A take a look at a graph of Bitcoin’s (BTC) worth efficiency up to now few months will present a see-saw chart, however with considerably extra downs than up.

Whereas the present market cycle may appear completely different from earlier ones, the HODL waves metric exhibits that it’s not a lot completely different from earlier cycles.

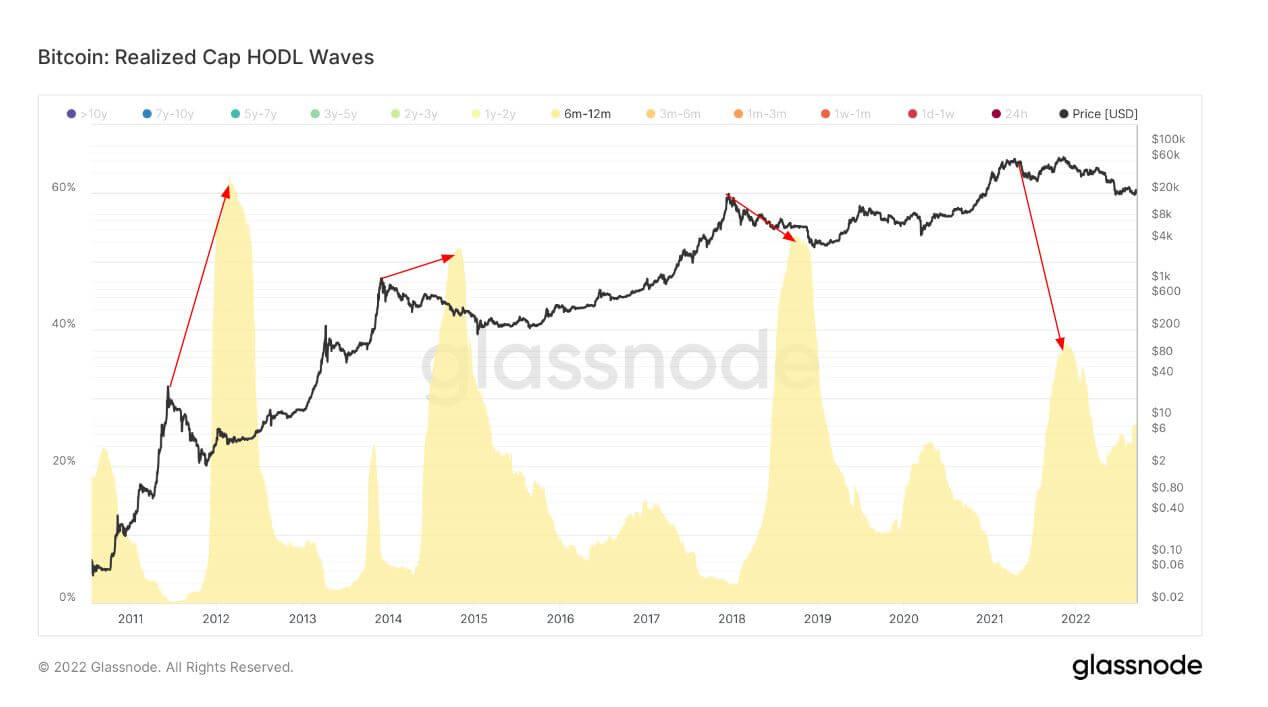

The HODL waves metric is a chart that teams Bitcoin provide in circulation into completely different age bands and the adjustments in these age bands through the years.

With the chart, it’s attainable to see what every group of market individuals does with their Bitcoin and determine which group is promoting.

A take a look at Glassnode’s Bitcoin Realized Cap HODL waves chart as analyzed by CryptoSlate analysis reveals that short-term holders between 6 – 12 months often purchase the flagship asset throughout a bull run when the value is close to the highest or on the very high.

Most of those holders purchase about six months after the market peaked — it is a graphical illustration of the worry of lacking out, and it’s when the HODL waves peak.

Often, Bitcoin’s worth declines quickly after, leaving these short-term holders with unrealized losses.

Quick-term holders shopping for means long-term holders are promoting to new market individuals. This has performed out in most market cycles, particularly in 2013, 2017, and 2021.

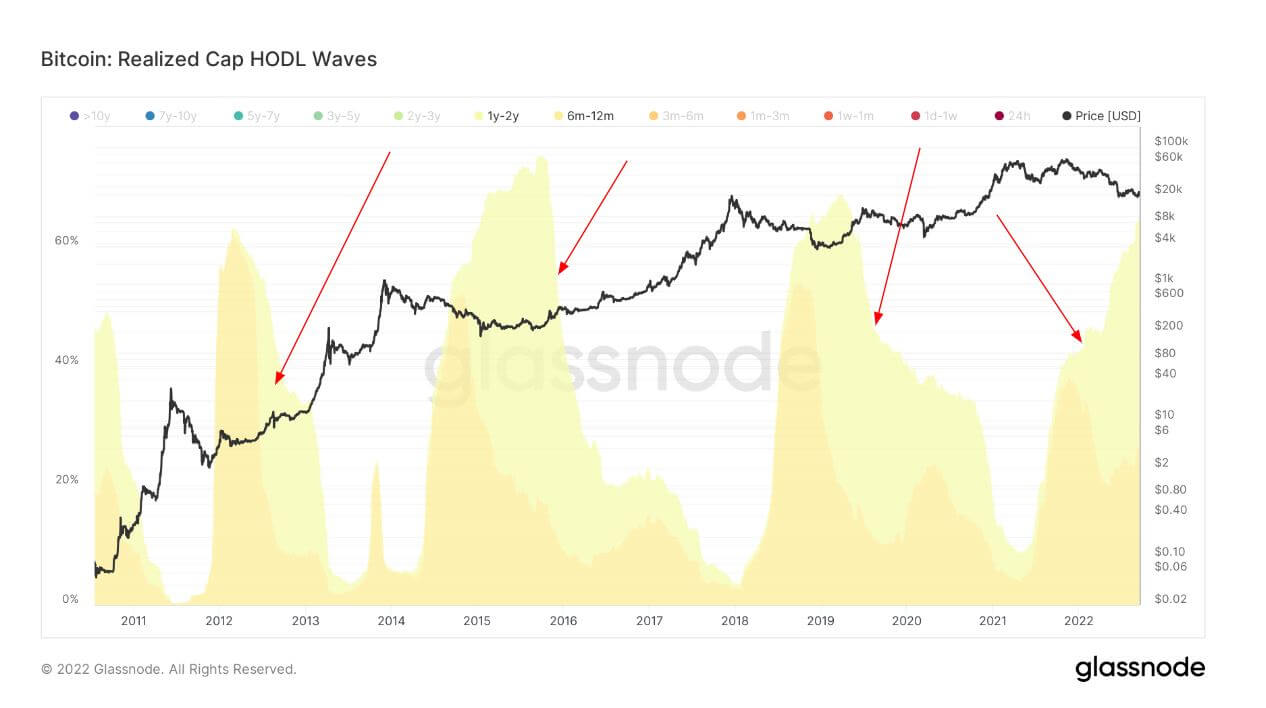

Nonetheless, the 1-2 yr HODL wave has been completely different since 2021. Though the HODL wave additionally declined, exhibiting that some offered throughout peak bull runs, the proportion was a lot decrease.

Whilst the value plummeted, about 60% of the availability remained. An evidence for this could be as a result of conviction in long-term holders, or it may consequence from being underwater since they purchased on the high when BTC was close to its ATH.

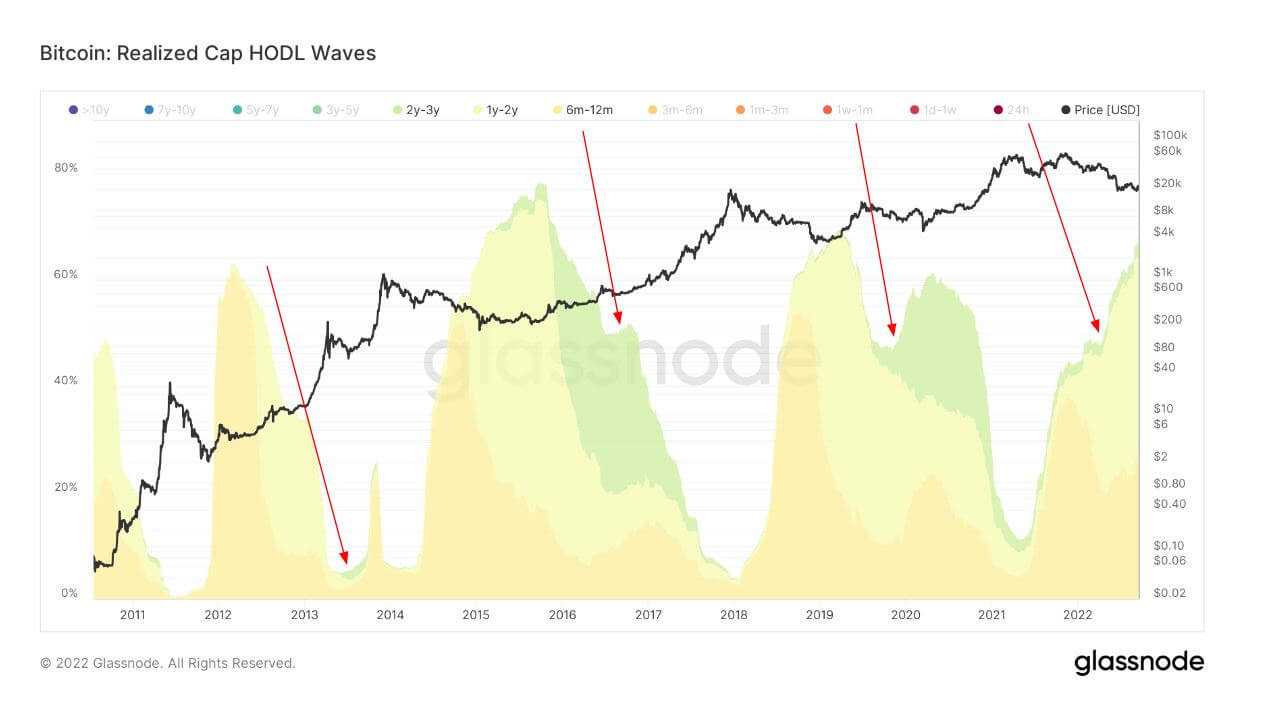

In the meantime, the 2-3 yr holders kind an even bigger proportion of the holding provide. Nonetheless, this cycle is considerably smaller than the opposite two earlier cycles. So we nonetheless want to attend for this cohort to mature as it will permit the community to grow to be even stronger with individuals who purchased the 2021 peak high.

In conclusion, the HODL wave metrics present that this cycle is identical as others with no distinction.