Fast Take

Bitcoin (BTC) has seen a noteworthy surge in October, marking a 28% improve and paving the way in which for it to be the second most profitable month of the yr, tailing behind January’s 40% ascension. One key metric that gives an insightful perspective is the ‘realized worth‘, an idea that reveals the imply buy worth for all present Bitcoin homeowners, thereby countering the consequences of volatility.

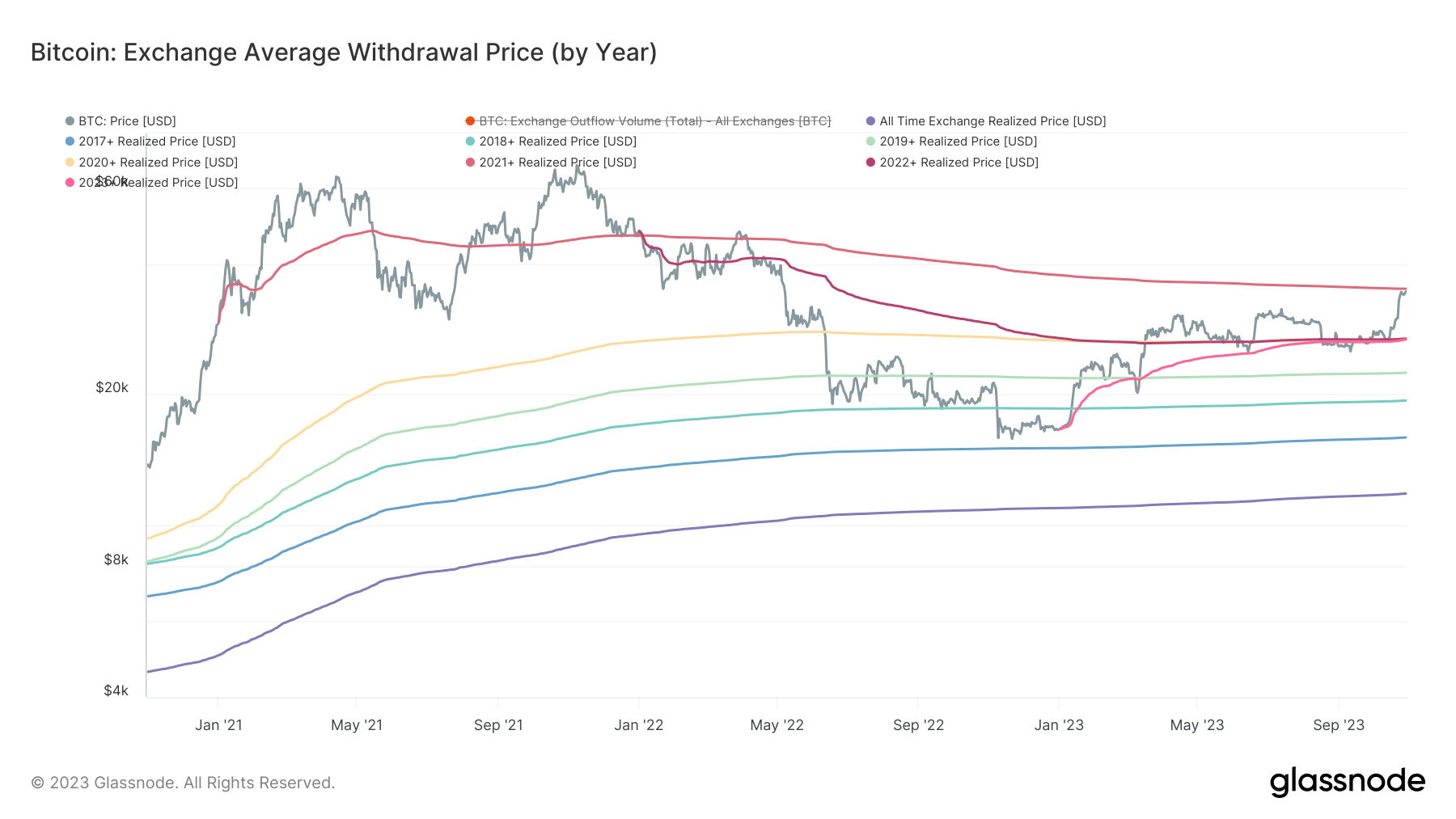

A more in-depth examination of the yearly cohorts’ on-chain price foundation reveals that each one teams, besides those that started buying in 2021, are in a worthwhile place.

Anticipating that the 2021 investor cohort will proceed with their dollar-cost averaging methods, it’s noteworthy that their realized worth degree has declined from $50,000 to $35,000 over a span of two years. As such, any surge past the $35,000 threshold might probably instigate a spherical of profit-taking. Due to this fact, this worth degree is predicted to function a short-term resistance, tempering any fast upward worth motion.

As well as, we’ve persistently used the 2023 realized worth degree as a help, deviating under it simply as soon as this yr throughout the SVB collapse in March. Nevertheless, we promptly rebounded above that degree shortly thereafter.

To interrupt it down, the realized costs for the cohorts are as follows: 2017+ ($15,907), 2018+ ($19,352), 2019+ ($22,432), 2020+ ($26,649), 2021+ ($35,053), 2022 ($26,902), and 2023 ($26,790).

| Cohort Realized Worth | Worth Realized Worth |

|---|---|

| 2017+ | $15,907 |

| 2018+ | $19,352 |

| 2019+ | $22,432 |

| 2020+ | $26,649 |

| 2021+ | $35,053 |

| 2022 | $26,902 |

| 2023 | $26,790 |

Realized Worth by cohort: (Supply: Glassnode)

The submit Bitcoin’s October surge leaves one purchaser group within the chilly appeared first on CryptoSlate.