Monitoring the proportion of Bitcoin’s provide in revenue gives essential insights into market tendencies and potential actions. This metric calculates the proportion of current Bitcoins at the moment held at a worth greater than their buy value. Its significance lies in offering a snapshot of general market profitability, revealing whether or not most holders are in a state of acquire or loss. Spikes on this metric typically correlate with market optimism, whereas drops can point out rising stress to promote, typically previous market downturns.

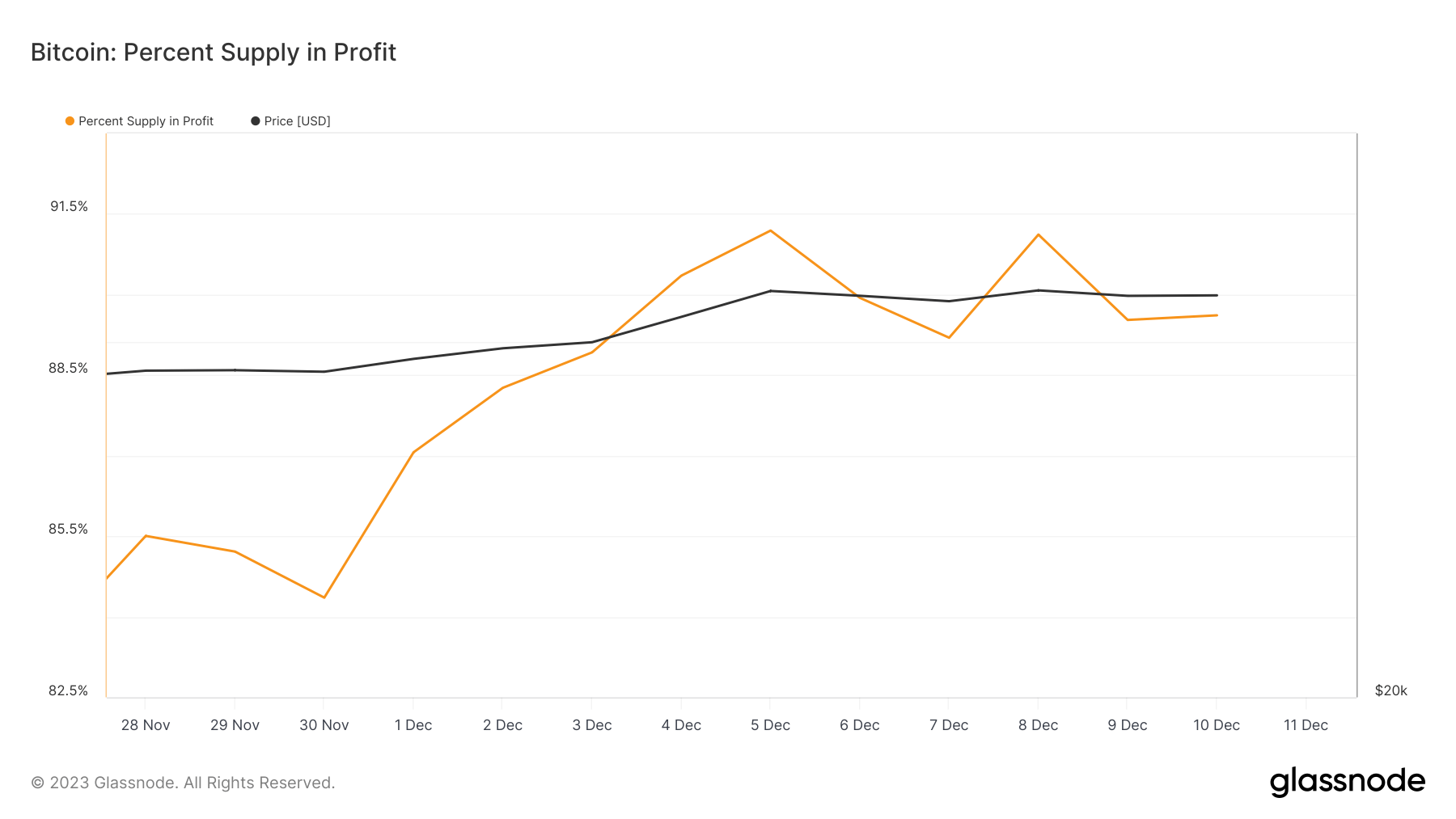

On Dec. 8, 2023, a vital market milestone was achieved as Bitcoin’s provide in revenue exceeded 91.1%, with its value surging over $44,000. This marked a momentous part of market prosperity unseen since early November 2021. Such a excessive proportion of Bitcoin in revenue sometimes indicators a widespread bullish sentiment, as most traders maintain belongings at a worth exceeding their preliminary funding.

Nevertheless, this peak was adopted by a swift correction over the weekend, with Bitcoin’s value retreating under $42,000. This shift resulted within the provide in revenue dwindling to 89.6%, illustrating a considerable profit-taking occasion out there. This discount means that merchants, presumably anticipating a extra dramatic decline, had been eager to safe their good points. Such conduct typically signifies a market poised at a vital juncture, with traders cautious of a possible fall under pivotal psychological ranges like $40,000.

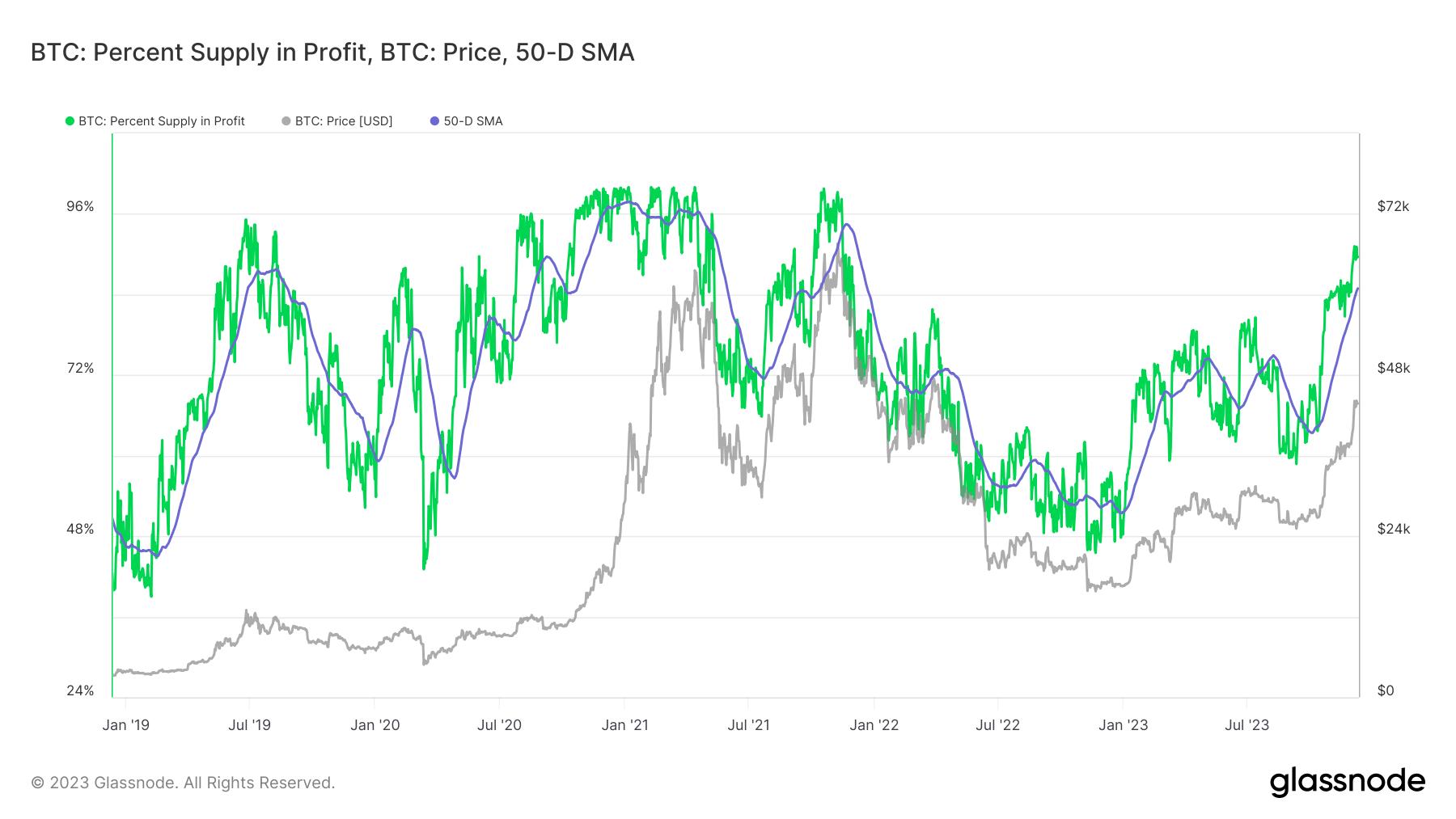

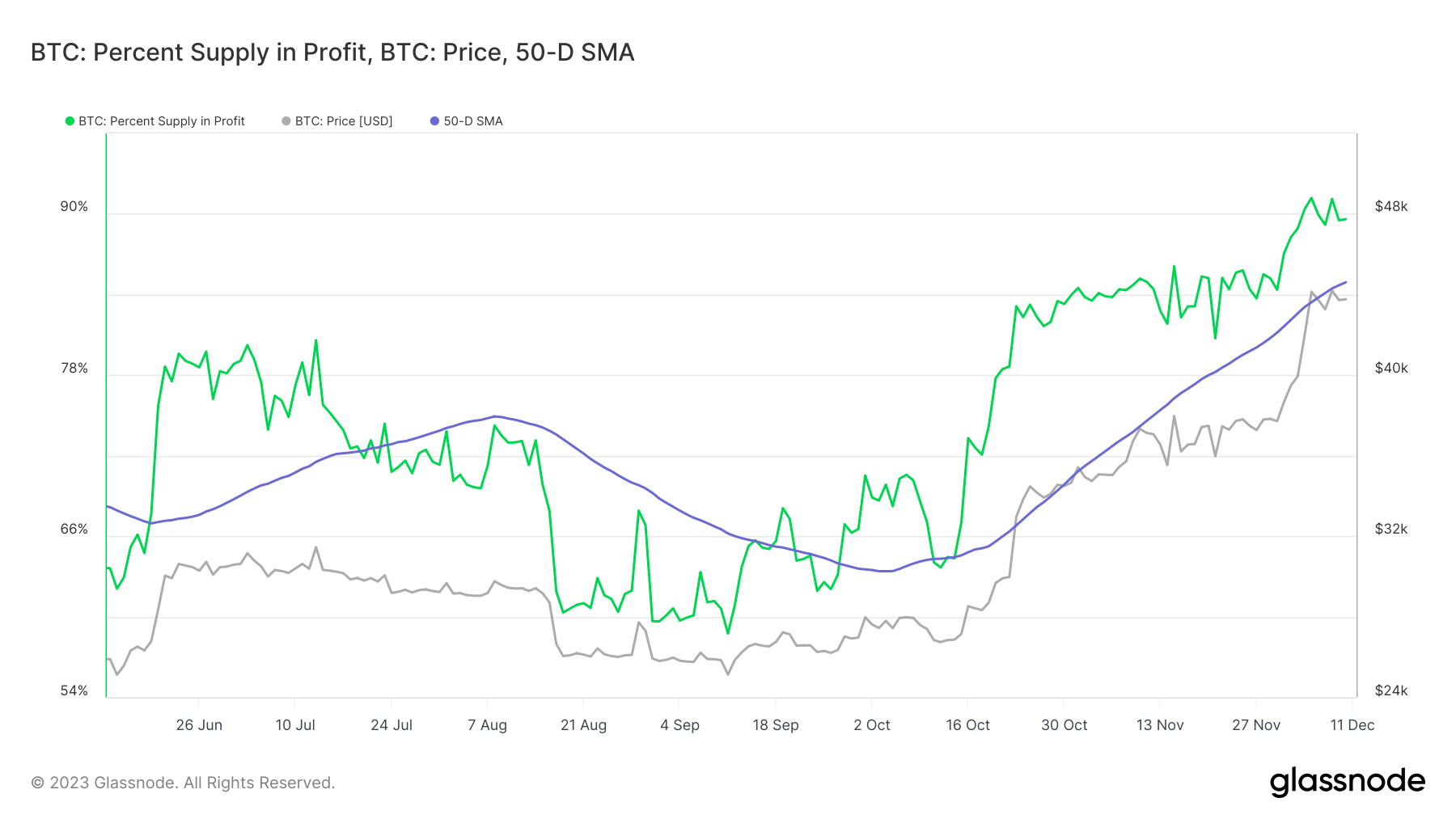

Whereas uncooked information on Bitcoin’s provide in revenue gives instant insights, it might probably typically be deceptive as a result of its susceptibility to every day market fluctuations. To garner a extra correct and long-term perspective, analyzing the 50-day transferring common (MA) of this metric is extra instructive. The 50-day MA smooths out short-term volatility, providing a clearer image of underlying market tendencies. When the proportion of Bitcoin’s provide in revenue persistently hovers above this common, it usually displays a bullish market sentiment. Conversely, persistently low figures under the MA can trace at bearish tendencies.

Since early October, the 50-day MA for Bitcoin’s provide in revenue has witnessed a marked enhance. It rebounded from a low of 63.3% in early October to 84.91% by Dec. 11, after a decline from 74.9% in early August. Notably, the provision in revenue has remained above its 50-day MA since Oct. 14, underscoring a sustained bullish outlook amongst traders.

This persistent elevation above the 50-day MA is a robust indicator of market confidence. It means that the overarching sentiment stays constructive regardless of short-term corrections and volatility. Traders are seemingly unfazed by short-term downturns, sustaining their holdings in anticipation of future good points.

The submit Bitcoin’s provide in revenue reveals bullish sentiment regardless of volatility appeared first on CryptoSlate.