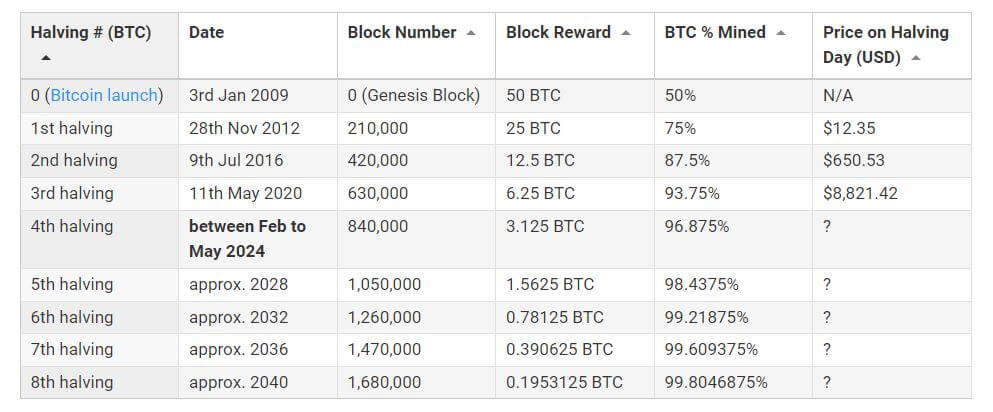

The Bitcoin halving refers to an occasion the place miners’ block rewards are minimize in half. This happens roughly each 4 years, relying on when a complete of 210,000 blocks have been mined from the earlier halving go-live date.

Consequently, the variety of new tokens getting into circulation slows and fewer tokens enter the provision – making Bitcoin extra scarce over time.

This course of will proceed to the final halving in 2136 when the mining reward shall be minimize to 0.00000001 BTC.

The place are we within the present Bitcoin halving cycle?

The third and subsequent halving is on observe to finalize on March 25, 2024, with roughly 75,000 blocks left to mine earlier than hitting that time.

Based mostly on this shifting estimate, the variety of days from the earlier halving, on Could 11, 2020, involves 1,414 days. Earlier halvings took:

- 1st halving: Nov. 28, 2012 to July 8, 2016 – 1,318 days.

- 2nd halving: July 9, 2016 to Could 10, 2020 – 1,401 days

The value on halving day has, thus far, recorded positive aspects above the value on the earlier halving day, lending assist to the speculation that BTC shortage drives worth upwards.

However is that the complete story?

Realized Worth

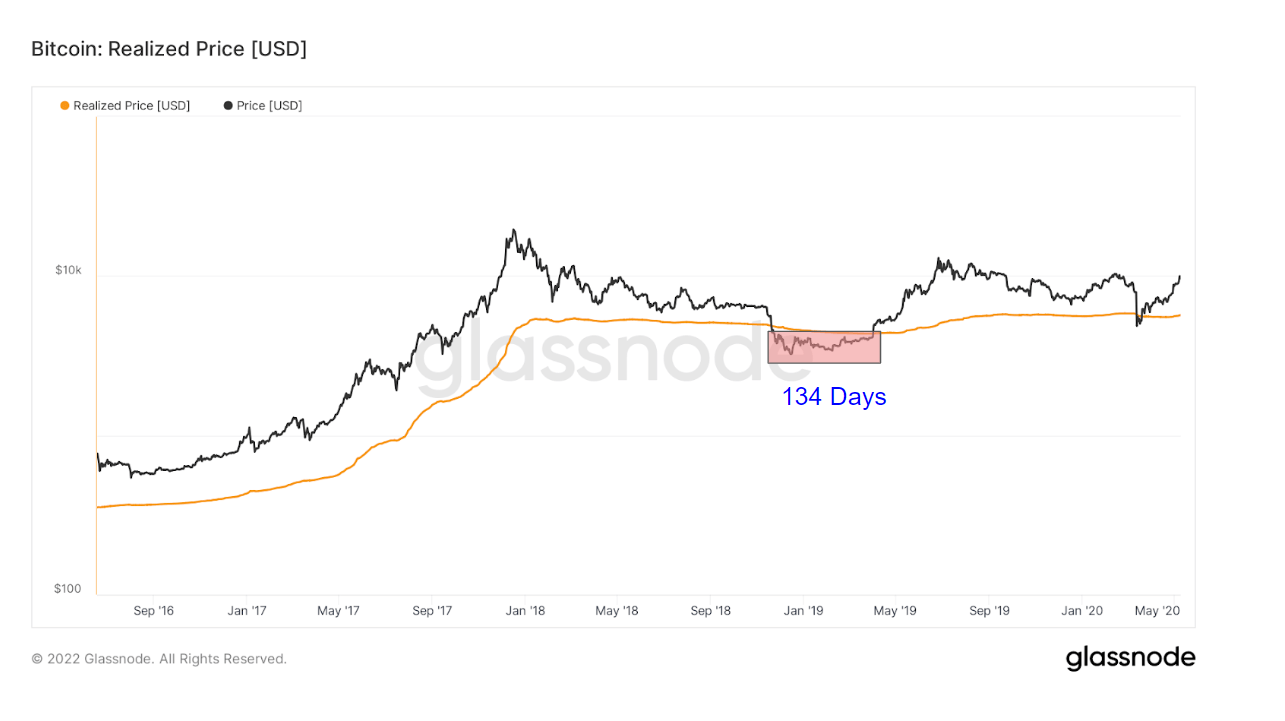

Realized Worth is calculated by taking the realized complete market cap and divided by the variety of Bitcoin in circulation. In different phrases, Realized Worth is an alternative choice to the precise market worth and measures what the market as an entire paid for its BTC on common.

Merchants take into account Realized Worth as on-chain assist and resistance worth ranges. An precise worth above the Realized Worth signifies the market as an entire is in revenue and is regarded as a promote indicator (bearish).

In distinction, an precise worth under the Realized Worth signifies the market as an entire is at loss and is regarded as a purchase (or bottoming) indicator (bullish).

On-chain evaluation of Glassnode knowledge revealed steady in depth intervals of the Realized Worth under the precise worth within the run-up to every respective halving go-live date.

The primary halving noticed BTC under the Realized Worth for 299 days earlier than the following halving occurred some seven months later in July 2016.

The second halving noticed BTC under the Realized Worth for 134 days (and once more briefly in April 2020) earlier than the following halving occurred roughly twelve months later in Could 2020.

Counting right down to the third halving, the Realized Worth is presently under BTC and has been since 168 days in the past. The precise worth of BTC is presently under the Realized Worth of $21,000, suggesting an upswing within the precise worth on playing cards, as occurred in earlier situations.