On-chain knowledge exhibits Bitcoin long-term holders have ramped up their promoting lately, one thing that might result in additional plunge within the crypto’s worth.

Bitcoin Alternate Influx CDD Has Spiked Up Over The Final Day

As identified by an analyst in a CryptoQuant put up, the present rise within the CDD is the biggest since sixth October.

A “Coin Day” is the amount that 1 BTC accumulates after staying nonetheless for 1 day in a single tackle. If a coin that has amassed some variety of Coin Days lastly strikes to a different pockets, its Coin Days counter resets, and the Coin Days are stated to be “destroyed.”

The “Coin Days Destroyed” (CDD) metric retains notice of the whole variety of such Coin Days being destroyed all through the community on any given day.

One other model of this indicator is the “trade influx CDD,” which measures solely these Coin Days that have been reset due to transactions to centralized exchanges.

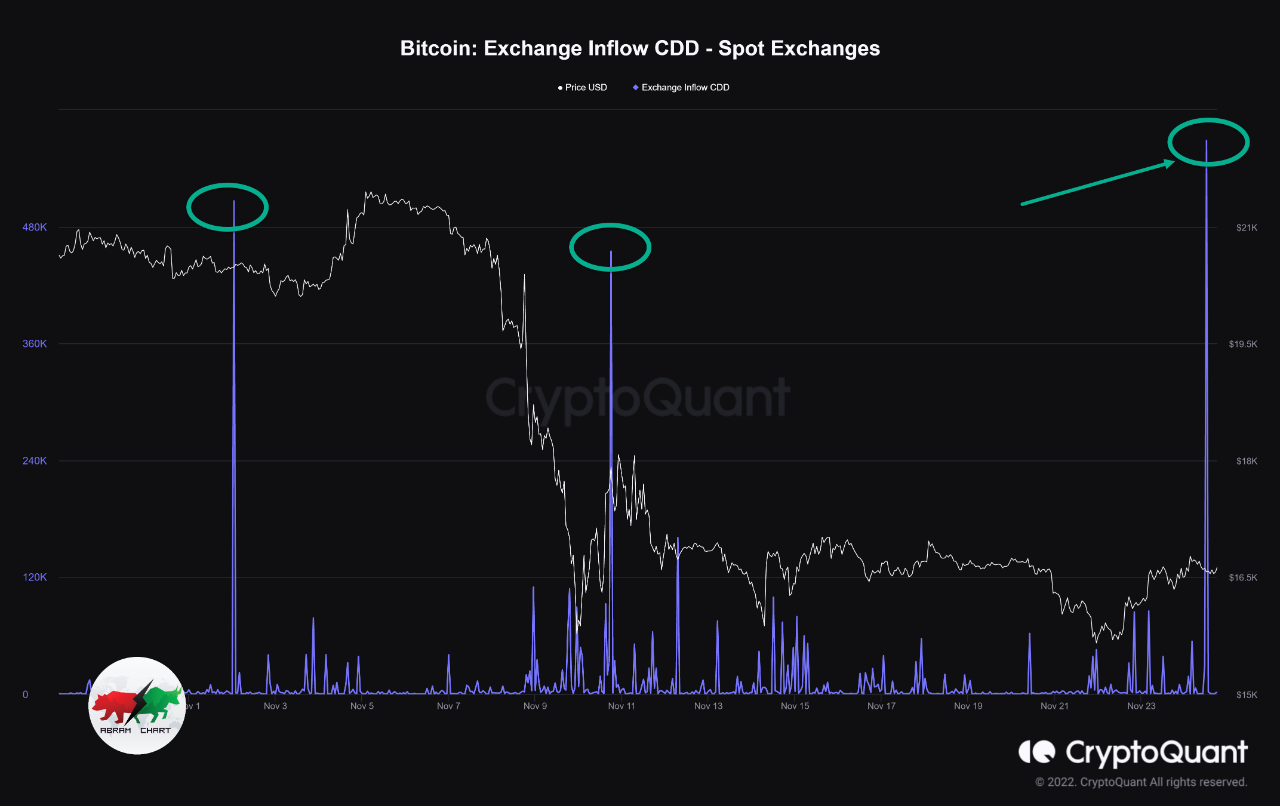

Now, here’s a chart that exhibits the pattern within the Bitcoin trade influx CDD over the previous month:

The worth of the metric appears to have spiked up over the past day or so | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin trade influx CDD has proven a pointy rise in its worth lately.

There’s a cohort within the BTC market referred to as the “long-term holder” (LTH) group, which incorporates all traders who maintain onto their cash for lengthy intervals with out transferring them.

Associated Studying: Bitcoin Capitulation Deepens As aSOPR Metric Plunges To Dec 2018 Lows

Due to the dormancy of their cash, thes LTHs accumulate a big numbers of Coin Days. As such, at any time when these holders do transfer their cash, the CDD often spikes up because of the scale of Coin Days concerned.

The present spike within the Bitcoin trade influx CDD thus means that some LTHs have deposited their cash to trade wallets.

Because the exchanges in query are spot platforms, it’s attainable that this motion of cash was made for promoting functions.

From the graph, it’s obvious that each the earlier huge spikes within the indicator have been adopted by declines within the worth of Bitcoin.

If the newest surge was additionally due to LTHs making ready to dump their cash, then the crypto is more likely to observe bearish pattern this time as nicely.

BTC Worth

On the time of writing, Bitcoin’s worth floats round $16.4k, down 2% within the final week. Over the previous month, the crypto has misplaced 15% in worth.

Seems to be like the value of the coin has been again to transferring sideways in the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Zdeněk Macháček on Unsplash.com, charts from TradingView.com, CryptoQuant.com