Fast Take

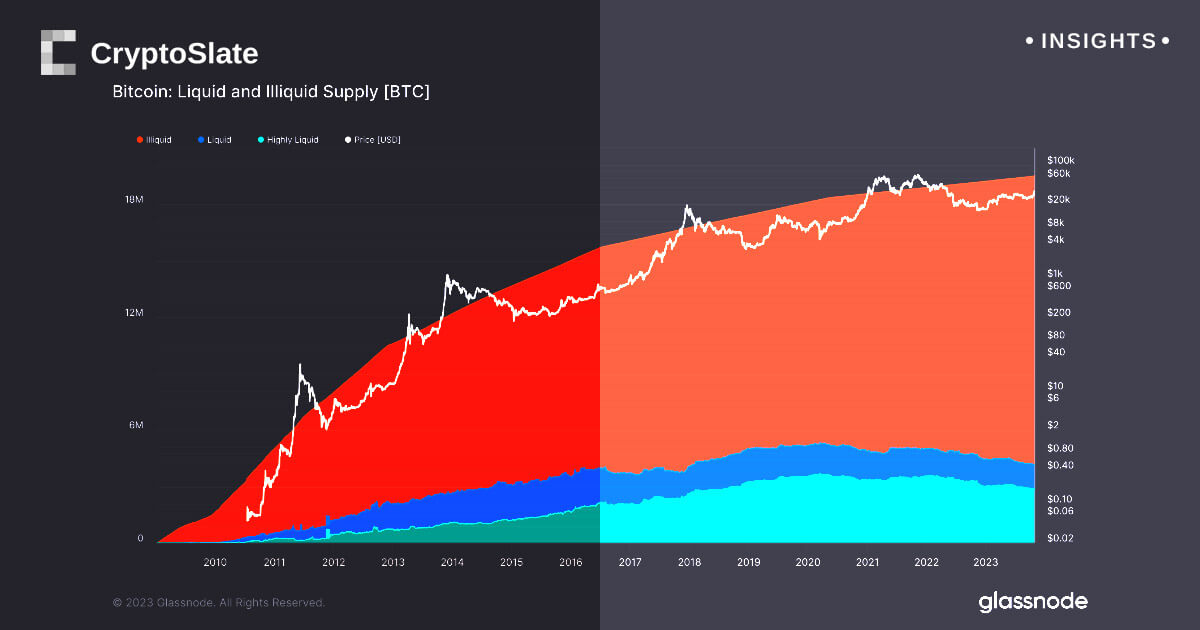

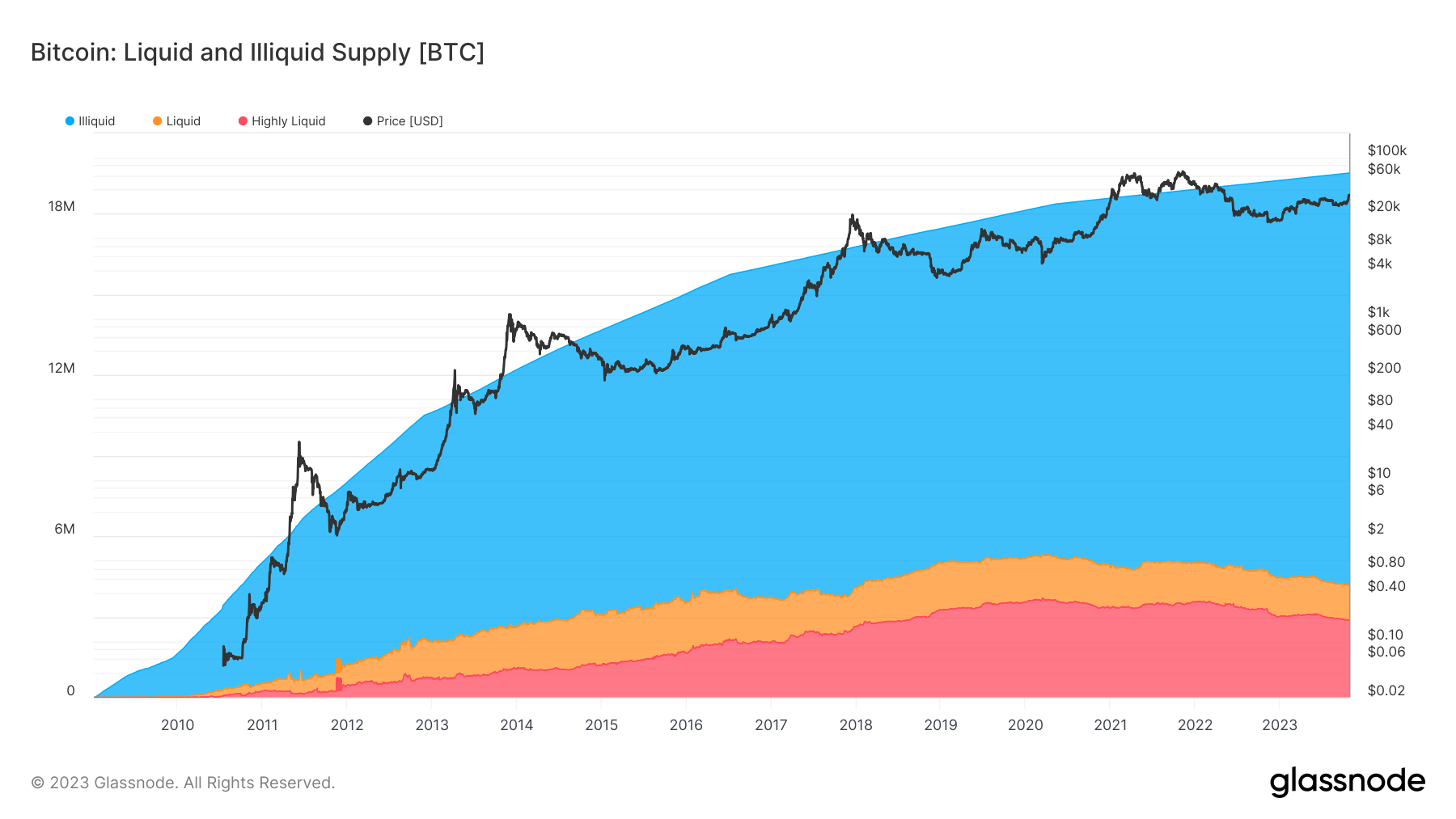

The Bitcoin market is presently witnessing pivotal adjustments in its liquidity dynamics. With the illiquid provide reaching an all-time excessive at 15.3 million BTC, representing roughly 78% of the Bitcoin circulating provide, it suggests a rising pool of holders dedicated to their long-term Bitcoin investments.

Concurrently, the liquid provide has retraced to 2012 ranges at 1.3 million BTC. This lowering development implies a possible shift available in the market’s working conduct, with extra entities transitioning to longer-term holding methods, thus becoming a member of the ranks of the ‘illiquid entities’.

Moreover, the extremely liquid provide has seen a big discount over the previous three years, down from 3.7 million BTC in March 2020 to the present 2.9 million BTC. This decline might signify a thinning of energetic merchants or entities that quickly transfer Bitcoin.

These liquidity dynamics collectively trace at a constriction of Bitcoin’s energetic provide. The mixture of a rising illiquid provide and shrinking liquid and extremely liquid provides can create a ‘brief squeeze’ situation. This happens when the market’s restricted energetic provide struggles to fulfill buying and selling demand, doubtlessly triggering sharp upward worth actions as merchants scramble to cowl their brief positions.

The put up Bitcoin illiquid provide hits all-time excessive reaching 15.3 million BTC appeared first on CryptoSlate.