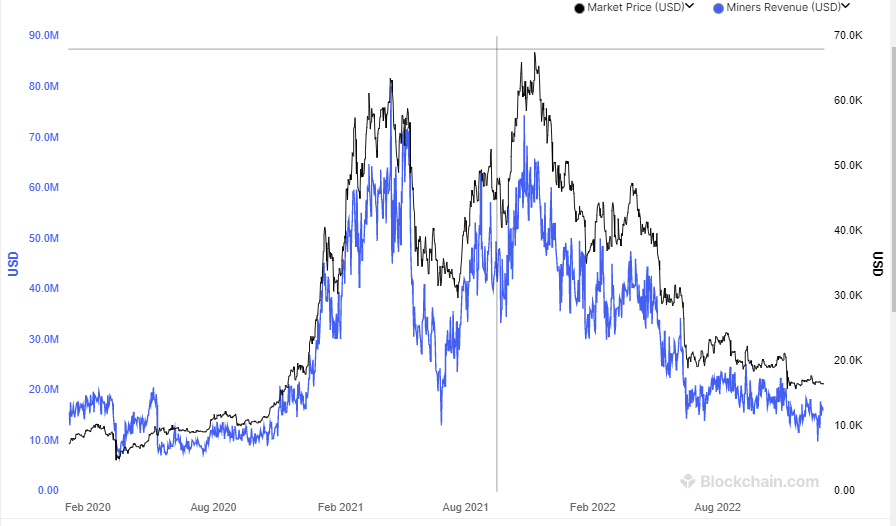

Bitcoin mining income was all the way down to $9.55 billion in 2022 from $15.3 billion in 2021 – a 37.5% decline.

For the reason that peak of a large rally in 2021, cryptocurrencies have misplaced greater than $2 trillion in market cap to succeed in beneath $900 billion. There was greater than a 70% drop in Bitcoin, the world’s largest digital coin because it reached an all-time excessive of almost $69,000 in November. As well as, a number of high-profile firm and undertaking failures have despatched shock waves up to now 12 months.

This all started in Could with the collapse of terraUSD, which introduced down different corporations like Three Arrows Capital, a crypto-oriented hedge fund. Then, in November, FTX, one of many world’s largest cryptocurrency exchanges, collapsed, affecting the business.

Moreover, rising rates of interest have put stress on danger property, similar to shares and crypto, together with crypto-specific failures.

As buyers grew to become cautious of risky property, deteriorating market circumstances additionally affected miners. Apart from market circumstances, miners additionally confronted excessive electrical energy prices and file mining issue. In 2022, mining issue reached a file excessive because of a rise in hash price, which left some miners struggling for profitability.

As a result of this, the miner’s each day income has fallen sharply to $16.173 million – down from $63.548 million on Nov. 10, 2021.

Prime Mining corporations suffered in 2022

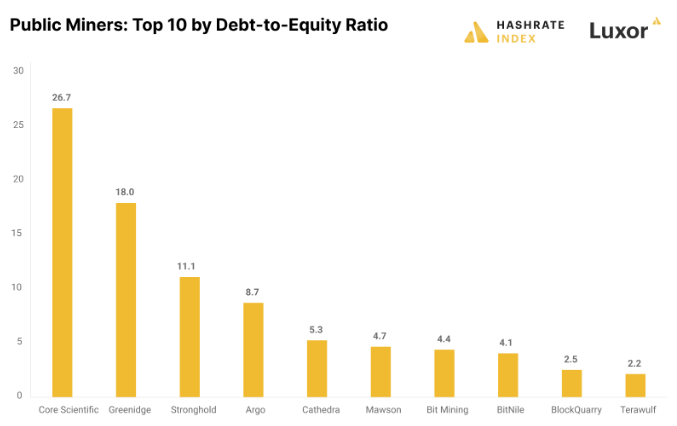

In line with Hashrate Index, the debt-to-equity ratio greater than tripled for a lot of mining corporations, indicating better monetary leverage.

Core Scientific has the best debt-to-equity ratio at 26.7, adopted by Greenidge and Stronghold at 18 and 11.1, respectively. Argo additionally has a excessive debt-to-equity ratio of 8.7.

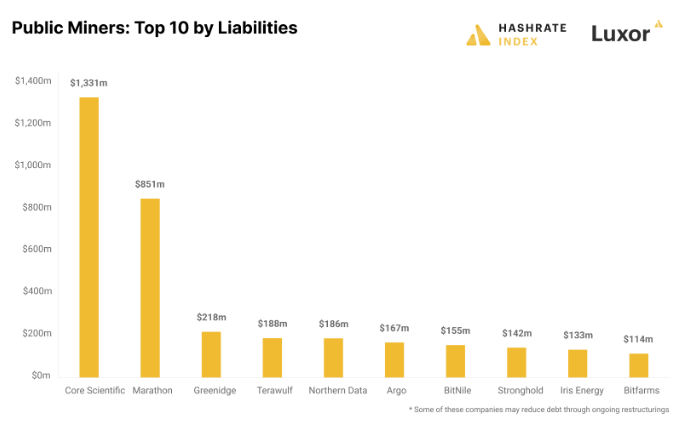

In line with Core Scientific’s stability sheet, as of Sept. 30, the corporate owed essentially the most, with $1.3 billion in liabilities. The second-largest debtor is Marathon, with $851 million in liabilities.

In consequence, miners with excessive debt-to-equity ratios, similar to Core Scientific (CORZ), filed for chapter. Whereas Greenidge Technology (GREE) and Stronghold Digital Mining restructured their debt obligations.

Because of the bearish sentiment in 2022, miners’ profitability suffered. Bitcoin’s profitability is measured in {dollars} per terahash, or TH, per second. Throughout its peak in 2017, bitcoin mining generated $3.39/TH per second, but it surely dropped to $0.104/TH in 2022.

Distinguished public mining corporations suffered appreciable losses in 2022 that rose over 90% on common.