Cipher Mining and Stronghold Digital began the brand new 12 months by asserting important expansions of their Bitcoin mining capabilities, scaling up operations in response to altering market dynamics. These developments come as Bitcoin miners adapt to an evolving panorama the place transaction charges, bolstered by new applied sciences like Inscriptions, are more and more important in income technology.

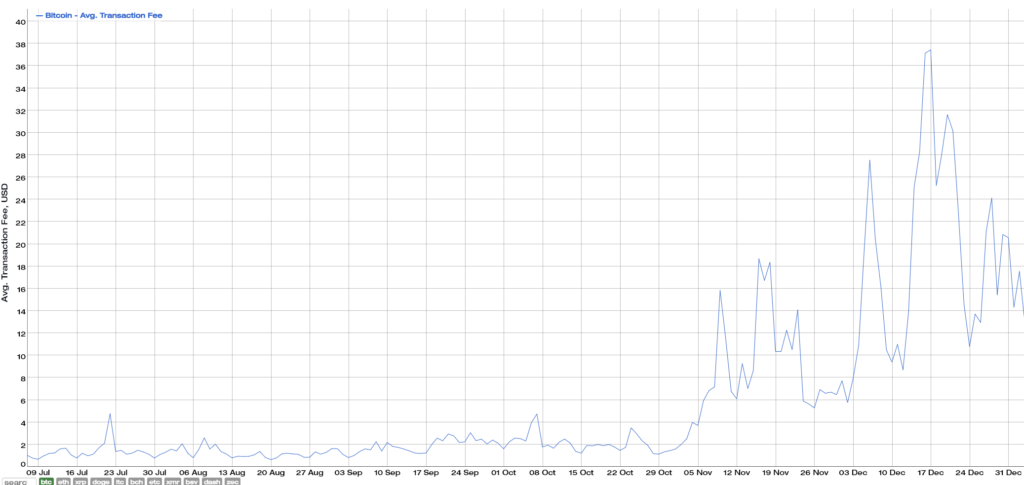

Bitcoin transaction charges peaked at nearly $40 in mid-December, resulting in elevated income for miners, indicating a possible haven forward of the 2024 halving.

Bitcoin miners earn income in two major methods: by producing new Bitcoin by mining and by amassing transaction charges from processing transactions on the Bitcoin community. Because the Bitcoin protocol is designed to halve the mining reward at particular intervals, the significance of transaction charges as a income for miners will increase over time.

When transaction charges enhance, this straight boosts miners’ earnings. For example, excessive transaction charges have led to important beneficial properties for Bitcoin miners. A current surge in transaction charges has been pushed by elevated community exercise, comparable to the recognition of Ordinals Bitcoin Inscriptions.

The rise in transaction charges is a response to community congestion. Because the Bitcoin community turns into extra congested with elevated mempool dimension bloat as a result of dimension and quantity of Ordinals, customers are keen to pay larger charges to make sure their transactions are processed and confirmed promptly. This dynamic creates a market the place miners can prioritize transactions with larger charges, thereby rising their earnings.

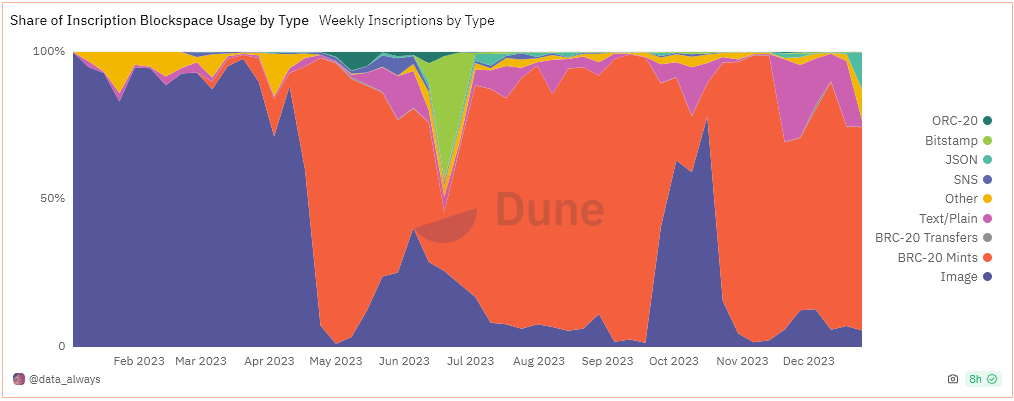

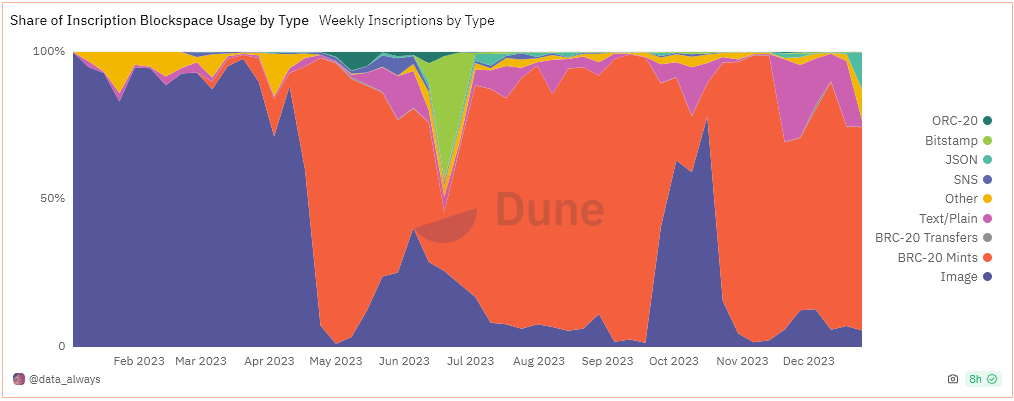

The chart beneath reveals the share of blockspace taken up by every knowledge kind for Inscriptions, indicating BRC-20 tokens surpassed pictures round Might 2023. BRC-20 tokens use, on common, 60 bytes of house in comparison with between 300 bytes to 15kb utilized by pictures.

In the long run, because the mining reward continues to decrease, transaction charges are anticipated to turn into an more and more vital income for miners. This shift is anticipated to make sure the long-term financial viability and safety of the Bitcoin community.

Cipher and Stronghold new miner acquisition.

Cipher Mining Inc. revealed plans for a 60 MW enlargement at its Bear and Chief Joint Enterprise Knowledge Facilities, coupled with buying 16,700 new Avalon A1466 miners from Canaan. This enhance, slated for the second quarter of 2024, is ready to reinforce Cipher’s self-mining capability to roughly 8.4 EH/s. Tyler Web page, CEO of Cipher, emphasised the importance of this enlargement for the corporate’s development, significantly because the trade approaches the Bitcoin halving occasion in 2024. web page confirmed,

“We look ahead to including one other 2.5 EH/s of their machines to our three way partnership knowledge facilities in Texas with this buy.”

Stronghold Digital Mining Inc. additionally introduced its acquisition of 5,000 Bitcoin miners, aiming so as to add almost 1 EH/s to its mining functionality. The extra miners will probably be a mixture of Bitmain, MicroBT, and Caanan miners, together with 2,800 Bitmain S19K Professional miners, 1,100 MicroBT Whastminer M50 miners, and 1,100 Avalon A1346 miners. These miners, boasting a hash charge capability of round 600 PH/s and an effectivity of 25 J/T, are anticipated to be operational this month. Stronghold’s current replace highlighted a 2% sequential enhance in Bitcoin-equivalent manufacturing for Dec. 2023, indicating the corporate’s robust efficiency amid fluctuating market situations.

Singapore-based Canaan notably performed a pivotal function in these expansions, with new orders totaling over 17,000 Bitcoin mining machines, highlighting Canaan’s rising affect alongside rivals Bitmain and MicroBT. Nangeng Zhang, CEO of Canaan, expressed enthusiasm for these partnerships, stating,

“The Canaan machines we bought final 12 months are among the many top-performing rigs in our fleet, particularly within the scorching summer season months in Texas.”

Danger-reward of transaction payment reliance.

Whereas these strategic expansions by Cipher and Stronghold come when rising applied sciences like Inscriptions reshape Bitcoin miner income, there isn’t any certainty that charges will proceed at this degree. A current CryptoSlate Alpha Perception revealed a surge in transaction charges in 2023, which contributed considerably to the income streams of miners. With the upcoming Bitcoin halving, the place block rewards are set to be halved, miners might more and more depend on transaction charges as a key income supply.

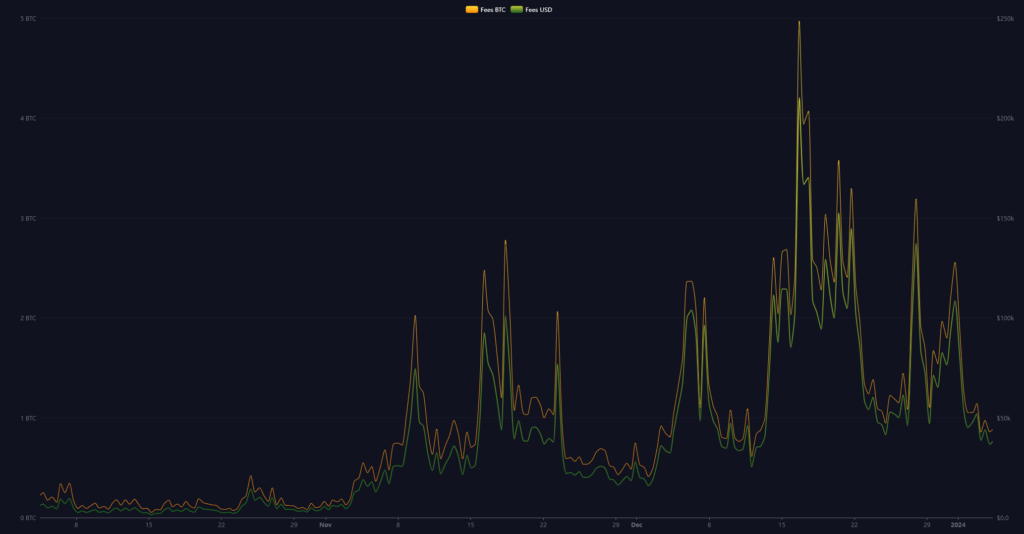

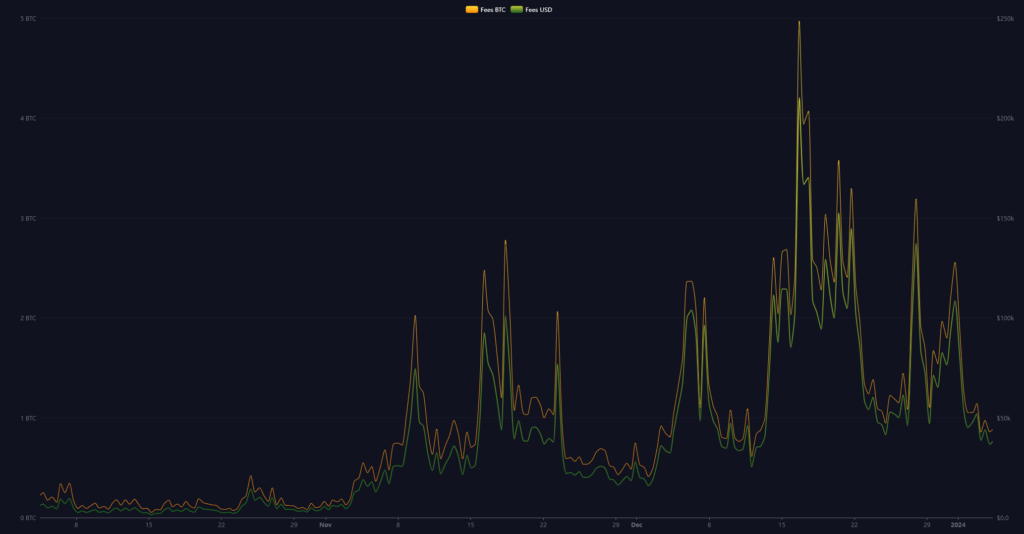

Nonetheless, because the chart beneath reveals, block charges peaked at round $250,000 on Dec. 16 and have since retraced to a median of $38,000. Whereas that is nonetheless notably larger than the typical of $4,700 in Nov. 2023, Bitcoin miners might now be playing that Inscriptions proceed gaining traction to offset the upcoming halving.

This shift represents a big transformation within the mining trade, the place technological developments and market situations constantly redefine income fashions and operational methods.