Fast Take

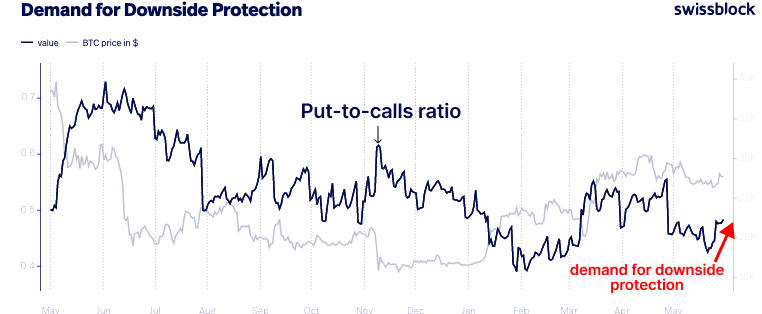

- Demand for draw back safety on Bitcoin is rising, based on Swissblock.

- The put-to-call ratio is signaling that traders are hedging to the draw back.

- Swissblock reiterates that the uncertainty is getting louder because of many macro components, such because the debt ceiling drama persevering with, China knowledge being bearish, and a possible for extra charge hikes.

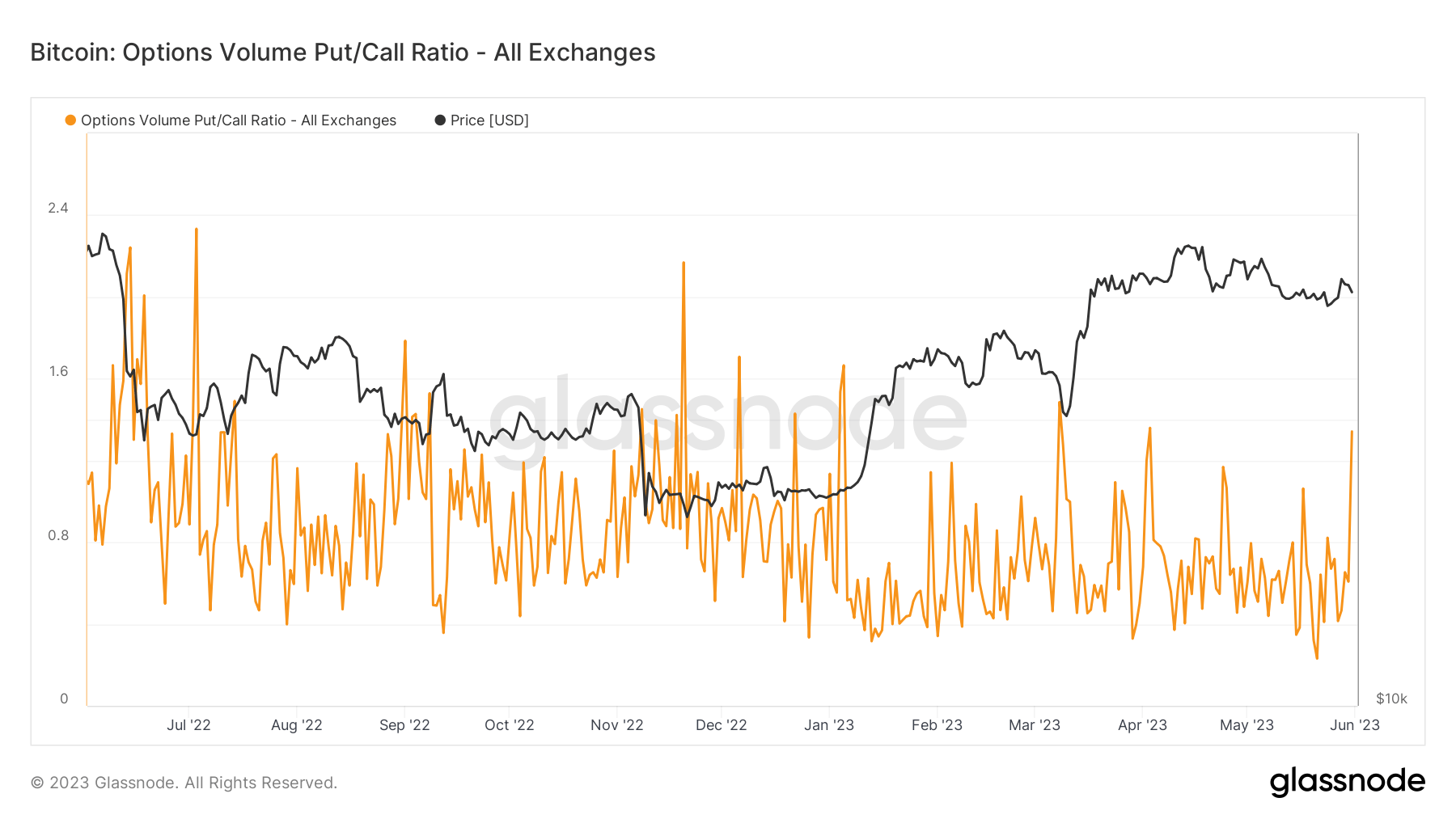

- As well as, the Bitcoin Choices Quantity Put/Name Ratio reveals the put quantity divided by name quantity traded in choices contracts within the final 24 hours can be going to highs for this 12 months, at the moment at 1.34, with the excessive occurring at 1.48 through the SVB collapse.

The submit Bitcoin traders search draw back safety amid rising macro uncertainties appeared first on CryptoSlate.