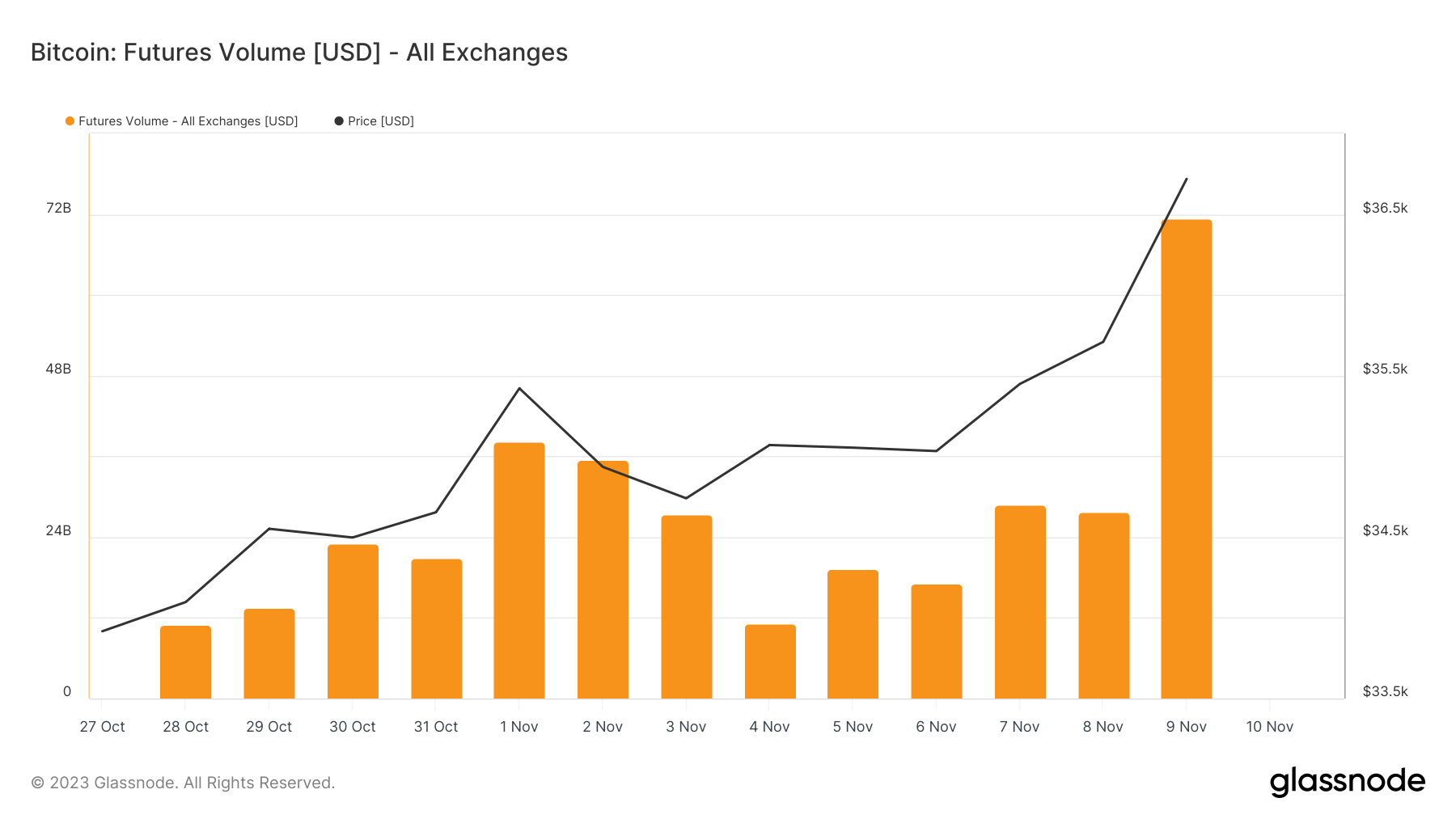

Bitcoin’s value jumped from $35,708 to $36,718 between Nov. 8 and Nov. 9, triggering a large response from the futures market.

The overall quantity of Bitcoin futures traded throughout all exchanges leaped from $27.69 billion to $71.29 billion, displaying a notable improve in speculative exercise in Bitcoin.

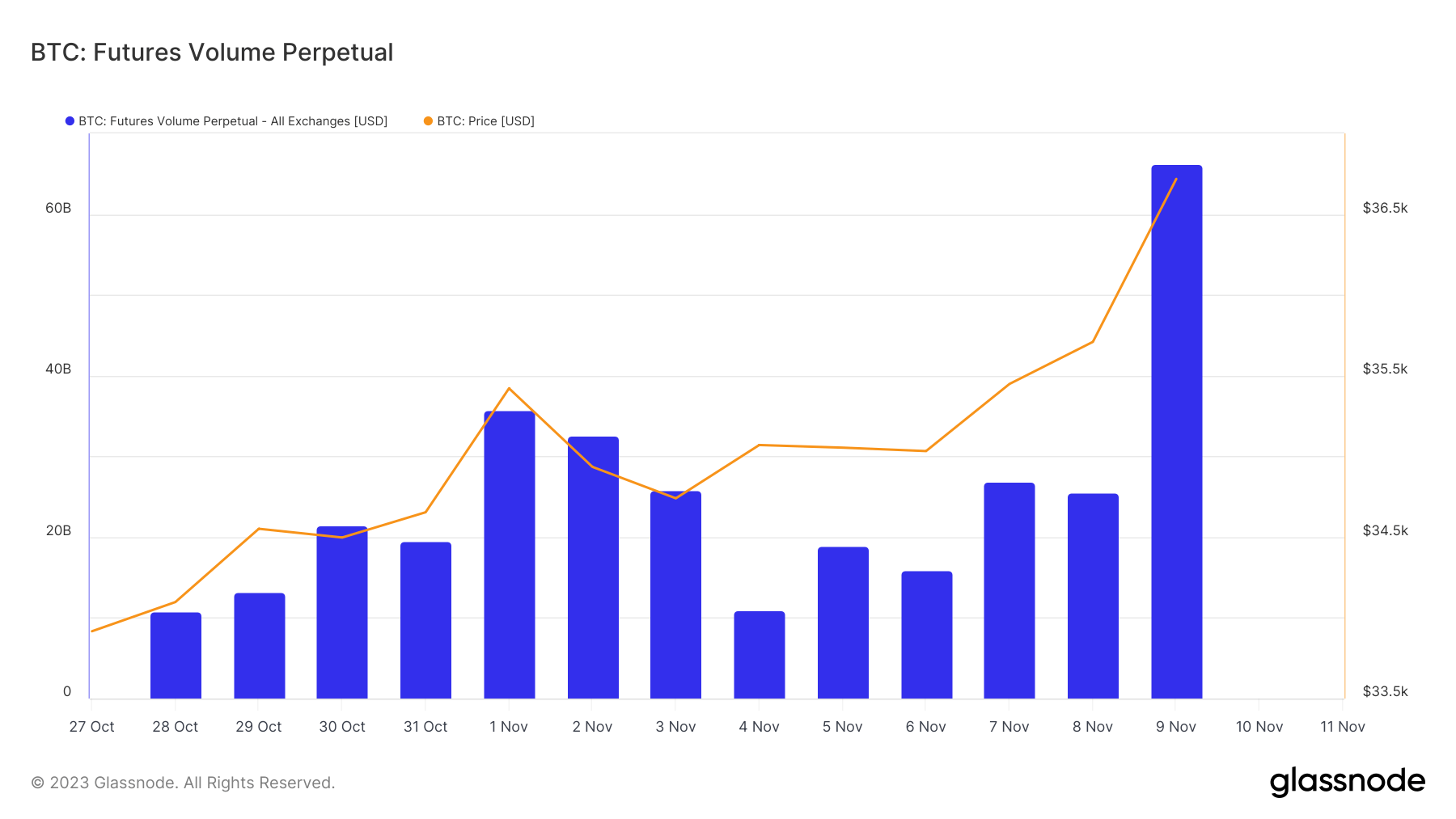

This was adopted by an identical pattern in perpetual futures quantity, which grew from $25.06 billion on Nov. 8 to $66.31 billion on Nov. 9. Such a excessive quantity in perpetual futures is especially noteworthy because it signifies ongoing curiosity and a speculative temper amongst merchants as a result of their non-expiry nature.

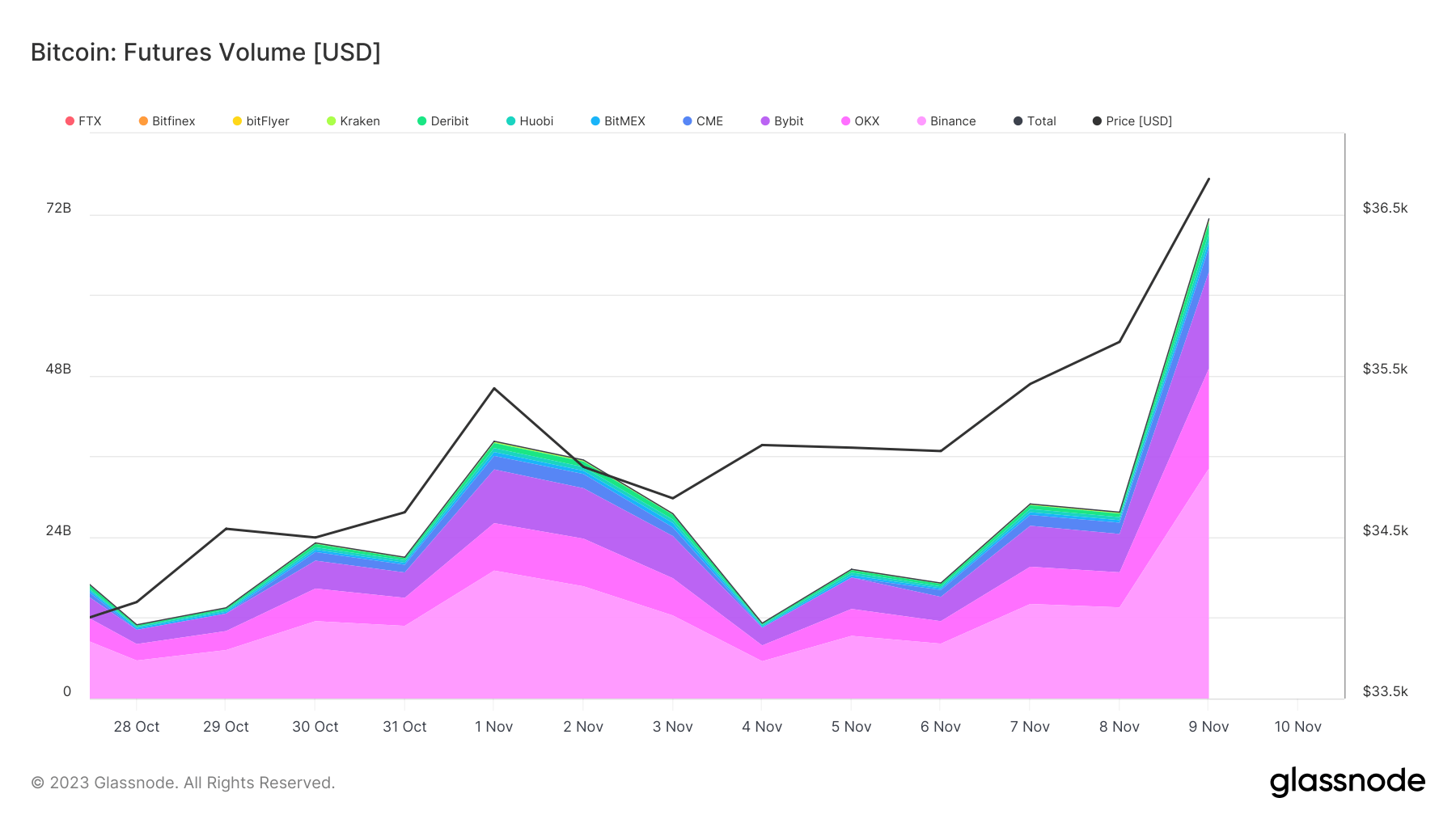

The distribution of this elevated quantity throughout main exchanges like Binance, OKX, Bybit, and CME supplies perception into the market’s breadth. Binance, for example, noticed its futures quantity greater than double, reaching $34.19 billion. This broad-based improve is indicative of widespread dealer participation and curiosity.

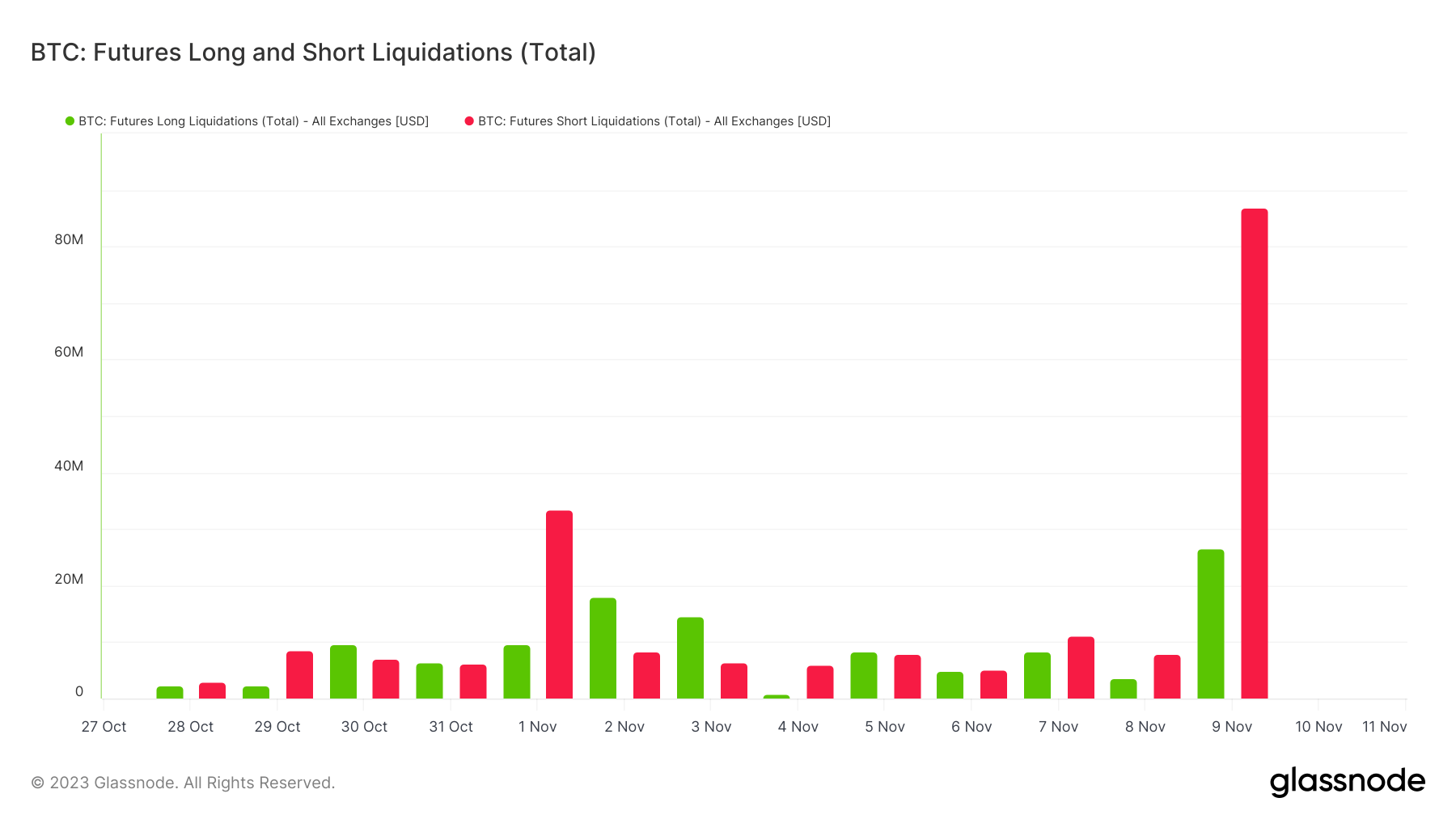

A vital facet of this market motion is the sample of liquidations. Lengthy liquidations rose from $3.72 million to $26.5 million, however extra dramatically, quick liquidations elevated from $7.83 million to $86.86 million. This means that many merchants who wager in opposition to Bitcoin had been compelled to exit their positions, presumably fueling the upward value momentum.

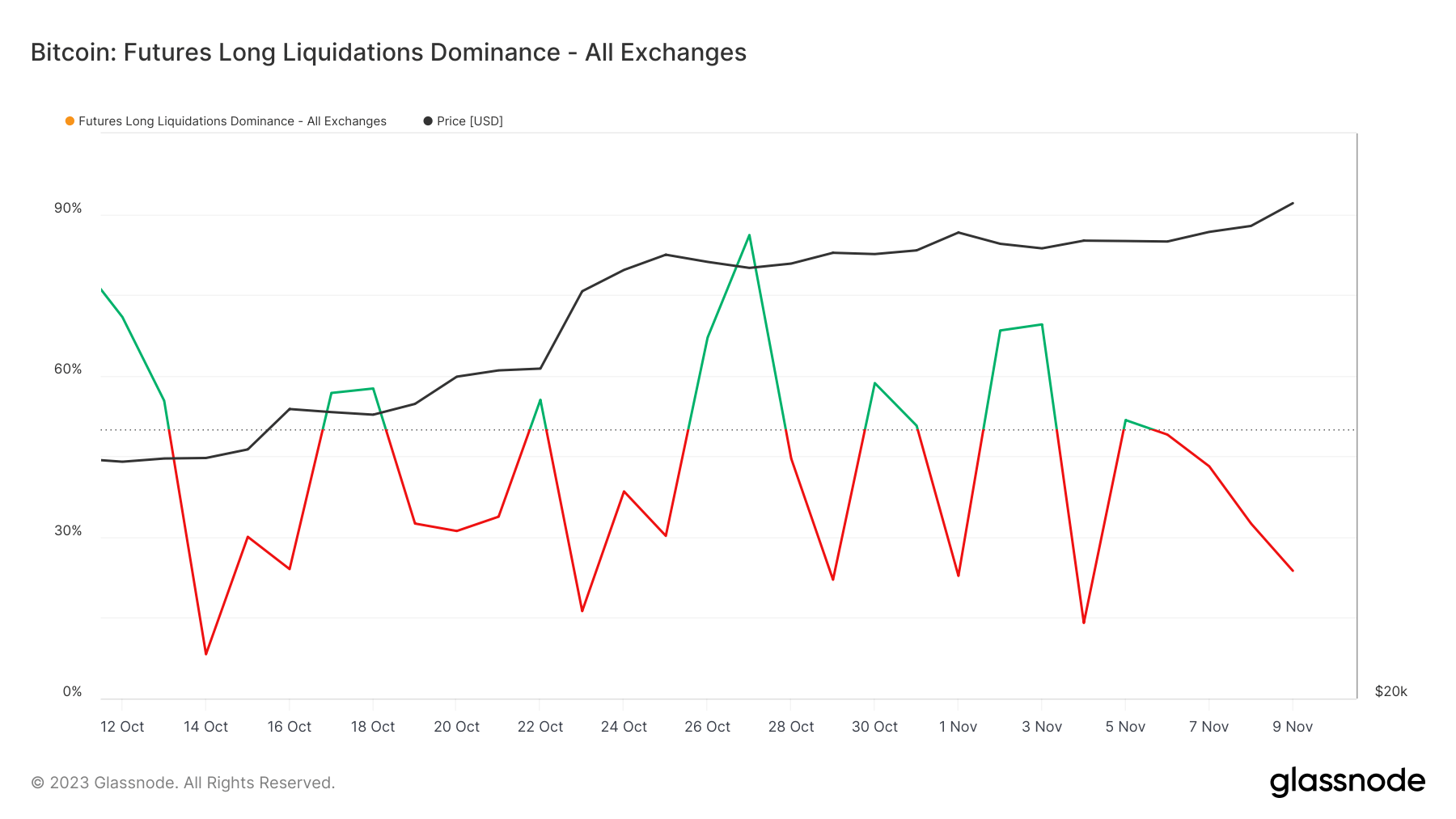

The lengthy liquidations dominance at 23.73% on Nov. 9 implies that whereas there have been important lengthy liquidations, the market predominantly skilled a squeeze on quick positions.

Monitoring the futures market is significant because it signifies dealer sentiment and potential value actions. The rise in liquidations, significantly the sharp improve in brief liquidations, can sign a shift in market sentiment and sometimes precedes a value motion, as seen on this occasion. Equally, the rise in quantity, particularly in a market like Bitcoin’s, can denote heightened investor curiosity or speculative buying and selling, each of which may considerably impression the worth.

The numerous improve in brief liquidations signifies a robust market correction in opposition to bearish bets, reinforcing the bullish pattern.

The submit Bitcoin futures quantity surges 157% as BTC reaches $36.6k appeared first on CryptoSlate.