Fast Take

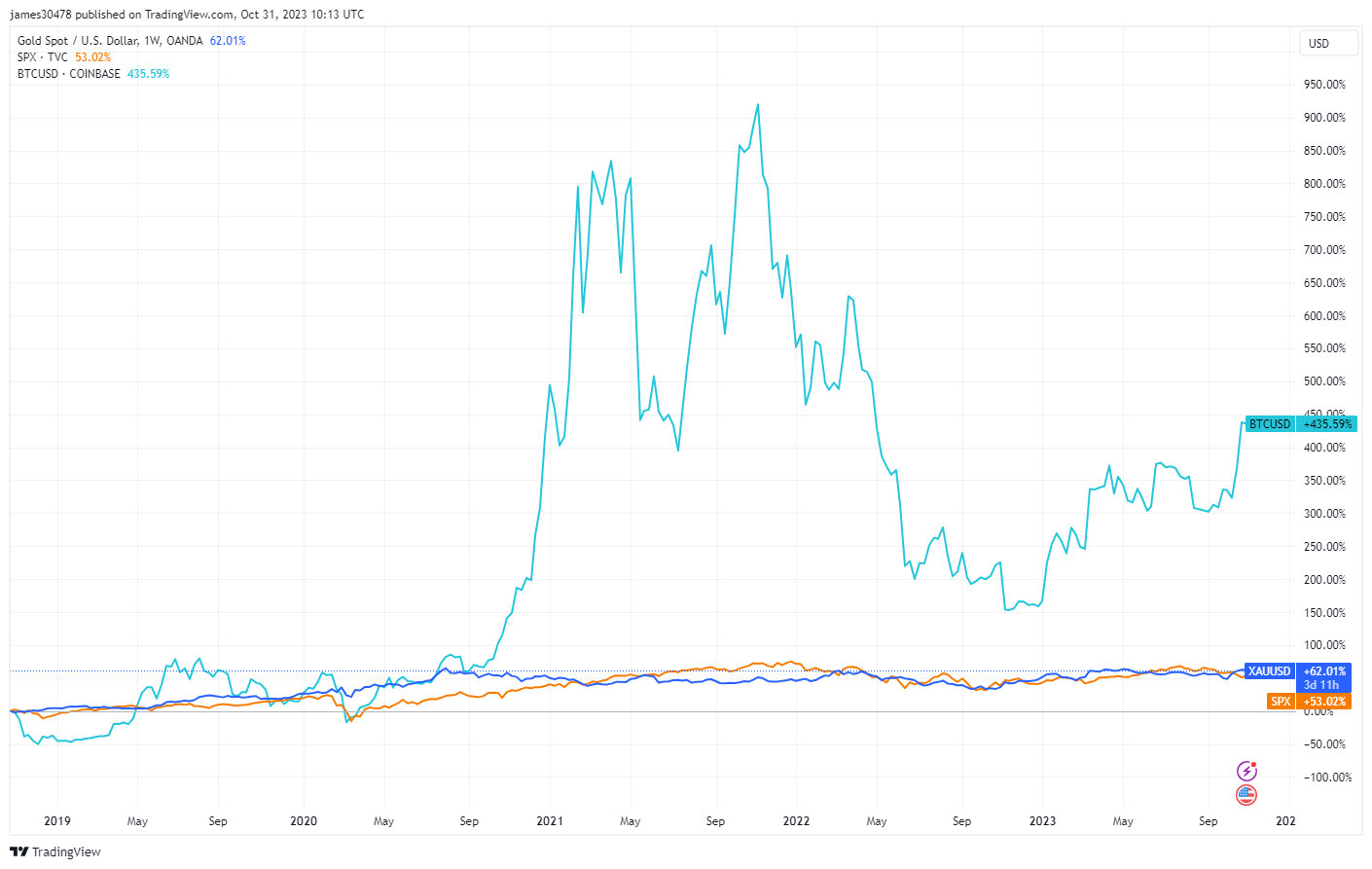

A compelling pattern has emerged within the monetary world, with gold not too long ago closing above $2,000, a threshold it first surpassed earlier this 12 months in April. During the last 5 years, gold has persistently outperformed the S&P 500, delivering a return of 62% in comparison with the S&P’s 53%. At present, each are recording year-to-date will increase of roughly 8.5%.

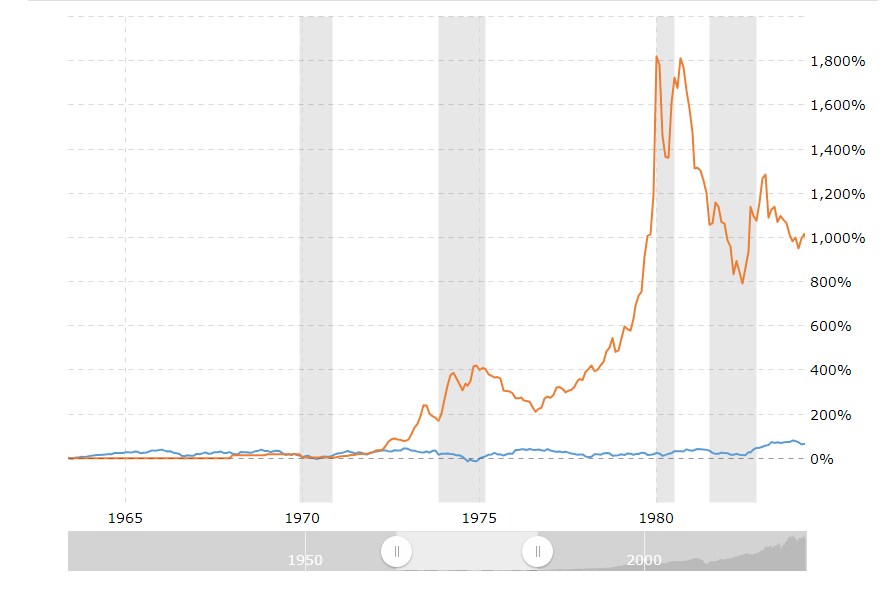

CryptoSlate’s evaluation means that present market circumstances are echoing patterns noticed within the Seventies. Previous to that decade, the performances of gold and equities have been carefully matched.

Nevertheless, within the inflationary surroundings of the Seventies, gold achieved unprecedented development, surging over 1,000% and considerably outdoing equities. The latest efficiency of gold could sign a possible repeat of this historic pattern, signifying necessary implications for traders and market dynamics.

Based mostly on basic evaluation, Bitcoin (BTC) has proven sturdy efficiency relative to gold, with a rise of over 100% 12 months so far and a staggering 430% development over the previous 5 years. This raises the query of whether or not Bitcoin may probably outperform gold in the identical method that gold outpaced equities within the Seventies.

The publish Bitcoin vs. Gold: Mapping present developments onto historic information appeared first on CryptoSlate.