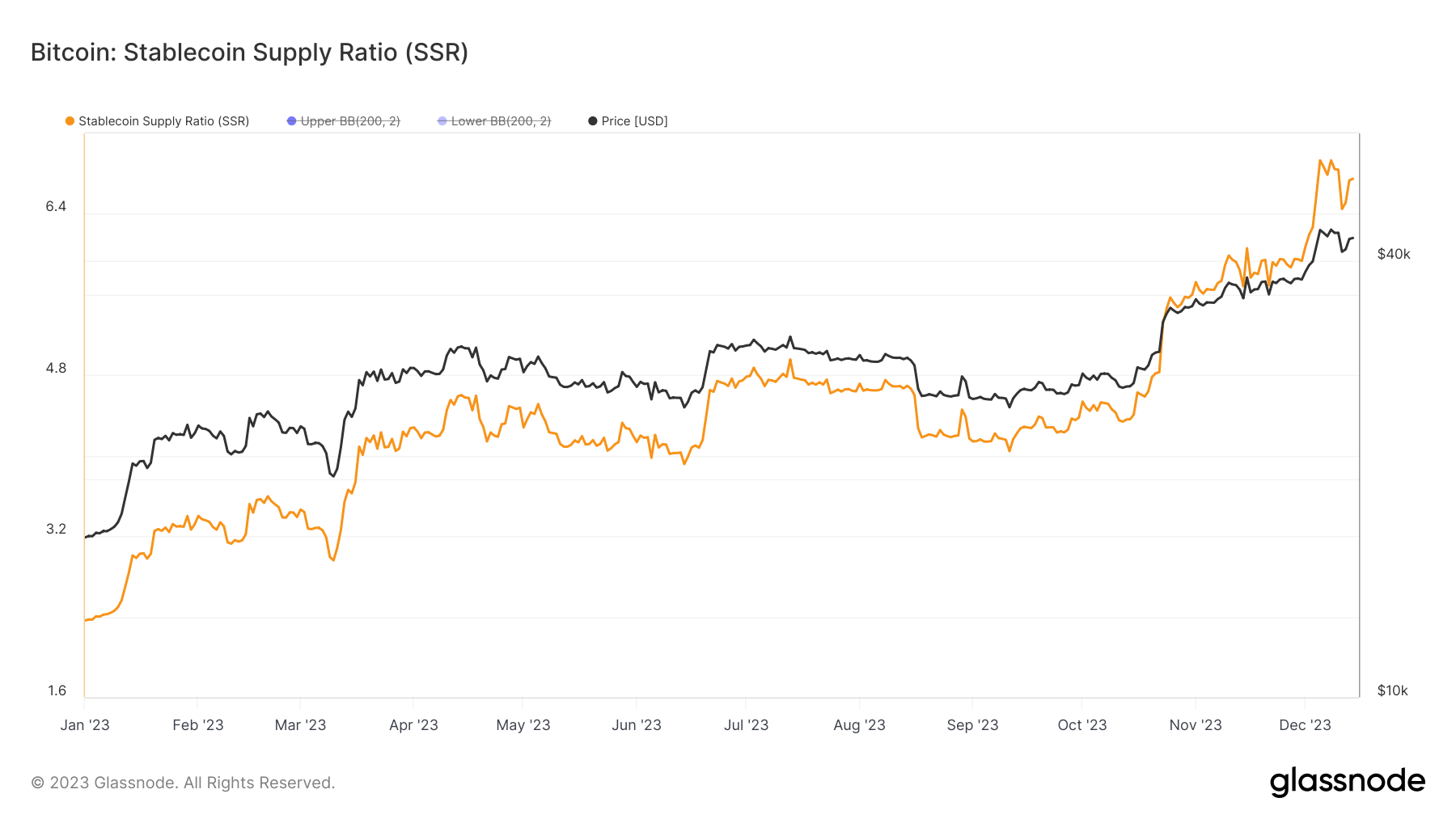

This 12 months, the Stablecoin Provide Ratio (SSR) has proven vital developments, providing deep insights into Bitcoin’s market conduct. The SSR, calculated by dividing Bitcoin’s market cap by the market cap of main stablecoins, is a barometer for the relative monetary energy and buying energy of stablecoins towards Bitcoin.

This 12 months, a marked enhance in SSR has been noticed, with the ratio climbing from 2.36 on Jan. 1 to six.74 by Dec. 14. This rise signifies a rising market cap of Bitcoin relative to stablecoins, hinting at shifts in market liquidity and investor choice.

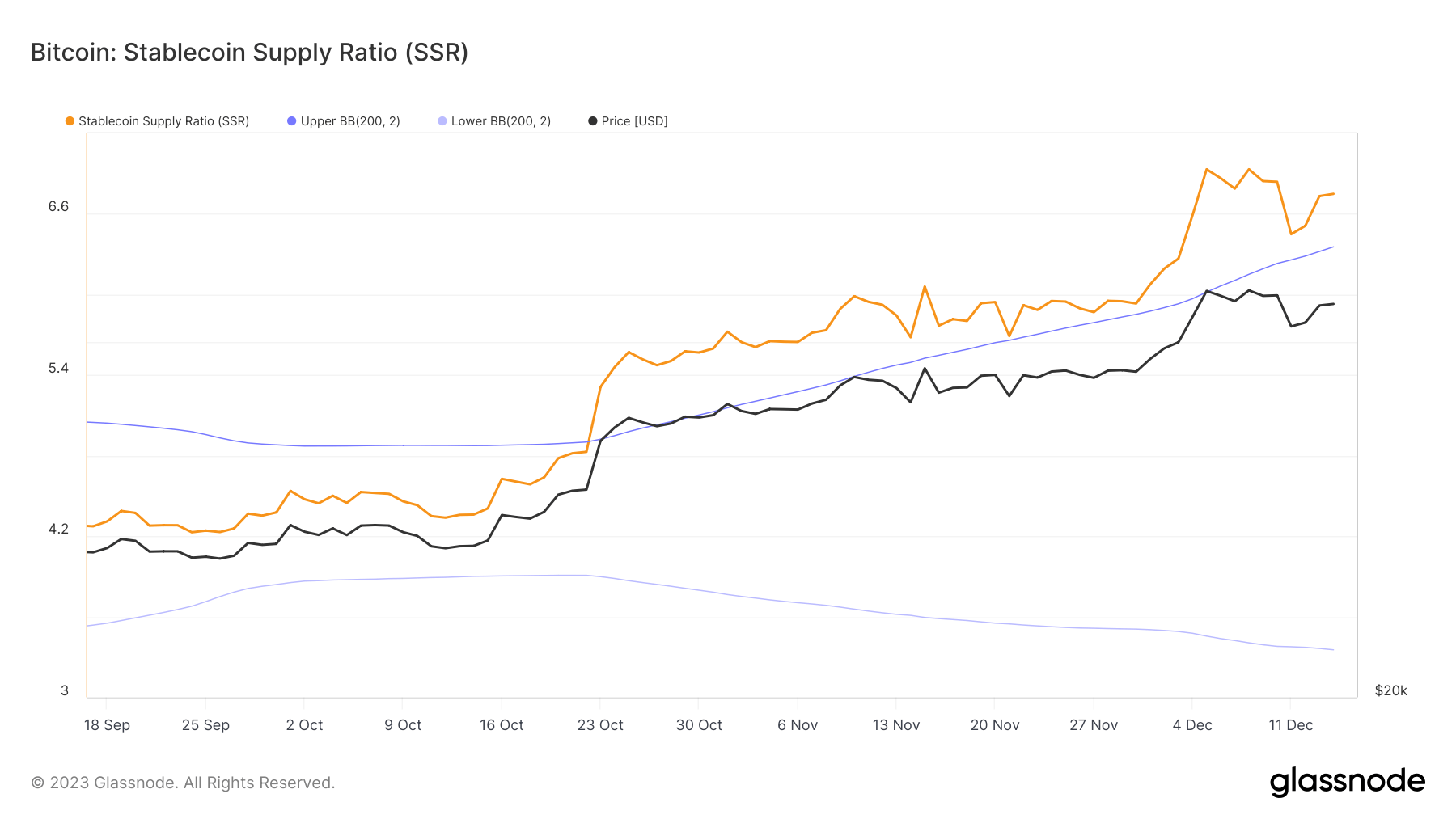

To completely perceive these developments, it’s essential to look at the SSR in relation to Bollinger Bands. Bollinger Bands are a set of pattern strains plotted two customary deviations (positively and negatively) away from a easy shifting common (SMA) of a specific asset or metric. They assist determine the diploma of volatility out there. When the SSR crossed the higher Bollinger Band at 4.90 on Oct. 23 and remained above it, it signaled an uncommon market situation: Bitcoin’s market cap grew considerably in comparison with stablecoins, indicating a possible shift in investor conduct or market sentiment.

A report excessive SSR of 6.93 on Dec. 8 additional underscores this pattern, although the next slight lower following Bitcoin’s worth dip from $44,200 to $41,200 reveals that as Bitcoin’s worth fluctuates, the relative energy and impression of stablecoins available on the market modify accordingly, influencing the SSR.

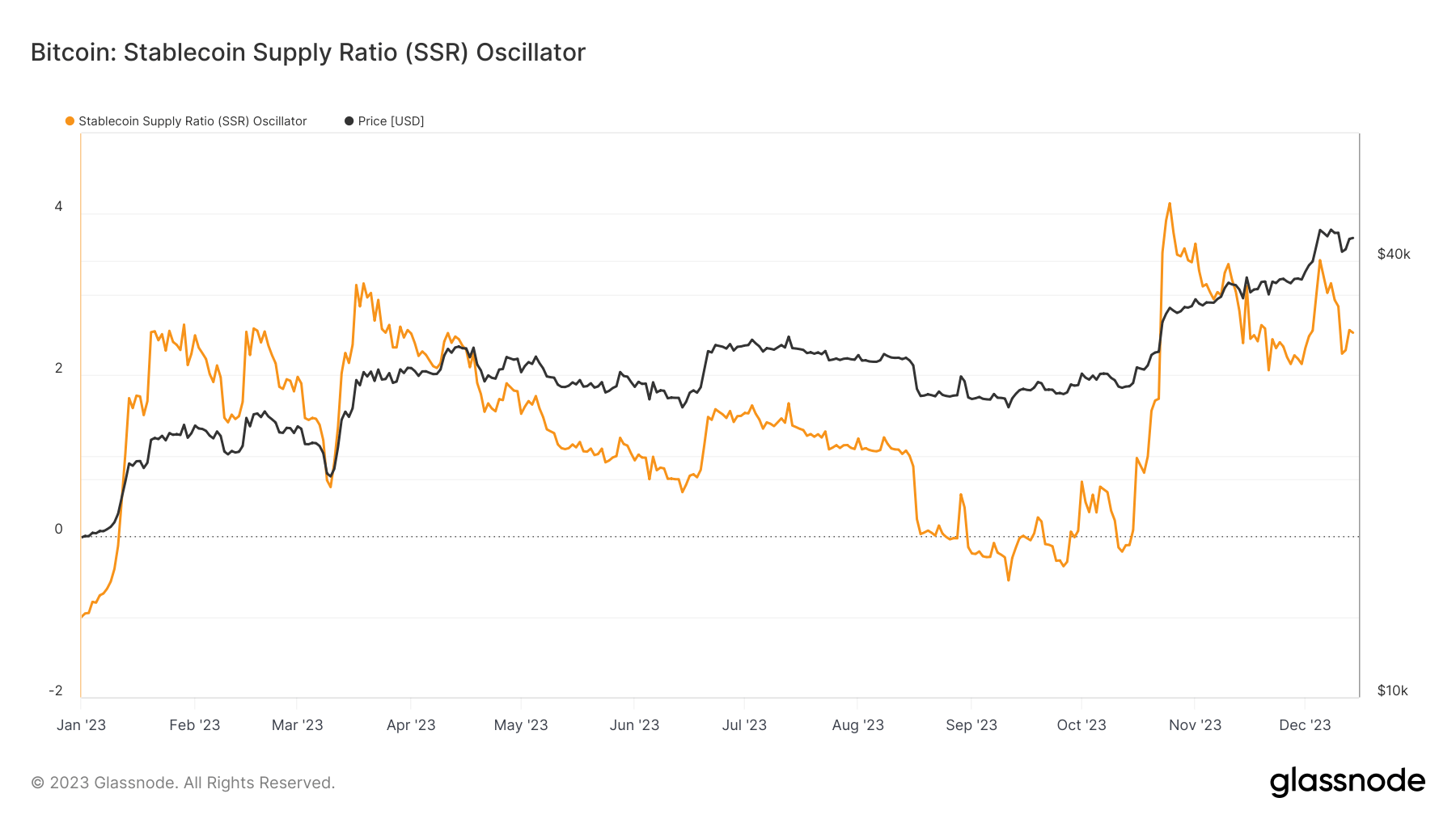

The Stablecoin Oscillator, a by-product of the SSR, tracks how the 200-day SMA of the SSR strikes inside its Bollinger Bands, offering a extra nuanced view of market developments. Between Dec. 8 and Dec. 14, the oscillator fell from 3.13 to 2.52 as Bitcoin’s worth dropped and partially recovered. This reveals a balancing act between Bitcoin’s direct market efficiency and the comparative worth and utility of stablecoins. As Bitcoin’s worth adjustments, it influences the SSR, which in flip impacts the oscillator, highlighting the continual and complicated relationship between these two essential points of the cryptocurrency market.

The year-to-date (YTD) excessive for the oscillator was marked on Oct. 25, reaching 4.13, contrasting with a YTD low of -1 firstly of the 12 months. The oscillator’s YTD excessive and low factors replicate the market’s altering sentiment and the evolving function of stablecoins in relation to Bitcoin.

An growing SSR, particularly alongside a rising Bitcoin worth, factors to a diversified funding panorama. Bitcoin’s market cap progress outpacing that of stablecoins may very well be pushed by numerous elements, together with direct fiat investments, conversions from stablecoins to Bitcoin, and speculative buying and selling the place stablecoins are retained as a hedge whereas Bitcoin is actively traded.

The put up Bitcoin outpaces stablecoins in market cap progress appeared first on CryptoSlate.