On-chain knowledge reveals the Bitcoin leverage ratio has surged as much as a brand new all-time excessive, suggesting the market might be heading in the direction of excessive volatility.

Bitcoin All Exchanges Estimated Leverage Ratio Units New ATH

As identified by a CryptoQuant publish, the funding charge has remained impartial whereas the leverage has elevated out there.

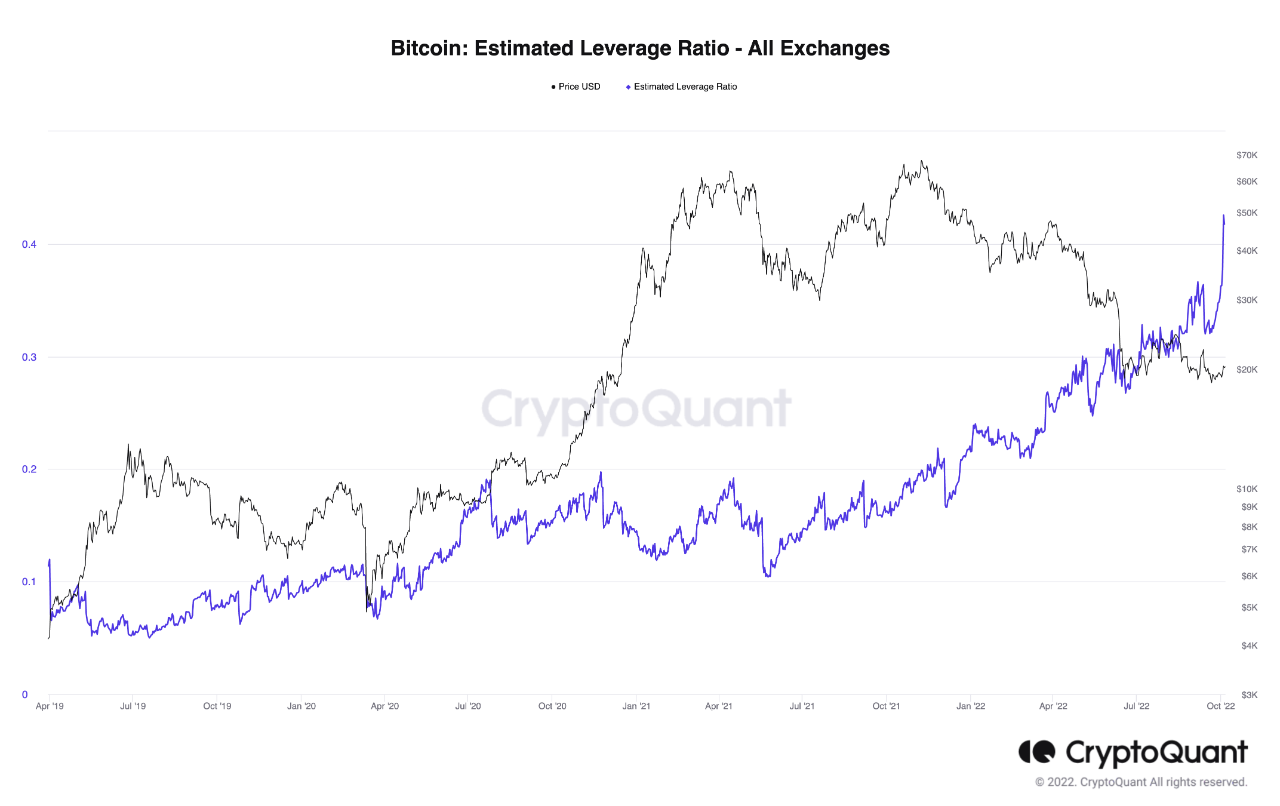

The “all exchanges estimated leverage ratio” is an indicator that measures the ratio between the Bitcoin open curiosity and the by-product change reserve.

What this metric tells us is the typical quantity of leverage presently being utilized by traders within the BTC futures market.

When the worth of this indicator is excessive, it means customers are taking a variety of leverage proper now. Traditionally, such values have led to greater volatility within the value of the crypto.

Then again, the worth of the metric being low suggests traders aren’t taking excessive danger in the intervening time, as they haven’t used a lot leverage.

Now, here’s a chart that reveals the development within the Bitcoin leverage ratio over the previous couple of years:

Appears to be like like the worth of the metric has been rising up throughout the previous couple of months | Supply: CryptoQuant

As you possibly can see within the above graph, the Bitcoin estimated leverage ratio has shot up just lately and has attained a brand new ATH. Which means that traders are taking a excessive quantity of leverage on common.

The rationale overleveraged markets have often turned extremely unstable up to now lies in the truth that such situations result in mass liquidations turning into extra possible.

Any sudden swings within the value during times of excessive leverage can result in a variety of contracts getting liquidated without delay. Nevertheless it doesn’t finish there; these liquidations additional amplify the worth transfer that created them, and therefore trigger much more liquidations.

Liquidations cascading collectively in such a approach is named a “squeeze.” Such occasions can contain both longs or shorts.

The Bitcoin funding charges (the periodic price exchanged between lengthy and brief merchants) may give us an thought about which route a attainable squeeze might go in.

CryptoQuant notes that this metric has a impartial worth presently, implying the market is equally divided between shorts and longs. As such, it’s laborious to say something in regards to the route a attainable squeeze within the close to future may lean in the direction of.

The Bitcoin volatility has the truth is been very low in latest weeks, however with such excessive accumulation of leverage, it could be a matter of time earlier than a unstable value takes over.

BTC Value

On the time of writing, Bitcoin’s value floats round $19.6k, up 2% up to now week.

The BTC worth continues to development sideways | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com