A transferring common (MA) is a inventory indicator generally utilized in technical evaluation. As its title suggests, the indicator smooths out value knowledge by making a continually up to date common value over a particular time interval.

In technical evaluation, transferring averages assist determine pattern instructions by analyzing earlier value actions.

Shifting averages are extensively used when analyzing the worth of Bitcoin. Out of all of the cryptocurrencies, Bitcoin behaves like shares probably the most, and has traditionally responded properly to such evaluation.

Though technical evaluation (TA) stays a controversial matter within the crypto business, analyzing Bitcoin’s MAs can be utilized alongside different metrics to find out the present state of the market.

Within the context of Bitcoin, transferring averages can be utilized to determine the place help and resistance are fashioned. Trying again on the historic knowledge, we will use transferring averages to determine durations the place Bitcoin’s value dropped to its cycle lows.

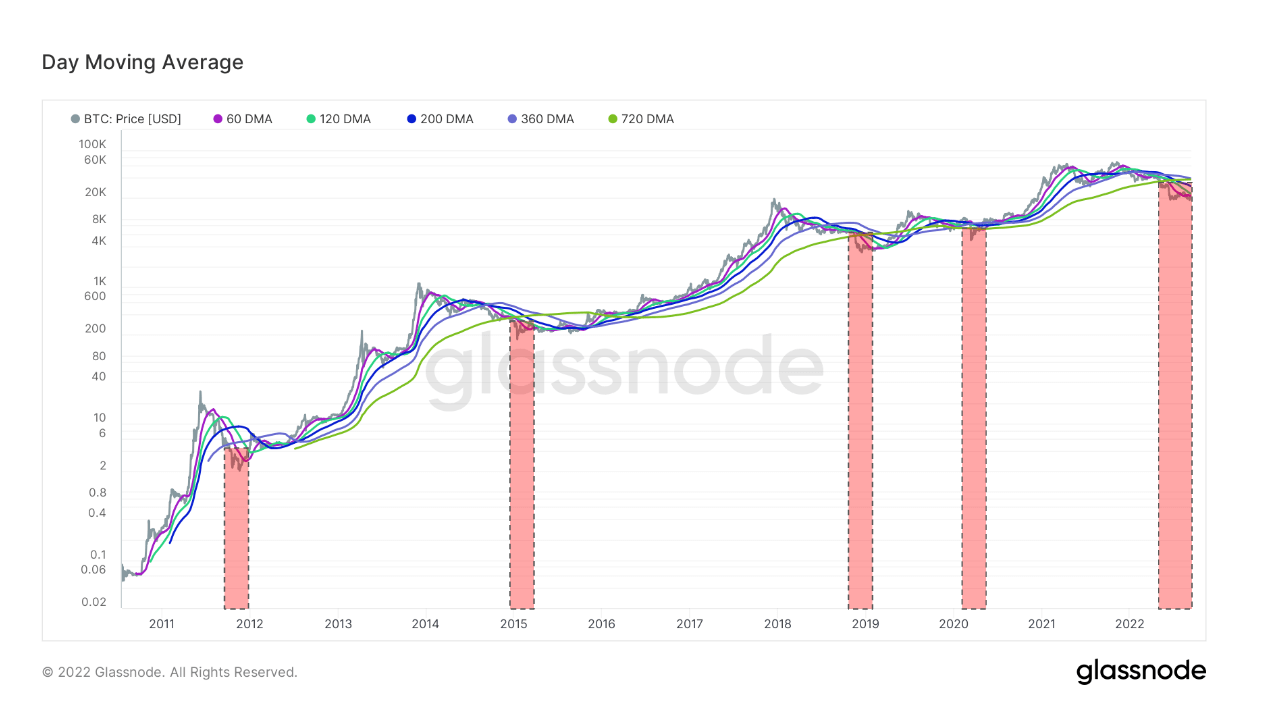

When analyzing Bitcoin, the 60-day, 120-day, 200-day, 360-day, and 720-day transferring averages are notably essential. Each time Bitcoin’s value dropped under these MAs, the market noticed what some analysts name a “generational purchase” alternative.

In line with knowledge from Glassnode, Bitcoin has fallen under all key transferring averages for the fifth time ever. Bitcoin’s present stint under the transferring averages can also be the longest ever — coming in at virtually twice so long as the earlier drops we’ve seen on the finish of 2011, 2015, 2019, and 2020.

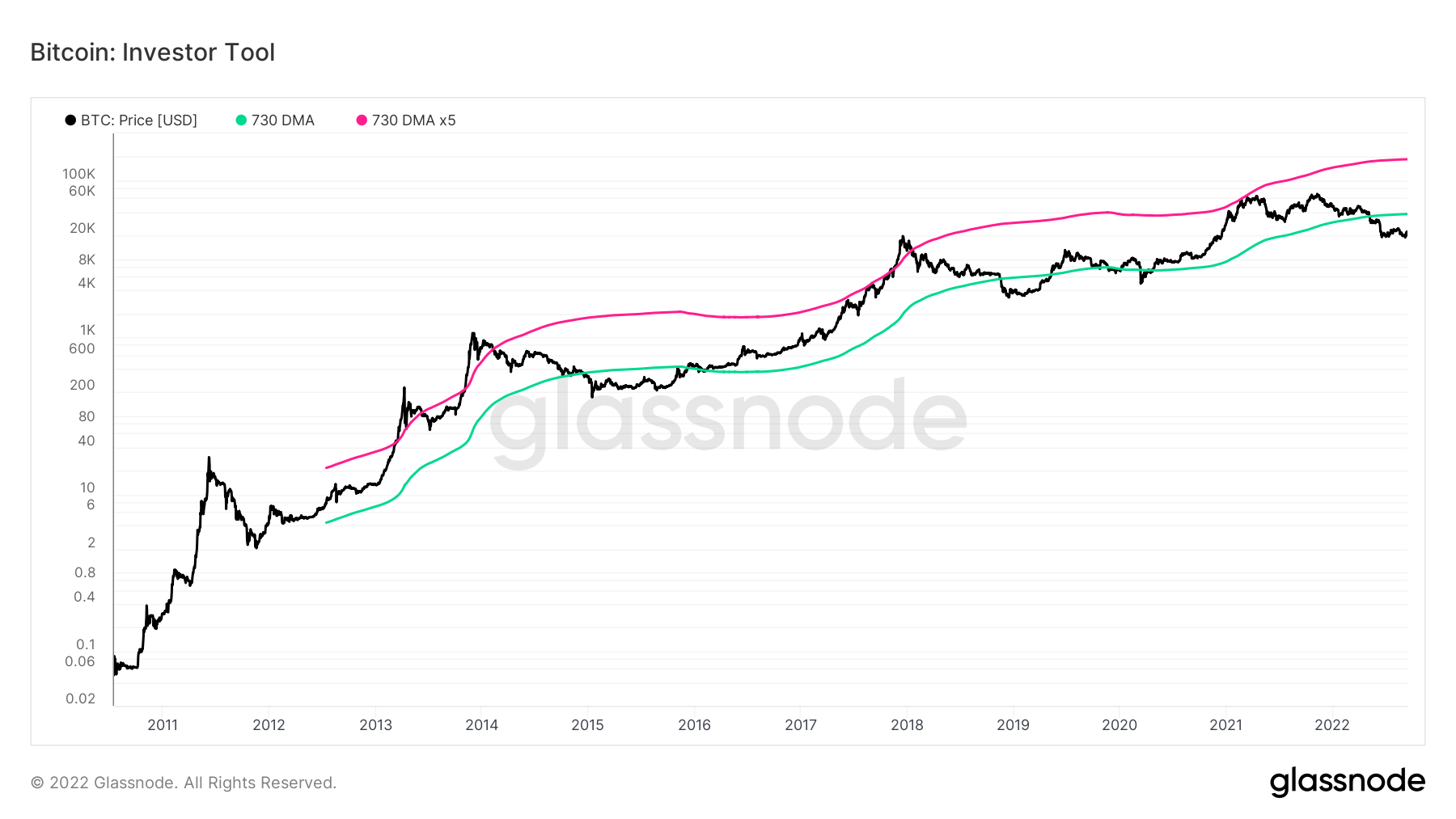

Shifting averages are additionally a part of different key indicators for figuring out the Bitcoin market cycle. A kind of indicators is the Bitcoin Investor Software, created by analyst Philip Swift. Supposed as a device for long-term buyers, the indicator consists of two easy transferring averages of Bitcoin’s value — the 2-year MA and a 5x a number of of the 2-year MA.

These transferring averages are used as the idea for figuring out undervalued and overvalued situations out there. It signifies durations the place costs are more likely to method cyclical tops and bottoms.

Bitcoin’s value buying and selling under the 2-year MA has traditionally generated outsized returns and signaled bear cycle lows. When the worth traded above the 2-year MA x5, it signaled bull cycle tops and a zone the place long-term buyers de-risk.

Because the Terra (LUNA) collapse in Could, Bitcoin has remained under the 730-day MA. Since 2011, BTC went under the 730-day MA solely 3 times — between 2015 and 2016, in 2019, and briefly in 2020. Every time BTC spent under the 730-day MA was shorter than the earlier one. Its drop in March 2020 was measured in days, not months. Bitcoin’s present stint below the MA has damaged this sample and is coming into its fourth consecutive month.

Bitcoin recovered from each drop under the 730-day MA. If its historic patterns repeat, it’s additionally set to get better from this drop. Nevertheless, it’s nonetheless early to inform how briskly its restoration shall be. The present crypto market uncertainty is worsened by deteriorating macro situations, making it onerous to foretell what the incoming winter will convey.