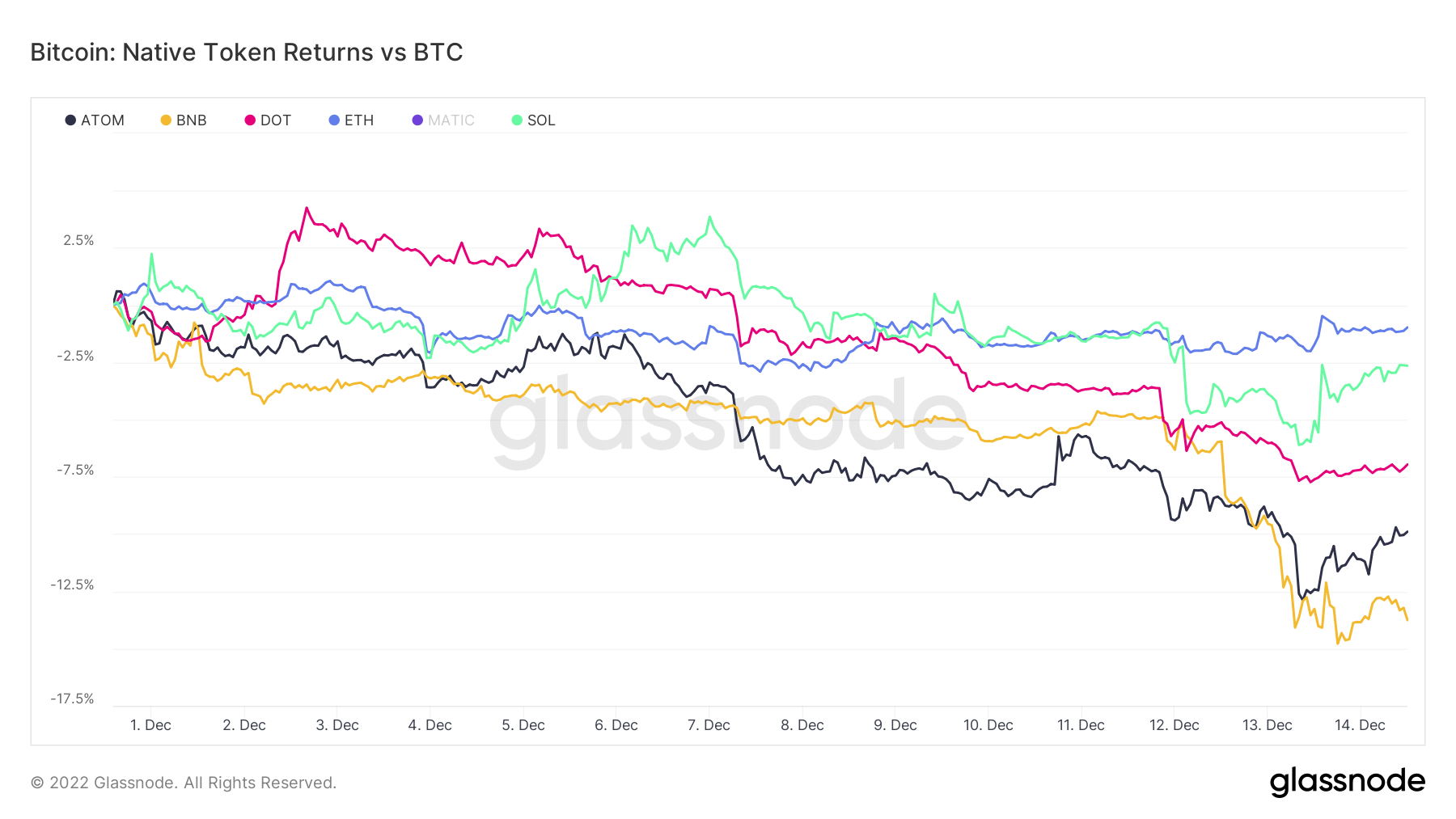

In December, Bitcoin outperformed the native tokens of the Solana, Ethereum, Polkadot, Binance, and Cosmos ecosystems, based on knowledge analyzed by CryptoSlate.

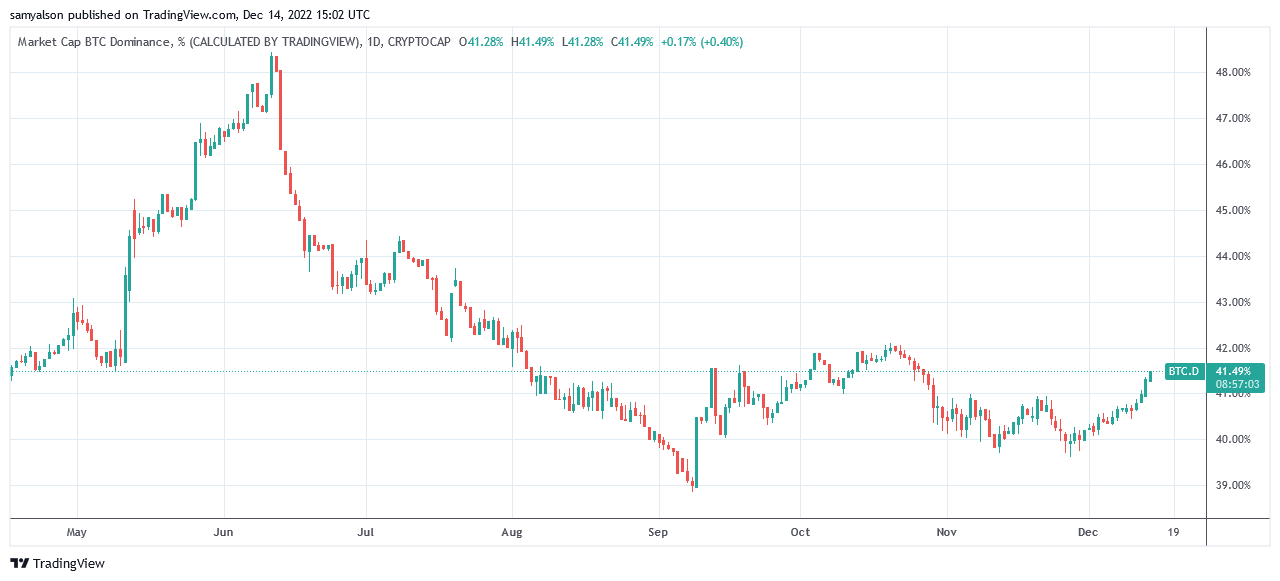

Bitcoin dominance (BTC.D) has additionally begun trending upward this month. The chart beneath reveals BTC.D beginning December at 39.9% and shifting progressively greater. The present studying is 41.5% – a seven-week excessive.

Bitcoin beats giant caps

Since December opened, Bitcoin has traded inside a good vary between $16,790 and $17,400.

Following the discharge of better-than-expected U.S. Shopper Value Index (CPI) knowledge on Dec. 13, BTC broke out of this vary, spiking to $18,000, however giving up a few of these positive factors, closing the day at $17,800.

Dec. 14 has seen the main cryptocurrency construct on the momentum, hitting a peak value of $18,130 to date. Nevertheless, with uncertainty reigning, notably with regard to the macro outlook going into the vacation season, none of this ought to be taken as a confirmed reversal.

Nonetheless, BTC has outperformed large-cap Layer 1s to date this month. Losses in comparison with Bitcoin for December got here in at:

- Ethereum -1.0%

- Solana -2.9%

- Polkadot -7.2%

- Cosmos -11.2%

- Binance -13.6%

Binance’s efficiency noticeably deteriorated round Dec. 12, as FUD surrounding its solvency triggered a run on the alternate.

On-chain knowledge confirmed that $6.5 billion was withdrawn during the last 24 hours. Binance CEO Changpeng Zhao (CZ) responded by saying it was good to “stress take a look at” his firm.

In an replace, CZ stated regardless of the huge outflows, current exercise was not within the prime 5 for withdrawals. He added that the alternate is now seeing web deposits.

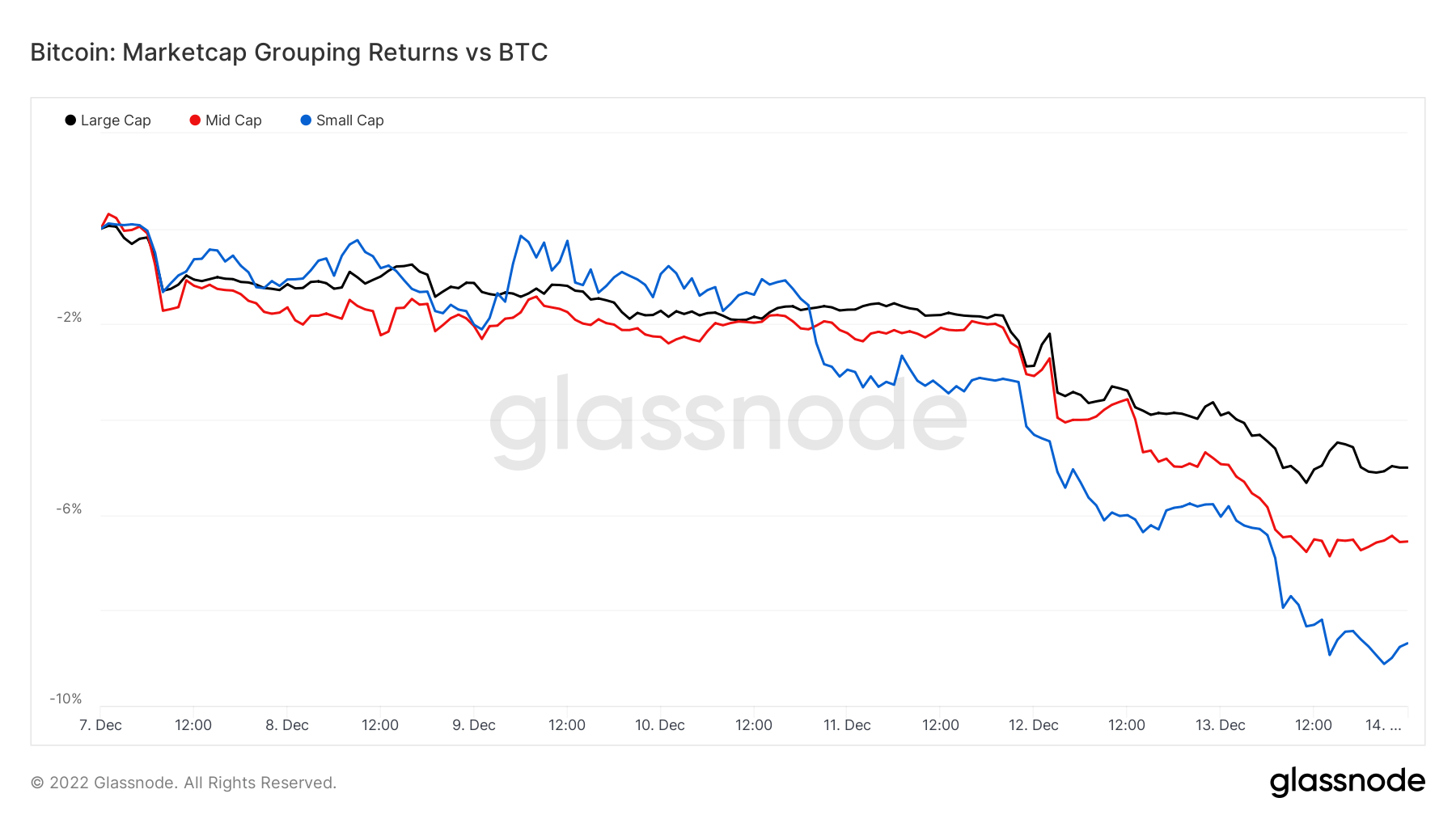

Small-caps go from finest to worst-performing cohort

Analyzing the returns of huge, mid, and small-cap cohorts in opposition to Bitcoin reveals all three teams have didn’t outperform the market chief since Dec. 7.

The chart beneath reveals small-caps difficult BTC however coming unstuck round Dec. 10. Since then, small-caps have plummeted to the worst-performing cohort at -8.8%.

In opposition to BTC, mid-caps returned -6.3%, whereas large-caps fared finest at -4.8%.

Like Binance Coin (BNB,) Dec. 12 marked a noticeable downturn in efficiency for all three cohorts.