The present bear market has proven that it’s not like earlier ones in a number of methods. One solution to monitor the distinction is by trying on the conduct of short-term holders of Bitcoin (BTC) versus long-term holders.

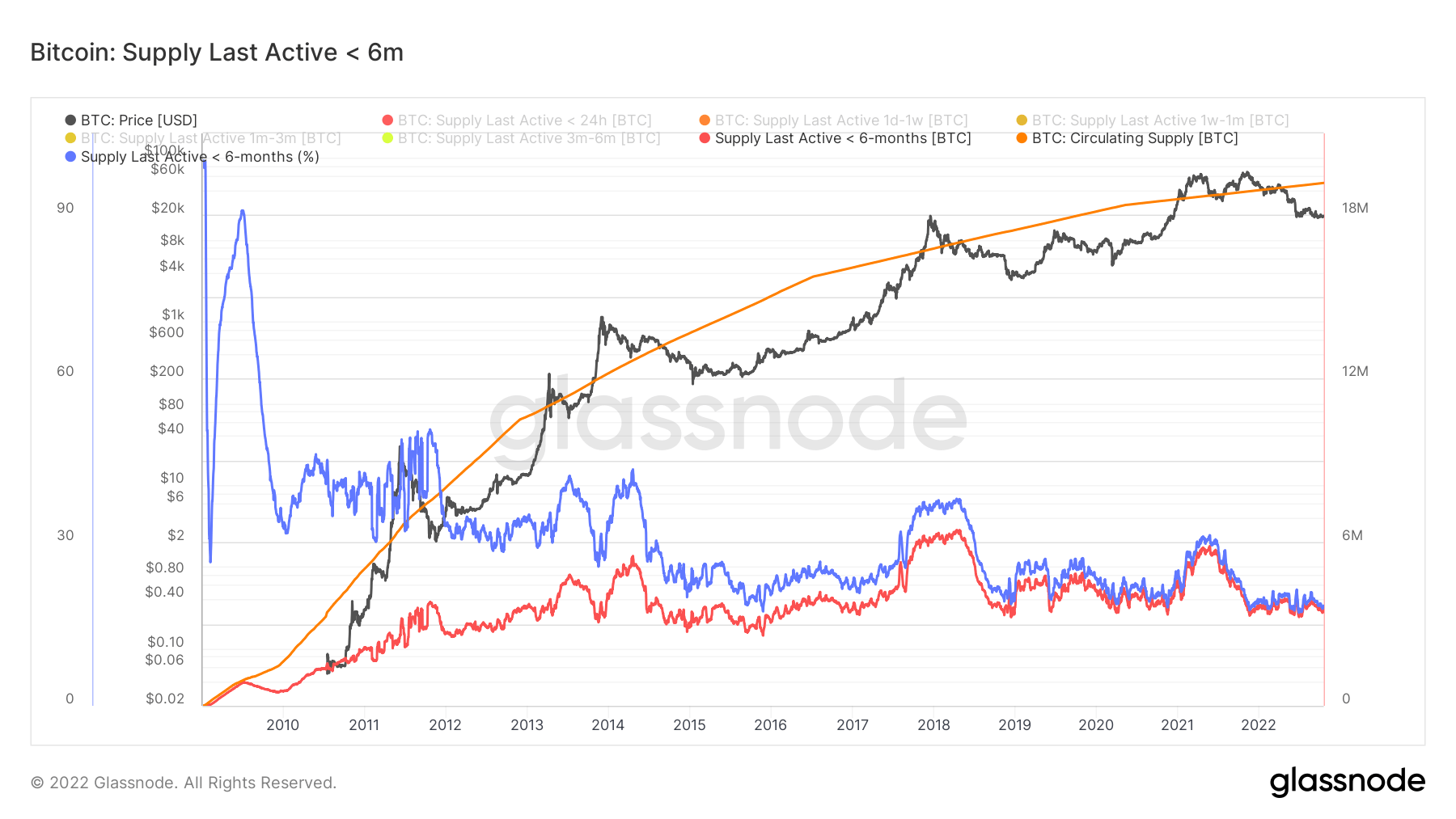

In earlier bear markets, short-term holders — who’ve held BTC for six months or much less — are normally speculators who’re there for the value positive aspects. So when the value goes above the circulating provide, it’s sometimes an indication that the value for the cycle has peaked. Quick-term holders normally pile in at this level for worry of lacking out.

On-chain knowledge exhibits that short-term holders are at present on the similar level as within the earlier bear market, suggesting that they’ve misplaced religion and exited the ecosystem. Going by this, we’re already close to the underside of this cycle, judging by earlier cycles.

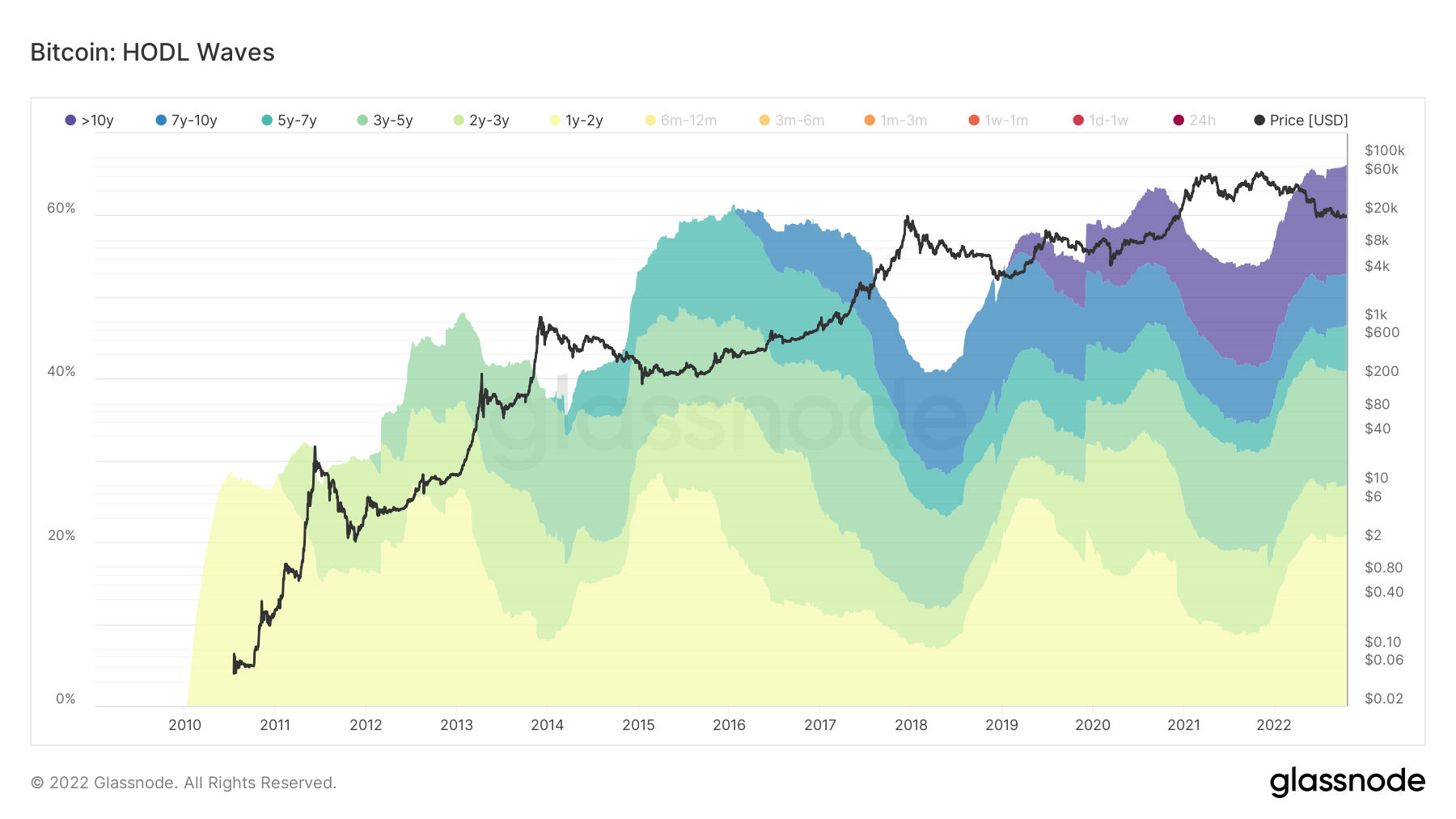

Nonetheless, long-term holders — who’ve held BTC for a 12 months or extra — at present maintain over 66% of the asset’s provide. Furthermore, the cohort has but to promote in a 12 months regardless of all of the occasions which have occurred to date. This implies a stronger conviction amongst this group of buyers.

LTH normally accumulate when the costs are down, and their conduct is often the catalyst for the subsequent bull run. This has occurred within the earlier bear cycles.

Whether or not it will occur on this one stays uncertain provided that the present cycle is much less about crypto investor behaviors and extra in regards to the macroeconomic circumstances, notably the Fed insurance policies.

Bitcoin (BTC) has already fallen from its earlier cycle peak, the primary time that might occur in a bear market. It represents the type of precedents set by the present bear cycle and exhibits simply how uncommon it’s.

With the Fed saying individuals ought to anticipate extra ache and inflation displaying little signal of abating, additional price hikes are doubtless — which may additional drive the value of BTC down.