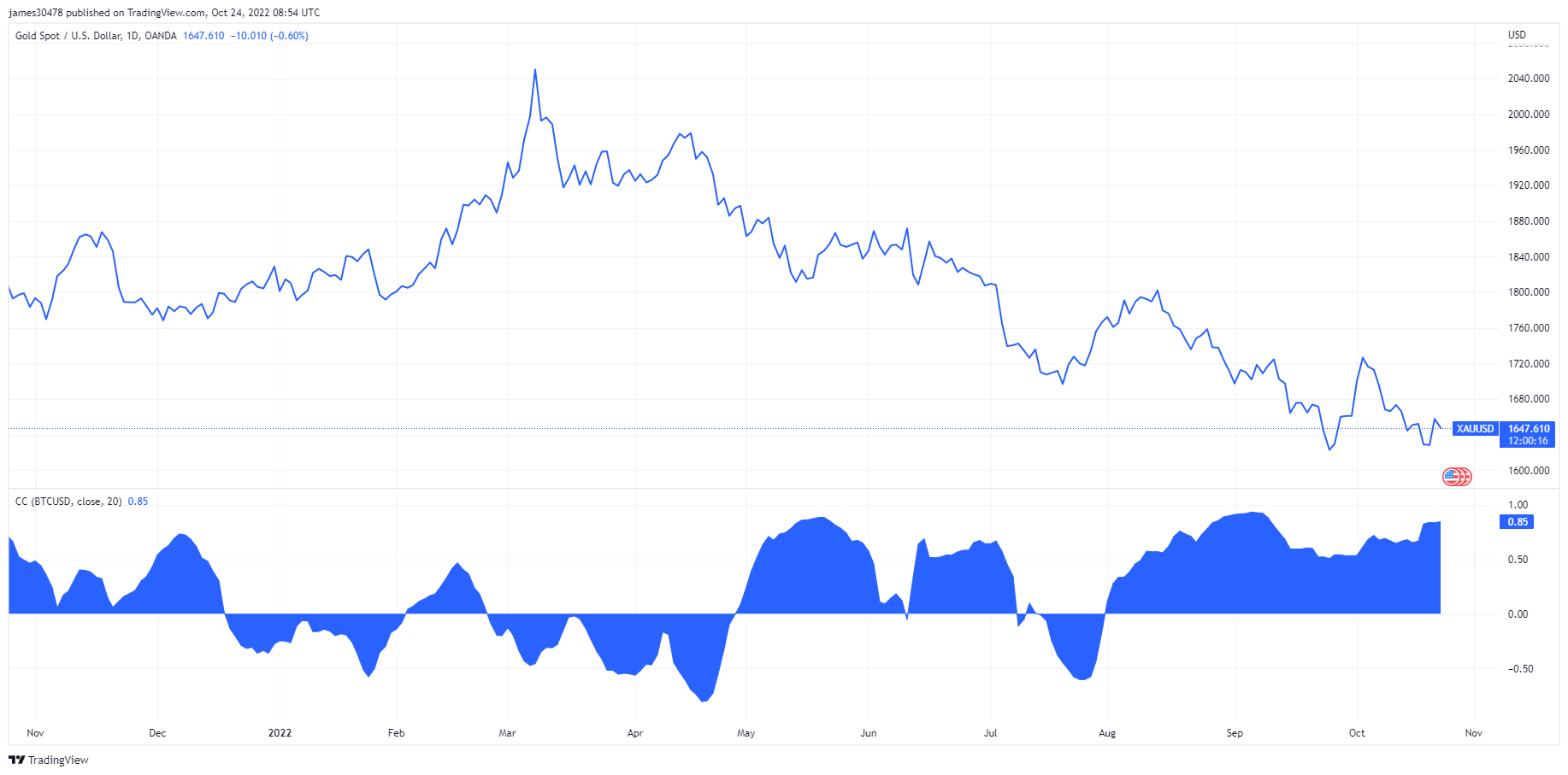

Bitcoin (BTC) adoption has elevated, and the most important cryptocurrency has change into much less dangerous as its correlation fee with gold reached 85% prior to now 12 months, which alerts {that a} BTC worth backside may very well be close to.

The correlation of property measures how one asset strikes in comparison with the opposite, and it’s scored between 1 and 0. If each property transfer in the identical course collectively, they’d be thought of extremely correlated, and their correlation fee could be 1. Equally, in the event that they transfer in reverse instructions, their correlation fee could be 0.

The present correlation fee of Bitcoin and gold is at 0.85, which signifies that these property transfer in the identical course with 85% accuracy.

Because the chart above additionally demonstrates, the value correlation of Bitcoin and gold has been above the 0.50 fee since early Could, apart from a brief timeframe between mid-July and early August.

This enhance within the correlation signifies that Bitcoin adoption has elevated. Shifting in the identical course as gold would possibly imply that buyers began seeing Bitcoin as digital gold, as their fundamentals are already comparable.

Bitcoin mining firm Argo’s CEO, Peter Wall, talked about this enhance in adoption when the correlation charges began to extend. In an interview Wall gave on Could 30, he referred to Bitcoin as Gold 2.0 and stated that Bitcoin’s restricted cap resembled the restricted nature of gold.

Nearing Bitcoin backside

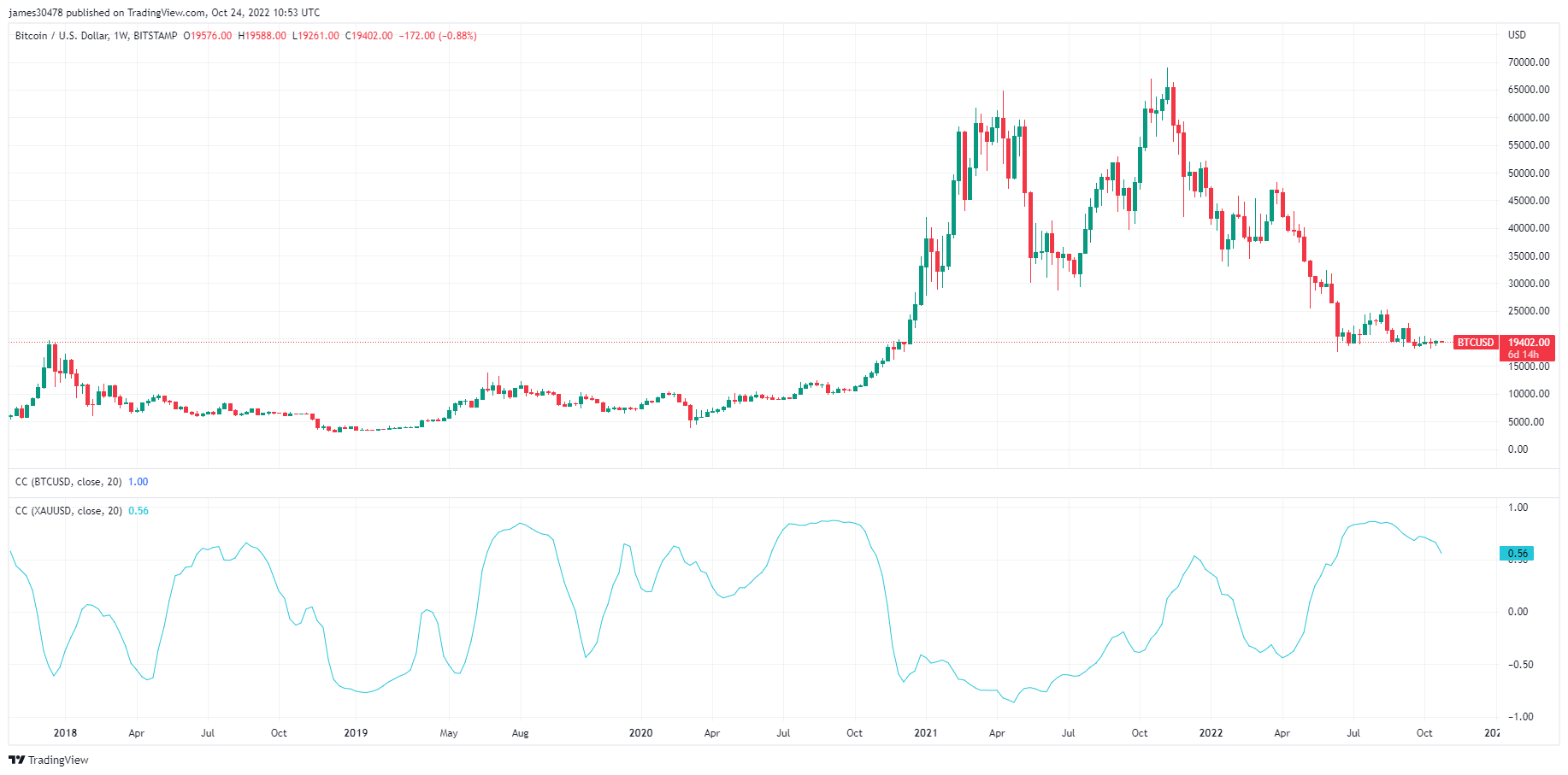

Historic information on the Bitcoin and gold correlation means that occasions of excessive correlation presage a worth backside for Bitcoin.

The chart above reveals Bitcoin’s worth in opposition to the U.S. Greenback since 2018 and demonstrates the correlation fee between gold and Bitcoin with the blue line.

The chart’s sections displaying the value actions in late 2017, July 2018, September 2018, August 2019, January 2020, March 2020, July-October 2020, December 2021, and July 2022 correspond with a comparatively excessive worth correlation between gold and Bitcoin.