Bitcoin appears to have established stable help on the $37k degree, demonstrated by its swift restoration following a dip to $35,000 upon information about Binance’s SEC fantastic. Whereas this rebound represents a 122% improve for the reason that starting of the yr, there was comparatively minimal distribution of BTC throughout this era.

A more in-depth examination of the Bitcoin provide held each by short-term and long-term holders exhibits a transparent accumulation development throughout the board. This development solely appears to have elevated with Bitcoin’s spike above $37,000, indicating a dedication amongst all holders to purchase extra BTC.

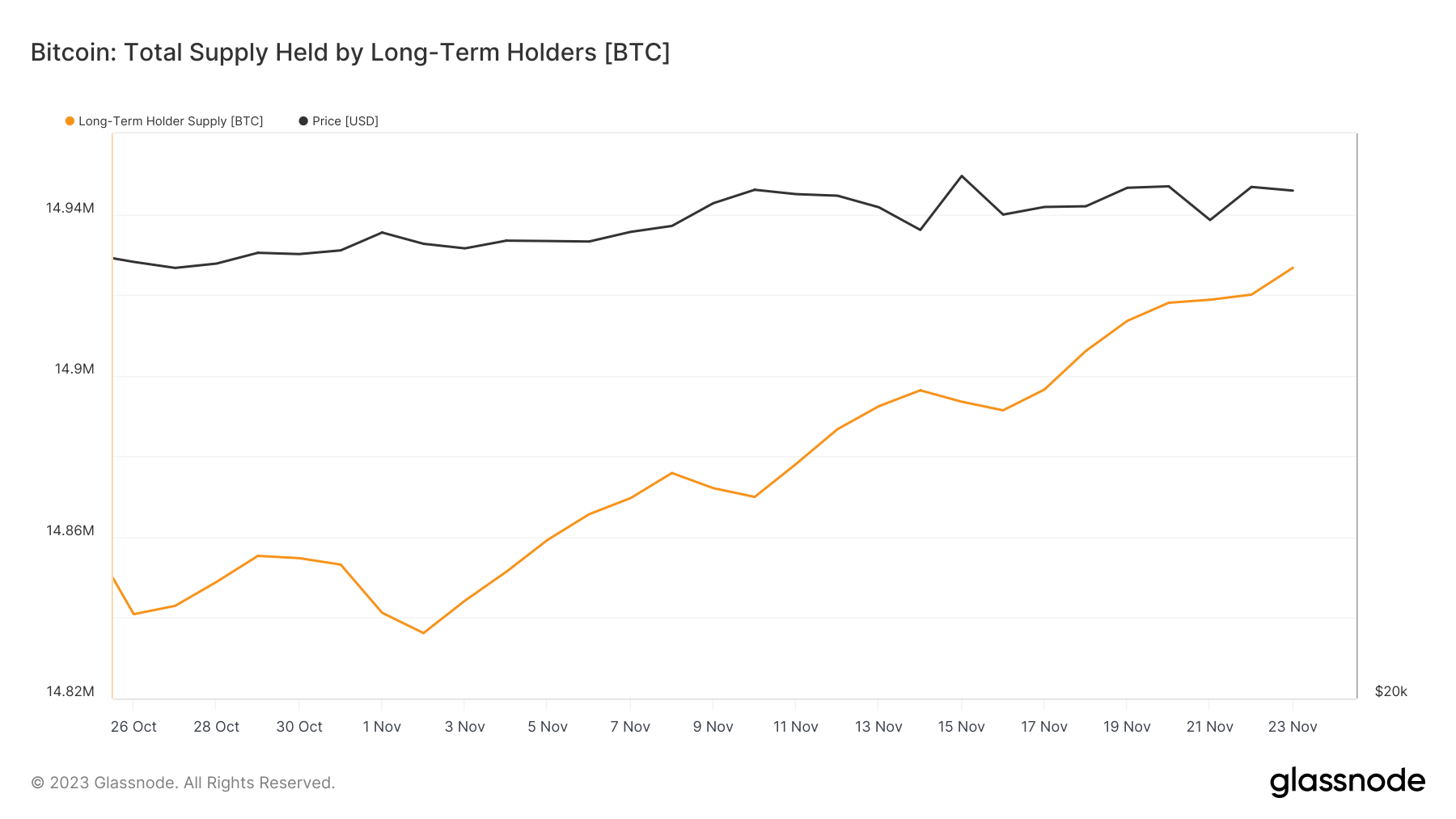

Glassnode information on long-term holders has been notably telling over the previous yr. This cohort, identified for his or her endurance available in the market, has seen their holdings develop persistently, particularly as Bitcoin’s worth surpassed the $37,000 mark. The rise in long-term holder provide exhibits sturdy confidence in Bitcoin’s future prospects amongst these buyers.

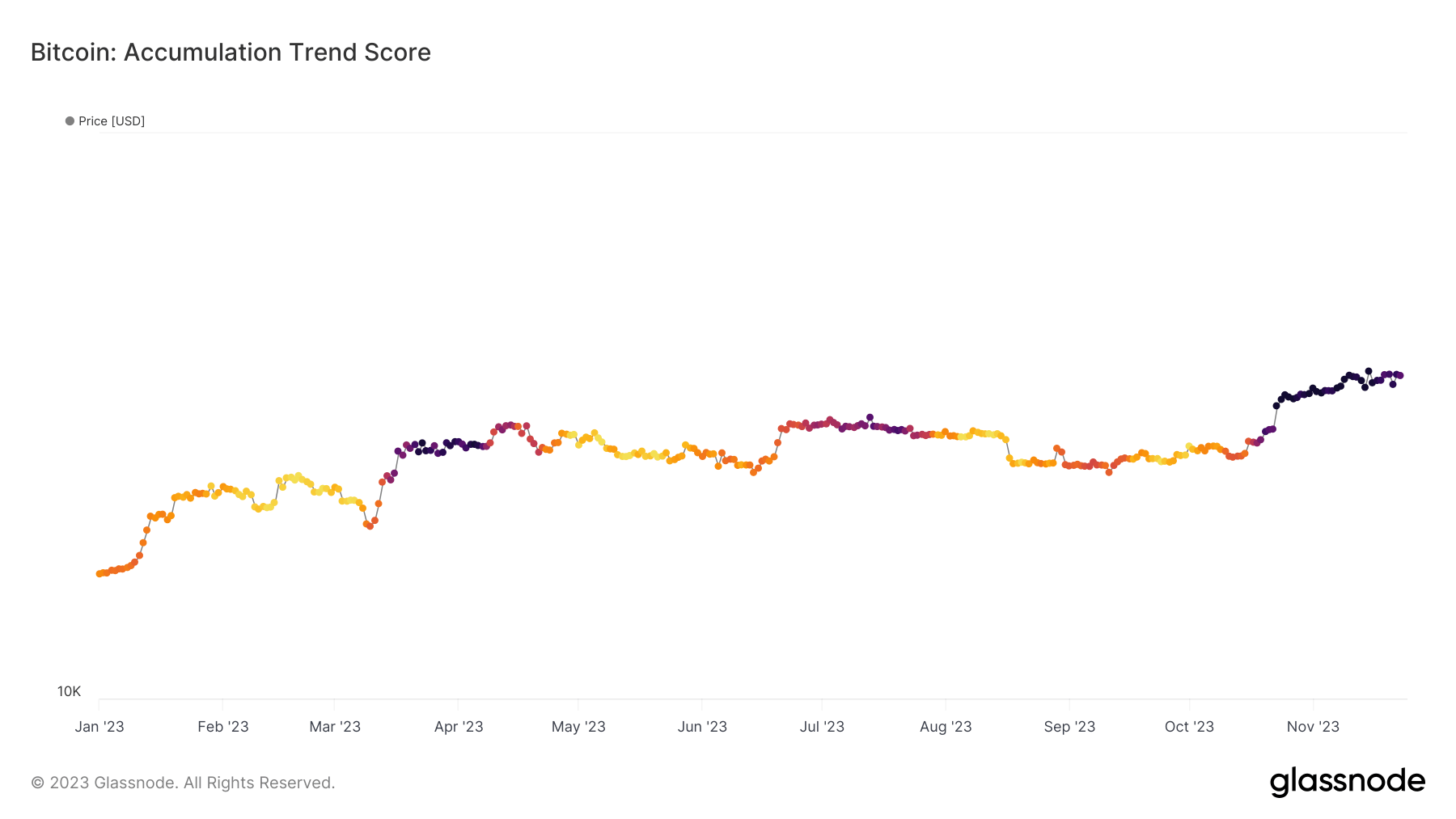

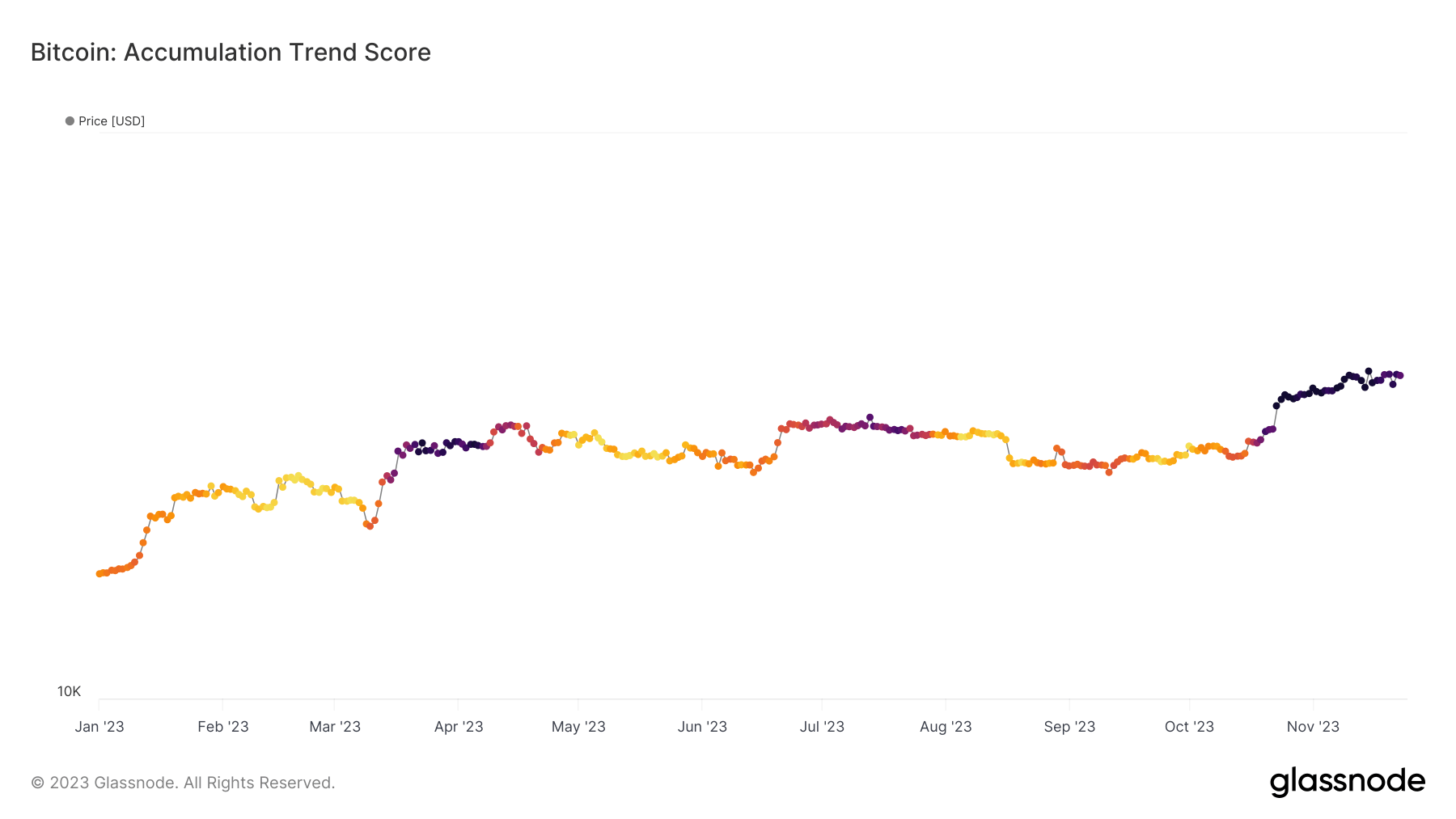

The Bitcoin accumulation development rating additional helps this thesis. This metric, which gauges the diploma of accumulation exercise throughout the market, has proven constructive indicators. A rise on this rating typically signifies heightened investor curiosity in buying extra Bitcoin, typically a bullish sign available in the market. On this case, the development rating’s rise alongside climbing costs confirms that long-term holders will not be simply holding onto their belongings however actively growing their positions.

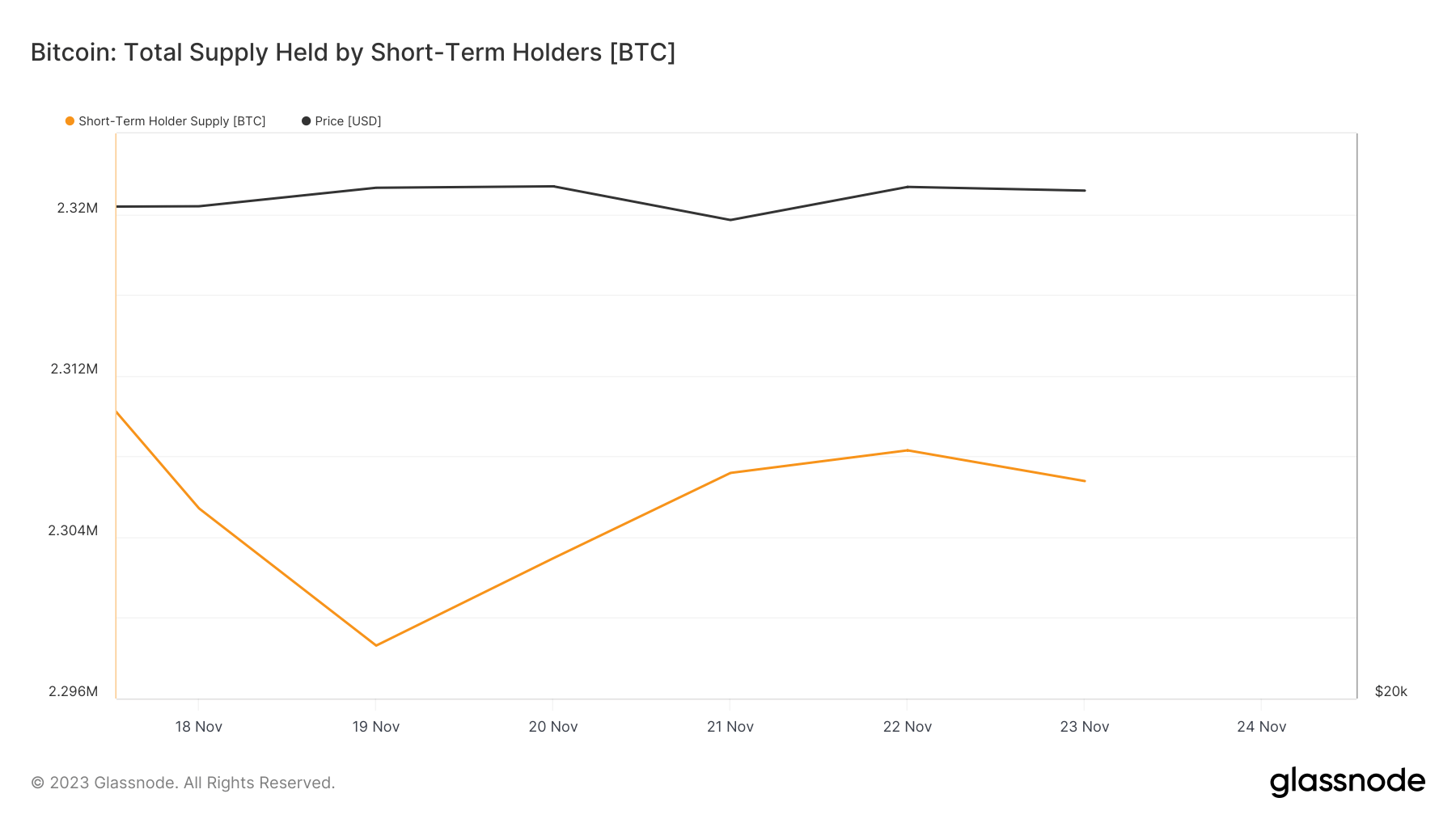

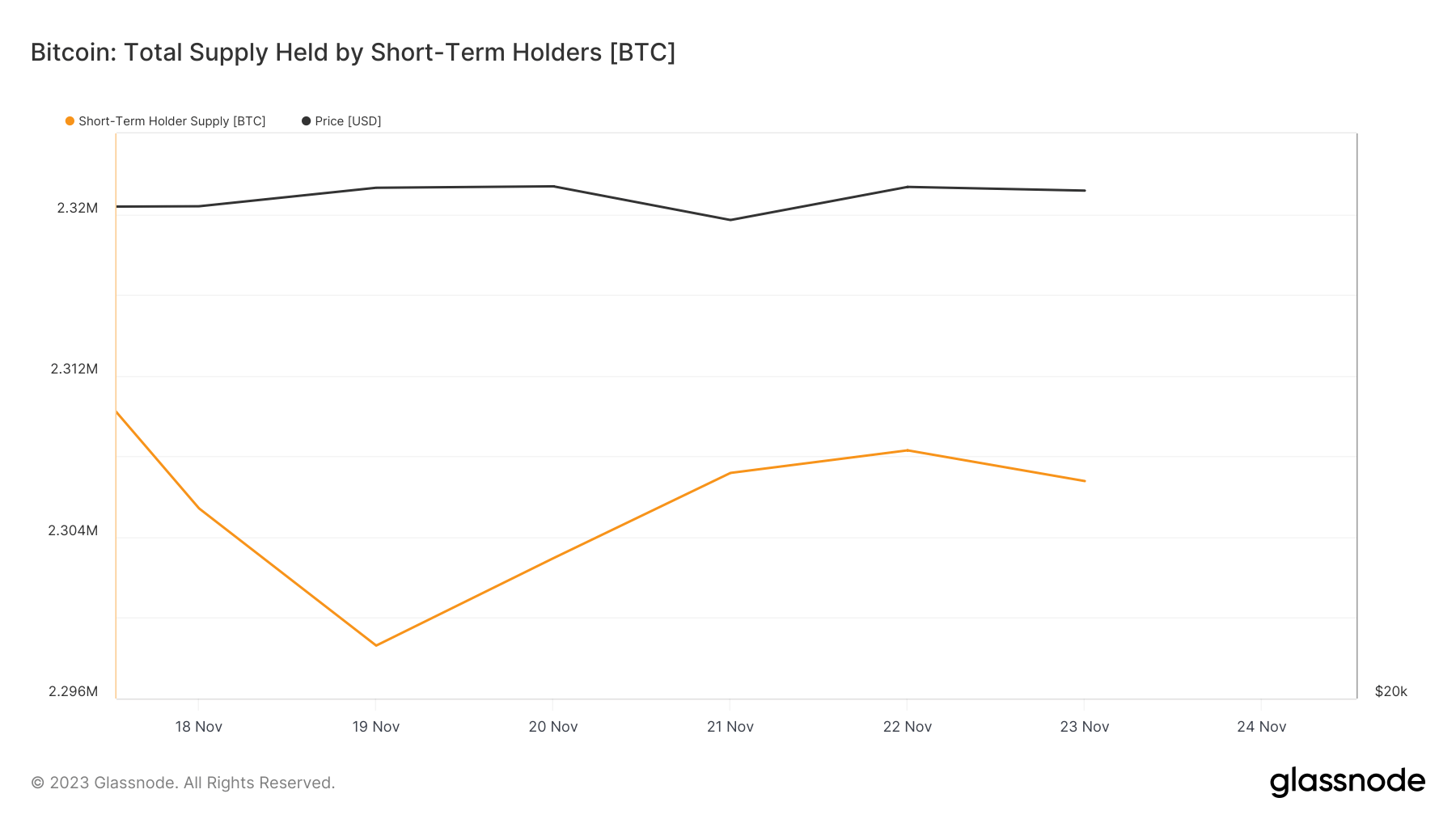

Over the previous yr, there was a major decline in short-term holder provide. Aside from distribution, this might point out {that a} important a part of short-term holder provide has transitioned into the fingers of long-term holders, as buyers maintain their cash past the 155-day threshold that usually differentiates short-term from long-term provide.

Nonetheless, the final 5 days have seen an uptick in short-term holder provide. This current improve means that Bitcoin’s escalating worth has attracted new buyers, eager on capitalizing on its progress. Monitoring short-term holder provide is essential because it typically displays the market’s instant response to cost actions and might be an early indicator of fixing market sentiments.

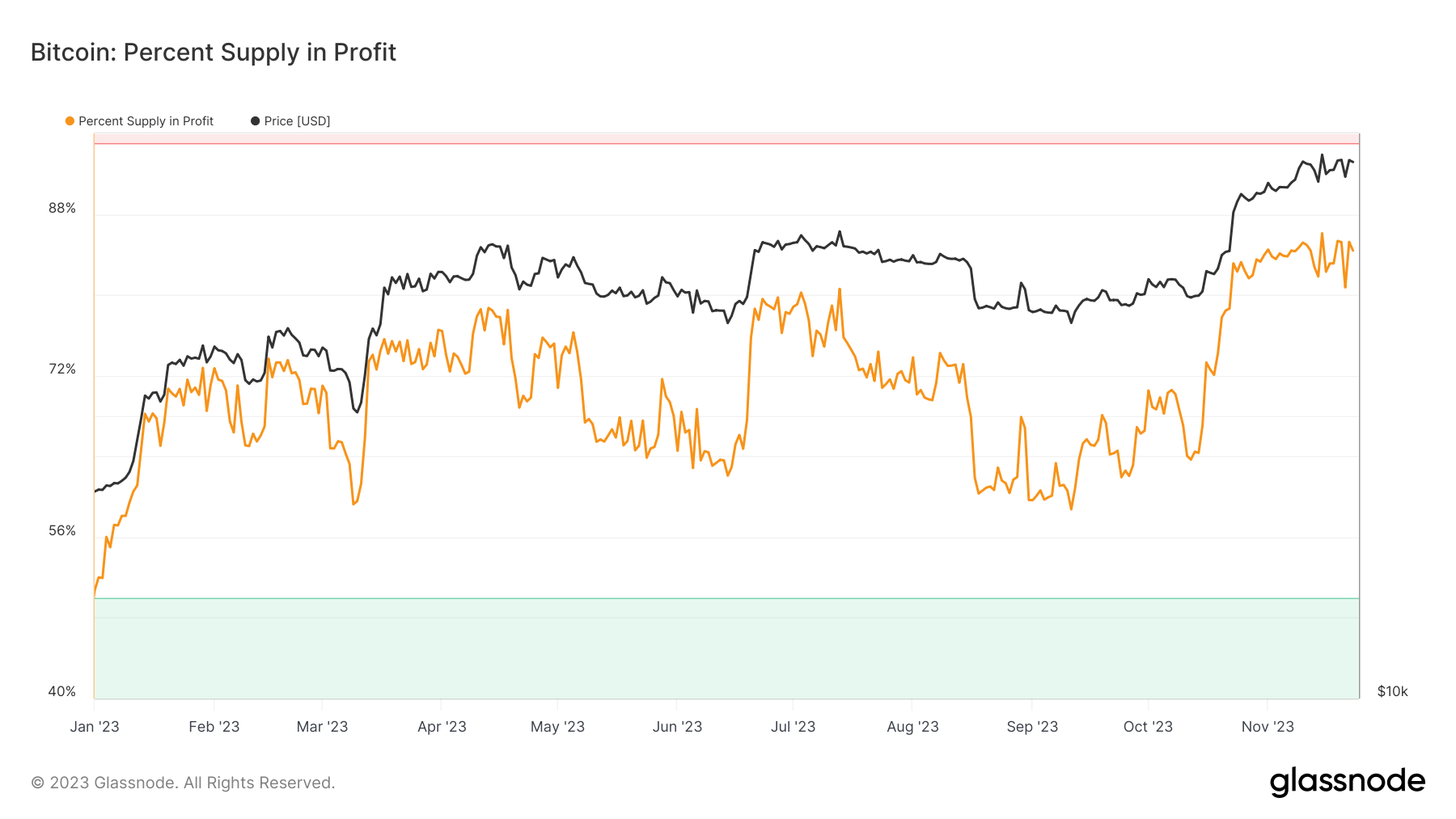

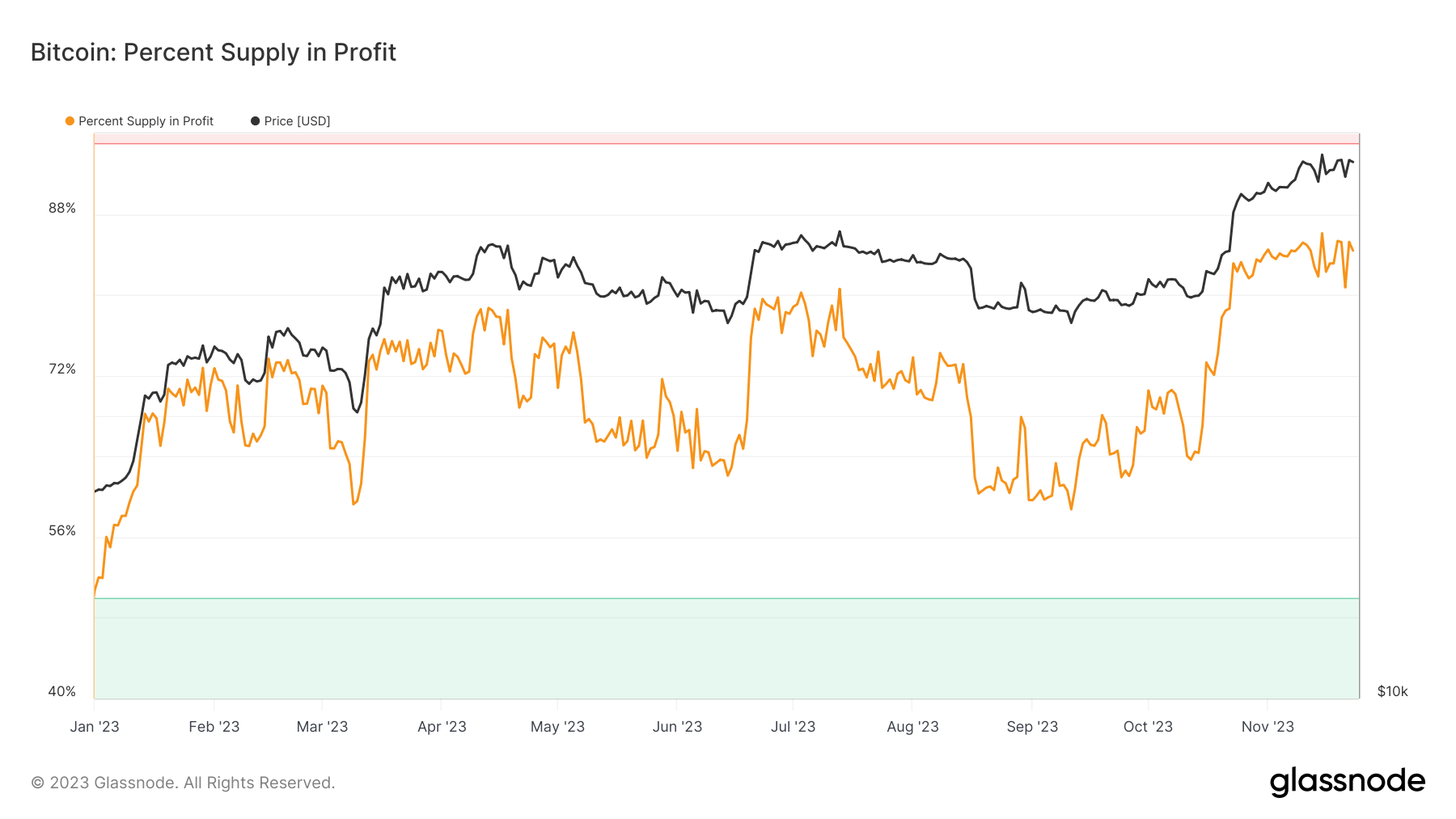

This accumulation has led to a major spike in unrealized earnings for Bitcoin holders. As of Nov. 23, 84.38% of Bitcoin’s provide is in a state of revenue. This metric is pivotal because it represents the potential promoting stress or holding energy throughout the market. Traditionally, excessive ranges of unrealized earnings have been precursors to bull rallies, as they point out sturdy market confidence and an inclination for holders to await additional worth appreciation earlier than distributing their cash to appreciate earnings.