Bitcoin’s current value struggles introduced traders with “shopping for alternatives,” ensuing within the influx of $441 million into crypto-related funding merchandise, in accordance with CoinShares‘ newest report.

James Butterfill, the pinnacle of analysis at CoinShares, defined that digital property skilled heavy volatility final week because of promoting pressures from the German authorities and information of defunct Mt. Gox’s repayments.

These components prompted Bitcoin’s value to drop considerably, hitting a five-month low under $55,000. It additionally recorded probably the most vital market liquidations because the FTX collapse in 2022.

Butterfill identified that the “value weak spot” introduced a “shopping for alternative” for traders trying to acquire publicity to the rising business.

This influx marks a turnaround after three consecutive weeks of outflows. Nonetheless, Change-Traded Product (ETP) volumes remained low at $7.9 billion.

Butterfill added:

“Volumes in Change Traded Merchandise (ETPs) remained comparatively low at $7.9 billion for the week, reflecting the everyday seasonal sample of decrease volumes in the summertime months. This represents a 17% decrease participation fee in comparison with the overall marketplace for trusted exchanges.”

Buyers unfold tentacles

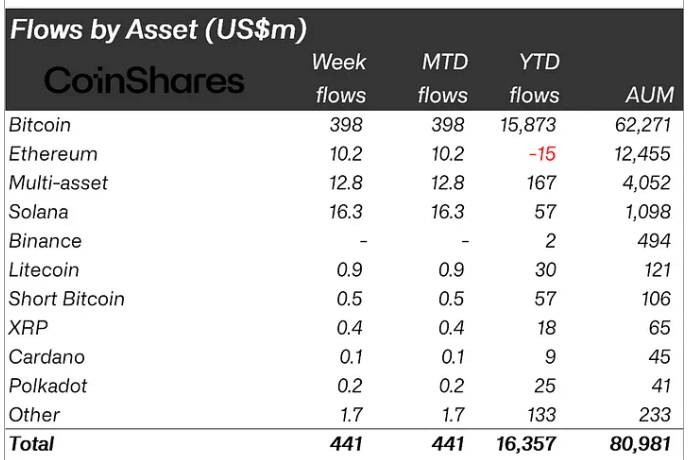

CoinShares famous that traders have been prepared to unfold their funds throughout totally different digital property, which decreased Bitcoin’s common dominance to 90% of the overall inflows. In accordance with the agency, the flagship digital asset noticed inflows totaling $398 million, bringing its year-to-date stream to $15.8 billion.

In the meantime, high altcoins like Solana additionally noticed vital inflows, reflecting traders’ diversification methods. Final week, funding merchandise associated to Solana obtained $16 million in inflows, bringing their year-to-date flows to $57 million.

Equally, Ethereum noticed a constructive shift with $10 million in inflows. Nonetheless, it stays the one ETP with a internet outflow of $15 million year-to-date.

Different altcoins, corresponding to Polkadot, XRP, Litecoin, and Cardano, noticed cumulative inflows of greater than $1 million.