The most important information within the cryptoverse for Nov. 25 consists of Binance publishing BTC proof of reserve, BNB hitting 6% market dominance as mid-cap tokens outperform Bitcoin, 100,000 Bitcoin value over $1.5 billion leaving Coinbase in 48 hours, and CoinList denying rumors of insolvency.

Bitcoin value $1.5B withdrawn from Coinbase in 48 hours

Glassnode information reveals that Coinbase BTC reserve misplaced about 50,000 BTC on Nov. 24, and one other 50,000 BTC on Nov. 25.

Consequently, Coinbase misplaced Bitcoin value over $1.5 billion in an area of 48 hours, which marks the third-largest BTC withdrawal within the change’s historical past.

Binance publishes BTC proof of reserves to supply extra transparency on buyer funds

Main crypto change Binance has began rolling out its proof of reserves (PoR) starting with Bitcoin. Binance PoR exhibits that clients’ steadiness on the change was 575,742.4228 BTC, whereas its on-chain reserve sits 1% larger at 582,485.9302 BTC.

Binance mentioned it is going to publish the PoR of different crypto property and contain third-party auditors to audit its reserve within the coming weeks.

Mid-cap tokens outperform Bitcoin over previous 7 days as BNB hits 6% market dominance

Over the previous seven days, the market capitalization of mid-cap tokens (initiatives with a market cap between $100 million and $1 billion) surged by 4% whereas Bitcoin’s dominance fell from a excessive of 45% to 40%.

Equally, Binance BNB has gained over 31% towards Bitcoin since Oct. 23, as its market dominance hit an all-time excessive of 6% of the whole crypto market cap.

CoinList denies insolvency rumors, claims technical difficulties inflicting points with withdrawals

During the last seven days, CoinList has reportedly didn’t course of withdrawal requests, elevating issues over its insolvency danger.

The ICO platform in addressing the insolvency rumors mentioned it was experiencing technical points from its custodial associate which affected customers’ deposits and withdrawals.

CoinList added that it was working to resolve the problems and would publish its proof of reserves quickly.

Belgium says Bitcoin, Ethereum should not securities

The Belgium Monetary Providers and Markets Authority said that property with issuers and funding aims are labeled as securities.

On this foundation, the regulator has clarified that Bitcoin and Ethereum should not securities, on condition that there isn’t any issuer, however are created by a pc code.

FTX attacker turns to ChipMixer to launder tokens

The hacker who attacked FTX on Nov. 12 has moved to launder a number of the stolen Bitcoin through Chipmixer. Thus far, the attacker has laundered about 360 BTC.

Nevertheless, ongoing discussions within the crypto neighborhood led by FatManTerra counsel that the blending protocol might have been deployed by the U.S. authorities to crack Bitcoin privateness.

Bahamas Securities Fee calls FTX CEO John Ray’s allegations inaccurate; says its actions had been ‘misinterpreted’

FTX CEO John Ray III alleged that the Securities Fee of The Bahamas (SCB) was behind the unauthorized transfer to switch its property to the regulator.

The SCB claimed that the asset switch was executed to guard crypto property below FTX’s management from potential thefts and hacks.

Huge staked Ethereum withdrawals by whales permit arbitrageurs to revenue

Over the previous 24 hours, two Ethereum whales reportedly withdrew 84,131 ETH and 42,400 stETH respectively from the Aave V2 protocol.

Consequently, the stETH/ETH pair on Curve depegged to 0,9682, which noticed arbitragers merchants make the most of the value distinction to pocket huge income.

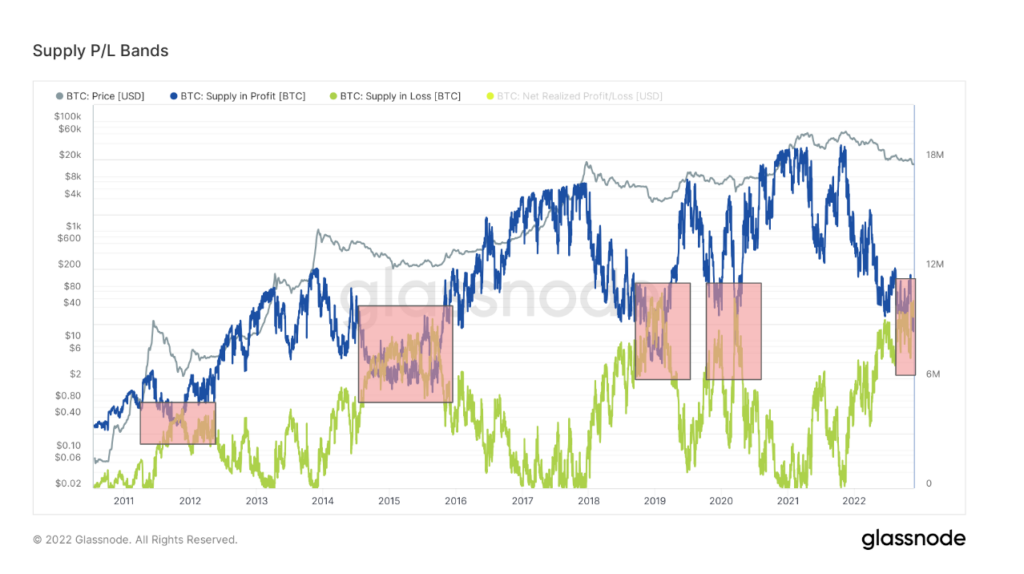

On-chain information flashes a number of bear market backside indicators

Because the Bitcoin halving of 2024 attracts close to, on-chain information analyzed by CryptoSlate signifies that the bear market could also be near its backside.

Trying into the Provide P/L Bands, its blue (revenue) and inexperienced (loss) strains have converged, which coincides with earlier bear market bottoms. That is the fifth time in Bitcoin’s historical past, that the convergence occurred, The earlier occasions of 2012, 2014, and 2019 had been adopted by a surge to a brand new all-time excessive worth.

Equally, the short-term holder provide metrics have surpassed three million cash, which signifies the Bitcoin crabs are filling their baggage because the market bottoms.

Information from across the Cryptoverse

El Salvador opens Bitcoin workplace

The federal government of El Salvador led by Bitcoin Maximalist Nayib Bukele has created the Nationwide Bitcoin Workplace (ONBTC) to handle all Bitcoin-related initiatives.

The ONBTC will oversee the event of Bitcoin, Blockchain, and cryptocurrency firms within the nation.

Binance allocates $1B to crypto restoration fund

Binance CEO Changpeng “CZ” Zhao mentioned his change has allotted one other $1 billion to extend the scale of the trade restoration fund to over $2 billion.

Different main crypto firms together with Bounce Crypto and Aptos Labs pledged to contribute about $50 million to the restoration fund.

Sam Bankman-Fried below investigation by Turkish Authorities

Turkey’s Monetary Crimes Investigation Board mentioned it’s investigating FTX founder Sam Bankman-Fried for allegedly facilitating asset laundering. Consequently, the authority is trying to seize the “suspicious property” from the bankrupt crypto change.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) decreased barely by -0.28% to commerce at $16.526, whereas Ethereum (ETH) decreased by -0.5% to commerce at $1,196.