The discharge of October’s Client Value Index (CPI) information confirmed inflation at 7.7% year-on-year. This got here in higher than the estimated 7.9% determine.

The preliminary response from Bitcoin noticed a much-needed worth spike to peak at $17,800 as of press time.

Fed sends blended indicators

On November 2, following the conclusion of the FOMC assembly, the Fed enacted a fourth 75 foundation level rate of interest hike, bringing the Federal Funds Fee to three.75% to 4%.

The FOMC assertion referenced “modest progress in spending and manufacturing,” whereas additionally pointing to inflation dangers attributable to strong employment figures and the fallout from battle in Japanese Europe.

Additional, the assertion talked about a dedication to proceed with the tempo of charge hikes till inflation falls again to its 2% goal degree.

“The Committee anticipates that ongoing will increase within the goal vary will probably be applicable to be able to attain a stance of financial coverage that’s sufficiently restrictive to return inflation to 2 p.c over time.”

Nevertheless, through the post-FOMC convention, Fed Chair Jerome Powell informed reporters that it’s possible the tempo of charge hikes must decelerate, and this might occur from the following assembly.

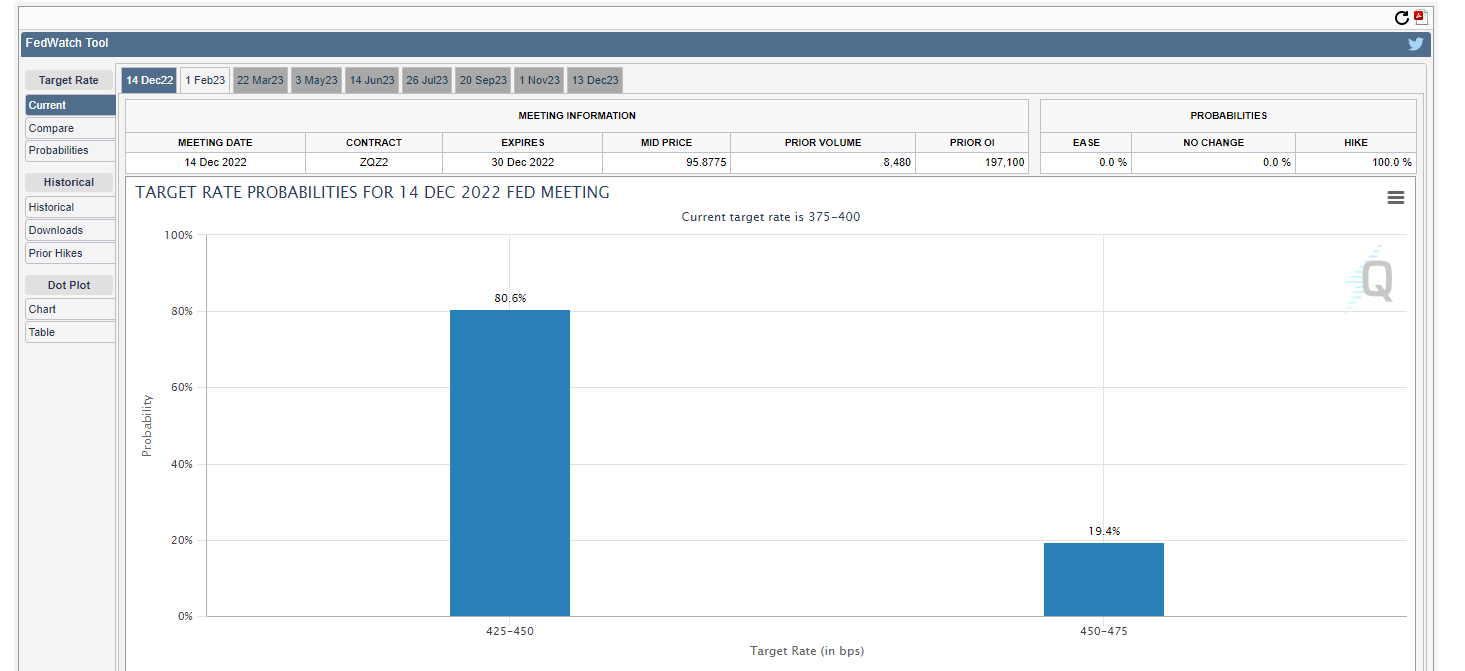

Following the better-than-expected CPI information, the likelihood of a 50 bps hike following the following FOMC assembly, on Dec. 14, at the moment is available in at 81%, signaling overwhelming market expectations for the Fed to decelerate its tempo of charge hikes.

Bitcoin bounces on better-than-expected CPI

The fallout from FTX’s collapse had already triggered market weak point throughout the board. Bitcoin made a 103-week low to backside at $15,600 through the late night (UTC) of Nov. 9.

Nevertheless, on the discharge of CPI information, Bitcoin spiked 7.5% on the 15-minute candle to prime out at $17,800. The 13:45 candle is on observe to retest the earlier candle peak.