Launched on the day of the Bitcoin halving, Runes are a type of information embedded straight into Bitcoin transactions. Not like easy monetary transfers, Runes encapsulate extra info inside these transactions.

Bitcoin Runes function by using a technique often called “transaction augmentation,” which permits customers to embed arbitrary information into transaction outputs. Runes can retailer quite a lot of information sorts, from easy messages to extra complicated contract-like scripts.

This mechanism is distinctly completely different from different Bitcoin-based improvements corresponding to Ordinals and BRC-20 tokens. Ordinals inscribe information into particular person satoshis, turning every right into a discrete and uniquely identifiable unit of knowledge. It makes Ordinals best for representing digital artifacts like photos or texts on the Bitcoin blockchain.

Alternatively, BRC-20 tokens are a token commonplace much like Ethereum’s ERC-20, which is designed for issuing and managing tokens on Bitcoin’s sidechains — particularly the RSK Good Contract Community.

The Runes protocol operates utilizing a system often called Unspent Transaction Outputs (UTXOs). A UTXO represents a certain quantity of Bitcoin that hasn’t been spent and can be utilized to fund new transactions. Runes are assigned to a UTXO through an OP_RETURN operate, which permits information to be embedded in transactions with out cluttering the community.

In a transaction, a Rune is linked to a UTXO via an OP_RETURN output that specifies the output location, a singular numerical ID for the Rune, and the quantity of Rune being transacted. This setup additionally handles Rune traits corresponding to divisibility and different metadata, all encoded throughout the similar transaction. The switch of Runes between events makes use of Bitcoin’s safe framework to element which Runes are transferring from one UTXO to a different.

The strategic launch of Runes on the day of the halving leveraged the eye the occasion acquired from the broader market. This timing was chosen to maximise visibility and affect, leveraging the elevated consideration throughout halving when miner rewards are diminished, and the longer term worth of Bitcoin is hotly debated.

The quick affect Runes had on the Bitcoin community was big. Regardless that the market was anticipating excessive charges and congestion across the halving, the affect Runes had appears to have been surprising.

Though Runes have been designed to attenuate community muddle through the use of OP_RETURN outputs, that are provably unspendable and thus don’t contribute on to the expansion of the UTXO set, they will nonetheless result in community congestion attributable to their recognition and the quantity of transactions they generate.

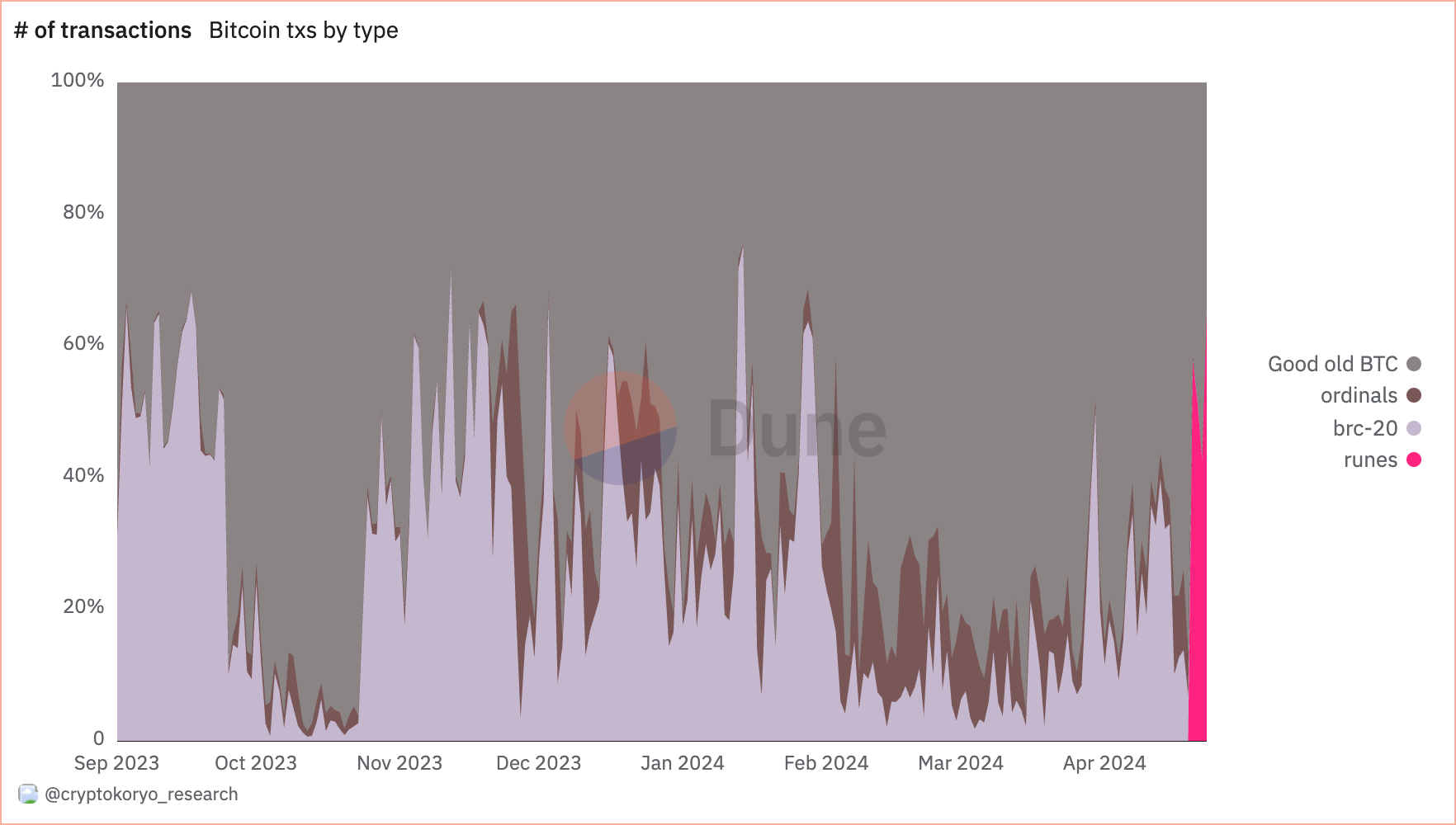

On April 19, the day earlier than the halving, most transactions on the Bitcoin community have been common monetary transactions, accounting for 86.7% of the full transaction share. Ordinals and BRC-20 transactions accounted for six.5% and 6.9% of the full share, respectively.

On April 20, the day of the halving, Runes transactions accounted for 57.7% of all transactions on the Bitcoin community. Monetary transactions accounted for a 41.5% share, whereas Ordinals and BRC-20 took up 0.5% and 0.2% of transactions, respectively.

Runes continued to dominate the community all through the weekend, accounting for 51.6% of the full transactions on April 21. The dominance barely decreased by April 22, dropping to 42.5%, with Bitcoin monetary transactions accounting for 56.5% of the full transactions processed that day.

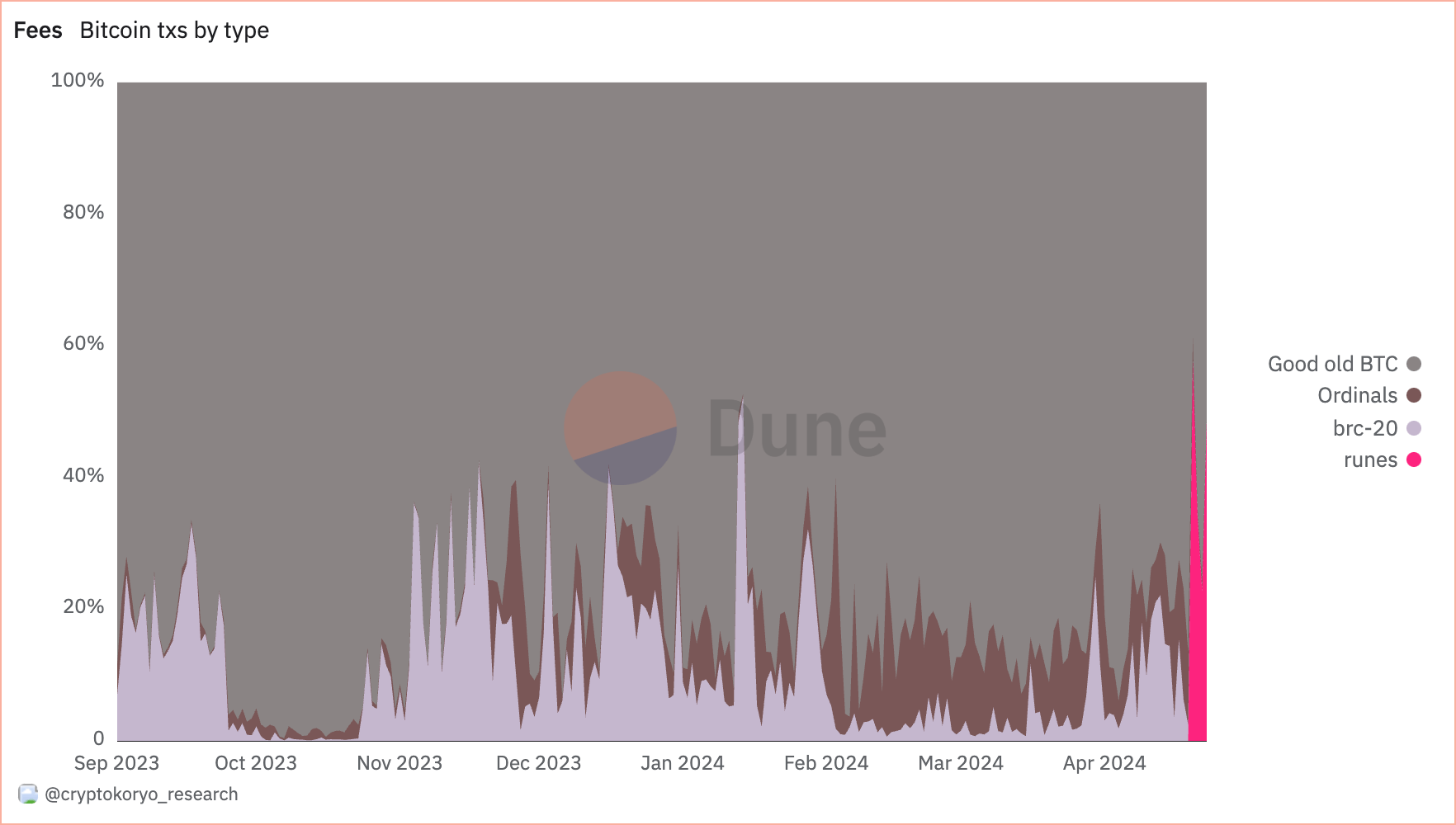

The monetary implications of Runes have been equally vital, as evidenced by the allocation of transaction charges. On April 20, Runes accounted for 57.7% of the transactions paid on the Bitcoin community.

The share of charges from monetary transactions dropped from 86.6% on April 19 to 38.7% on April 20. Nonetheless, the share of charges from Runes decreased within the days because the halving, as they accounted for 34.5% of the charges on April 21 and 22.8% on April 22.

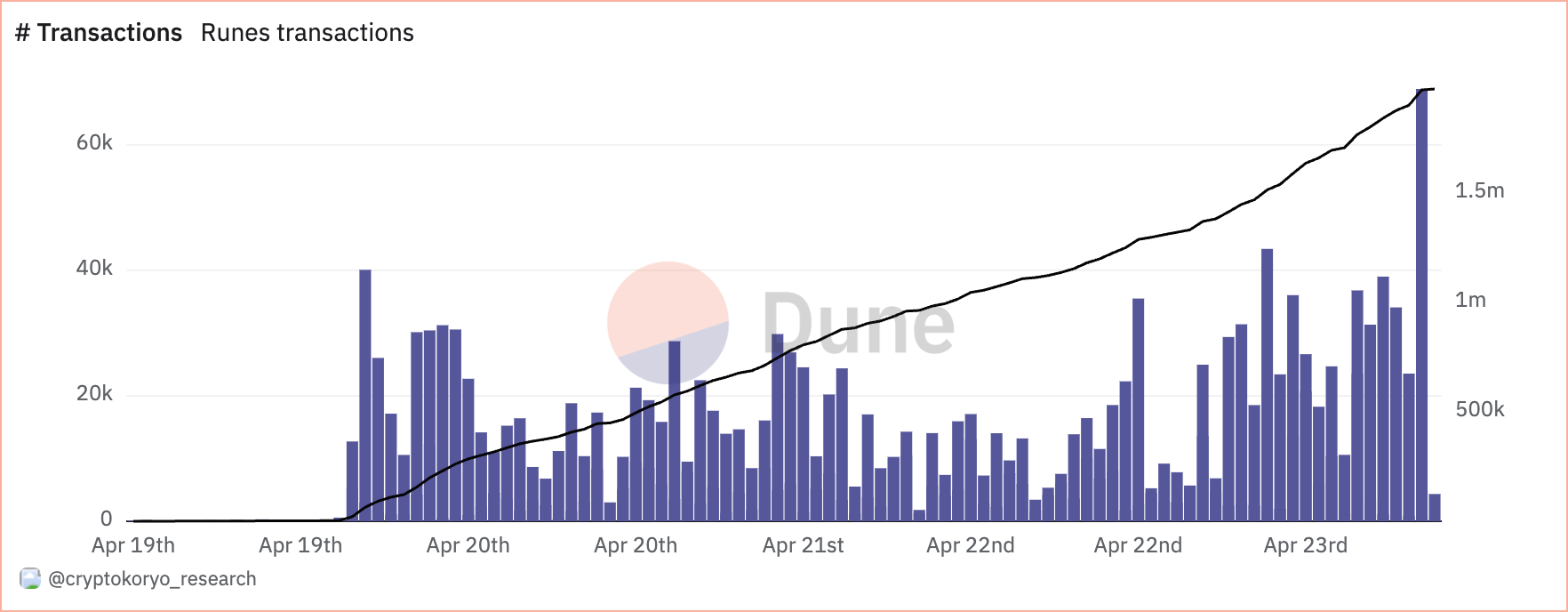

As of April 23, there have been 1.973 million Runes transactions.

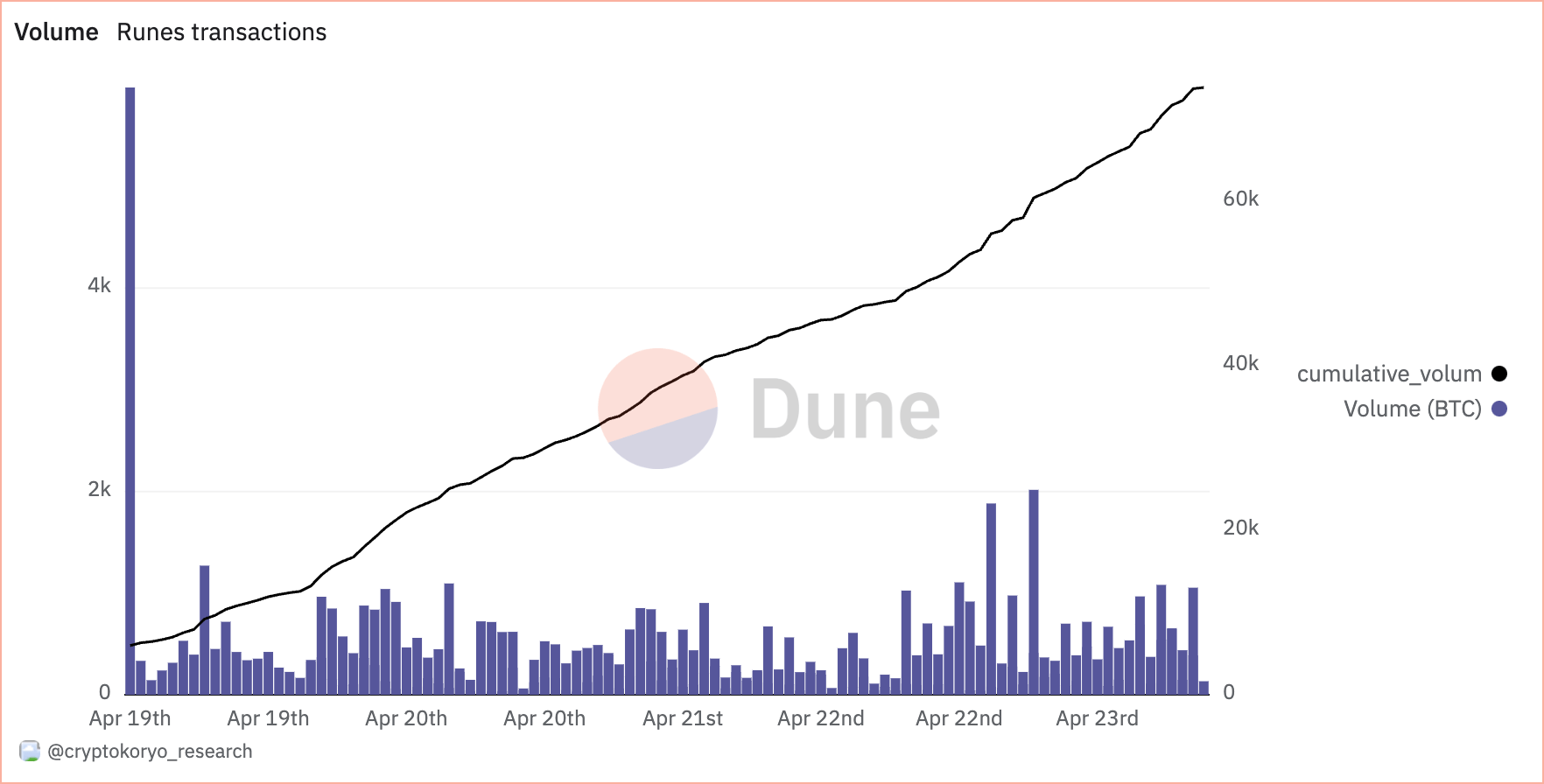

They generated 1,484 BTC in charges and reached a cumulative quantity of 73,765 BTC.

Regardless of their bombastic launch, the quick results of Runes on the community have considerably moderated within the days following the halving. The decline within the share of Runes in transactions and charges means that whereas the preliminary pleasure was excessive, the continued integration of Runes into common transaction patterns may see a extra gradual development.

The total penalties Runes can have on the Bitcoin community are but to be understood. A major a part of the market has been celebrating the introduction of a brand new type of interplay with the Bitcoin blockchain. Whereas some are centered on the speculative alternatives requirements like Runes and Ordinals allow, others appear excited concerning the innovation and customers this might convey to the Bitcoin ecosystem.

Nonetheless, a fair bigger a part of the market has been warning concerning the elevated load on the community brought on by Runes, which might result in greater charges and slower transaction occasions. The principle challenge critics appear to have is the dilution of Bitcoin’s purity. An costly, congested community impacts not solely Bitcoin’s utility as a method of fee but in addition as a retailer of worth.

Nonetheless, there appears to be an opportunity the community adjusts to the existence of Runes and absorbs the stress they create. A comparatively related discourse surrounded Ordinals upon their launch, and nearly a 12 months and a half later, the information exhibits their affect is minimal.

Whereas we’d see extra volatility by way of charges within the coming weeks and months, it is going to take longer to see whether or not Runes develop into a foundational part of Bitcoin transactions or only a area of interest market inside a bigger ecosystem.

The put up Bitcoin Runes made up 57.7% of transactions on halving day appeared first on CryptoSlate.