Earlier CryptoSlate evaluation revealed that the crypto trade is slowly getting out of the bear market. Nonetheless, the transition from a bear market to a bull market is usually a tumultuous and risky course of.

Lengthy-term holders (LTH) are an important components on this a part of the cycle, as their habits determines native bottoms and fuels future worth rallies.

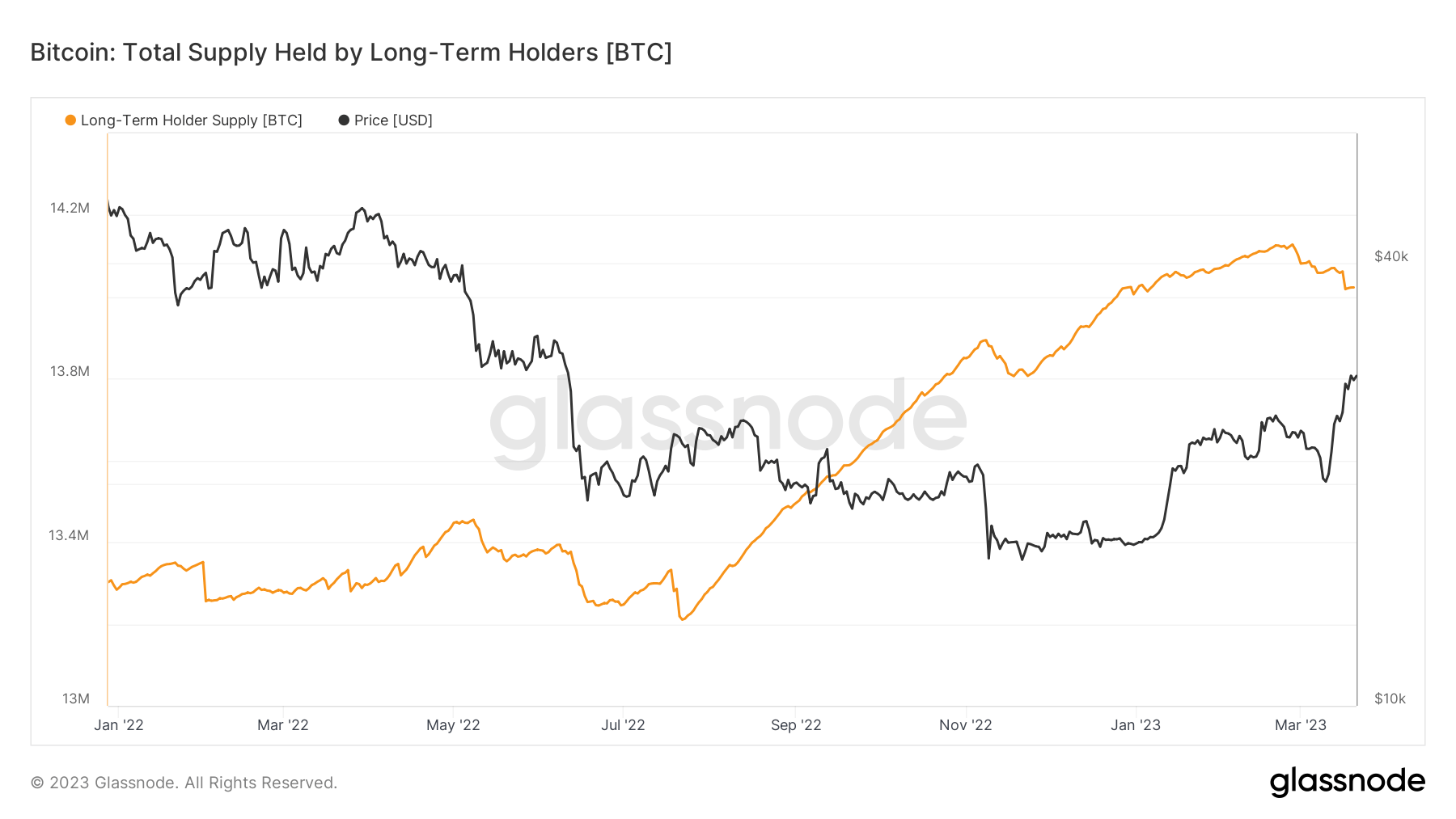

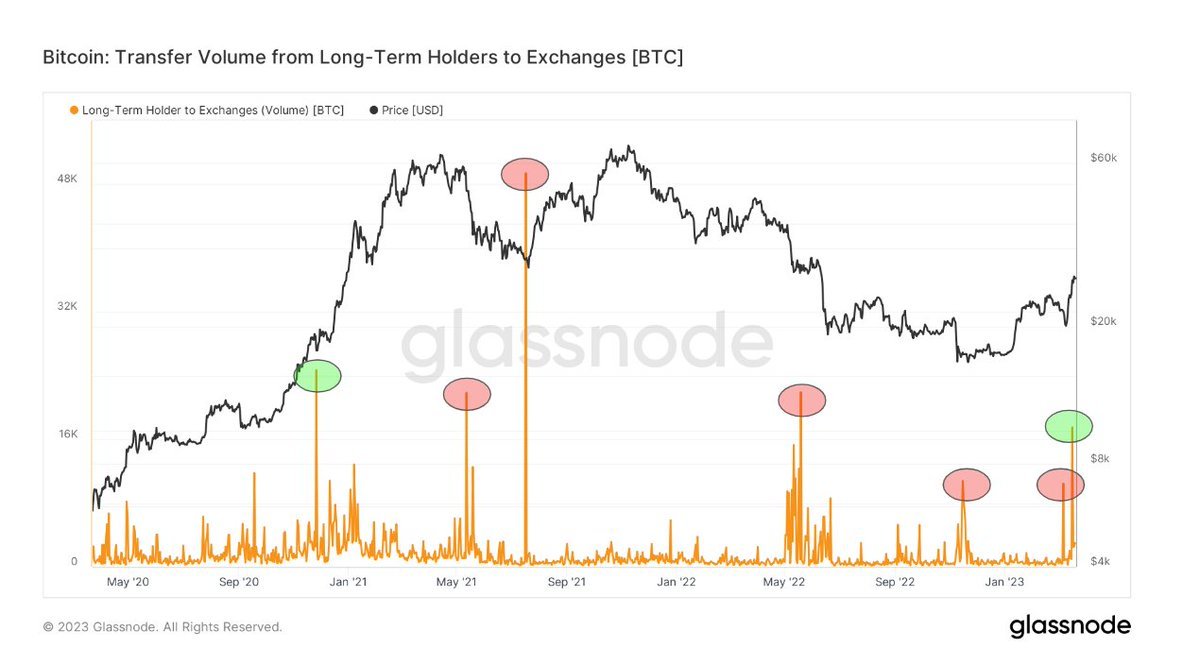

As Bitcoin (BTC) surged previous $28,000, LTHs rushed to promote a few of their holdings for the primary time in nearly a yr. The last few months have been spent in heavy accumulation, with LTHs growing their holdings repeatedly from November 2022 till the top of February. The slight lower of their provide that started in February noticed an nearly vertical drop between March 15 and March 17 — when LTHs bought off roughly 43,543 BTC.

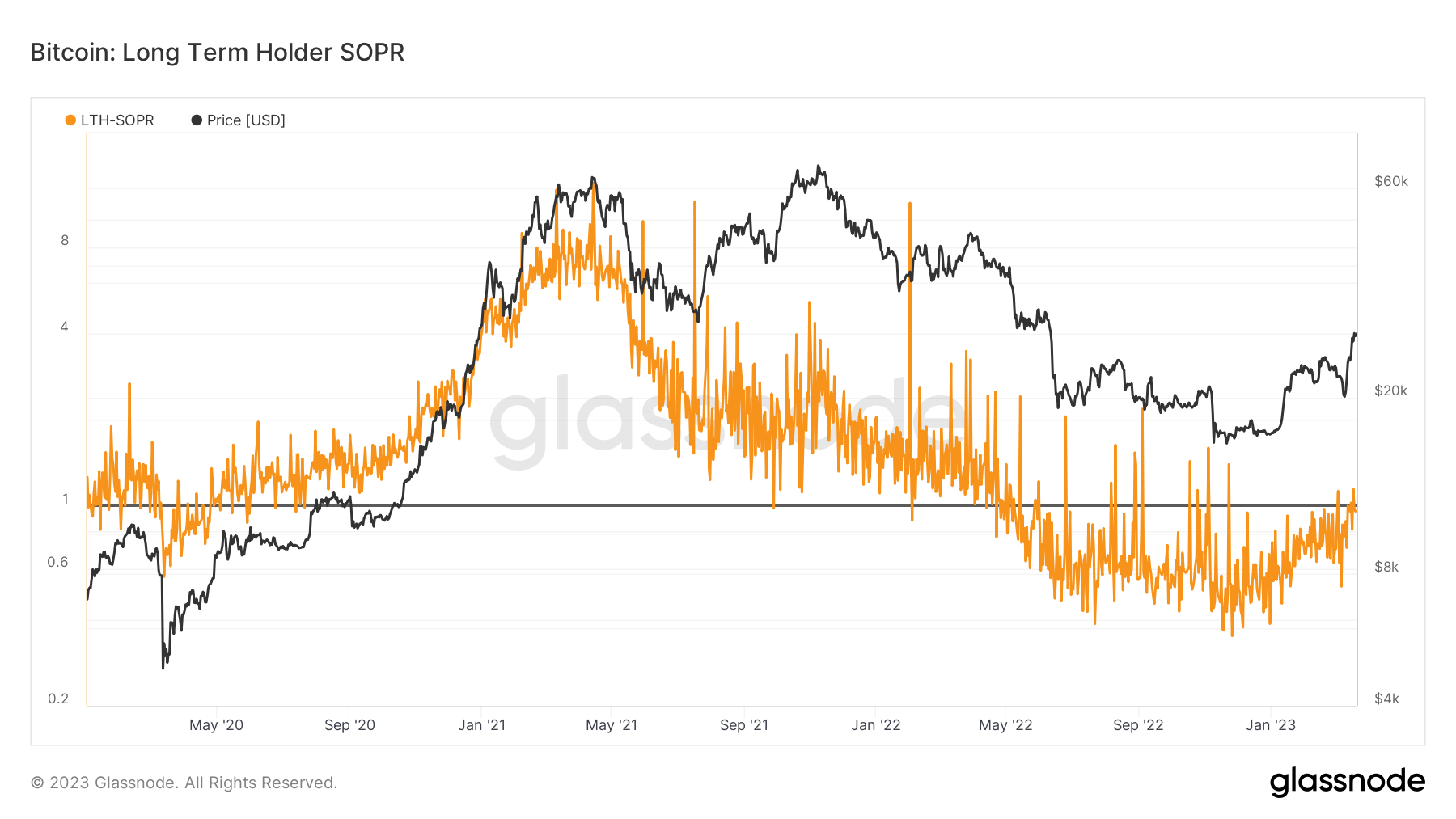

That is the primary time since Could 2022 that long-term holders spent a few of their BTC in revenue.

Bitcoin’s Spent Output Revenue Ratio (SOPR) — a ratio that exhibits the profitability of spent BTC — reached 1.02 on March 16. It surged previous 1.14 once more on March 18 and stood at 0.98 at press time. A SOPR worth increased than 1 implies that the cash spent on that day are, on common, promoting at a revenue.

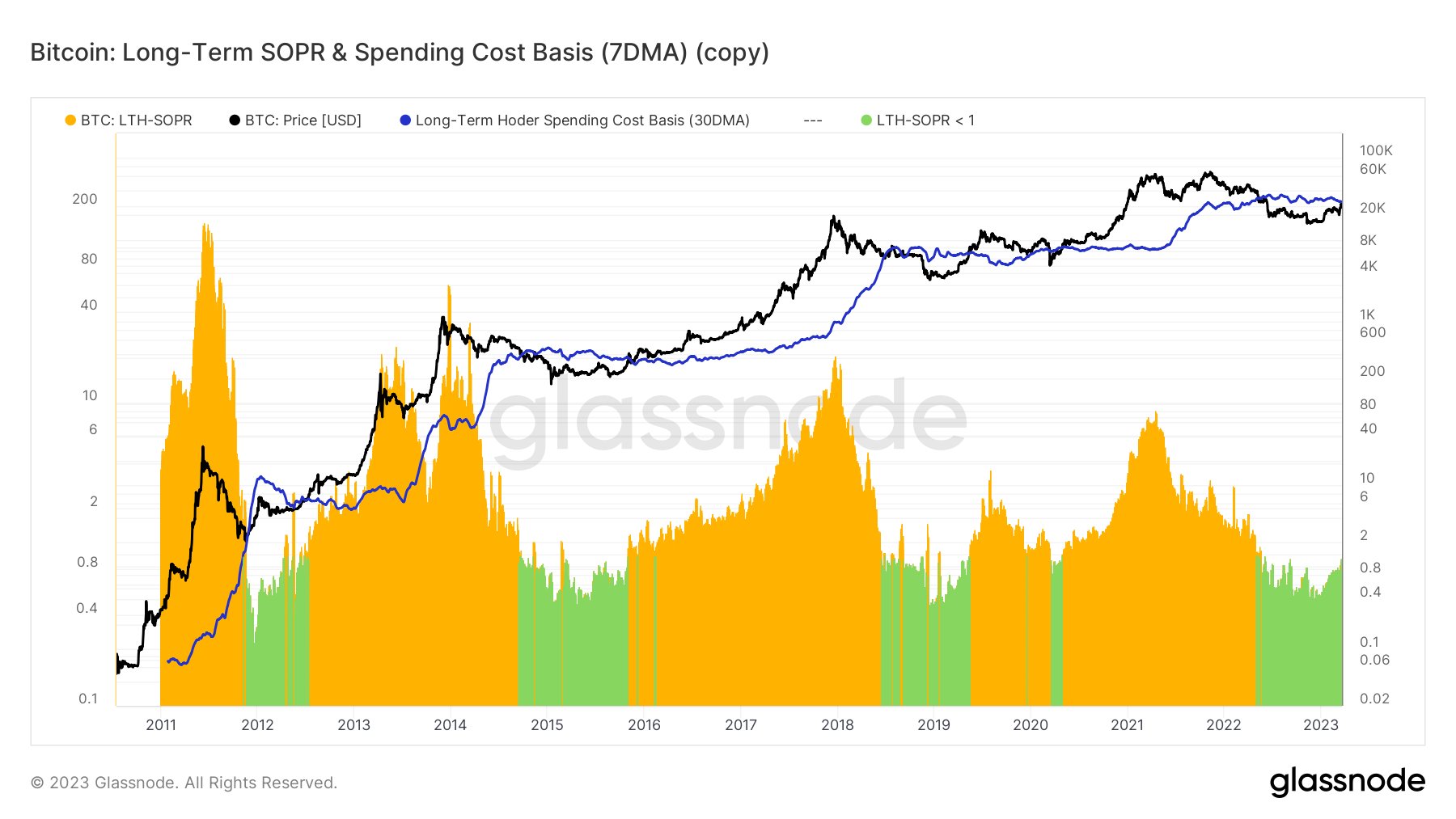

CryptoSlate evaluation additionally confirmed that the long-term holder spending value foundation has nearly met Bitcoin’s spot worth. On March 20, LTH spending value foundation reached simply over $29,000 — whereas BTC reached $28,400.

That is the primary time since January 2020 that long-term holders bought their BTC to lock in earnings. All LTH selloffs since then have been a results of capitulation. This habits is seen within the improve in switch quantity from LTHs to change addresses.

If LTHs proceed to promote their BTC, we may see a worth pullback within the coming weeks. The market tends to react with volatility at any time when long-term holder provide decreases, which may erase a lot of the positive factors Bitcoin made for the reason that ongoing banking disaster started.