Out of all of the crypto spinoff merchandise, perpetual futures have emerged as a most well-liked instrument for market hypothesis. Bitcoin merchants use the instrument en masse for danger hedging and capturing funding charge premiums.

Perpetual futures, or perpetual swaps as they’re generally referred to, are futures contracts with no expiration date. These holding perpetual contracts are in a position to purchase or promote the underlying asset at an unspecified level sooner or later. The worth of the contract stays the identical because the underlying asset’s spot charge on the contract’s opening date.

To maintain the contract’s value near the spot value as time goes by, exchanges implement a mechanism referred to as a crypto funding charge. The funding charge is a small share of a place’s worth that should be paid or obtained from a counterparty at common intervals, normally each few hours.

A optimistic funding charge exhibits that the worth of the perpetual contract is larger than the spot charge, indicating larger demand. When the demand is excessive, purchase contracts (longs) pay funding charges to the promote contracts (shorts), incentivizing opposing positions and bringing the contract’s value nearer to the spot charge.

When the funding charge is destructive, promote contracts pay the funding charge to the lengthy contracts, once more pushing the contract’s value nearer to the spot charge.

Given the scale of each the expiring and the perpetual futures market, evaluating the 2 can present the broader market sentiment on the subject of future value actions.

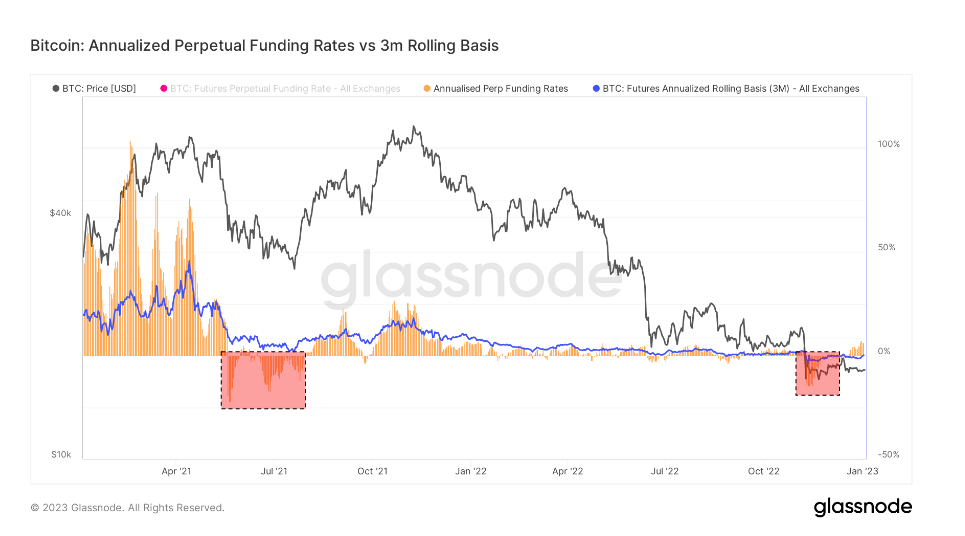

Bitcoin’s annualized 3-month futures foundation compares the annualized charges of return out there in a cash-and-carry commerce between 3-month expiring futures and perpetual funding charges.

CryptoSlate evaluation of this metric exhibits that the perpetual futures’ foundation is considerably extra unstable than that of expiring futures. The discrepancy between the 2 is a results of elevated demand for leverage available in the market. Merchants appear to be in search of a monetary instrument that tracks spot market value indexes extra intently, and perpetual futures match their wants completely.

Durations the place the perpetual futures’ foundation trades decrease than the 3-month expiring futures foundation have traditionally occurred after sharp value declines. Giant derisking occasions akin to bull market corrections or extended bearish slumps are sometimes adopted by a lower within the perpetual future foundation.

Alternatively, having the perpetual futures foundation commerce larger than the 3-month expiring futures foundation present excessive demand for leverage available in the market. This creates an oversupply of sell-side contracts that result in value slumps, as merchants act quick to arbitrage down the excessive funding charges.

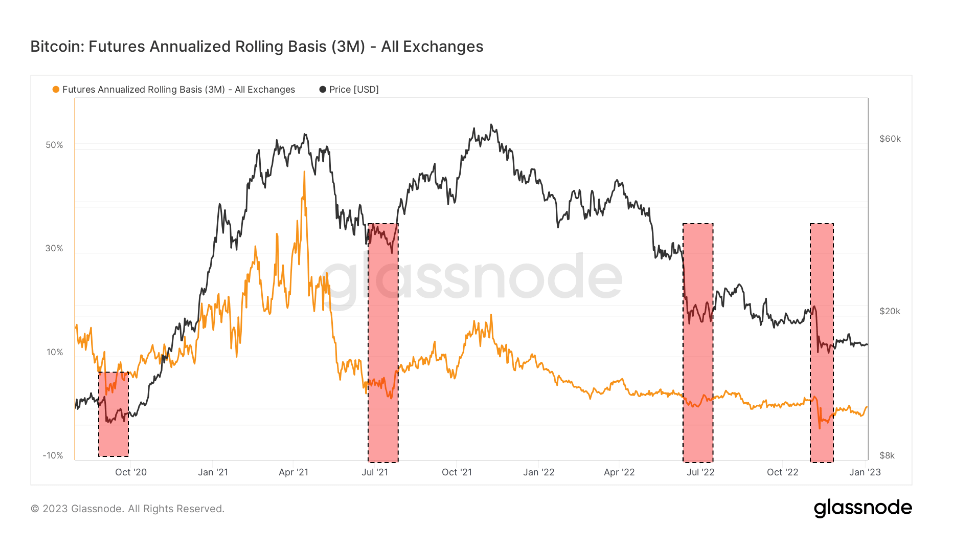

Wanting on the chart above exhibits that each Bitcoin expiring futures and perpetual swaps had been buying and selling in a state of backwardation through the FTX collapse.

Backwardation is a state wherein the worth of a futures contract is decrease than the spot value of its underlying asset. It happens when the demand for an asset will get larger than the demand for contracts maturing within the coming months.

As such, backwardation is a reasonably uncommon sight within the derivatives market. In the course of the collapse of FTX, expiring futures had been buying and selling at an annualized foundation of -0.3%, whereas perpetual swaps had been buying and selling on an annualized foundation of -2.5%.

The one comparable durations of backwardation had been seen in September 2020, the summer season of 2021 following the China mining ban, and July 2020. These had been durations of maximum volatility and had been dominated by shorts. All of those durations of backwardation noticed the market hedged in the direction of the draw back and getting ready for additional slumps.

Nonetheless, each interval of backwardation was adopted by a value rally. Upward value motion started in October 2020 and peaked in April 2021. July 2021 was spent within the purple and was adopted by a rally that continued properly into December 2021. The Terra collapse in June 2022 noticed a rally in late summer season that lasted till the tip of September.

The vertical value drop brought on by the FTX collapse introduced on backwardation that appears eerily just like the beforehand recorded durations. If historic patterns had been to repeat, the market might see optimistic value motion within the coming months.

On the time of press, Bitcoin is ranked #1 by market cap and the BTC value is up 1.06% over the previous 24 hours. BTC has a market capitalization of $325.89 billion with a 24-hour buying and selling quantity of $12.84 billion. Study extra ›

Market abstract

On the time of press, the worldwide cryptocurrency market is valued at at $823.22 billion with a 24-hour quantity of $26.36 billion. Bitcoin dominance is at the moment at 39.59%. Study extra ›