Fast Take

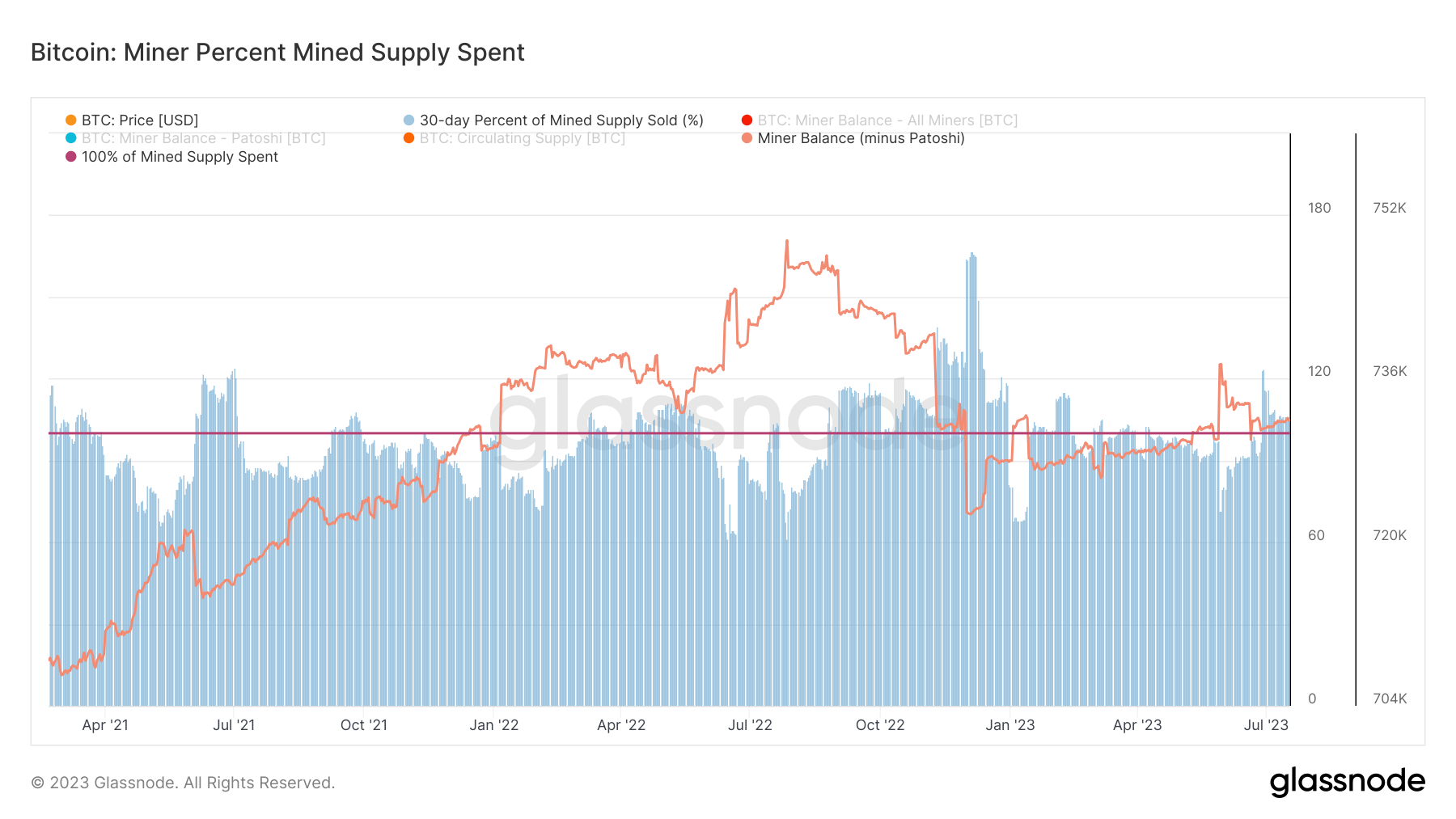

In keeping with Accountant and Bitcoin Mining Analyst at Compass Mining, Anthony Energy, throughout 2021, we noticed a pattern of Bitcoin miners retaining most of their Bitcoin manufacturing because the cryptocurrency’s value skilled important progress.

Nonetheless, the following lower in Bitcoin’s value in 2022 compelled plenty of miners, burdened with substantial debt, to liquidate their holdings. Marathon Digital and Hut 8, particularly, have been dedicated to sustaining their Bitcoin property for so long as possible, in line with Energy.

Knowledge from Glassnode assist this; as we are able to see all through 2021, miner stability on mixture continued to extend, however as 2022 continued, miners have been offloading to cowl money owed and obligations from a decreasing Bitcoin value.

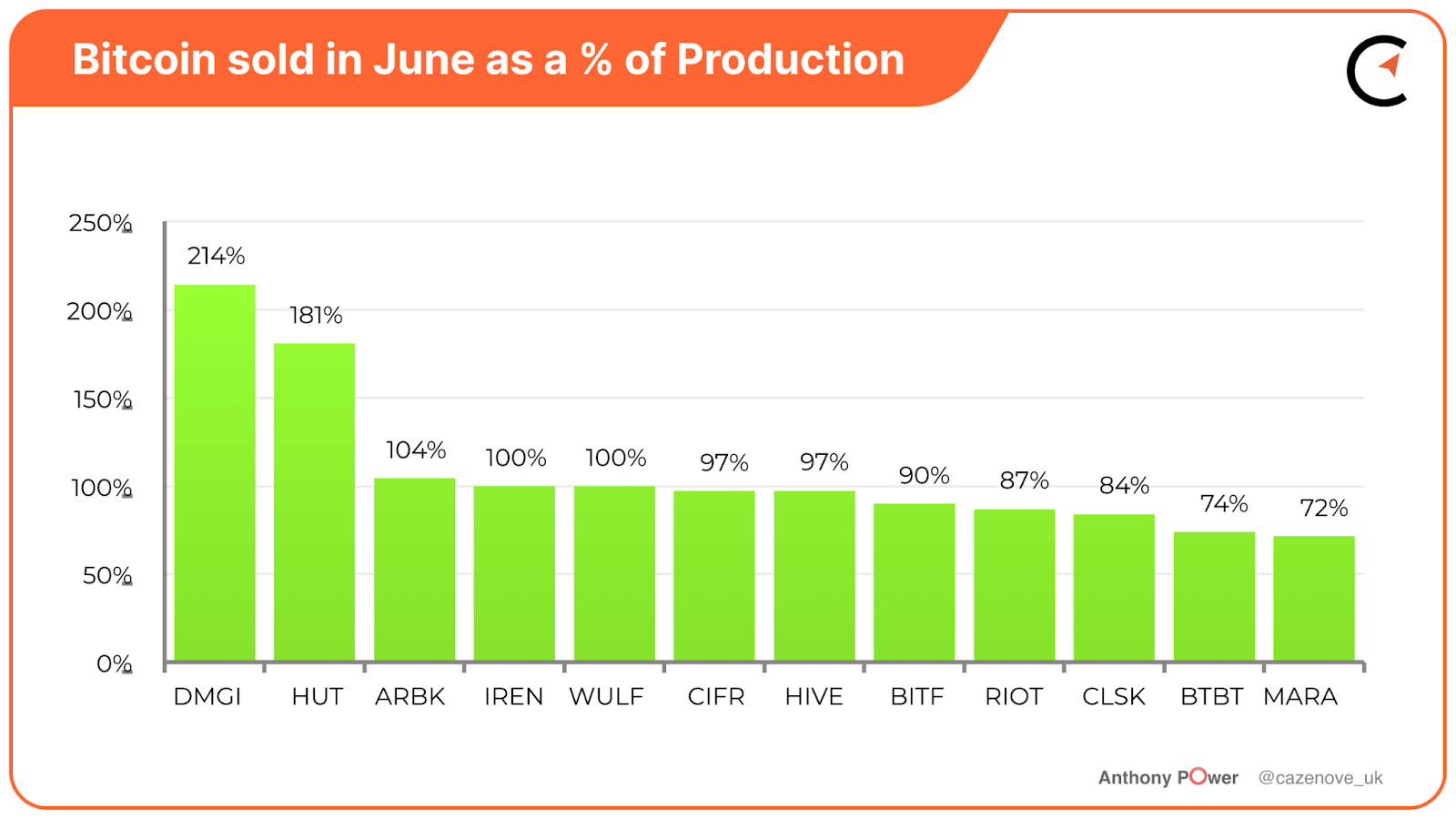

Quick ahead to the present 12 months, it’s noticeable that each one miners have begun to liquidate some, if not all, of their Bitcoin manufacturing in response to the rebound in Bitcoin’s value, in line with Anthony Energy.

The graph offered beneath underlines the adopted technique by 58% of miners. They’re not solely liquidating part of their Bitcoin manufacturing but in addition rising their cryptocurrency reserves in anticipation of the halving occasion subsequent 12 months, in line with Anthony Energy.

The submit Bitcoin miners’ altering methods: from hoarding to promoting appeared first on CryptoSlate.