Fast Take

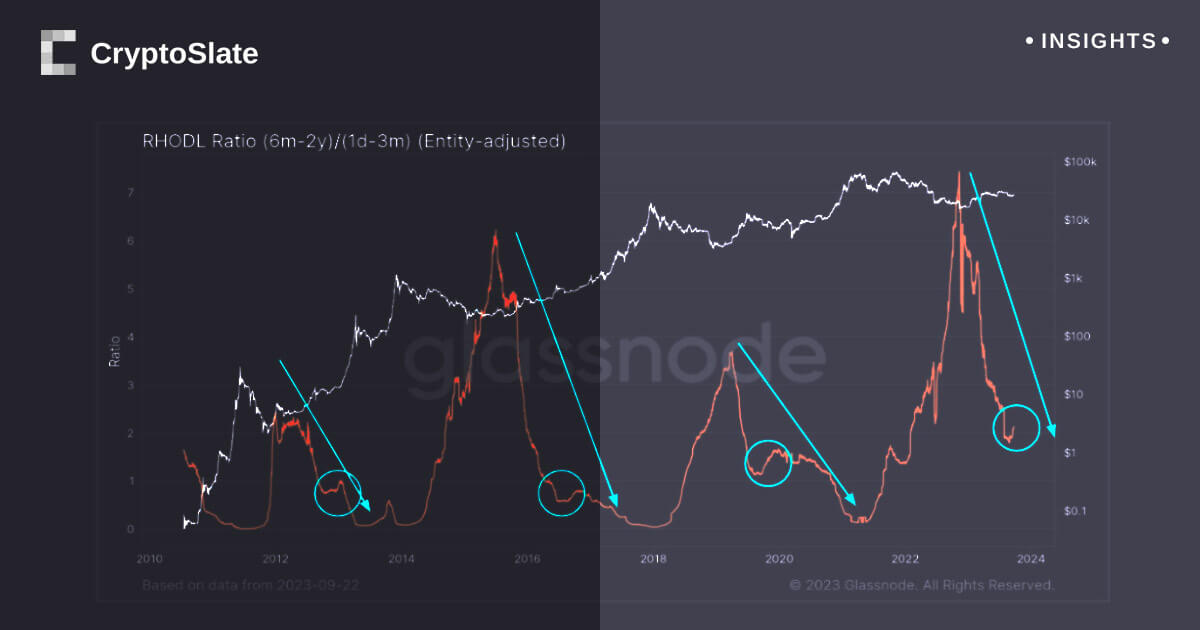

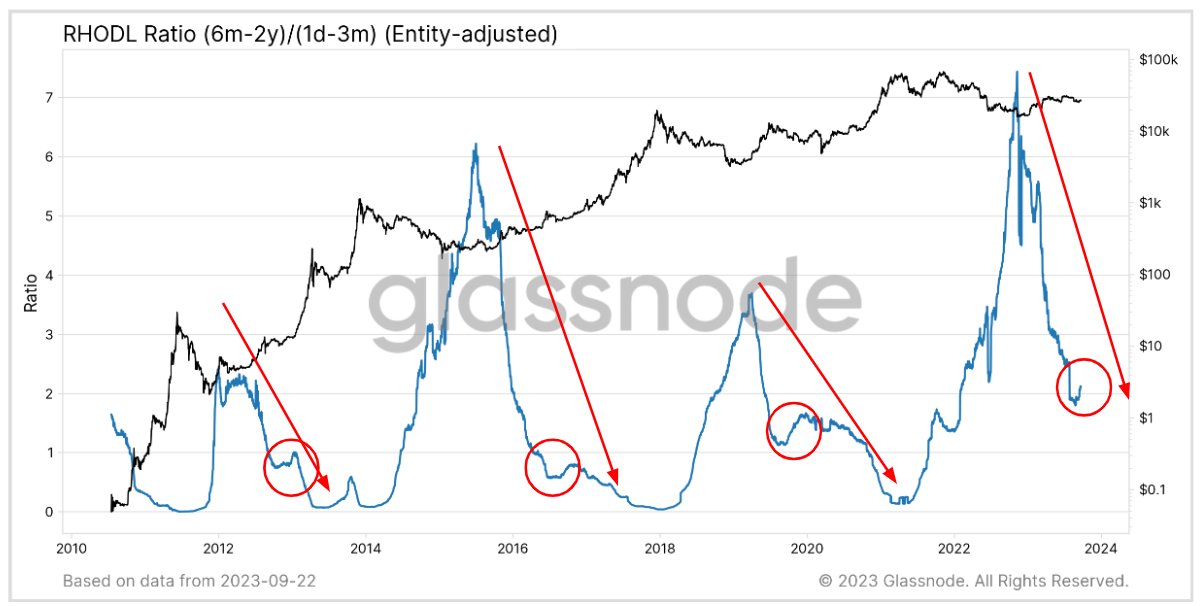

Latest analyses of Bitcoin’s RHODL Ratio have offered an intriguing perspective on the capital rotation dynamics throughout cycle transitions. The RHODL Ratio, developed as a ratio of single-cycle long-term holders (6 months to three years) to the youngest short-term holders (1 day to three months), affords us a useful analytical instrument to look at the turning factors inside the capital rotation scheme within the crypto market.

Presently, knowledge means that the underside for this cycle is already in place, indicating the kick-off of the following bull run. Regardless of this favorable development, the market is presently experiencing a phenomenon that seems akin to a ‘lifeless cat bounce.’ This time period, borrowed from inventory market jargon, refers to a brief restoration within the value from a protracted decline or a bear market, adopted by the continuation of the downtrend.

Nevertheless, it’s important to notice that the Bitcoin market’s resilience has been examined a number of instances in historical past and it has typically bounced again stronger.

The put up Bitcoin’s cycle transition is underway as indicator reveals potential market backside appeared first on CryptoSlate.