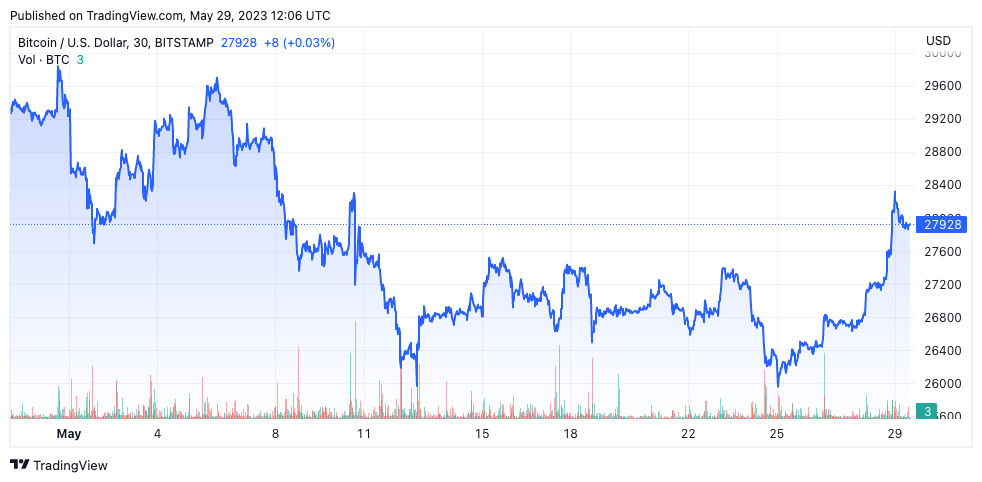

Bitcoin skilled a fleeting spike within the early morning hours on Monday, Might 29, briefly surpassing the $28,000 resistance stage after spending the higher a part of Might comparatively flat. The shopping for strain dwindled over the previous weekend, with Bitcoin stabilizing at $28,800.

Bitcoin’s weekend volatility left a lot of the market unfazed, with whales and long-term holders ramping up accumulation. The 2 cohorts, believed by many to be one of many main drivers of market sentiment, have been dedicated to accumulation all through Might however have used Bitcoin’s weekend volatility to extend their holdings.

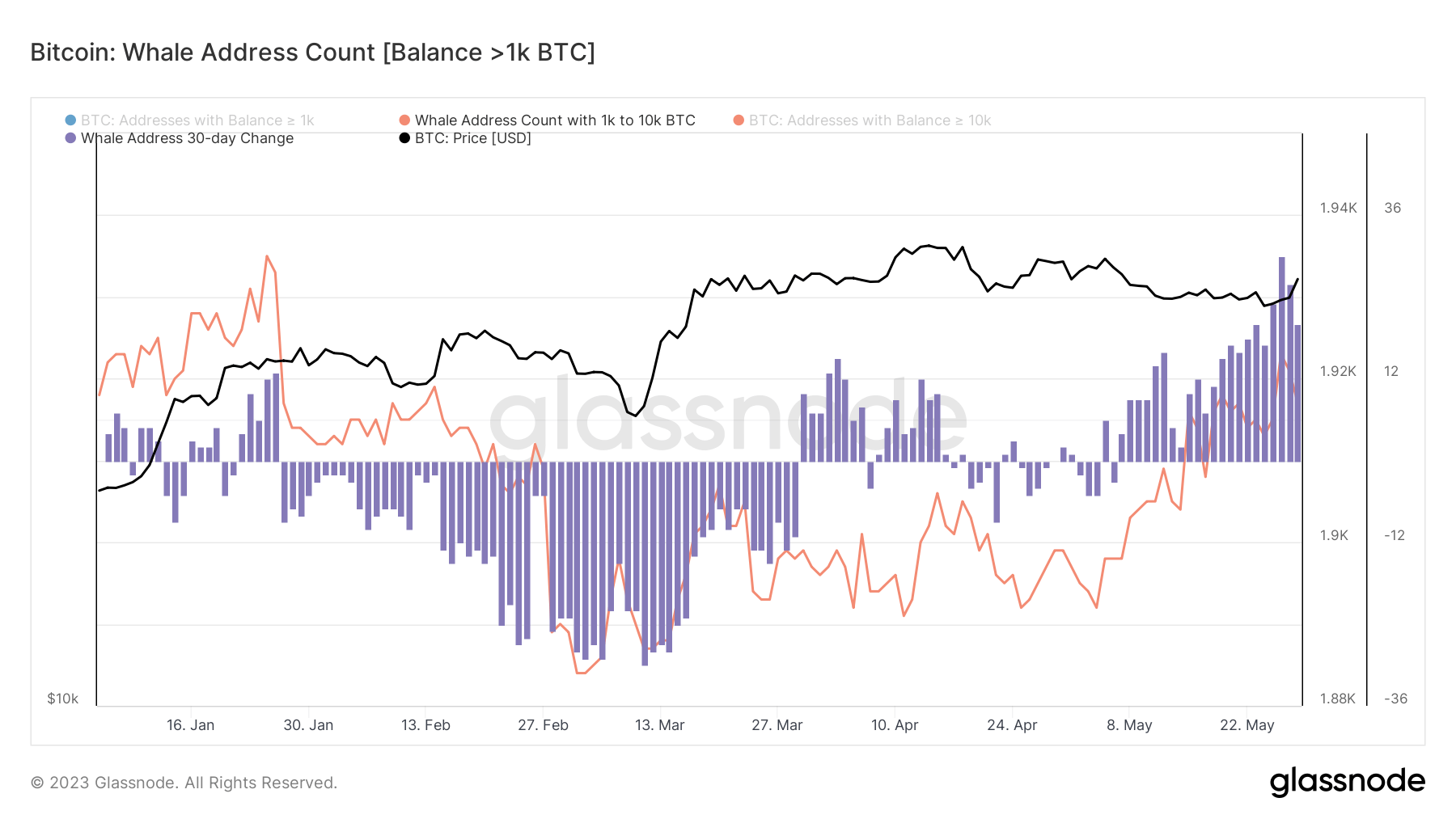

Whale addresses, categorized as addresses holding over 1,000 BTC, have seen an uptick in numbers through the second half of Might, culminating over the weekend.

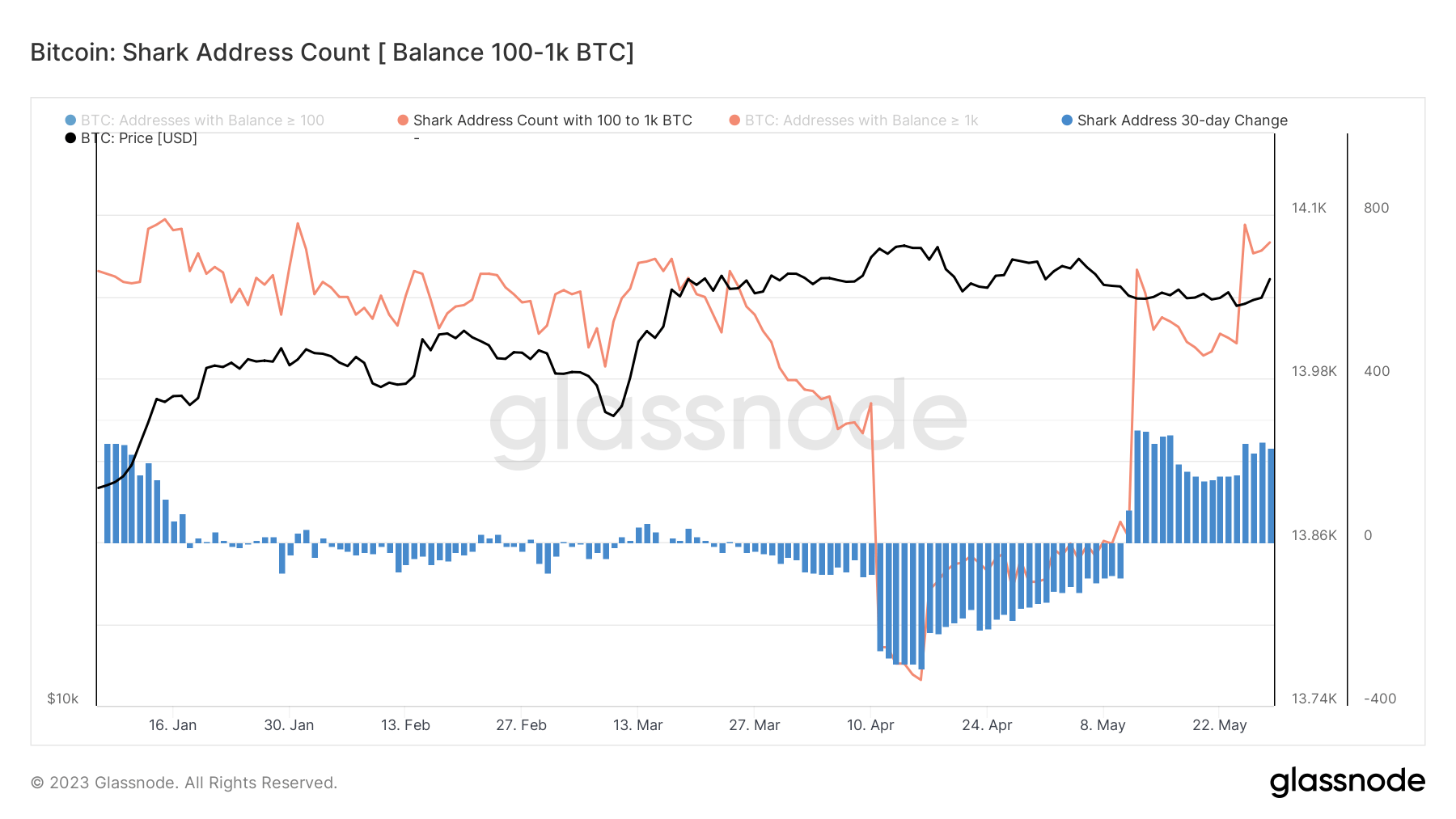

An analogous pattern emerged amongst shark addresses, outlined as these holding between 100 BTC and 1,000 BTC, with Glassnode knowledge exhibiting an evident improve.

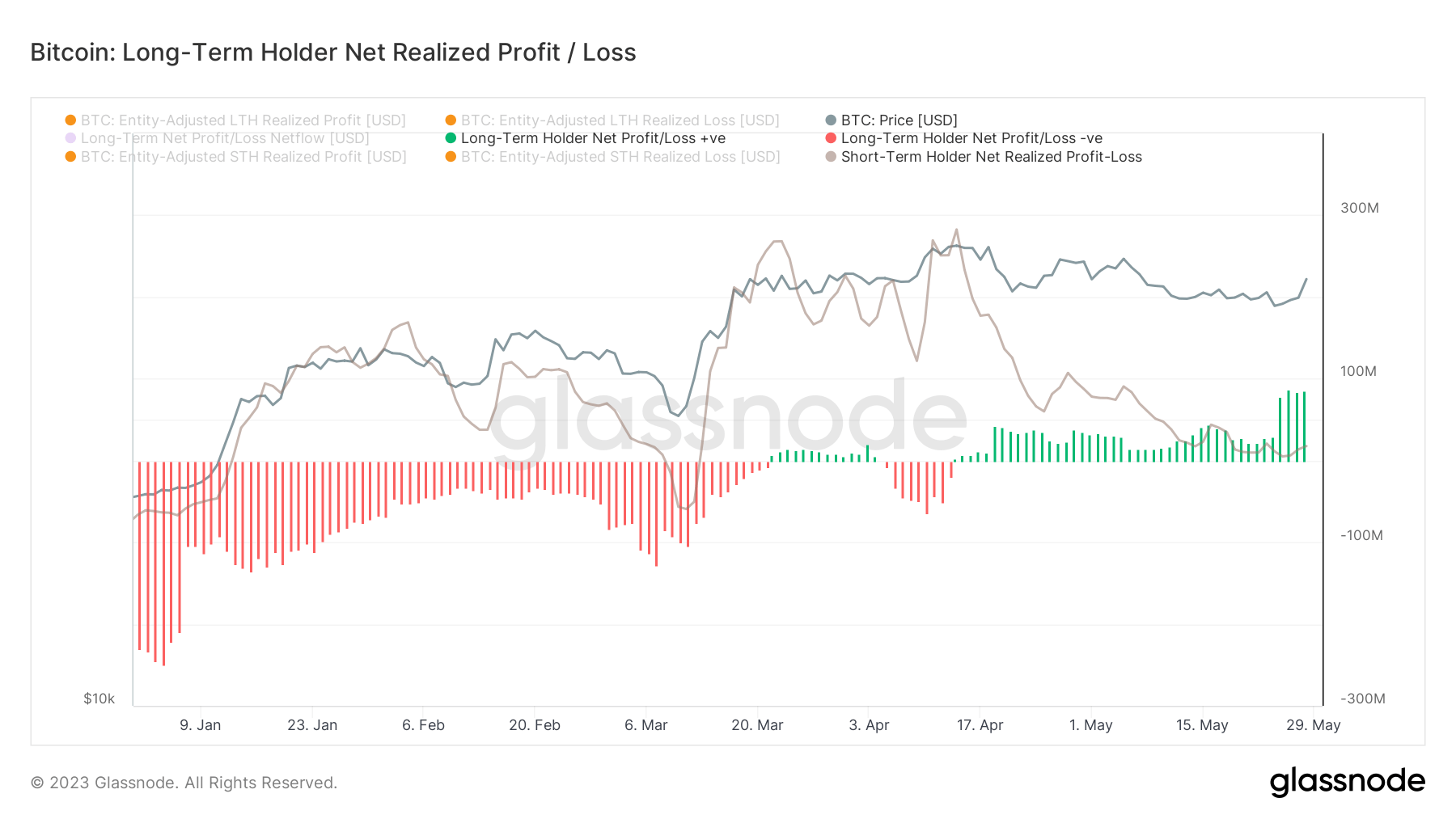

Moreover, long-term holders have detected a major surge within the internet realized revenue/loss (NPL). This means that these persistent traders have spent their cash above their acquisition price all through Might.

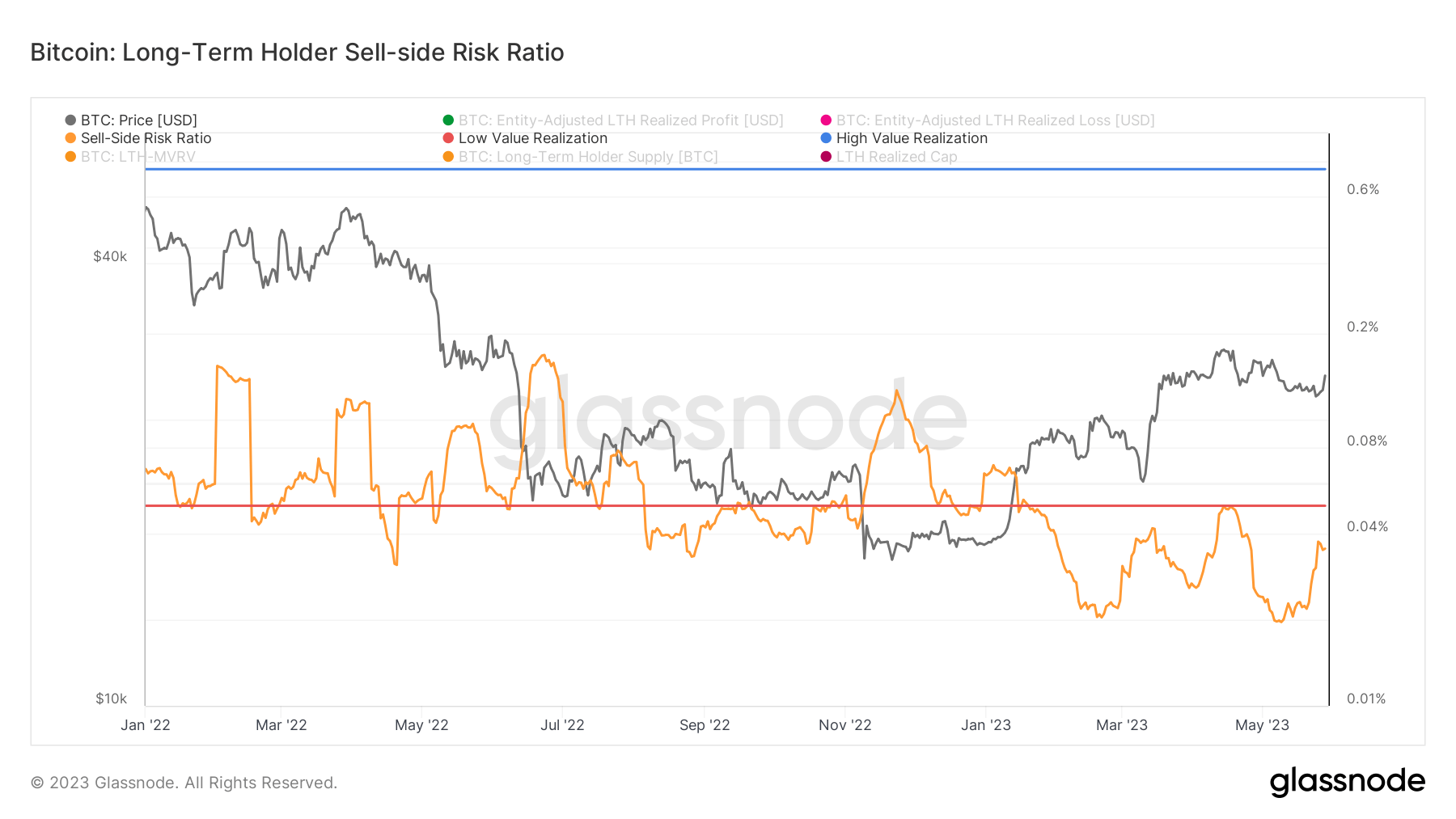

CryptoSlate evaluation discovered that the cash accrued by these cohorts aren’t more likely to hit the exchanges any time quickly. A notable lower and the continuation of the downtrend seen within the sell-side threat ratio from long-term holders signifies that the accrued Bitcoin is being held for its long-term progress potential.

Regardless of the ambiguous value conduct we’ve seen over the week, the lively accumulation by whales and long-term holders might stabilize the market. Whereas different cohorts, similar to shrimp and short-term holders, have additionally been accumulating, the numerous market affect of whales and long-term holders means that their accumulation patterns may pave the best way for a extra strong basis for future progress.

The submit Bitcoin touches $28,000 as whales, long-term holders ramp up accumulation appeared first on CryptoSlate.