Bitcoin surged previous $46,000 for the primary time since final month’s approval of a number of BTC exchange-traded fund (ETF) merchandise by the U.S. Securities and Alternate Fee (SEC).

CryptoSlate information exhibits that the main cryptocurrency noticed a 5% enhance inside the final 24 hours, peaking at almost $46,500 as of press time.

CryptoSlate Perception reported that the inflow of investments into BTC ETFs, equivalent to BlackRock’s IBIT, might present substantial momentum to Bitcoin’s market worth. Moreover, Bitcoin’s present worth trajectory aligns with its historic market patterns, suggesting potential for additional progress, notably post-halving.

Markus Thielen, the founding father of 10x Analysis, highlighted historic developments indicating Bitcoin tends to expertise worth upticks through the Chinese language New 12 months interval, with festivities commencing by Feb. 10.

“Bitcoin will possible rally no less than to the earlier January excessive of round 48,000. As we talked about in our notes, Elliot-Wave’s evaluation indicated that Bitcoin might even rally in the direction of 52,000 by mid-March,” Thielen added.

This latest worth surge has propelled Bitcoin into the highest ten belongings by market capitalization, reflecting the rising significance of digital belongings inside the broader monetary panorama.

Concurrently, Ethereum and different distinguished different cryptocurrencies, together with Binance-backed BNB, Solana, Tron, Avalanche, and XRP, demonstrated resilience, registering positive factors exceeding 2% through the reporting interval.

The collective market capitalization of cryptocurrencies expanded by 3% inside the previous day, reaching $1.7 trillion.

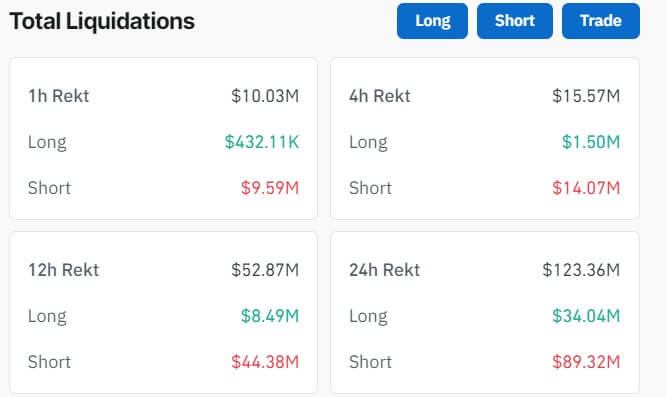

$123 million liquidated

Coinglass information exhibits that the value motion liquidated $123 million throughout all belongings from greater than 38,000 crypto merchants through the previous day. Amongst them, lengthy merchants noticed losses totaling $34 million, whereas quick merchants confronted liquidations of roughly $90 million.