Fast Take

The latest plummet of Bitcoin to $26.1k was an enormous liquidation occasion, underlined by vital adjustments within the cryptocurrency’s perpetual funding charge and open curiosity.

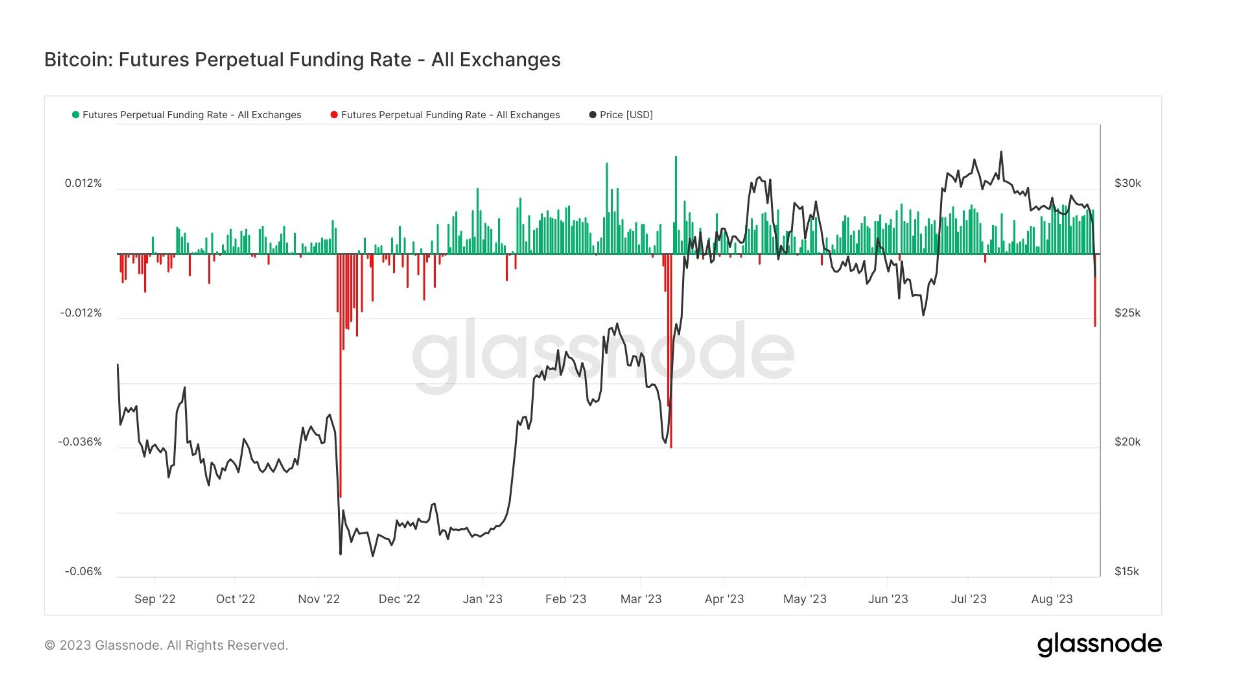

The perpetual funding charge, a mechanism utilized by exchanges for perpetual futures contracts, which normally sees lengthy positions periodically pay quick positions when optimistic, has shifted into the unfavourable terrain.

This alteration implies a reversal of roles the place quick positions periodically pay lengthy positions, a transparent indicator of market nervousness.

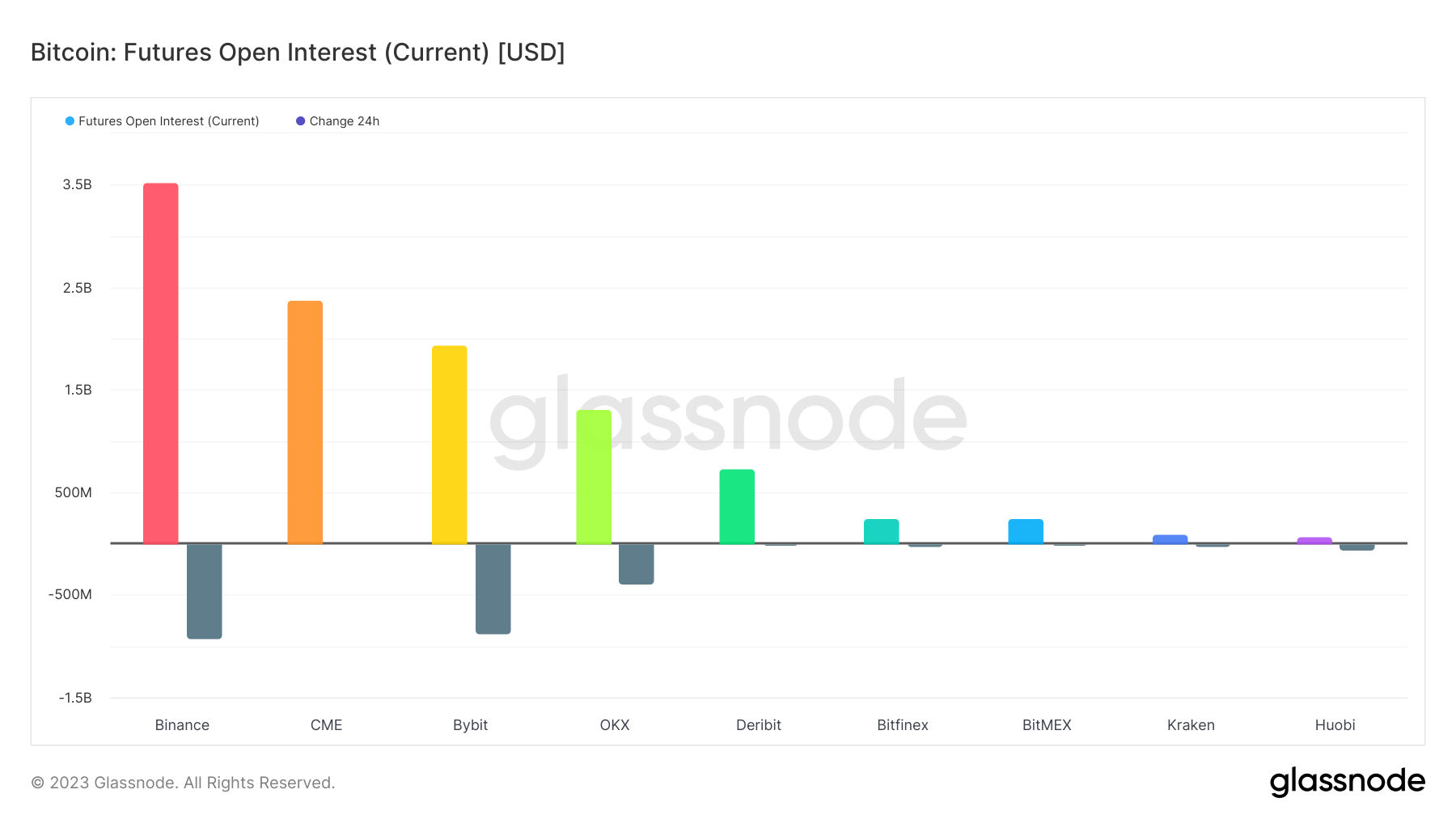

Concurrently, we witnessed a big drop in open curiosity, a measure of the full variety of excellent spinoff contracts, corresponding to futures that haven’t been settled.

There was a placing obliteration of $1B price of liquidations, leading to an enormous reset. Particularly, round 60,000 Bitcoin open curiosity contracts have been worn out within the course of, a big share of which have been related to main exchanges like Binance, Bybit, and OKX.

This mass liquidation occasion has reset the market dynamics, paving the best way for probably novel funding methods and market behaviors in upcoming buying and selling classes.

The publish Bitcoin’s plunge to $26.1k triggers large reset in crypto market dynamics appeared first on CryptoSlate.