Choices are pivotal in gauging market expectations, permitting merchants to safe the correct to purchase (name choices) or promote (put choices) Bitcoin at a predetermined value. The open curiosity – the sum of all energetic possibility contracts – and the ratio between places and calls can mirror the market’s sentiment and conviction. On the identical time, quantity underscores the immediacy of buying and selling exercise.

Constructing on our earlier CryptoSlate evaluation, the Bitcoin choices market has continued to exhibit refined shifts in sentiment for the reason that starting of November.

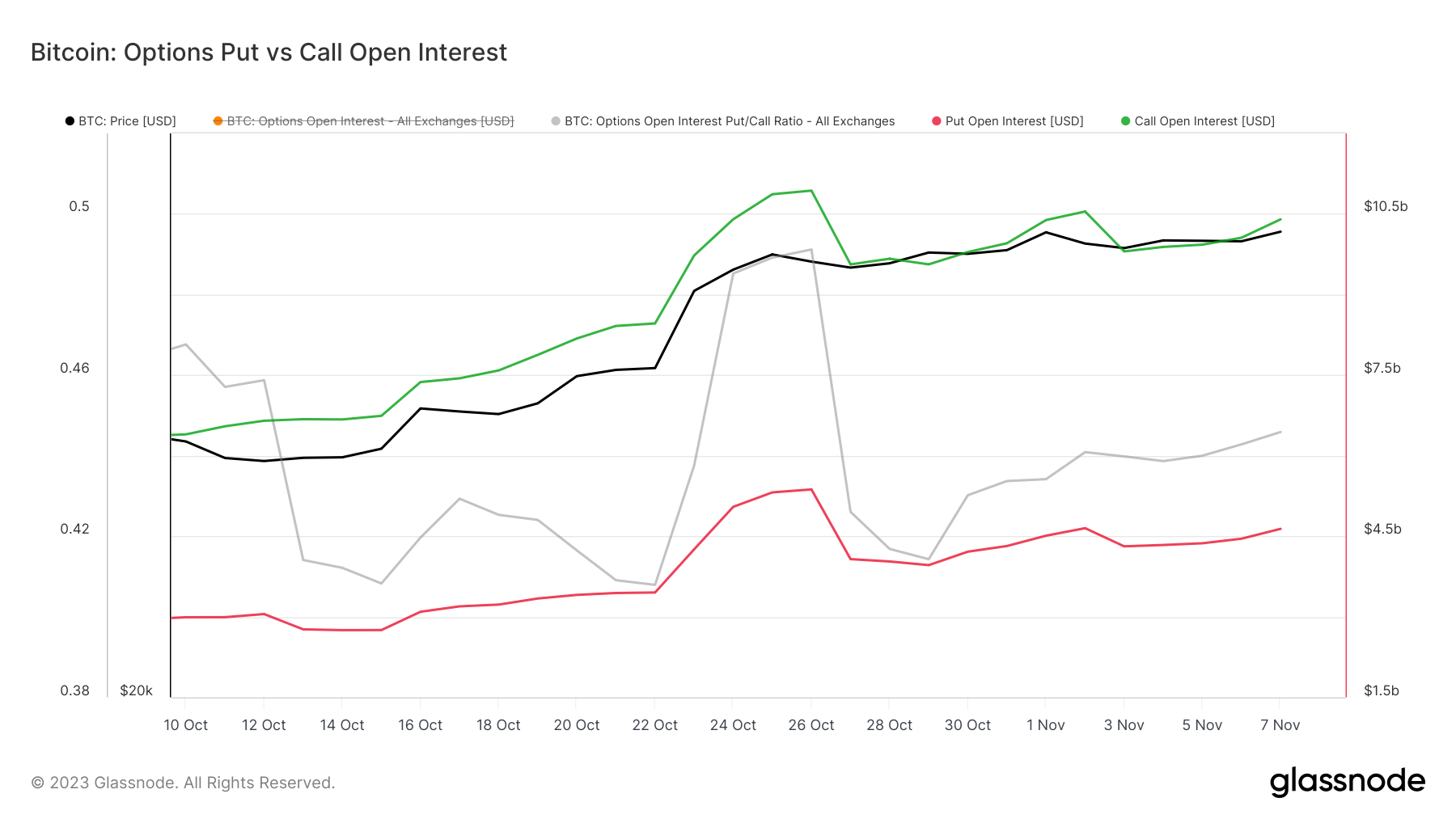

There was a average enhance in name open curiosity to $10.40 billion and an increase in put open curiosity to $4.63 billion. Whereas the upward trajectory has persevered since October, the tempo suggests a extra cautious optimism amongst merchants.

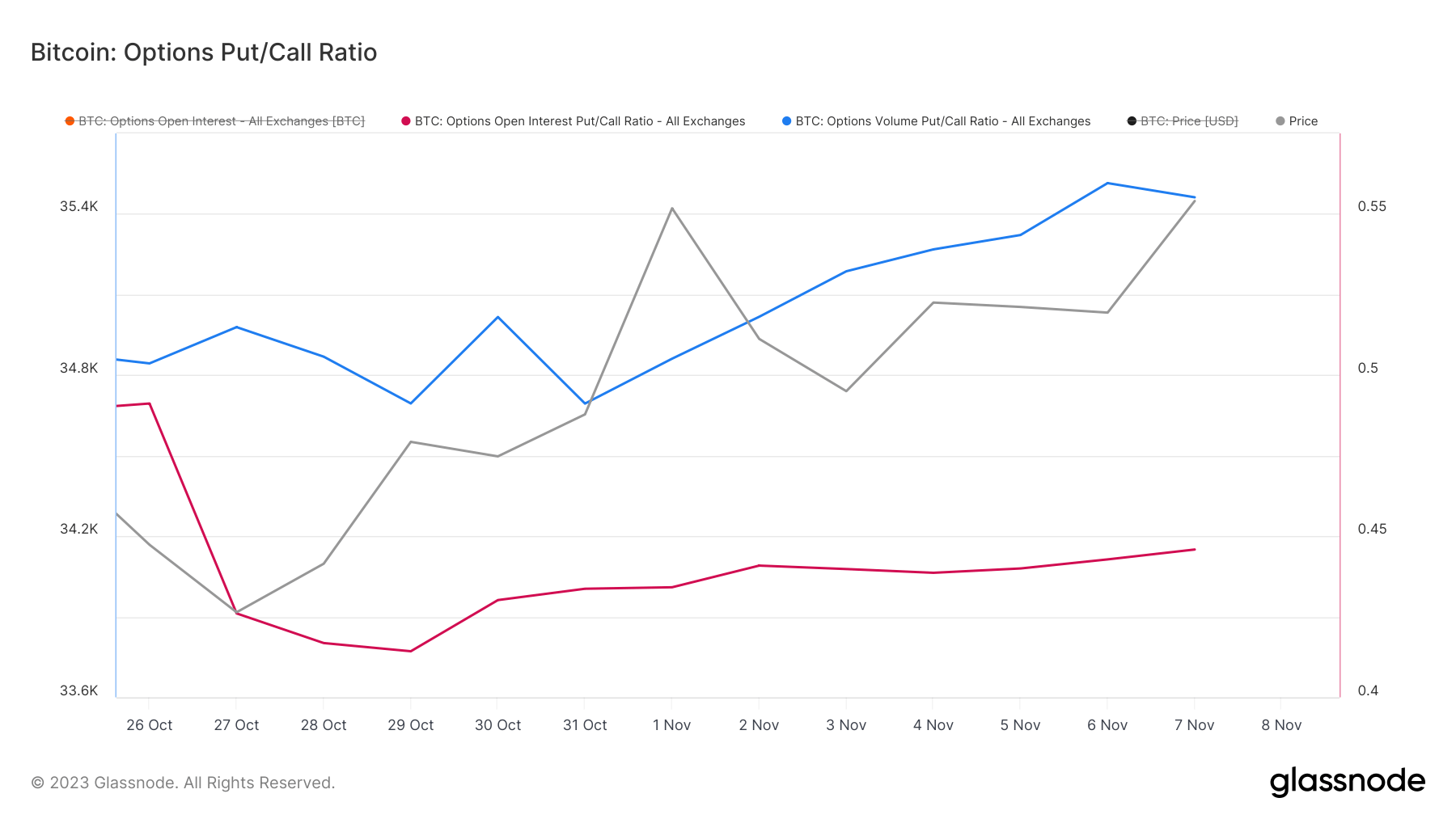

The put/name ratio of open curiosity has seen a slight enhance from 0.433 to 0.445, indicating a refined however noticeable shift. A rise within the put/name ratio often signifies a bearish sentiment. Nonetheless, because the ratio nonetheless stays effectively under 1, it’s extra indicative of elevated hedging exercise.

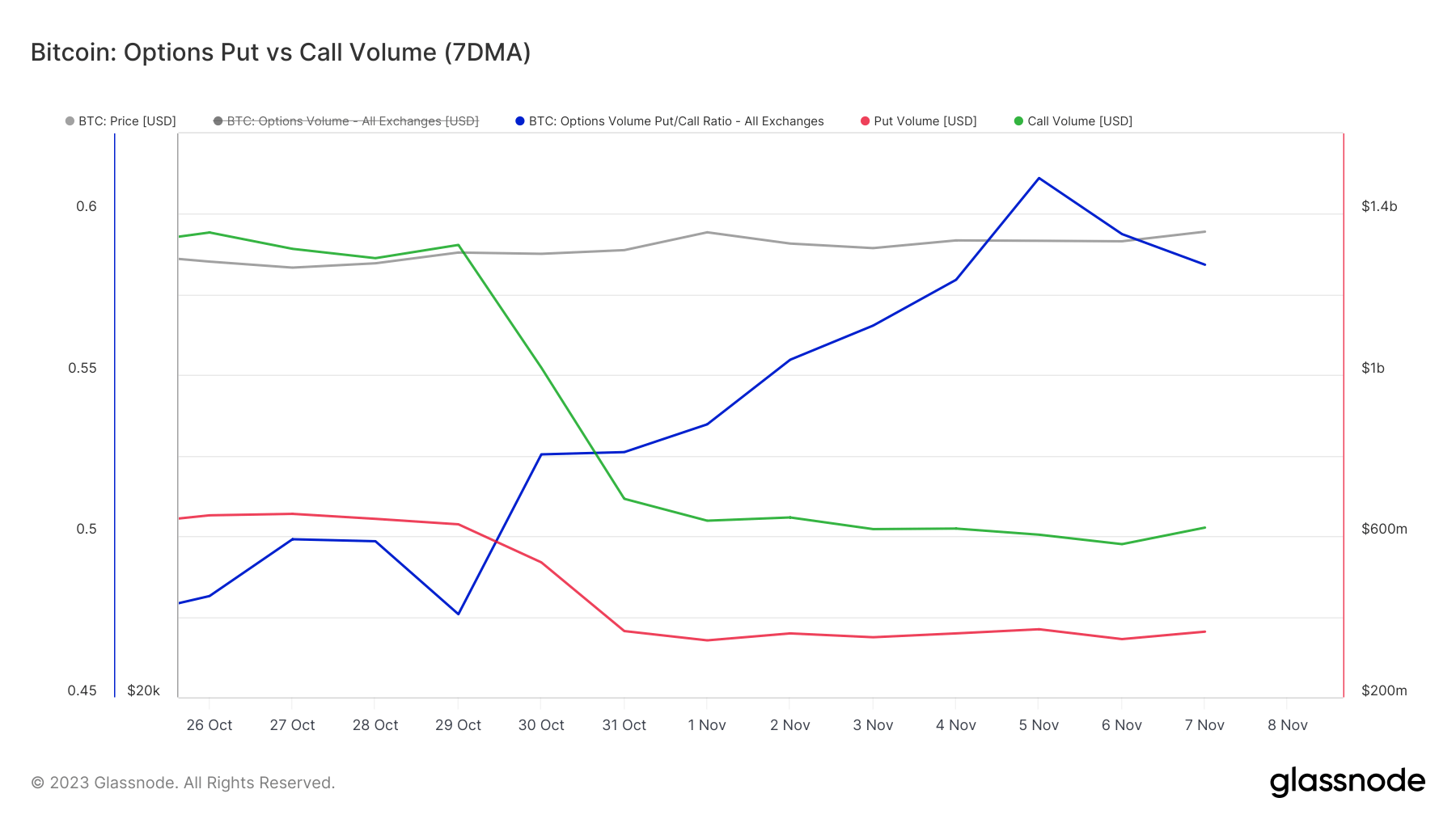

That is additional strengthened by the amount ratio’s development from 0.526 to 0.584, which emphasizes a defensive stance amidst an general bullish market.

For the reason that starting of the month, Bitcoin’s value has edged up from $34,600 and damaged above $35,400, reinforcing this sentiment.

Contrasting with the all-time excessive name open curiosity from CryptoSlate’s final evaluation, the present figures reveal a market that’s optimistic but extra measured. The put/name ratio’s gradual enhance displays a market that, whereas nonetheless bullish, is turning into extra cautious. The constant enhance in each name and put open pursuits factors to an energetic market, with merchants gearing up for potential value escalations and concurrently guarding towards downward dangers.

Taking a look at strike costs means that optimism is persistent, however merchants are additionally getting ready for situations the place the worth won’t meet their bullish expectations.

The submit Bitcoin’s climb above $35,000 adopted by surprisingly measured market appeared first on CryptoSlate.