Dylan LeClair mentioned Bitcoin’s latest stable efficiency boils right down to the understanding that trustlessness is the one method ahead.

The Analysis Analyst identified that, amid robust geopolitical and macroeconomic situations, Bitcoin has managed to buck the broader market development – due to the rising realization it has no counterparty threat.

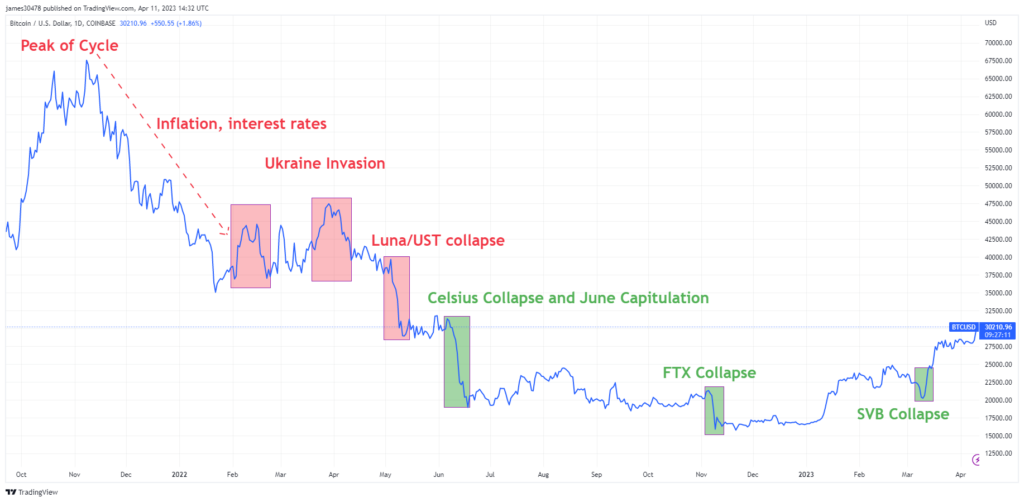

BTC has suffered a steep worth decline for the reason that November 2021 high. Latest occasions, together with a spate of CeFi bankruptcies, have contributed considerably to suppressing restoration.

Nonetheless, regardless of the doom and gloom, Bitcoin rose above $30,000 on April 11 – marking a 10-month excessive.

Powerful run for Bitcoin

For the reason that November 2021 high, Bitcoin posted a peak-to-trough lack of 78% – bottoming at $15,500 in November 2022.

During the last 18 months, the main cryptocurrency has confronted important headwinds – starting with the onset of inflation and the related flip to quantitative tightening. Additional uncertainty took maintain because the battle in Japanese Europe broke out in February 2022.

By Might 2022, the UST scandal piled on the promote strain because it emerged your complete LUNA ecosystem was a fraud from the beginning. The occasion triggered a downward spiral, affecting different CeFi platforms and additional exposing elements of the business as an interconnected home of playing cards.

Nonetheless, it wasn’t till the collapse of FTX that the market backside got here in. Since then, Bitcoin has grown 94%, with the interval from March 11, as banking collapses occurred, demonstrating a powerful rally.

Worst behind us?

In explaining Bitcoin’s run, LeClair mentioned, “Each 4 years, the fraud, the leverage, it will get utterly worn out” – leaving the market with majority believers, holding for the long run.

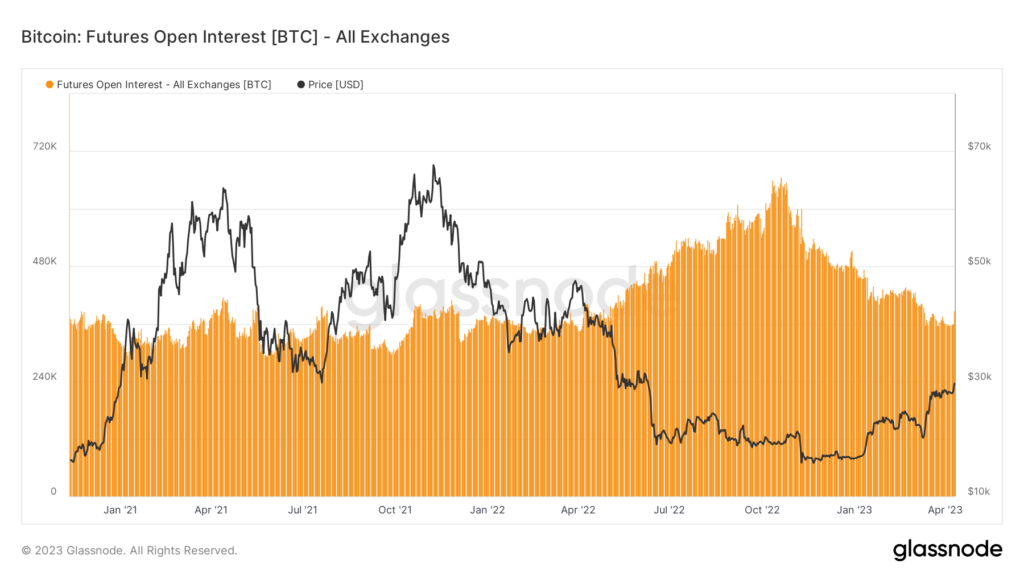

The Glassnode Open Curiosity chart beneath helps LeClair’s assertion. It exhibits the variety of open futures derivatives contracts sliding from a November 2022 peak of about 600,000 to roughly 400,000 at current – which is roughly in step with historic ranges.

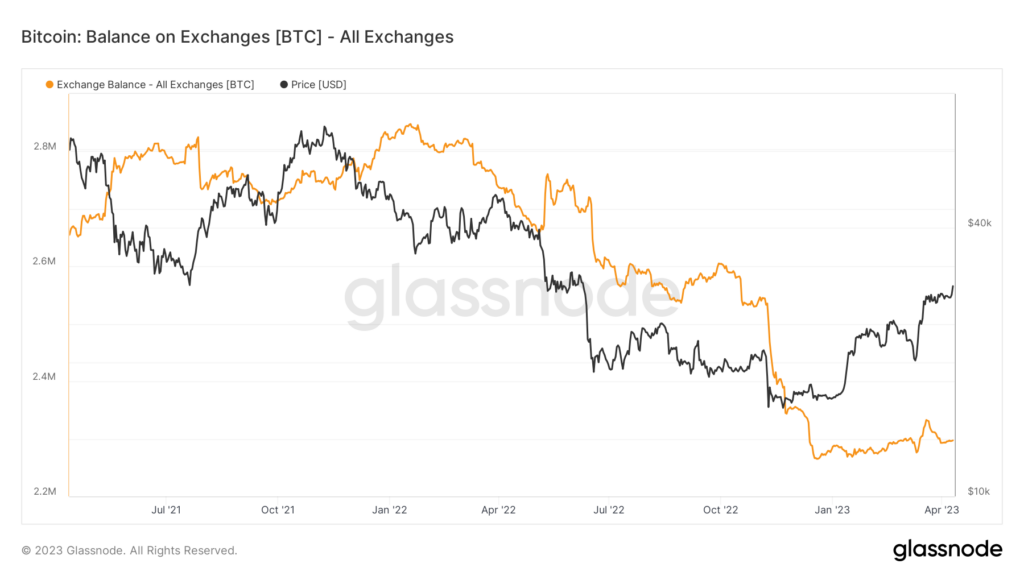

Equally, the quantity of Bitcoin held on exchanges has sunk significantly over the past two years – signifying a development towards long-term hodling.

LeClair mentioned what’s occurring right here is that folks have realized they wish to maintain a decentralized asset that doesn’t require belief.

“They don’t wish to belief a stablecoin. They don’t wish to belief a crypto protocol or a developer. They wish to maintain a decentralized financial asset with no counterparty threat.”

CryptoSlate Analyst James Van Straten echoed LeClair’s evaluation, including that the on-chain metrics recommend we’re over the worst. Nonetheless, stagflation will proceed to be an element.

Nonetheless, we’re approaching the top of the speed cycle with the probability of a closing 25 foundation level hike left. The pause interval will show attention-grabbing, with expectations of rising unemployment and falling equities – if that performs out, Bitcoin’s resilience, as a hedge, can be retested.