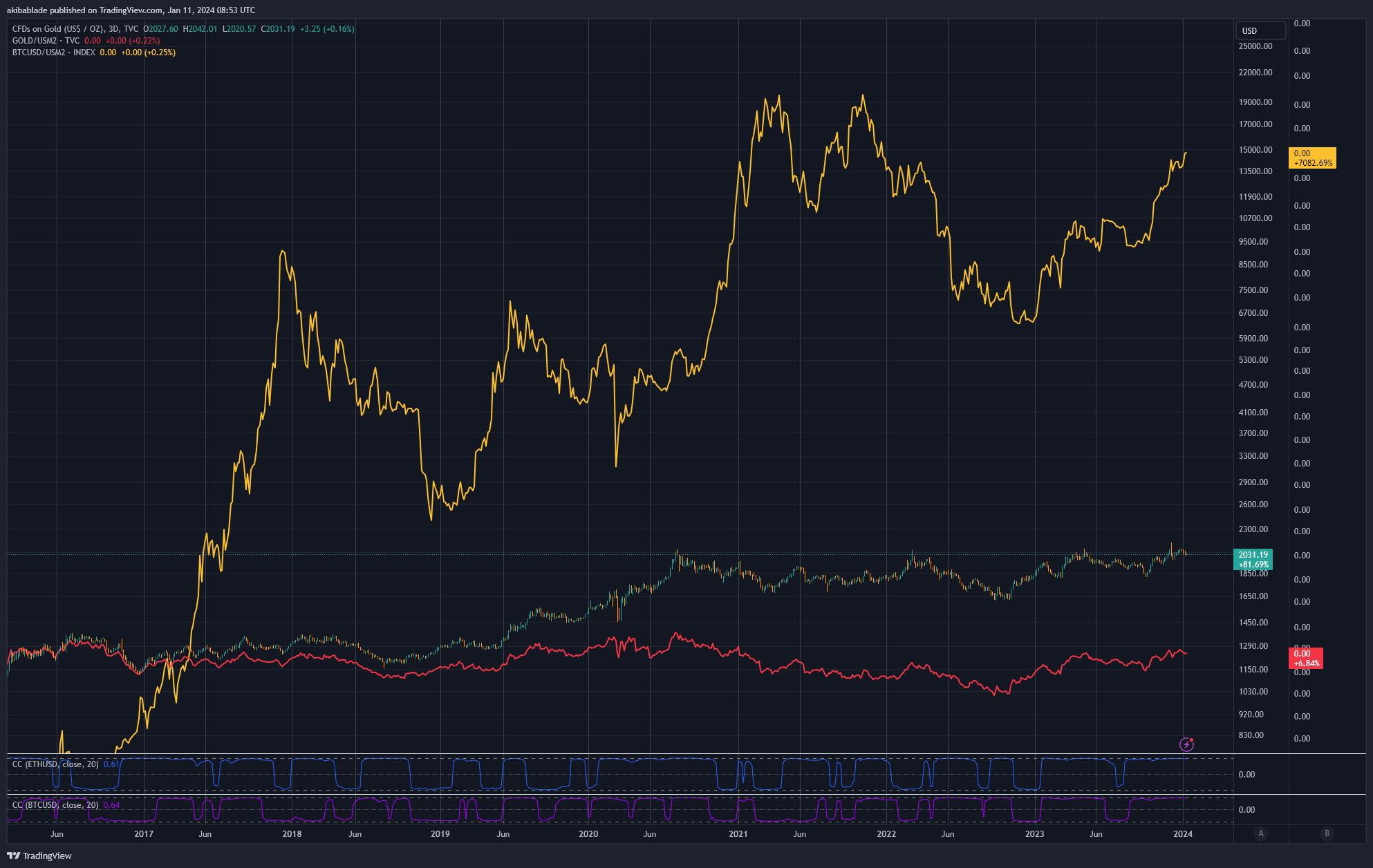

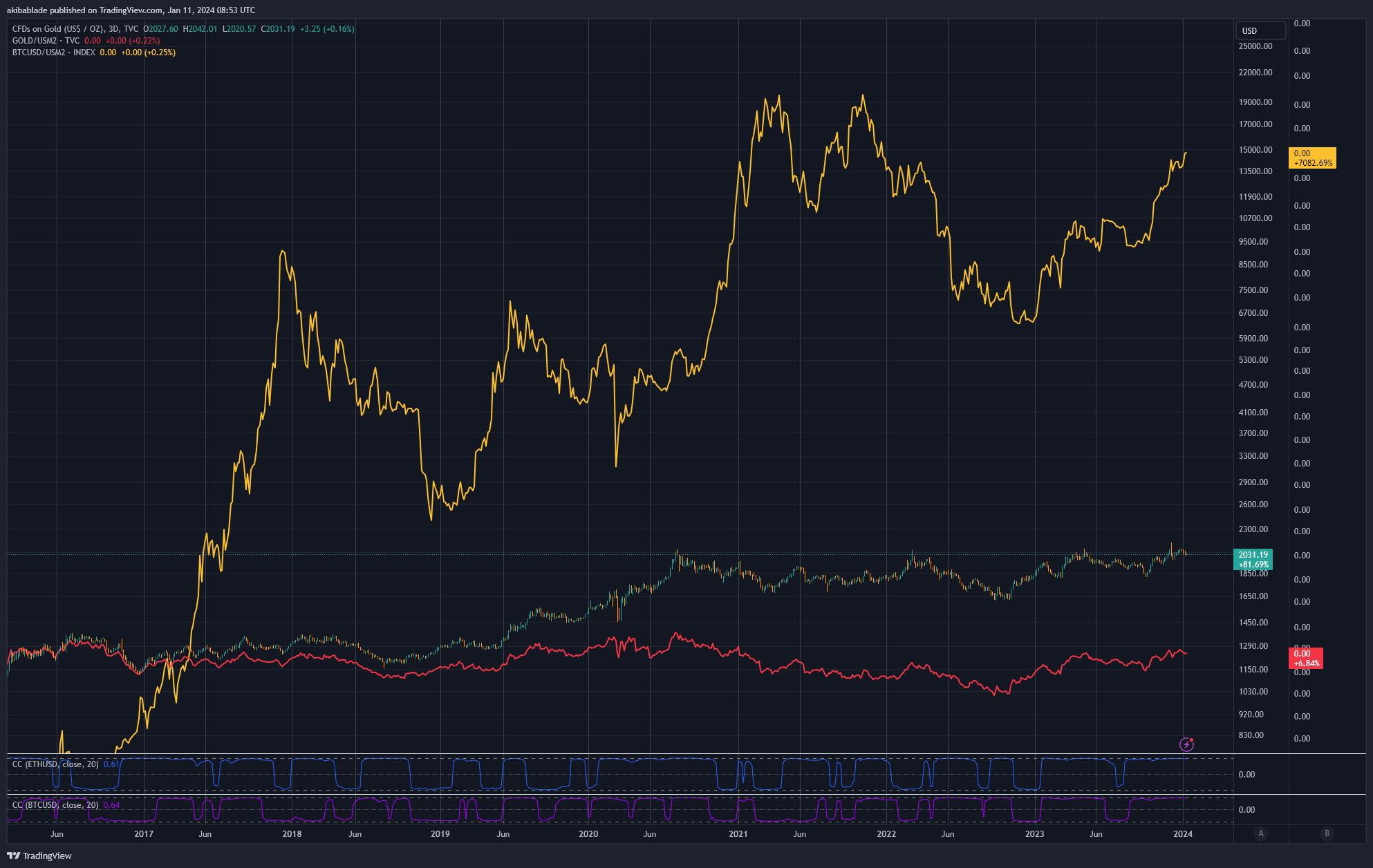

As we are able to’t evaluate Bitcoin over the identical interval because it was not launched till 2009, and its worth discovery was extremely unstable throughout its early days, I’ve used 2015 – 2024 within the chart under to check Gold/M2 to Bitcoin/M2.

As you may see, Bitcoin has carried out considerably higher than gold (7,082%) over the previous decade, even accounting for the 70% enhance within the variety of {dollars} included within the M2 provide.

Nevertheless, not solely has Bitcoin proven to extend even in opposition to greenback dilution, nevertheless it additionally has a set provide and tight market dynamics. Solely 30% of all Bitcoin in circulation has been traded throughout the previous 12 months.

Bitcoin’s provide is capped at 21 million cash, making it essentially scarce. This shortage is a vital driver of its worth, akin to valuable metals like gold. Nevertheless, Bitcoin’s provide is predictably finite, not like gold, the place new reserves may be found and mined. The introduction of the spot Bitcoin ETFs is more likely to amplify the shortage impact.

As extra buyers purchase into the ETF, a portion of Bitcoin’s restricted provide will likely be locked as much as again these funding merchandise, decreasing the obtainable provide for normal buying and selling on open markets. This decreased provide may result in worth appreciation, particularly within the face of accelerating demand (usually spurred by simpler entry by monetary merchandise like ETFs). There’s additionally a cyclical impact right here whereby ETF issuers should fill baskets of shares with Bitcoin from the open market.

Furthermore, the truth that 70% of the present circulating provide of Bitcoin hasn’t moved in over a 12 months signifies a sturdy holding habits amongst present Bitcoin house owners. This holding sample reduces the efficient circulation of Bitcoin, additional enhancing its shortage.

When long-term holders maintain a good portion of an asset, any enhance in demand, comparable to that generated by the launch of a brand new funding car just like the spot Bitcoin ETFs, can have a disproportionate impact on the worth. There’s much less provide obtainable to satisfy this new demand.

This habits contrasts with gold, the place holding patterns are extra various and embrace important industrial and jewellery use, which might dampen the scarcity-driven worth appreciation seen in belongings like Bitcoin.

Thus, whereas gold has seen exceedingly strong positive aspects over the previous 20 years, evaluating its ETF-fueled development to Bitcoin might, in actuality, be exceedingly underwhelming.

It’s necessary to notice that demand for Bitcoin in relation to its shortage nonetheless has to correlate to its demand on the asking worth. It’s unlikely that Bitcoin can have the identical demand at $1 million per coin as it could at $1 per coin, as an illustration. For my part, that is the place the rubber meets the street; at what worth does the demand for Bitcoin change?

Digging into the numbers – Bitcoin vs gold AUM

Yesterday, Bitcoin traded $52 billion throughout all exchanges at round $45,000 – $47,000.

Round 6.2 million BTC are out there (they moved throughout the previous 12 months). Glassnode estimates round 7.9 million cash have been misplaced or are unlikely to maneuver any time quickly. Given the present circulating provide of round 19.59 million, we are able to thus estimate a liquid pool of between 6.2 and 11.6 million cash obtainable for buy.

At immediately’s worth, this equates to round $291 to $545 billion in liquid cash out there, or round ten instances the every day quantity traded.

Thus, hypothetically, every of the 11 spot Bitcoin ETFs launching immediately would want to amass round $49 billion in AUM to eat up the whole theoretical liquidity out there.

As of Jan. 10, 2024, the highest gold ETF, GLD, has an AUM of $56 billion. Assessing the general high ETFs, SPY has $483 billion, and IVV has $396 billion.

The entire worth of belongings below administration for all gold ETFs within the U.S. is round $114 billion.

Thus, there may be definitely room out there for spot Bitcoin ETFs to amass presently liquid cash, however it’s nonetheless a good market, and in lower than 100 days, it can turn into even tighter.

When analysts evaluate the success of a spot gold launch 20 years in the past with the potential for Bitcoin to comply with go well with, I feel they might be drastically underestimating the variations between gold and ‘digital gold.’

Placing it into context, if BlackRock acquires the identical AUM in Bitcoin because it has in gold (roughly $27 billion,) it could be 5% to 9% of all liquid Bitcoin available on the market. Furthermore, there are presently 2.35 million BTC on exchanges. So it could must buy 24% of exchange-listed Bitcoin… at present costs, that’s.

Drawing on the parallels and contrasts between the historic influence of Gold ETFs and the potential affect of the upcoming spot Bitcoin ETFs, it turns into evident that whereas the success of Gold ETFs was important, the distinctive attributes of Bitcoin, comparable to its fastened provide and prevailing holding patterns, may result in an much more profound influence available on the market, accentuating the potential for a transformative impact far past what was noticed with gold.