Realized cap provides a novel perspective on market conduct, representing the stream of capital out and in of Bitcoin (BTC). The realized cap is calculated by making use of value stamps to every Bitcoin on the time of its final transaction, providing a extra nuanced view of the market worth than the standard market cap.

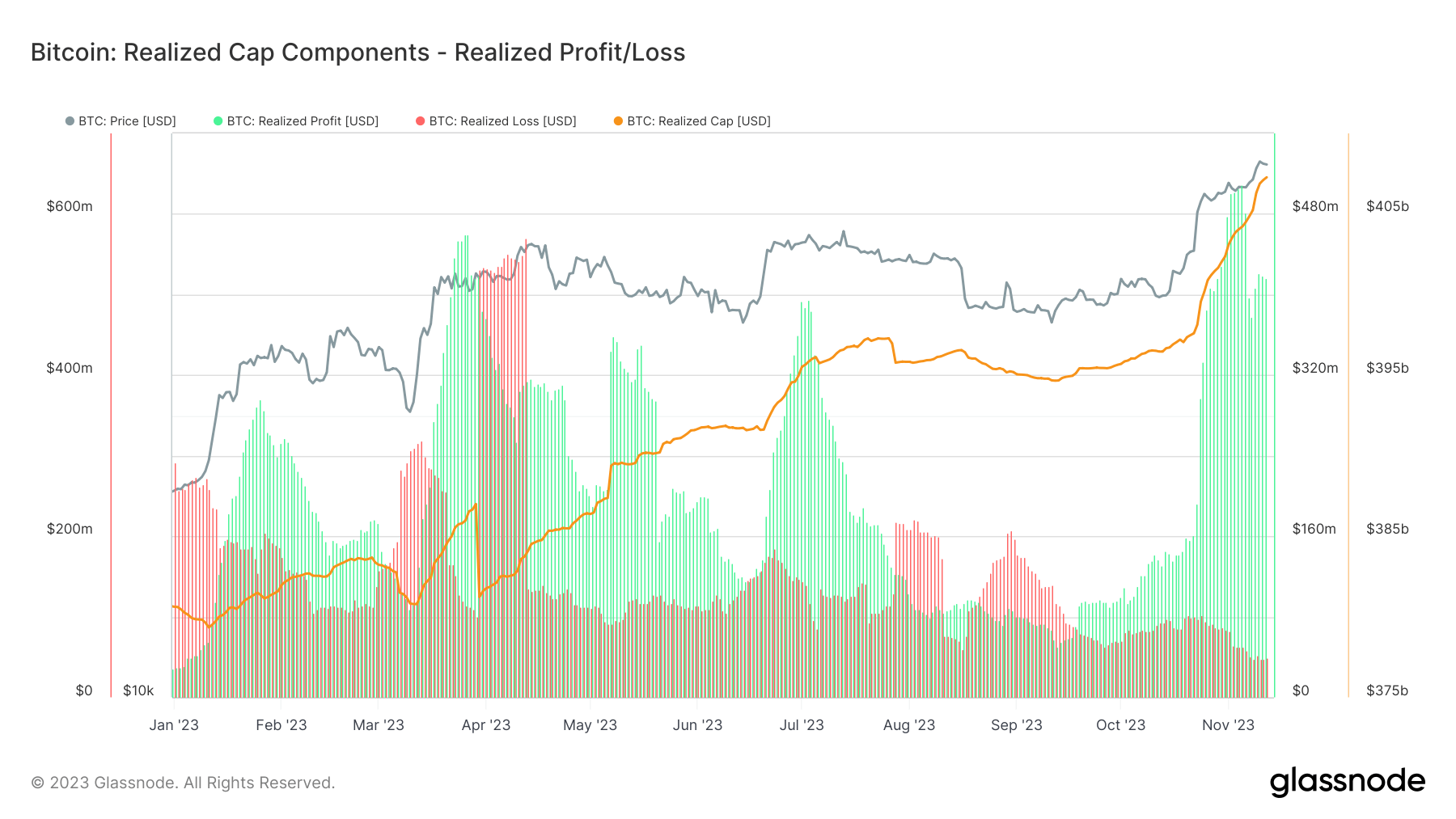

At first of the yr, Bitcoin’s realized cap stood at $380 billion, with its value hovering slightly below $17,000. By Oct. 13, 2023, the realized cap elevated to $396 billion, alongside a value rise to $26,800.

By Nov. 12, BTC had surged to $37,000, and the realized cap reached $407 billion, indicating a big influx of capital into Bitcoin.

The shift in realized earnings and losses offers perception into market sentiment. Whereas realized earnings have been outpacing realized losses since mid-September, it wasn’t till Oct. 26 that the distinction between them elevated nearly fivefold.

The year-to-date excessive for realized earnings was recorded on Nov.5, with Bitcoin holders taking on $509 million in earnings. This contrasts with the common every day realized losses, which have been declining, dropping from round $80 million in mid-October to $49 million on Nov. 12. On the identical day, realized earnings stood at a sturdy $416 million.

The rise in realized earnings signifies that buyers are discovering profitable exit factors, whereas the lower in realized losses factors to a discount in panic promoting or distressed exits from the market. This pattern is additional bolstered by the upcoming Bitcoin halving in April 2024, an occasion traditionally related to a tightening of Bitcoin provide and subsequent value appreciation.

Assessing the out there provide additionally offers context to those traits. With the short-term holder provide at multi-year lows and a good portion of the availability being categorised as illiquid, it’s evident {that a} substantial portion of Bitcoin is being held for the long run. This shift in the direction of long-term holding, particularly amongst institutional buyers and thru merchandise like GBTC, underscores a maturing market and a rising recognition of Bitcoin as a retailer of worth.

The decline in realized losses and the rise in realized earnings point out a market much less susceptible to panic and extra pushed by strategic selections. As the subsequent halving approaches, the market will probably witness additional tightening of provide, doubtlessly resulting in elevated valuations and extra profit-taking.

The submit Bitcoin’s realized earnings surge as market braces for 2024 halving appeared first on CryptoSlate.